Car Insurance Hartford

When it comes to safeguarding your vehicle and ensuring peace of mind, few names carry the weight and reputation of The Hartford. With a rich history spanning over 200 years, this insurance giant has solidified its position as a trusted provider in the automotive insurance sector. In this comprehensive guide, we will delve into the world of Car Insurance Hartford, exploring its unique offerings, the benefits it provides, and how it stands out in the competitive insurance market.

A Legacy of Trust: The Hartford’s Journey in Automotive Insurance

The Hartford’s journey in the insurance industry is a testament to its resilience and adaptability. Founded in 1810, the company has weathered various economic and societal shifts, consistently evolving to meet the changing needs of its customers. Over the centuries, The Hartford has expanded its services, and its automotive insurance division has become a cornerstone of its success.

The company's entry into the automotive insurance realm was a strategic move, recognizing the growing importance of automobiles in everyday life. With a focus on comprehensive coverage and exceptional customer service, The Hartford quickly gained a reputation for being a reliable partner for drivers across the nation.

Core Values and Customer-Centric Approach

At the heart of The Hartford’s success is its unwavering commitment to its core values. These values, which include integrity, respect, inclusiveness, and a strong focus on customer satisfaction, have guided the company’s decisions and shaped its insurance offerings.

The Hartford understands that car insurance is more than just a policy; it's a promise of protection and support during challenging times. This customer-centric approach has led to the development of innovative products and services, ensuring that policyholders receive the coverage they need and the personalized attention they deserve.

A Diverse Range of Automotive Insurance Options

One of the standout features of Car Insurance Hartford is the breadth of its offerings. The company provides a comprehensive suite of insurance products tailored to meet the diverse needs of its customers. Whether you’re a young driver looking for basic coverage or a seasoned motorist seeking specialized protection, The Hartford has a plan to fit your requirements.

Here's a glimpse at some of the key automotive insurance options available through The Hartford:

- Standard Auto Insurance: This comprehensive policy covers a wide range of potential risks, including liability, collision, and comprehensive coverage. It's designed to protect you and your vehicle in various situations, from accidents to natural disasters.

- Classic Car Insurance: Recognizing the unique needs of classic car enthusiasts, The Hartford offers specialized insurance for vintage vehicles. This policy provides coverage for the vehicle's unique value, ensuring it's protected for years to come.

- Rideshare Insurance: With the rise of ridesharing services, The Hartford has developed a dedicated insurance plan for drivers who use their vehicles for ride-sharing. This policy offers liability and comprehensive coverage tailored to the specific risks associated with this industry.

- Motorcycle Insurance: The Hartford understands the passion and unique risks associated with riding motorcycles. Their motorcycle insurance policy provides coverage for damage, liability, and medical expenses, ensuring peace of mind on the open road.

- RV and Camper Insurance: For those who love the open road and the great outdoors, The Hartford offers specialized insurance for recreational vehicles and campers. This policy covers not just the vehicle but also the contents inside, providing comprehensive protection for your adventures.

The Hartford's commitment to innovation is evident in its continuous development of new insurance products and services. They stay ahead of the curve, anticipating the changing needs of their customers and adapting their offerings accordingly.

Benefits and Features of Car Insurance Hartford

Car Insurance Hartford is renowned for its extensive benefits and features, setting it apart from other insurance providers in the market. Here’s a closer look at some of the key advantages of choosing The Hartford for your automotive insurance needs:

Comprehensive Coverage

The Hartford’s policies are designed to provide comprehensive protection, ensuring that policyholders are covered for a wide range of potential risks. Whether it’s an accident, a natural disaster, or a mechanical failure, The Hartford’s policies offer peace of mind knowing that your vehicle and personal belongings are protected.

| Coverage Type | Description |

|---|---|

| Liability Coverage | Protects you from financial loss in the event of an accident where you're found at fault. |

| Collision Coverage | Covers the cost of repairs or replacement if your vehicle is damaged in a collision. |

| Comprehensive Coverage | Provides protection for your vehicle against non-collision incidents, such as theft, vandalism, or natural disasters. |

| Medical Payments Coverage | Assists with medical expenses for you and your passengers in the event of an accident, regardless of fault. |

Personalized Service and Support

At The Hartford, customer service is a top priority. The company prides itself on providing personalized attention to each policyholder, ensuring that their unique needs are met. From the initial quote process to filing a claim, The Hartford’s team of dedicated professionals is there to guide and support customers every step of the way.

Innovative Digital Tools

The Hartford understands the importance of convenience and efficiency in today’s fast-paced world. That’s why they’ve invested in developing a range of digital tools to enhance the customer experience. From online quote generation to mobile apps for policy management and claims tracking, The Hartford ensures that policyholders can access their insurance information and services with ease.

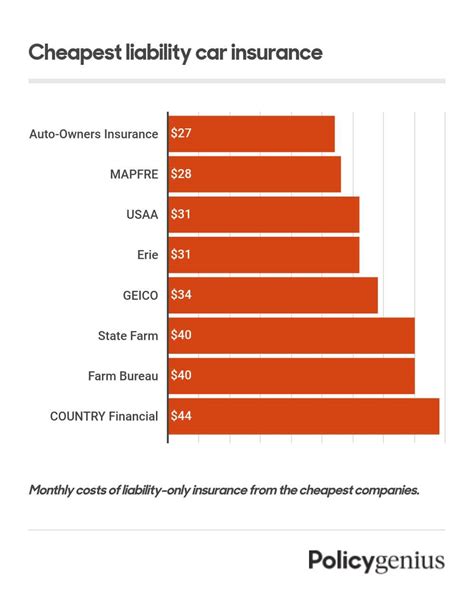

Competitive Pricing and Discounts

The Hartford is committed to providing affordable insurance solutions without compromising on coverage. Their policies are competitively priced, and they offer a range of discounts to help policyholders save even more. From multi-policy discounts to good student and safe driver incentives, The Hartford rewards its customers for responsible behavior and loyalty.

Exceptional Claims Handling

In the event of an accident or a claim, The Hartford’s claims process is designed to be efficient and stress-free. Their dedicated claims team works tirelessly to ensure that policyholders receive prompt and fair settlements. With a focus on customer satisfaction, The Hartford aims to make the claims process as seamless as possible, providing support and guidance throughout.

Community Engagement and Social Responsibility

Beyond its insurance offerings, The Hartford is deeply committed to giving back to the communities it serves. The company actively engages in various social responsibility initiatives, supporting causes that align with its values. From environmental sustainability efforts to educational programs, The Hartford strives to make a positive impact beyond its core business.

Real-World Experiences: Testimonials from Hartford Policyholders

The best way to understand the value of Car Insurance Hartford is through the experiences of its policyholders. Here are a few real-world testimonials that showcase the impact and benefits of choosing The Hartford for automotive insurance:

"As a classic car enthusiast, I wanted insurance that understood the unique value of my vehicle. The Hartford's Classic Car Insurance policy provided the perfect solution. Not only did they insure my car for its true value, but their customer service team was incredibly knowledgeable and helpful. I highly recommend The Hartford for anyone with a passion for classic cars."

- John, Classic Car Owner

"I've been with The Hartford for years, and their commitment to customer service is exceptional. When I had an accident, their claims team was there for me every step of the way. They ensured that my vehicle was repaired promptly and that I received fair compensation. I couldn't ask for a better insurance partner."

- Sarah, Long-Term Policyholder

"As a rideshare driver, I needed specialized insurance to protect me and my passengers. The Hartford's Rideshare Insurance policy was the perfect fit. It provides comprehensive coverage, and their app makes it easy to manage my policy and track claims. I feel confident and secure on the road with The Hartford."

- Michael, Rideshare Driver

Conclusion: A Trusted Partner for Your Automotive Insurance Needs

Car Insurance Hartford is more than just an insurance provider; it’s a trusted partner dedicated to protecting its customers and their vehicles. With a rich history, a customer-centric approach, and a commitment to innovation, The Hartford has solidified its position as a leader in the automotive insurance industry.

From its comprehensive range of insurance options to its personalized service and support, The Hartford offers a level of protection and peace of mind that sets it apart. Whether you're a new driver or a seasoned motorist, The Hartford has the expertise and resources to meet your unique insurance needs.

So, when it comes to safeguarding your vehicle and ensuring a secure future, trust The Hartford to be your reliable companion on the road ahead.

How can I get a quote for Car Insurance Hartford?

+Obtaining a quote for Car Insurance Hartford is simple and convenient. You can start by visiting their official website and using their online quote generator. Alternatively, you can reach out to their customer service team via phone or email, and they’ll be happy to assist you in getting a personalized quote based on your specific needs.

What makes The Hartford’s automotive insurance policies unique?

+The Hartford’s automotive insurance policies stand out due to their comprehensive coverage, personalized service, and commitment to innovation. They offer a wide range of specialized policies, from classic car insurance to rideshare coverage, ensuring that every policyholder’s unique needs are met. Additionally, their focus on customer satisfaction and continuous improvement sets them apart in the competitive insurance market.

Are there any discounts available with The Hartford’s car insurance policies?

+Absolutely! The Hartford offers a variety of discounts to help policyholders save on their insurance premiums. These discounts include multi-policy discounts, good student incentives, safe driver rewards, and more. By taking advantage of these discounts, you can enjoy significant savings while still receiving comprehensive coverage.

What should I do in the event of an accident while insured with The Hartford?

+If you’re involved in an accident while insured with The Hartford, it’s important to remain calm and follow these steps: First, ensure your safety and the safety of others involved. Then, contact The Hartford’s claims team as soon as possible to report the accident. They will guide you through the claims process, providing support and assistance every step of the way. Remember to collect all relevant information, such as the other driver’s details and any witness statements.

How can I access my insurance policy information and manage my account with The Hartford?

+The Hartford offers a user-friendly online platform and mobile app for policyholders to access their insurance information and manage their accounts. You can log in to your account through their website or app to view policy details, make payments, update your information, and even track the progress of any ongoing claims. The digital tools provided by The Hartford make managing your insurance simple and convenient.