Car Insurance Quick Quote

Finding the right car insurance coverage can be a daunting task, especially when you're short on time. That's where quick quotes come in—a convenient and efficient way to get an estimate of your car insurance costs in a matter of minutes. This comprehensive guide will delve into the world of car insurance quick quotes, exploring their benefits, how they work, and the key factors that influence your premium. Whether you're a seasoned driver or a first-time car owner, understanding the ins and outs of quick quotes can empower you to make informed decisions about your car insurance coverage.

The Convenience of Quick Quotes: A Time-Saver for Drivers

In today’s fast-paced world, convenience is a top priority, and quick quotes for car insurance provide just that. Instead of spending hours researching and calling different insurance providers, you can now obtain an estimate of your insurance costs with just a few clicks or a short phone call. This streamlined process saves you valuable time and effort, allowing you to quickly assess your insurance options and make an informed choice.

Quick quotes are particularly beneficial for busy individuals who value their time and appreciate the efficiency of online services. By leveraging technology, insurance companies can provide an instant estimate of your insurance premium, based on the information you provide. This modern approach to insurance shopping ensures that you can get a quote whenever and wherever it's convenient for you, without the need for lengthy meetings or appointments.

How Do Quick Quotes Work: Understanding the Process

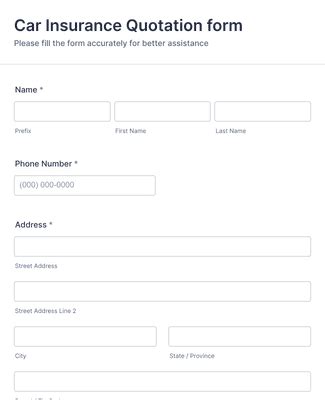

The process of obtaining a quick quote for car insurance is designed to be straightforward and user-friendly. Here’s a step-by-step breakdown of how it typically works:

- Provide Basic Information: When requesting a quick quote, you'll be asked to provide some essential details about yourself, your vehicle, and your driving history. This typically includes your name, date of birth, vehicle make and model, and your driving record.

- Select Coverage Options: Most quick quote tools allow you to choose the type and level of coverage you're interested in. You can opt for comprehensive, collision, liability, or other specific types of coverage based on your needs and budget.

- Answer Additional Questions: To refine the quote, you may be asked additional questions about your vehicle's usage, any safety features it has, and your preferred payment method. These details help insurance providers tailor the quote to your specific situation.

- Instant Quote Generation: Once you've provided all the necessary information, the quick quote tool will generate an estimated insurance premium based on the data you've entered. This estimate gives you a good idea of what your insurance costs might be.

- Review and Compare: After receiving your quick quote, take the time to review it carefully and compare it with quotes from other insurance providers. This step allows you to assess the value and coverage offered by different companies, ensuring you get the best deal.

By following this simple process, you can quickly and easily obtain a car insurance quick quote, making it a convenient and efficient way to explore your insurance options.

Factors That Influence Your Quick Quote: Uncovering the Key Variables

When you request a quick quote for car insurance, several factors come into play that influence the estimated premium you receive. Understanding these factors can help you make more informed decisions and potentially negotiate better rates. Here are some of the key variables that impact your quick quote:

- Vehicle Type and Value: The make, model, and age of your vehicle play a significant role in determining your insurance costs. Generally, newer and more expensive vehicles tend to have higher insurance premiums due to their replacement and repair costs.

- Driver Profile: Your personal information, including your age, gender, and driving record, is a crucial factor. Younger drivers and those with a history of accidents or violations may face higher insurance premiums.

- Coverage Selection: The type and level of coverage you choose directly affect your premium. Comprehensive coverage, which includes collision, liability, and additional protections, will typically cost more than basic liability coverage.

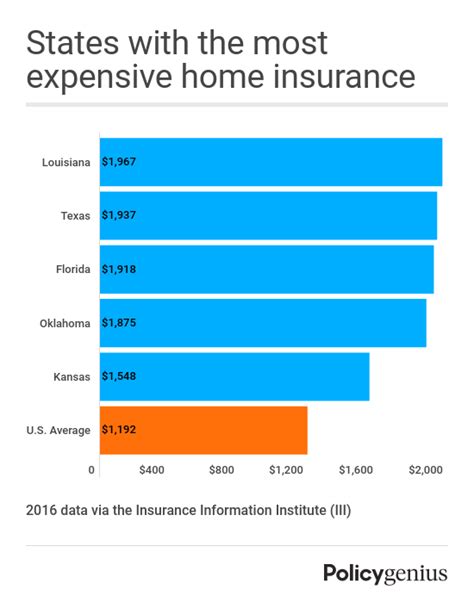

- Location and Usage: Where you live and how you use your vehicle can impact your insurance costs. Urban areas with higher traffic density and theft rates may result in higher premiums, while rural areas may offer more affordable rates. Additionally, if you use your vehicle for business purposes or commute long distances, your insurance costs may increase.

- Discounts and Bundles: Many insurance providers offer discounts for various reasons, such as good driving records, safety features in your vehicle, or bundling multiple insurance policies (e.g., car and home insurance) with the same provider.

By being aware of these factors and providing accurate information when requesting a quick quote, you can ensure that the estimate you receive is as precise as possible. This knowledge empowers you to negotiate better rates and make more informed choices about your car insurance coverage.

Maximizing Your Quick Quote: Tips for Getting the Best Estimate

While quick quotes provide a convenient way to estimate your car insurance costs, there are strategies you can employ to ensure you get the most accurate and competitive estimate. Here are some tips to help you maximize your quick quote experience:

- Provide Accurate Information: Accuracy is key when providing details about yourself, your vehicle, and your driving history. Inaccurate information can lead to an incorrect quote, so be sure to double-check your inputs and ensure they reflect your current situation.

- Explore Different Coverage Options: Don't settle for the first quote you receive. Take the time to experiment with different coverage levels and types to find the best balance between cost and protection. Remember, the more comprehensive your coverage, the higher the premium is likely to be.

- Compare Multiple Quotes: Obtaining quotes from multiple insurance providers is essential to finding the best deal. Compare the estimates side by side, considering not only the premium but also the coverage offered and the reputation of the insurance company.

- Consider Bundling Policies: If you have multiple insurance needs, such as car and home insurance, consider bundling your policies with the same provider. Many insurance companies offer discounts for bundling, which can significantly reduce your overall insurance costs.

- Research Discounts and Promotions: Stay informed about the discounts and promotions offered by insurance providers. Some companies offer discounts for safe driving records, loyalty, or even specific professions. By researching and applying for these discounts, you can potentially lower your insurance premium.

By following these tips and being proactive in your insurance shopping, you can make the most of your quick quote experience and find the best car insurance coverage for your needs and budget.

The Future of Quick Quotes: Innovations and Trends

As technology continues to advance, the world of car insurance quick quotes is evolving rapidly. Insurance providers are constantly innovating to enhance the accuracy and convenience of their quick quote tools, ensuring an even better experience for drivers. Here are some of the exciting trends and innovations shaping the future of quick quotes:

- Enhanced Data Analysis: Insurance companies are leveraging advanced analytics and machine learning to improve the accuracy of quick quotes. By analyzing vast amounts of data, they can more precisely assess risk factors and provide tailored quotes based on individual circumstances.

- Real-Time Updates: Some insurance providers are now offering real-time updates to quick quotes. This means that as you make changes to your coverage or provide additional information, the quote adjusts instantly, giving you a more dynamic and accurate estimate.

- Digital Integration: Quick quotes are becoming more seamlessly integrated into the digital ecosystem. You can now obtain quotes through various channels, including mobile apps, chatbots, and voice assistants, making the process even more accessible and convenient.

- Personalized Recommendations: Advanced algorithms are being used to provide personalized coverage recommendations based on your unique needs and circumstances. These recommendations can help you make more informed decisions about your insurance coverage.

- Collaborative Insurance: With the rise of collaborative consumption, some insurance providers are exploring peer-to-peer insurance models. These innovative approaches allow individuals to share risks and resources, potentially leading to more affordable insurance options.

As these trends and innovations continue to shape the insurance industry, quick quotes will become even more accurate, personalized, and accessible. Stay tuned to the latest advancements to make the most of your car insurance shopping experience.

The Bottom Line: Quick Quotes as a Powerful Tool

Car insurance quick quotes have revolutionized the way drivers shop for insurance, offering a fast, convenient, and efficient way to estimate insurance costs. By understanding the process, the factors that influence your quote, and the strategies to maximize your estimate, you can make informed decisions about your car insurance coverage. Remember, while quick quotes are a powerful tool, they are just the beginning of your insurance journey. Take the time to explore your options, compare quotes, and seek out the best coverage and value for your needs.

With the right approach and a bit of research, you can navigate the world of car insurance with confidence, ensuring you get the protection you need at a price that fits your budget. So, embrace the convenience of quick quotes and take control of your insurance future.

How accurate are quick quotes for car insurance?

+Quick quotes provide an estimated premium based on the information you provide. While they are a good starting point, the final insurance premium may vary slightly due to additional factors assessed during the full application process.

Can I get a quick quote without providing my personal information?

+No, quick quotes require some basic personal and vehicle information to generate an estimate. However, you can choose to remain anonymous until you’re ready to proceed with an application.

Are quick quotes available for all types of car insurance coverage?

+Yes, quick quotes are available for various types of car insurance coverage, including liability, comprehensive, collision, and more. You can typically choose the coverage type when requesting a quote.