Low Cost Motorcycle Insurance

Welcome to this comprehensive guide on low-cost motorcycle insurance, a topic that is of great interest to many motorcycle enthusiasts and budget-conscious riders alike. As a knowledgeable expert in the field, I will provide you with an in-depth analysis and valuable insights to help you navigate the world of motorcycle insurance, ensuring you find the best coverage at an affordable price.

Understanding the Basics of Motorcycle Insurance

Motorcycle insurance is an essential aspect of responsible riding, providing financial protection and peace of mind in the event of accidents, theft, or other unforeseen circumstances. It is a legal requirement in many regions and serves as a vital safety net for riders and their motorcycles.

The cost of motorcycle insurance can vary significantly based on numerous factors, including the rider's location, riding experience, the type of motorcycle, and the level of coverage desired. Understanding these variables is key to securing the most cost-effective insurance plan.

Factors Affecting Motorcycle Insurance Rates

Several key factors influence the cost of motorcycle insurance. These include:

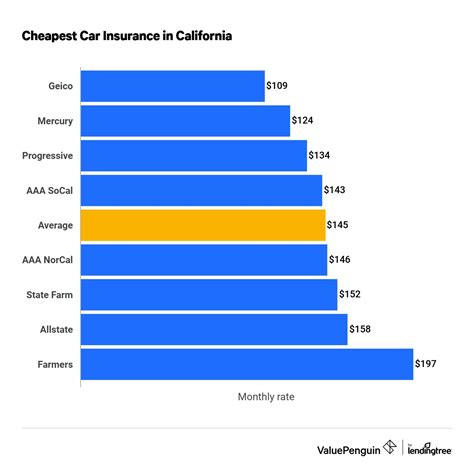

- Location: Insurance rates can vary significantly between different states or regions. This is due to variations in local laws, accident rates, and the cost of living.

- Rider’s Age and Experience: Younger riders, especially those under 25, often face higher insurance premiums due to their perceived higher risk. Conversely, experienced riders with a clean driving record may benefit from lower rates.

- Type of Motorcycle: The make, model, and age of your motorcycle can impact insurance costs. High-performance bikes or vintage models may require specialized coverage and thus, higher premiums.

- Coverage Level: The extent of coverage you choose will affect your insurance premium. Comprehensive coverage, which includes collision, liability, and comprehensive coverage, will typically be more expensive than basic liability-only coverage.

By understanding these factors, you can begin to tailor your insurance search to your specific needs and budget.

Strategies for Securing Low-Cost Motorcycle Insurance

While motorcycle insurance is an essential expense, there are several strategies you can employ to reduce the cost of your coverage without compromising on quality.

Compare Multiple Insurance Providers

The insurance market is highly competitive, and rates can vary significantly between providers. By obtaining quotes from multiple insurers, you can compare coverage options and prices, ensuring you find the best value for your money.

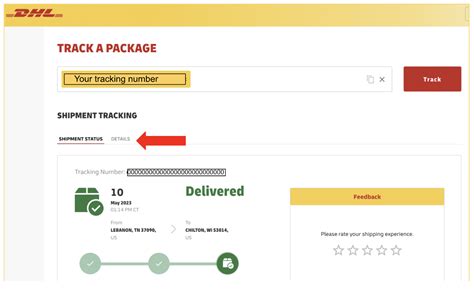

Online comparison tools can be a valuable resource for this task, allowing you to quickly and easily gather quotes from various insurers. However, it's essential to thoroughly review each quote to ensure you understand the coverage offered and any potential exclusions.

Choose the Right Coverage Level

While it’s tempting to opt for the most comprehensive coverage available, this may not always be the most cost-effective option. Consider your individual needs and riding habits to determine the level of coverage that best suits you.

If you ride infrequently or primarily use your motorcycle for short commutes, basic liability coverage may be sufficient. However, if you frequently ride long distances or participate in motorcycle events, comprehensive coverage may be more appropriate.

Explore Discounts and Savings Opportunities

Many insurance providers offer a range of discounts that can significantly reduce your premium. These may include:

- Multi-Policy Discounts: Insuring multiple vehicles or combining your motorcycle insurance with other policies, such as home or auto insurance, can often lead to substantial savings.

- Safe Riding Discounts : Some insurers offer discounts to riders who have completed approved safe riding courses or have a clean driving record.

- Loyalty Discounts: Staying with the same insurer for an extended period may result in loyalty discounts or other incentives.

- Payment Method Discounts : Paying your premium in full upfront or using a specific payment method, such as direct debit, may qualify you for a discount.

Be sure to ask your insurance provider about any potential discounts you may be eligible for, as these can make a significant difference in your overall premium.

Consider Alternative Insurance Options

In addition to traditional insurance providers, there are alternative options available that may offer more affordable coverage.

- Motorcycle Associations: Many motorcycle associations, such as the American Motorcyclist Association (AMA) or the Harley Owners Group (HOG), offer insurance programs for their members. These programs can provide comprehensive coverage at competitive rates.

- Online Insurance Brokers: Online insurance brokers often have access to a wide range of insurance providers and can help you find the most cost-effective coverage for your needs.

- Specialized Insurance Providers: There are insurance providers that specialize in motorcycle insurance, offering tailored coverage and competitive rates.

Understanding the Fine Print: Coverage Details and Exclusions

When comparing insurance policies, it’s crucial to thoroughly understand the coverage details and any potential exclusions. This ensures that you are adequately protected and aren’t caught off guard by unexpected limitations.

Common Coverage Types

Motorcycle insurance typically includes several key coverage types:

- Liability Coverage: This is the most basic type of coverage and is required by law in most states. It covers the cost of damage or injuries you cause to others in an accident.

- Collision Coverage: This covers the cost of repairing or replacing your motorcycle if it’s damaged in an accident, regardless of fault.

- Comprehensive Coverage: This provides protection against damage caused by events other than collisions, such as theft, vandalism, fire, or natural disasters.

- Medical Payments Coverage: Also known as Personal Injury Protection (PIP), this covers the cost of medical treatment for you and your passengers if you’re involved in an accident, regardless of fault.

- Uninsured/Underinsured Motorist Coverage: This provides protection if you’re involved in an accident with a driver who has no insurance or insufficient insurance to cover the damages.

Exclusions and Limitations

While comprehensive coverage is essential, it’s important to be aware of any potential exclusions or limitations. These may include:

- Damage caused by normal wear and tear or mechanical failure.

- Damage or theft of personal belongings carried on your motorcycle.

- Certain types of racing or off-road riding.

- Damage or loss resulting from war, nuclear incidents, or acts of terrorism.

Be sure to carefully review the policy documents to understand any exclusions or limitations that may apply to your coverage.

The Future of Motorcycle Insurance: Emerging Trends and Technologies

The insurance industry is continually evolving, and several emerging trends and technologies are set to shape the future of motorcycle insurance.

Telematics and Usage-Based Insurance

Telematics devices, which monitor driving behavior and habits, are increasingly being used in insurance. These devices can track factors such as speed, acceleration, and braking, providing insurers with real-time data on driving behavior.

Usage-based insurance, also known as pay-as-you-go or pay-per-mile insurance, uses telematics data to offer customized insurance premiums based on actual driving behavior. This can be particularly beneficial for low-mileage riders or those with safe driving habits, as it allows them to pay premiums that more accurately reflect their risk profile.

Digital Transformation and Direct-to-Consumer Insurance

The digital transformation of the insurance industry is paving the way for more efficient and customer-centric processes. Many insurers are now offering online quote comparisons, digital policy management, and even fully digital claims processes.

Direct-to-consumer insurance, where customers can purchase insurance policies directly from insurers without the need for a broker or agent, is also gaining traction. This model often offers more competitive pricing and a simplified, streamlined process.

Data Analytics and Risk Assessment

Advancements in data analytics are enabling insurers to more accurately assess risk and price insurance policies accordingly. By analyzing vast amounts of data, insurers can identify trends and patterns that were previously difficult to detect, leading to more precise risk assessments and potentially lower premiums for low-risk riders.

Conclusion: Navigating the Road to Affordable Motorcycle Insurance

Securing low-cost motorcycle insurance is a journey that requires careful consideration and research. By understanding the factors that influence insurance rates, comparing multiple providers, and exploring alternative options, you can find the coverage that best suits your needs at a price that fits your budget.

As the insurance industry continues to evolve, embracing new technologies and trends, the landscape of motorcycle insurance is set to become even more dynamic and consumer-friendly. Stay informed, shop around, and don't be afraid to ask questions to ensure you're getting the best possible deal on your motorcycle insurance.

What is the average cost of motorcycle insurance?

+The average cost of motorcycle insurance can vary significantly based on several factors, including location, rider’s age and experience, type of motorcycle, and coverage level. As of 2023, the average annual premium for motorcycle insurance in the United States is around $700. However, it’s important to note that this is just an average, and your specific premium may be higher or lower depending on your individual circumstances.

How can I lower my motorcycle insurance premium?

+There are several strategies you can employ to reduce your motorcycle insurance premium. These include comparing quotes from multiple insurers, choosing the right coverage level for your needs, exploring discounts and savings opportunities, and considering alternative insurance options such as motorcycle associations or online insurance brokers. Additionally, maintaining a clean driving record and taking approved safe riding courses can often lead to lower premiums.

What factors influence motorcycle insurance rates the most?

+Several key factors influence motorcycle insurance rates, including location, rider’s age and experience, type of motorcycle, and coverage level. Location is a significant factor as insurance rates can vary greatly between different states or regions due to variations in local laws, accident rates, and the cost of living. The rider’s age and experience also play a role, with younger riders often facing higher premiums due to their perceived higher risk. The type of motorcycle and the coverage level you choose will also impact your insurance premium.