Car Insurance For

Car insurance is an essential aspect of vehicle ownership, providing financial protection and peace of mind to drivers worldwide. With a wide range of coverage options and varying insurance policies, understanding the specifics of car insurance is crucial for making informed decisions. This comprehensive guide delves into the intricacies of car insurance, offering insights and expert advice to help you navigate the complex world of automotive coverage.

Understanding Car Insurance Coverage

Car insurance is designed to safeguard drivers and vehicle owners from financial losses arising from accidents, theft, or other unexpected events. The primary goal is to ensure that drivers can receive compensation for damages or injuries sustained, regardless of the specific circumstances.

The coverage offered by car insurance policies can be divided into several key categories, each addressing different potential risks and liabilities. These categories typically include:

- Liability Coverage: This covers the costs associated with bodily injury or property damage caused to others in an accident for which the insured driver is at fault.

- Collision Coverage: Pays for the repair or replacement of the insured vehicle in the event of a collision, regardless of fault.

- Comprehensive Coverage: Provides protection against damage caused by non-collision incidents such as fire, theft, vandalism, or natural disasters.

- Medical Payments Coverage: Covers the medical expenses of the insured driver and passengers, regardless of who is at fault in an accident.

- Uninsured/Underinsured Motorist Coverage: Protects the insured driver and passengers if they are involved in an accident with a driver who does not have sufficient insurance coverage.

Factors Influencing Car Insurance Rates

The cost of car insurance, often referred to as the premium, can vary significantly based on a multitude of factors. Insurance providers use these factors to assess the level of risk associated with insuring a particular driver or vehicle. Some of the key factors that influence car insurance rates include:

Vehicle Type and Usage

The type of vehicle you drive plays a significant role in determining your insurance premium. Generally, more expensive vehicles, sports cars, and those with high-performance engines tend to have higher insurance costs. Additionally, the primary purpose of using the vehicle, such as for personal or business use, can also impact insurance rates.

| Vehicle Type | Insurance Premium Impact |

|---|---|

| Sports Cars | Higher Premiums |

| Luxury Vehicles | Higher Premiums |

| Economy Cars | Lower Premiums |

Driver’s Profile and History

Your personal driving record and demographic information are crucial factors in determining insurance rates. Insurance providers consider factors such as your age, gender, driving experience, and claims history to assess your risk profile.

For instance, younger drivers, especially males, are often considered higher-risk due to their lack of experience and higher propensity for accidents. Similarly, a driver with a history of accidents or traffic violations may face higher insurance premiums.

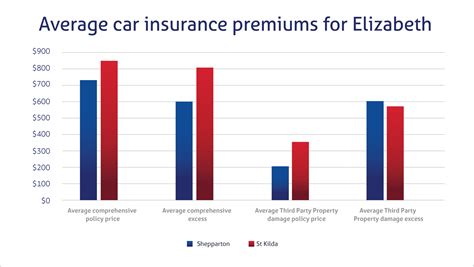

Geographic Location

The region where you live and drive can significantly impact your insurance rates. Areas with higher rates of accidents, theft, or vandalism may result in higher premiums. Additionally, the cost of living and repair services in your area can also influence insurance costs.

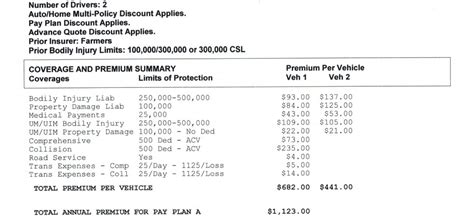

Coverage and Deductibles

The level of coverage you choose and the deductibles you select can greatly affect your insurance premium. Opting for higher coverage limits or lower deductibles will typically result in higher premiums, as you are choosing to transfer more risk to the insurance company.

Maximizing Value in Car Insurance

When it comes to car insurance, finding the right balance between coverage and cost is crucial. While it’s important to have adequate protection, you don’t want to overpay for insurance. Here are some strategies to help you maximize the value of your car insurance coverage:

Shop Around and Compare

Insurance rates can vary significantly between providers, so it’s essential to shop around and compare quotes. Obtaining multiple quotes allows you to identify the most competitive rates and the best coverage options for your needs.

Bundle Policies

If you have multiple insurance needs, such as home and auto insurance, consider bundling your policies with the same provider. Many insurance companies offer discounts for customers who bundle their policies, which can lead to significant savings.

Maintain a Clean Driving Record

A clean driving record is not only essential for road safety but also for keeping your insurance premiums low. Avoid traffic violations and accidents, as they can lead to increased insurance rates or even policy cancellation.

Choose the Right Coverage Levels

Understand your specific insurance needs and choose coverage levels accordingly. Overinsuring your vehicle can be a waste of money, while underinsuring may leave you vulnerable to significant financial losses in the event of an accident.

Consider Usage-Based Insurance

Some insurance providers offer usage-based insurance programs, where your premium is determined by your actual driving behavior and habits. These programs can be beneficial for safe and cautious drivers, as they may result in lower premiums.

The Future of Car Insurance

The car insurance industry is constantly evolving, driven by technological advancements and changing consumer needs. Here’s a glimpse into the future of car insurance and some of the trends that are shaping the industry:

Telematics and Usage-Based Insurance

Telematics technology, which involves the use of sensors and GPS to track driving behavior, is gaining traction in the insurance industry. Usage-based insurance programs that rely on telematics data to calculate premiums are expected to become more prevalent, offering personalized rates based on actual driving habits.

Connected Car Technology

The rise of connected car technology, where vehicles are equipped with advanced connectivity features, is opening new opportunities for insurance providers. Connected cars can provide real-time data on vehicle performance and driver behavior, allowing insurance companies to offer more accurate and tailored coverage.

Autonomous Vehicles

The advent of autonomous vehicles is set to revolutionize the car insurance industry. As self-driving cars become more common, insurance policies may need to adapt to cover new risks and liabilities associated with this technology. The focus may shift from individual driver behavior to the performance and safety of the vehicle’s autonomous systems.

Data Analytics and Predictive Modeling

Advanced data analytics and predictive modeling techniques are enabling insurance companies to make more accurate risk assessments. By analyzing vast amounts of data, insurance providers can identify trends and patterns, leading to more precise pricing and coverage offerings.

Frequently Asked Questions

How often should I review my car insurance policy?

+

It’s recommended to review your car insurance policy annually or whenever there are significant changes in your personal circumstances or vehicle usage. This ensures that your coverage remains adequate and up-to-date.

Can I switch car insurance providers mid-policy term?

+

Yes, you can typically switch insurance providers at any time, but it’s important to understand the terms of your current policy to avoid penalties or gaps in coverage. Make sure to carefully compare quotes and coverage options before making a switch.

What factors can lead to a car insurance policy being canceled or non-renewed?

+

Insurance providers may cancel or non-renew a policy due to various reasons, including multiple claims, severe traffic violations, or non-payment of premiums. It’s essential to maintain a good driving record and stay up-to-date with payments to avoid policy cancellation.