Car Insurance Average Cost Per Month

Understanding the average cost of car insurance per month is crucial for drivers to budget effectively and make informed decisions about their coverage. The expense of car insurance varies significantly based on numerous factors, including the policyholder's location, driving history, and the type of coverage chosen. This article aims to delve into the intricacies of car insurance costs, providing an in-depth analysis of the average monthly expenses and exploring the key elements that influence these rates.

The Average Monthly Cost of Car Insurance

On average, drivers in the United States can expect to pay around 150 per month</strong> for car insurance. However, it is essential to note that this figure is merely an average and can vary greatly depending on individual circumstances. In some cases, monthly premiums can be as low as 50, while for high-risk drivers, they may exceed $300.

The wide range of car insurance costs can be attributed to the diverse factors that insurance companies consider when calculating premiums. These factors, which we will explore in detail later, include demographic information, vehicle type, and driving behavior. By understanding these influences, drivers can make more accurate estimates of their potential insurance costs and take steps to mitigate high premiums.

Factors Affecting Car Insurance Costs

1. Demographic Factors

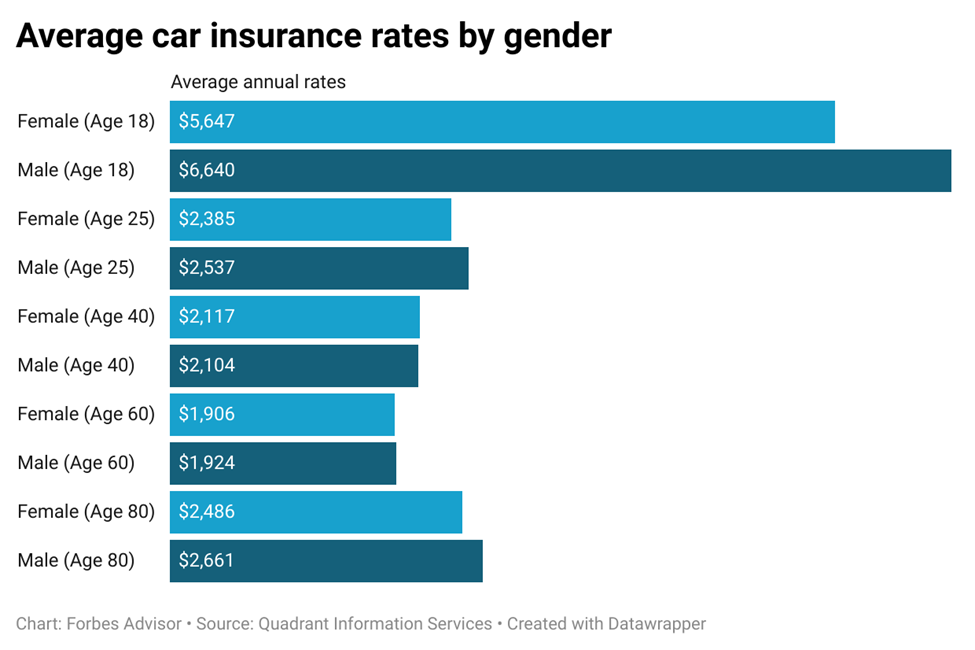

One of the most significant influences on car insurance rates is the policyholder’s demographic information. Insurance companies consider factors such as age, gender, marital status, and location when assessing risk. For instance, young drivers, especially males, are often considered high-risk due to their tendency for more frequent and severe accidents. As a result, they typically face higher insurance premiums.

| Demographic Factor | Impact on Insurance Rates |

|---|---|

| Age | Younger drivers (16-25) often pay more due to higher accident risk. |

| Gender | Males tend to pay more than females, particularly at younger ages. |

| Marital Status | Married individuals may benefit from lower rates, as they are statistically less likely to be involved in accidents. |

| Location | Urban areas with higher traffic and accident rates often result in higher insurance costs. |

2. Vehicle Characteristics

The type of vehicle insured also plays a significant role in determining insurance costs. Insurance companies consider factors such as the vehicle’s make, model, age, and safety features when assessing risk. Sports cars and luxury vehicles, for example, often come with higher insurance premiums due to their higher repair costs and potential for speeding-related accidents.

| Vehicle Factor | Impact on Insurance Rates |

|---|---|

| Make and Model | Certain makes and models are associated with higher accident risks or theft rates, leading to increased premiums. |

| Age of Vehicle | Older vehicles may have lower premiums, as they are generally less expensive to repair or replace. |

| Safety Features | Vehicles with advanced safety features like anti-lock brakes or collision avoidance systems may qualify for lower insurance rates. |

3. Driving Behavior and History

Your driving behavior and history are crucial factors in determining your insurance premiums. Insurance companies use your driving record to assess your risk level. A clean driving record with no accidents or traffic violations can lead to lower insurance rates. Conversely, a history of accidents, especially those where you were at fault, can significantly increase your premiums.

Additionally, the frequency and nature of your driving can impact your insurance costs. If you drive frequently, especially in high-risk areas or during peak traffic hours, your premiums may be higher. On the other hand, if you drive less often or primarily during safer times, you may qualify for lower rates.

4. Coverage Options and Limits

The type of coverage you choose and the limits you set for each coverage type can greatly affect your monthly insurance costs. Comprehensive coverage, which protects against damage from non-collision events like theft, vandalism, or natural disasters, typically comes at a higher cost. Similarly, higher liability limits, which increase the amount of coverage you have for property damage and bodily injury claims, can also increase your premiums.

It's essential to strike a balance between the coverage you need and the cost of your insurance. While it may be tempting to opt for the cheapest option, it's crucial to ensure that you have adequate coverage to protect yourself financially in the event of an accident or other covered incident.

Strategies to Reduce Car Insurance Costs

While the average cost of car insurance per month can vary significantly, there are strategies that drivers can employ to potentially reduce their insurance premiums. Here are some effective approaches to consider:

- Shop Around: Compare quotes from multiple insurance companies. Rates can vary widely between providers, so getting multiple quotes can help you find the best deal.

- Bundle Policies: If you have multiple insurance needs, such as home and auto insurance, consider bundling them with the same provider. Many companies offer discounts for bundling multiple policies.

- Maintain a Clean Driving Record: A clean driving record can lead to significant savings on your insurance premiums. Avoid traffic violations and accidents to keep your record clear.

- Consider Higher Deductibles: Opting for a higher deductible can lower your monthly premiums. However, it's essential to ensure that you can afford the deductible in the event of a claim.

- Take Advantage of Discounts: Many insurance companies offer discounts for various reasons, such as good student discounts, safe driver discounts, and loyalty discounts. Be sure to ask your insurer about available discounts and how you can qualify.

- Review Your Coverage Regularly: Your insurance needs may change over time. Regularly review your coverage to ensure you're not overinsured or underinsured. Adjust your coverage as necessary to reflect your current needs and circumstances.

It's important to note that while these strategies can help reduce your insurance costs, the most effective way to save money on car insurance is to be a safe and responsible driver. By avoiding accidents and traffic violations, you can maintain a clean driving record and potentially qualify for lower insurance rates.

The Future of Car Insurance Costs

The landscape of car insurance is continually evolving, and several emerging trends may impact the average cost of car insurance in the future. The widespread adoption of advanced driver-assistance systems (ADAS) and the ongoing development of autonomous vehicles are expected to significantly influence insurance premiums. These technologies have the potential to reduce accident rates, leading to lower insurance costs over time.

Additionally, the increasing popularity of usage-based insurance (UBI) programs, which use telematics to track driving behavior and offer personalized insurance rates, is another trend that could impact future insurance costs. UBI programs reward safe driving with lower premiums, providing an incentive for drivers to adopt safer driving habits.

As technology continues to advance and the insurance industry adapts to these changes, it's likely that we will see further innovations in car insurance, potentially leading to more accurate risk assessments and, consequently, more competitive insurance rates.

Conclusion

The average cost of car insurance per month can vary widely based on a multitude of factors, from demographic information to driving behavior. While the average premium hovers around $150 per month, this figure is merely a benchmark, and actual costs can be significantly higher or lower depending on individual circumstances.

Understanding the factors that influence car insurance rates is essential for drivers to make informed decisions about their coverage and budget accordingly. By considering the impact of demographic factors, vehicle characteristics, driving behavior, and coverage options, drivers can take proactive steps to manage their insurance costs effectively.

As the car insurance industry continues to evolve with technological advancements and changing consumer behaviors, it's crucial for drivers to stay informed about emerging trends and how they may impact their insurance premiums. By staying vigilant and adopting safe driving practices, drivers can not only reduce their risk of accidents but also potentially qualify for lower insurance rates in the future.

How often should I review my car insurance policy and consider adjusting my coverage or provider?

+It’s recommended to review your car insurance policy annually or whenever your circumstances change significantly. This could include buying a new car, moving to a different location, getting married, or reaching a new age bracket. Regular reviews ensure that your coverage remains adequate and that you’re not overpaying for unnecessary features.

Can I get car insurance if I have a poor credit score or a history of accidents?

+Yes, it is possible to obtain car insurance with a poor credit score or a history of accidents, although you may face higher premiums. Insurance companies often use credit scores as a factor in determining risk, so a lower score may result in higher rates. However, shopping around and comparing quotes can help you find the best deal.

Are there any ways to save on car insurance for young drivers, who often face higher premiums due to their age and lack of driving experience?

+Yes, there are several strategies young drivers can employ to reduce their insurance costs. These include maintaining a clean driving record, taking a defensive driving course, considering a higher deductible, and exploring discounts such as good student discounts or discounts for completing a driver’s education program.

What is the average cost of car insurance for older drivers, typically considered a lower-risk group due to their experience and more cautious driving habits?

+The average cost of car insurance for older drivers can vary widely based on individual circumstances and location. However, older drivers, especially those with a clean driving record, often enjoy lower insurance premiums due to their lower accident risk. On average, older drivers may pay slightly less than the overall national average of $150 per month.