Car Insurance Fl

When it comes to car insurance, Florida residents have unique considerations and a diverse range of options to navigate. With its vibrant culture, bustling cities, and year-round sunshine, Florida presents a distinct set of circumstances that influence the car insurance landscape. In this comprehensive guide, we delve into the specifics of car insurance in the Sunshine State, offering an expert analysis to help you make informed decisions.

Florida's car insurance market is dynamic, offering a wide array of coverage options and providers. From the bustling streets of Miami to the serene beaches of Naples, understanding the local insurance scene is crucial for ensuring adequate protection and peace of mind. This guide aims to provide an in-depth exploration of the key factors, coverage types, and best practices to help Floridians secure the right car insurance.

Understanding Florida's Car Insurance Requirements

Florida is known for its unique no-fault insurance system, which requires all drivers to carry Personal Injury Protection (PIP) coverage. This mandatory coverage ensures that, in the event of an accident, drivers can access medical benefits regardless of who is at fault. However, Florida also allows drivers to opt out of this system by purchasing additional liability coverage, which provides broader protection.

The minimum car insurance requirements in Florida are as follows:

- Personal Injury Protection (PIP): $10,000 in medical benefits per person, covering 80% of medical expenses.

- Property Damage Liability (PDL): $10,000 in coverage to repair or replace damaged property of others.

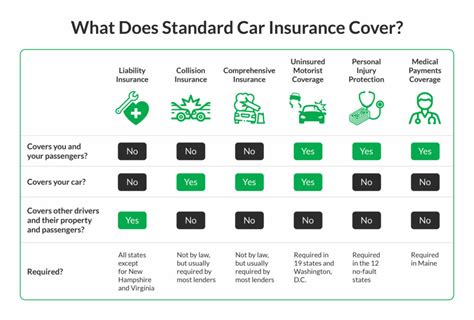

While these are the legal minimums, it's important to note that they may not provide sufficient protection in the event of a severe accident. Many Floridians opt for additional coverage, including bodily injury liability, uninsured/underinsured motorist coverage, comprehensive, and collision coverage.

Personal Injury Protection (PIP) Explained

Personal Injury Protection is a crucial component of Florida's car insurance landscape. It provides coverage for medical expenses, wage loss, and essential services following an accident, regardless of fault. Here's a breakdown of how PIP works:

- Medical Benefits: PIP covers 80% of medical expenses up to the policy limit. This includes hospital stays, doctor visits, prescription medications, and rehabilitation services.

- Wage Loss: If the accident results in the inability to work, PIP can provide compensation for lost wages up to a certain percentage of the insured's regular income.

- Death Benefits: In the unfortunate event of a fatality, PIP can provide death benefits to cover funeral expenses and other related costs.

- Essential Services: PIP may also cover necessary services like child care or housekeeping if the insured is unable to perform these tasks due to injuries sustained in the accident.

It's worth noting that while PIP is mandatory, policyholders can choose their coverage limits. Higher limits can provide more extensive protection, especially in the case of serious accidents.

Factors Influencing Car Insurance Rates in Florida

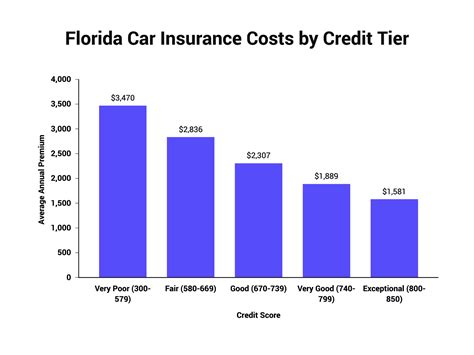

Car insurance rates in Florida are influenced by a multitude of factors, making it crucial for residents to understand these variables to secure the best coverage at an affordable price. Here are some key considerations:

Location

The specific location within Florida can significantly impact insurance rates. Urban areas like Miami and Tampa tend to have higher rates due to increased traffic density and a higher likelihood of accidents. On the other hand, more rural areas may offer lower rates due to reduced traffic and a lower risk of accidents.

Traffic and Crime Statistics

Areas with high traffic congestion and a history of accidents may see higher insurance rates. Similarly, regions with a higher crime rate, particularly in terms of car theft or vandalism, may also experience higher premiums. Insurance companies carefully consider these statistics when determining rates.

Driver's Age and Gender

Younger drivers, particularly those under 25, often face higher insurance rates due to their perceived higher risk of involvement in accidents. Additionally, gender can also play a role, with some insurance companies offering different rates based on statistical trends.

Driving Record

A clean driving record is a key factor in securing lower insurance rates. Drivers with a history of accidents, traffic violations, or DUIs may face higher premiums or even difficulty finding coverage. Maintaining a safe driving record is crucial for keeping insurance costs down.

Vehicle Type and Usage

The type of vehicle and its intended usage can influence insurance rates. Sports cars and luxury vehicles, for example, often have higher premiums due to their higher repair costs and increased likelihood of theft. Additionally, vehicles used for business purposes may require specialized coverage, impacting rates.

Insurance Company and Policy Type

Different insurance companies offer varying rates and policy options. It's essential to compare multiple providers to find the best fit. Additionally, the specific policy type, such as liability-only or comprehensive coverage, can significantly impact the overall cost.

Comparing Car Insurance Providers in Florida

Florida boasts a competitive car insurance market, with numerous providers offering a wide range of coverage options. Here's an overview of some of the top providers in the state, along with their unique features and offerings:

State Farm

State Farm is one of the leading insurance providers in Florida, offering a comprehensive range of coverage options. Their policies include standard liability, collision, comprehensive, and additional coverages like rental car reimbursement and roadside assistance. State Farm is known for its excellent customer service and offers a variety of discounts, making it a popular choice for Floridians.

Geico

Geico is a well-established insurance provider that caters to a wide range of drivers. They offer competitive rates and a user-friendly online platform for managing policies. Geico's policies typically include liability, collision, and comprehensive coverage, along with optional add-ons like rental car coverage and emergency roadside assistance. They also provide discounts for safe driving and loyalty.

Progressive

Progressive is another prominent player in Florida's car insurance market, known for its innovative approach and customizable policies. They offer a range of coverage options, including liability, collision, comprehensive, and additional benefits like rental car coverage and gap insurance. Progressive's policies are often tailored to individual needs, making them a flexible choice for many drivers.

Allstate

Allstate is a trusted insurance provider with a strong presence in Florida. Their policies include standard liability coverage, as well as optional add-ons like collision, comprehensive, rental car reimbursement, and roadside assistance. Allstate is known for its comprehensive customer support and offers various discounts for safe driving and loyalty.

USAA

USAA is a highly regarded insurance provider that specializes in serving military members and their families. They offer competitive rates and a range of coverage options, including liability, collision, and comprehensive coverage. USAA is known for its exceptional customer service and provides exclusive benefits to its military clientele.

Best Practices for Securing Affordable Car Insurance in Florida

Navigating Florida's car insurance landscape can be complex, but with the right approach, you can secure affordable coverage that meets your needs. Here are some best practices to consider:

Compare Multiple Providers

Don't settle for the first insurance quote you receive. Compare rates and coverage options from multiple providers to find the best deal. Online comparison tools can be a valuable resource for quickly assessing different options.

Bundle Policies

Many insurance providers offer discounts when you bundle multiple policies, such as car insurance with home or renters insurance. Bundling can lead to significant savings, so it's worth considering if you're in the market for multiple types of insurance.

Explore Discounts

Insurance providers offer a variety of discounts, including those for safe driving, loyalty, multi-car policies, and even good grades for students. Be sure to inquire about available discounts and take advantage of those that apply to your situation.

Maintain a Clean Driving Record

A clean driving record is crucial for keeping insurance rates low. Avoid traffic violations and accidents to ensure you're not penalized with higher premiums. If you've had a clean record for a significant period, you may qualify for additional discounts.

Consider Usage-Based Insurance

Some insurance providers offer usage-based insurance, where rates are determined by your actual driving habits. This can be a great option for safe drivers, as it rewards responsible behavior with lower premiums. However, it may not be suitable for everyone, so carefully consider your driving patterns before opting for this type of coverage.

FAQs

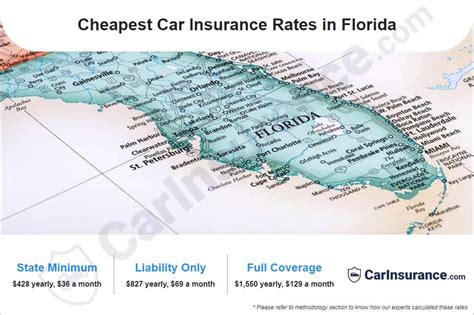

What is the average cost of car insurance in Florida?

+The average cost of car insurance in Florida can vary significantly based on factors like location, driving record, and the type of coverage. According to recent data, the average annual premium in Florida is around $1,500, but it can range from as low as $800 to over $2,500 depending on individual circumstances.

Can I get car insurance without a driver's license in Florida?

+Obtaining car insurance without a valid driver's license in Florida can be challenging. Most insurance providers require proof of a valid license to issue a policy. However, there may be exceptions for specific situations, such as purchasing a policy for a vehicle that will be driven by a licensed driver.

Are there any discounts available for senior drivers in Florida?

+Yes, many insurance providers offer discounts for senior drivers in Florida. These discounts may be based on age, driving experience, or even participation in safe driving programs. It's worth inquiring with multiple providers to find the best rates and discounts for senior citizens.

What happens if I'm involved in an accident with an uninsured driver in Florida?

+If you're involved in an accident with an uninsured driver in Florida, your own insurance policy's uninsured motorist coverage will come into play. This coverage protects you in the event of an accident with a driver who lacks insurance. It's important to ensure you have adequate uninsured motorist coverage to protect yourself in such situations.

Florida’s car insurance landscape is unique and dynamic, offering a range of coverage options and considerations. By understanding the state’s requirements, exploring different providers, and implementing best practices, Floridians can secure comprehensive car insurance at an affordable rate. Remember, taking the time to research and compare options is crucial for making informed decisions about your car insurance coverage.