Top Auto Insurance Companies In California

California is known for its diverse landscape, from bustling cities like Los Angeles and San Francisco to the picturesque coastline and rugged mountains. With a population of over 39 million people, it's no surprise that the Golden State boasts a thriving auto insurance market. Choosing the right auto insurance provider is crucial for every Californian driver, as it can significantly impact their financial security and peace of mind on the road.

In this comprehensive guide, we will delve into the world of auto insurance in California, exploring the top providers, their unique offerings, and the key factors that set them apart. By understanding the intricacies of the market and the services provided, drivers can make informed decisions to find the best coverage for their needs.

A Comprehensive Guide to Auto Insurance in California

When it comes to auto insurance, California residents have a wide array of options to choose from. The market is highly competitive, with both national and regional carriers vying for the loyalty of drivers across the state. To help you navigate this complex landscape, we have compiled a list of the top auto insurance companies in California, along with detailed insights into their offerings.

1. State Farm

State Farm is a well-established name in the auto insurance industry, and its presence in California is no exception. With a strong reputation for customer satisfaction and a wide range of coverage options, State Farm has earned its place as one of the top providers in the state.

Key Features:

- Competitive Rates: State Farm offers affordable premiums tailored to the unique needs of Californian drivers.

- Comprehensive Coverage: From liability insurance to collision and comprehensive coverage, State Farm provides a robust suite of options to protect drivers and their vehicles.

- Discounts: Policyholders can benefit from various discounts, including those for safe driving, multiple vehicles, and bundling with other State Farm insurance policies.

- Digital Services: State Farm offers a user-friendly mobile app and online platform, making it convenient for customers to manage their policies and access their information anytime, anywhere.

State Farm's commitment to customer service and its strong financial stability make it a top choice for many California drivers. With a wide network of local agents, policyholders can easily find personalized assistance and support.

2. GEICO

GEICO, known for its clever advertising campaigns, has made a significant impact on the California auto insurance market. This national provider offers a modern approach to insurance, combining competitive rates with innovative digital tools.

Key Features:

- Online Convenience: GEICO's digital platform allows customers to purchase, manage, and make claims online, providing a seamless and efficient experience.

- Discounts: Policyholders can save with discounts for safe driving, military personnel, and even for having good grades (for students).

- Customizable Coverage: GEICO offers a range of coverage options, allowing drivers to tailor their policies to their specific needs and budget.

- Roadside Assistance: GEICO's Emergency Roadside Service provides peace of mind with 24/7 assistance for towing, flat tire changes, and more.

GEICO's focus on convenience and its ability to cater to a diverse range of drivers make it a popular choice for those seeking a modern and streamlined insurance experience.

3. Progressive

Progressive is a well-known name in the insurance industry, offering a comprehensive suite of products, including auto insurance. In California, Progressive has established itself as a reliable and innovative provider, catering to the unique needs of the state's drivers.

Key Features:

- Name Your Price® Tool: Progressive's innovative tool allows drivers to set their budget and find a coverage option that fits their needs and price range.

- Snapshot® Program: This unique program uses telematics to monitor driving behavior, rewarding safe drivers with discounts.

- Discounts: Progressive offers a variety of discounts, including those for safe driving, multi-policy bundling, and even for being a loyal customer.

- Claims Satisfaction: Progressive is known for its efficient and customer-centric claims process, ensuring a smooth experience in the event of an accident.

Progressive's commitment to innovation and its focus on customer satisfaction have solidified its position as a top auto insurance provider in California.

4. Mercury Insurance

Mercury Insurance is a regional carrier with a strong presence in California. This provider specializes in offering comprehensive coverage options at competitive rates, making it a popular choice for many residents.

Key Features:

- Personalized Service: Mercury Insurance provides a dedicated local agent network, ensuring personalized assistance and support for policyholders.

- Comprehensive Coverage: From liability insurance to collision and comprehensive coverage, Mercury offers a wide range of options to protect drivers and their vehicles.

- Discounts: Policyholders can benefit from discounts for safe driving, multi-policy bundling, and even for being a loyal customer.

- SR-22 Insurance: Mercury Insurance is known for its expertise in providing SR-22 insurance, which is often required for drivers with certain violations or high-risk profiles.

Mercury Insurance's focus on personalized service and its expertise in handling complex insurance needs make it a trusted provider for many California drivers.

5. Esurance

Esurance is a modern auto insurance provider that has gained popularity for its digital-first approach. This provider offers a convenient and efficient insurance experience, tailored to the needs of today's tech-savvy drivers.

Key Features:

- Digital Convenience: Esurance's online platform allows customers to purchase, manage, and make claims with ease, providing a seamless experience.

- Discounts: Policyholders can save with discounts for safe driving, bundling policies, and even for being a tech-savvy customer who manages their policy online.

- Customizable Coverage: Esurance offers a range of coverage options, allowing drivers to build a policy that suits their unique needs and budget.

- Roadside Assistance: Esurance provides 24/7 roadside assistance, ensuring prompt help in case of emergencies.

Esurance's focus on digital convenience and its ability to cater to a tech-oriented demographic have made it a preferred choice for many California drivers seeking a modern insurance experience.

Factors to Consider When Choosing an Auto Insurance Provider

When selecting an auto insurance provider in California, it's important to consider various factors to ensure you find the best fit for your needs. Here are some key considerations:

Coverage Options

Different drivers have unique insurance needs. Assess the coverage options offered by each provider, ensuring they align with your requirements. From liability insurance to comprehensive and collision coverage, choose a provider that offers the level of protection you desire.

Premiums and Discounts

Compare the premiums offered by different providers, considering your budget and financial goals. Additionally, explore the discounts available. Many providers offer discounts for safe driving, multiple vehicles, and bundling policies, which can significantly reduce your insurance costs.

Claims Process

In the event of an accident, a seamless and efficient claims process is crucial. Research the reputation of each provider's claims department, looking for reviews and ratings that indicate a positive and timely experience.

Customer Service

Access to reliable and responsive customer service is essential. Consider the availability of local agents or representatives, as well as the provider's digital tools and resources for managing your policy.

Financial Stability

Ensure the provider you choose has a strong financial foundation. A financially stable company can provide long-term security and peace of mind, ensuring they will be able to fulfill their obligations even in challenging economic times.

Conclusion: Navigating the Auto Insurance Landscape in California

California's auto insurance market offers a diverse range of providers, each with its unique strengths and offerings. By understanding the key features and services provided by the top auto insurance companies, drivers can make informed decisions to find the best coverage at the most competitive rates.

Whether you prioritize personalized service, innovative digital tools, or comprehensive coverage options, there is an auto insurance provider in California that will meet your needs. Take the time to compare and research, and don't hesitate to reach out to providers for quotes and additional information. Your peace of mind and financial security on the road are worth the investment.

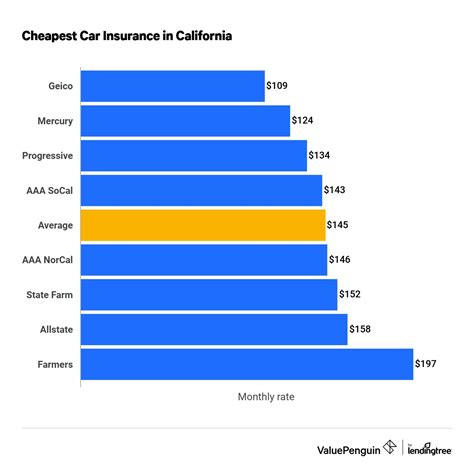

What is the average cost of auto insurance in California?

+The average cost of auto insurance in California varies depending on several factors, including the driver’s age, location, and driving history. According to recent data, the average annual premium for a standard liability policy in California is approximately 1,500. However, this can range widely based on individual circumstances.</p> </div> </div> <div class="faq-item"> <div class="faq-question"> <h3>Are there any unique coverage requirements in California?</h3> <span class="faq-toggle">+</span> </div> <div class="faq-answer"> <p>Yes, California has specific insurance requirements. All drivers must carry liability insurance with minimum limits of 15,000 for bodily injury per person, 30,000 for bodily injury per accident, and 5,000 for property damage. Additionally, drivers may be required to carry additional coverage, such as uninsured/underinsured motorist coverage, depending on their specific circumstances.

How can I save on my auto insurance premiums in California?

+There are several ways to save on auto insurance premiums in California. These include maintaining a clean driving record, taking advantage of discounts offered by insurance providers (such as safe driver discounts or multi-policy discounts), and shopping around to compare rates from different providers. Additionally, consider increasing your deductible to lower your premium, but be mindful of your financial ability to cover the deductible in case of a claim.