Car Insurance Multiple Quotes

In today's fast-paced world, ensuring you have the right car insurance coverage is crucial, but finding the best policy at the right price can be a daunting task. With countless insurance providers and a multitude of policy options, it's easy to feel overwhelmed. That's why many savvy consumers are turning to the practice of obtaining multiple quotes before making their decision. This comprehensive guide will delve into the benefits of comparing car insurance quotes, explore the factors that influence rates, and provide valuable insights to help you make an informed choice.

Unveiling the Benefits of Multiple Quotes

Obtaining multiple quotes for your car insurance is akin to shopping around for the best deal on any other significant purchase. It empowers you to make an informed decision, ensuring you get the coverage you need at a price that fits your budget. Here's a deeper look at the advantages of this approach:

Comparative Analysis

By gathering quotes from various insurers, you gain a comprehensive view of the market. This allows you to compare coverage options, deductibles, and, most importantly, prices. With this information, you can identify the best value for your money, ensuring you're not overpaying for coverage.

Personalized Coverage

Insurance providers offer a range of policies tailored to different needs. By obtaining multiple quotes, you can explore these options and find the coverage that aligns perfectly with your driving habits and preferences. Whether you require comprehensive coverage for a high-end vehicle or basic liability for a budget-friendly car, you can find the right fit.

Negotiating Power

Having multiple quotes in hand gives you leverage when negotiating with insurance providers. You can use the quotes to your advantage, highlighting the competitive rates offered by other companies. This can lead to better deals, discounts, or even customized policies that meet your specific requirements.

Peace of Mind

When you've taken the time to compare multiple quotes, you can rest assured that you've made an informed decision. You'll have confidence in your choice, knowing that you've explored all the available options and selected the best one for your needs. This peace of mind is invaluable when it comes to protecting your vehicle and your finances.

Factors Influencing Car Insurance Rates

Car insurance rates are influenced by a multitude of factors, each playing a unique role in determining the cost of your policy. Understanding these factors can help you navigate the quote-comparison process more effectively and make adjustments to potentially lower your rates.

Vehicle Type and Age

The type of vehicle you drive and its age significantly impact your insurance rates. Newer, more expensive vehicles generally cost more to insure, as they may require specialized repairs and carry a higher risk of theft. Similarly, classic or vintage cars may require specific coverage due to their unique value and usage.

Driving History and Record

Your driving history is a crucial factor in determining insurance rates. Insurers carefully examine your record, including any accidents, violations, or claims you've made in the past. A clean driving record often leads to lower rates, while a history of accidents or traffic violations can significantly increase your premiums.

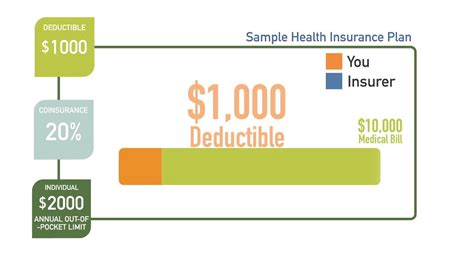

Coverage and Deductibles

The level of coverage you choose and the associated deductibles play a vital role in your insurance rates. Comprehensive coverage, which includes protection for various scenarios like theft, vandalism, and natural disasters, tends to be more expensive. On the other hand, higher deductibles (the amount you pay out of pocket before insurance coverage kicks in) can lower your premiums, as they indicate a willingness to bear more financial responsibility.

Location and Usage

Where you live and how you use your vehicle also impact your insurance rates. Areas with a higher incidence of accidents, thefts, or natural disasters often see increased insurance costs. Additionally, if you use your vehicle for business purposes or frequently commute long distances, your rates may be higher due to the increased risk associated with these activities.

Personal Factors

Personal factors such as age, gender, and marital status can influence insurance rates. Young, male drivers, for example, are often considered higher-risk due to their propensity for more aggressive driving. Conversely, older, experienced drivers with a clean record may enjoy lower rates. Marital status can also be a factor, with some insurers offering discounts for married couples.

Maximizing Savings: Strategies for Lower Rates

While obtaining multiple quotes is a great start, there are additional strategies you can employ to potentially lower your car insurance rates. These tactics can help you save money and ensure you're getting the best value for your insurance dollar.

Bundling Policies

Consider bundling your car insurance with other policies, such as home or renters insurance. Many insurers offer multi-policy discounts, which can significantly reduce your overall premiums. By combining your insurance needs, you not only save money but also simplify your insurance management.

Safe Driving Incentives

Incentivizing safe driving is a common practice among insurance providers. Many companies offer discounts for drivers who maintain a clean record over a certain period. Additionally, some insurers provide telematics devices or apps that track your driving habits, rewarding you with discounts for safe driving behaviors like maintaining a steady speed or avoiding hard braking.

Usage-Based Insurance

Usage-based insurance, also known as pay-as-you-drive insurance, is an innovative approach that tailors your premiums to your actual driving habits. This type of insurance uses telematics technology to monitor your driving distance, time of day, and other factors. If you drive less frequently or during safer hours, you may qualify for lower rates.

Loyalty Rewards

Loyalty can pay off when it comes to car insurance. Many insurers offer loyalty discounts to customers who have been with the company for an extended period. These discounts can accumulate over time, providing significant savings for long-term customers. However, be sure to compare rates periodically to ensure you're still getting the best deal.

Discounts and Special Offers

Insurance providers often offer a range of discounts and special offers to attract new customers or reward existing ones. These discounts can be for a variety of reasons, such as being a safe driver, having a certain type of vehicle, or even being a member of specific organizations or associations. Stay informed about these opportunities and ask your insurer about any applicable discounts.

The Future of Car Insurance: Trends and Innovations

The car insurance industry is evolving rapidly, driven by technological advancements and changing consumer needs. Here's a glimpse into the future of car insurance and how it may impact your quote-comparison process.

Telematics and Connected Cars

Telematics technology is revolutionizing the way insurance providers assess risk and price policies. With connected cars becoming increasingly common, insurers can gather real-time data on driving behavior, vehicle performance, and even road conditions. This data-driven approach allows for more accurate risk assessment and potentially lower rates for safe drivers.

Artificial Intelligence and Machine Learning

Artificial Intelligence (AI) and Machine Learning (ML) are transforming the insurance industry by enabling more efficient claims processing and risk assessment. These technologies can analyze vast amounts of data, identify patterns, and make predictions with greater accuracy. As a result, insurers can offer more tailored policies and potentially reduce costs for customers.

Digital Transformation

The digital transformation of the insurance industry is making it easier and more convenient for consumers to obtain quotes and manage their policies. Online quote comparison tools, mobile apps, and digital platforms are becoming the norm, providing consumers with instant access to information and a seamless purchasing experience.

Personalized Insurance

The future of car insurance is moving towards personalized, customized policies. With the help of advanced analytics and data-driven insights, insurers can offer coverage that is tailored to individual needs and preferences. This level of personalization ensures that you're only paying for the coverage you truly need, maximizing value and minimizing waste.

Sustainable and Green Initiatives

As environmental consciousness grows, the insurance industry is also embracing sustainability. Some insurers are offering discounts or incentives for drivers who opt for eco-friendly vehicles or adopt green driving practices. This trend is likely to continue, rewarding consumers who make environmentally conscious choices.

Expert Tips: Making the Most of Your Quote Comparison

To ensure you're making the most informed decision when comparing car insurance quotes, consider these expert tips:

- Understand Your Needs: Before requesting quotes, take the time to assess your specific insurance needs. Consider factors like your driving habits, the value of your vehicle, and any unique circumstances that may impact your coverage requirements.

- Be Transparent: When providing information to insurers, be honest and transparent. Misrepresenting your driving history or vehicle details can lead to issues down the line, potentially voiding your policy or resulting in higher premiums.

- Compare Apples to Apples: Ensure you're comparing quotes that offer similar coverage levels. Different insurers may use different terminology or have slightly different policy structures, so carefully review the details to ensure an accurate comparison.

- Consider Long-Term Costs: While finding the lowest initial premium is important, don't forget to consider long-term costs. Some insurers may offer competitive initial rates but have higher renewal costs or hidden fees. Look for providers with consistent, transparent pricing.

- Read the Fine Print: Don't rush through the policy details. Carefully review the fine print to understand any exclusions, limitations, or conditions that may impact your coverage. This step is crucial to ensuring you're fully protected in the event of a claim.

Conclusion: Empowering Your Insurance Decision

Obtaining multiple quotes for your car insurance is a powerful tool to ensure you're getting the best coverage at the right price. By understanding the benefits of quote comparison, the factors that influence rates, and the strategies to maximize savings, you can make an informed decision that aligns with your needs and budget. As the car insurance industry continues to evolve, staying informed and proactive will help you navigate the market and secure the best value for your insurance dollar.

Frequently Asked Questions

How often should I compare car insurance quotes?

+It’s recommended to compare quotes annually, especially when your policy is up for renewal. Market conditions and personal circumstances can change, leading to potential savings. Additionally, consider comparing quotes anytime you experience a significant life event, such as buying a new car, getting married, or moving to a new location.

Can I negotiate car insurance rates?

+Absolutely! Negotiating your car insurance rates is a common practice. When you have multiple quotes in hand, you can use them to leverage better rates or discounts from your insurer. Don’t be afraid to ask about discounts or to inquire about potential rate adjustments based on your driving record or other factors.

What factors can I control to lower my insurance rates?

+You have control over several factors that can impact your insurance rates. Maintaining a clean driving record, driving safely, and avoiding accidents or violations are key. Additionally, you can influence your rates by choosing a higher deductible, bundling policies, or adopting usage-based insurance if available.

How do telematics devices work, and are they beneficial for me?

+Telematics devices, often provided by insurers, track your driving behavior and send data to the insurance company. This data can include speed, acceleration, braking patterns, and mileage. While some drivers may be hesitant about being monitored, telematics can lead to lower rates for safe drivers. It’s a great option for those who are confident in their driving skills.