Car Insurance And Uber Driving

For many individuals, the flexibility and opportunity that ridesharing platforms like Uber offer is an attractive prospect. However, one crucial aspect that often raises concerns is insurance coverage. This article aims to delve into the intricate world of car insurance and its implications for Uber drivers, providing a comprehensive guide to ensure a seamless and secure ridesharing experience.

Understanding the Basics of Car Insurance for Uber Drivers

When you sign up to drive with Uber, it’s essential to understand that your personal car insurance policy might not provide adequate coverage for ridesharing activities. This is where specialized rideshare insurance comes into play, offering protection tailored to the unique needs of Uber drivers.

The Importance of Rideshare Insurance

Rideshare insurance is designed to bridge the coverage gap between personal auto insurance and the insurance provided by Uber. It ensures that you, your passengers, and other road users are protected during the various phases of your Uber journey.

Here’s a breakdown of the coverage typically offered by rideshare insurance policies:

- Personal Coverage: This includes the time when your Uber app is off, and you’re using your car for personal reasons. Your personal auto insurance typically covers you during this phase.

- Period 1 (App On, Waiting for a Ride): Once you turn on your Uber app and await a ride request, you enter Period 1. During this phase, your personal auto insurance may provide limited coverage, but rideshare insurance ensures comprehensive protection, including liability and collision coverage.

- Period 2 (En Route to Pick Up): When you receive a ride request and are en route to pick up your passenger, you transition to Period 2. Uber’s insurance policy provides liability coverage during this period, with a limit of $1 million. However, rideshare insurance can offer additional protection, including collision and comprehensive coverage.

- Period 3 (Active Trip): During an active Uber trip, Uber’s insurance policy provides the primary coverage, offering liability, collision, and comprehensive coverage. Rideshare insurance acts as a secondary policy, stepping in to cover any gaps in Uber’s coverage.

Choosing the Right Rideshare Insurance

Selecting the appropriate rideshare insurance policy is crucial to ensure you’re adequately protected. Here are some key factors to consider:

- Coverage Limits: Different insurance providers offer varying coverage limits. It’s essential to choose a policy with limits that align with your needs and provide sufficient protection.

- Deductibles: Deductibles can vary significantly between policies. Opt for a policy with a deductible that fits your financial comfort level.

- Additional Coverage Options: Some rideshare insurance policies offer optional add-ons, such as rental car coverage or personal injury protection. Evaluate your needs and consider these add-ons to enhance your coverage.

- Provider Reputation: Choose a reputable insurance provider with a solid track record of customer satisfaction and claims handling.

| Insurance Provider | Coverage Limits | Deductibles | Additional Options |

|---|---|---|---|

| Provider A | $1M liability, $50K collision | $500 | Rental car coverage |

| Provider B | $1.5M liability, $100K collision | $250 | Personal injury protection |

| Provider C | $2M liability, $200K collision | $750 | Medical payments coverage |

💡 Pro Tip: When comparing rideshare insurance policies, consider not only the coverage limits and deductibles but also the overall customer experience and ease of claims processing.

Managing Your Car Insurance and Uber Driving: Best Practices

Ensuring a smooth and stress-free ridesharing experience involves more than just selecting the right insurance policy. Here are some best practices to follow when managing your car insurance as an Uber driver:

Inform Your Insurer

Informing your personal auto insurance provider that you drive for Uber is crucial. While your personal policy may not cover ridesharing activities, being transparent can help prevent issues if you need to make a claim.

Understand Uber’s Insurance Coverage

Familiarize yourself with Uber’s insurance policy. Understand the coverage limits and exclusions to ensure you’re aware of any gaps that your rideshare insurance policy should cover.

Review and Update Your Coverage Regularly

As your driving habits and needs change, it’s essential to review your insurance coverage regularly. This ensures that your policy remains adequate and up-to-date. Consider adjusting your coverage limits or adding optional coverage as needed.

Keep Records and Documentation

Maintain a record of all insurance-related documents, including your policy details, declarations page, and any correspondence with your insurer. This can be invaluable if you need to make a claim or dispute a coverage decision.

Stay Informed About State Regulations

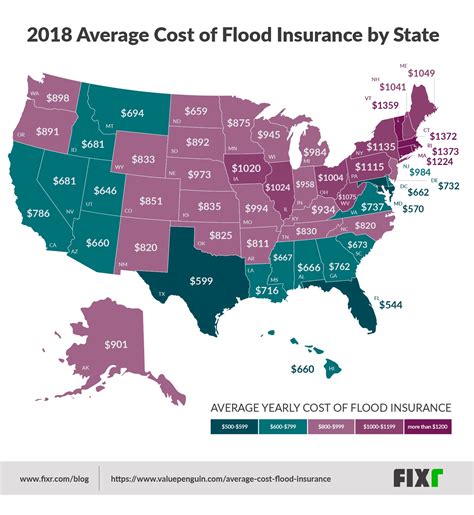

Insurance regulations can vary by state. Stay informed about the specific requirements and regulations in your state to ensure you’re complying with local laws.

The Future of Car Insurance and Ridesharing

The ridesharing industry is evolving, and so are insurance policies. As Uber and other platforms continue to grow, insurance providers are adapting their offerings to meet the unique needs of rideshare drivers.

Emerging Trends in Rideshare Insurance

Here are some trends and developments to watch in the world of rideshare insurance:

- Tailored Coverage: Insurance providers are developing more specialized coverage options, catering to the diverse needs of rideshare drivers. This includes policies with flexible coverage limits and additional add-ons.

- Technology Integration: The use of telematics and other technologies is becoming more prevalent in rideshare insurance. These tools can provide real-time data on driving behavior, allowing insurers to offer personalized premiums and coverage.

- Partnerships with Ridesharing Platforms: Some insurance providers are forming partnerships with ridesharing platforms to offer exclusive coverage options to drivers. These partnerships can provide streamlined coverage and claims processes.

Preparing for the Future

As an Uber driver, staying informed about these developments is crucial. By understanding the evolving landscape of rideshare insurance, you can make informed decisions about your coverage and ensure you’re prepared for any changes in the industry.

Conclusion

Driving for Uber can be a rewarding experience, but it’s essential to approach it with the right insurance coverage. By understanding the different phases of ridesharing and the coverage they require, selecting a reputable rideshare insurance policy, and following best practices for managing your insurance, you can ensure a safe and secure ridesharing journey.

How much does rideshare insurance typically cost?

+The cost of rideshare insurance can vary depending on several factors, including your location, driving record, and the coverage limits you choose. On average, rideshare insurance policies can range from 150 to 500 per year. However, it’s important to note that premiums can vary significantly, so it’s best to obtain quotes from multiple providers to find the most competitive rates.

Can I use my personal car for Uber driving without rideshare insurance?

+While it’s possible to use your personal car for Uber driving without rideshare insurance, it’s highly recommended to have the appropriate coverage. Without rideshare insurance, you may not be adequately protected during the various phases of your Uber journey, leaving you vulnerable to financial liability in the event of an accident or claim.

What should I do if I’m involved in an accident while driving for Uber?

+If you’re involved in an accident while driving for Uber, the first step is to ensure the safety of yourself and your passengers. Contact the authorities and provide any necessary medical assistance. It’s crucial to document the incident by taking photos of the accident scene, collecting contact information from involved parties, and obtaining a police report. Afterward, notify both Uber and your rideshare insurance provider to initiate the claims process.