Car Insurance Quote California

Securing a car insurance quote in California is a vital step for any driver in the state. With its diverse landscapes, bustling cities, and unique road regulations, California presents a challenging environment for motorists. The Golden State's extensive road network, including iconic highways like Route 66 and the Pacific Coast Highway, demands robust insurance coverage. As one of the most populous states, California's roads are often congested, increasing the likelihood of accidents and subsequent insurance claims. Understanding the intricacies of car insurance in this region is crucial for ensuring comprehensive protection and financial security.

Understanding California's Car Insurance Landscape

California's car insurance market is characterized by a unique blend of state-mandated coverage and optional add-ons. The state requires a minimum level of liability insurance, but drivers have the flexibility to customize their policies with additional coverage to suit their specific needs and preferences.

The liability insurance component is designed to protect policyholders against financial losses arising from accidents they cause. It covers bodily injury and property damage, ensuring that victims of such incidents receive compensation for their injuries and related expenses. This is a critical aspect of car insurance in California, given the state's high population density and the resulting potential for accidents.

However, liability insurance alone may not provide sufficient coverage for all situations. California drivers often opt for additional coverage, such as collision and comprehensive insurance. Collision insurance covers damage to the insured vehicle resulting from collisions with other vehicles or objects, while comprehensive insurance provides protection against theft, vandalism, and damage caused by natural disasters or falling objects. These add-ons offer a more comprehensive safety net, ensuring that policyholders are protected against a wide range of potential risks.

Furthermore, California's unique road regulations and driving conditions necessitate specialized coverage. For instance, drivers in areas prone to earthquakes may want to consider earthquake insurance, which provides protection against damage caused by seismic activity. Similarly, those residing in regions with a high risk of wildfires may opt for wildfire insurance to safeguard their vehicles against potential fire-related damages.

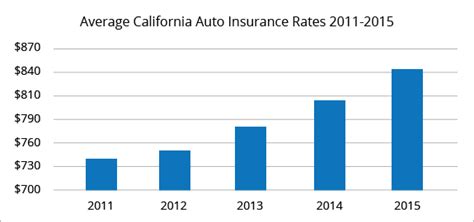

When obtaining a car insurance quote in California, drivers should be aware of the potential impact of their credit score on their insurance premiums. Unlike many other states, California allows insurance companies to use credit-based insurance scores as a factor in determining premiums. This means that drivers with a higher credit score may enjoy more competitive rates, while those with lower scores may face higher insurance costs.

In addition to credit score, other factors that influence car insurance premiums in California include the driver's age, gender, driving record, and the type and value of the vehicle being insured. Younger drivers, particularly those under the age of 25, often face higher premiums due to their perceived higher risk of accidents. Similarly, drivers with a history of traffic violations or accidents may also see increased insurance costs.

Navigating the Quote Process: A Step-by-Step Guide

Obtaining a car insurance quote in California is a straightforward process that can be completed online or over the phone. Here's a step-by-step guide to help you navigate the quote process effectively:

Step 1: Gather Essential Information

Before you begin the quote process, ensure you have all the necessary information at hand. This includes your driver's license number, the Vehicle Identification Number (VIN) of your car, and details about your driving history, such as any accidents or traffic violations you've been involved in.

Additionally, it's beneficial to have a rough idea of the coverage limits you're seeking. This includes the desired liability limits (both bodily injury and property damage), as well as any optional coverage you wish to include, such as collision, comprehensive, or specialized coverage like earthquake or wildfire insurance.

If you're unsure about the appropriate coverage limits, consider consulting with an insurance agent or using an online tool that can guide you through the process and provide recommendations based on your specific circumstances.

Step 2: Compare Multiple Quotes

One of the key advantages of obtaining quotes online is the ability to easily compare multiple offers from different insurers. This comparison allows you to identify the best value for your money and choose a policy that suits your needs and budget.

When comparing quotes, pay close attention to the coverage limits and deductibles. Ensure that the policies you're considering provide the level of protection you require. Also, consider the reputation and financial stability of the insurance companies, as this can impact the quality of service you receive in the event of a claim.

Online comparison tools can be particularly useful in this step, as they often provide side-by-side comparisons of different policies, making it easier to identify the best options.

Step 3: Consider Discounts and Bundling Options

Many insurance companies offer discounts to policyholders, which can significantly reduce the cost of your insurance premiums. Common discounts include those for safe driving, multiple vehicles, and loyalty. Some insurers also offer discounts for specific occupations or memberships, so it's worth checking if you're eligible for any of these discounts.

Additionally, consider the benefits of bundling your car insurance with other policies, such as homeowners or renters insurance. Bundling can often lead to substantial savings, as insurance companies often offer discounts to policyholders who have multiple policies with them.

Step 4: Review and Finalize Your Quote

Once you've compared quotes and identified the best option for your needs, carefully review the policy details. Ensure that the coverage limits, deductibles, and other terms and conditions align with your expectations.

If you have any questions or concerns about the policy, don't hesitate to contact the insurance company or an agent. They can provide clarification and guidance to help you make an informed decision.

Once you're satisfied with the quote, you can proceed with purchasing the policy. This typically involves providing payment details and accepting the terms and conditions of the insurance contract.

Exploring Specialized Coverage Options

California's diverse landscapes and unique driving conditions present a range of risks that may not be adequately covered by standard car insurance policies. As such, specialized coverage options are often necessary to ensure comprehensive protection.

Earthquake Insurance

California is known for its seismic activity, with earthquakes being a common occurrence in many parts of the state. While standard car insurance policies may provide some coverage for damage caused by earthquakes, this coverage is often limited and may not fully protect policyholders against the significant financial losses that can result from such events.

Earthquake insurance is designed to provide additional coverage for damage caused by seismic activity. This coverage can be particularly valuable for drivers in regions like the San Francisco Bay Area or Southern California, which are prone to earthquakes. It offers peace of mind, knowing that your vehicle is protected against potential damages that could otherwise be financially devastating.

Wildfire Insurance

California's dry climate and frequent droughts make it susceptible to wildfires, particularly during the summer and fall months. Wildfires can cause significant damage to vehicles, including charring, melting, and smoke damage. Standard car insurance policies often exclude coverage for such damages, leaving policyholders financially vulnerable.

Wildfire insurance is specifically designed to provide protection against these risks. It covers damage to vehicles caused by wildfires, ensuring that policyholders are not left with the financial burden of repairing or replacing their vehicles after such incidents.

Other Specialized Coverages

In addition to earthquake and wildfire insurance, California drivers may benefit from other specialized coverages, depending on their specific circumstances and locations.

For instance, drivers in coastal regions may want to consider flood insurance, which provides protection against damage caused by rising water levels, heavy rains, or coastal storms. This coverage can be particularly valuable for those living in areas prone to flooding, such as along the California coast.

Additionally, drivers who frequently travel long distances or use their vehicles for business purposes may want to consider adding roadside assistance coverage to their policies. This provides peace of mind by offering services such as towing, battery jumps, and tire changes in case of breakdowns or emergencies.

The Impact of Credit Score on Insurance Premiums

In California, credit score is a significant factor in determining car insurance premiums. Insurance companies use credit-based insurance scores to assess the risk associated with a policyholder, which can have a substantial impact on the cost of their insurance.

Policyholders with higher credit scores are generally considered lower risk and may enjoy more competitive insurance rates. This is because individuals with higher credit scores are often viewed as more responsible and financially stable, which can translate to a lower likelihood of filing insurance claims.

Conversely, those with lower credit scores may face higher insurance premiums. This is because insurance companies perceive individuals with lower credit scores as higher risk, potentially leading to more frequent and costly claims. As a result, these policyholders may pay a premium that reflects the increased risk associated with their credit profile.

It's important to note that while credit score is a significant factor, it's not the only one. Other factors, such as driving record, age, gender, and the type and value of the vehicle being insured, also play a role in determining insurance premiums. As such, even individuals with lower credit scores may be able to obtain competitive rates by maintaining a clean driving record, choosing a less expensive vehicle, or opting for higher deductibles.

The Importance of Shopping Around for the Best Rates

Given the significant variation in car insurance rates across different insurers, it's crucial for California drivers to shop around for the best deals. Each insurance company uses its own proprietary formula to calculate premiums, which means that rates can vary widely between providers, even for identical coverage.

By obtaining multiple quotes from different insurers, drivers can identify the companies that offer the most competitive rates for their specific circumstances. This process can be particularly beneficial for high-risk drivers, such as those with a history of accidents or traffic violations, as they may be able to find insurers who specialize in providing coverage for such individuals at more affordable rates.

Additionally, shopping around allows drivers to compare the coverage options and add-ons offered by different insurers. This ensures that policyholders can tailor their insurance policies to their specific needs, ensuring they have the right level of protection without paying for unnecessary coverage.

Online comparison tools can be a valuable asset in this process, as they provide a quick and convenient way to obtain multiple quotes and compare policies side by side. These tools often allow users to input their specific details, such as driving history and desired coverage limits, to generate personalized quotes from a range of insurers.

Frequently Asked Questions (FAQ)

How often should I review and update my car insurance policy in California?

+It's recommended to review your car insurance policy annually, or whenever you experience significant life changes such as moving to a new city, purchasing a new vehicle, or getting married. These events can impact your insurance needs and may warrant adjustments to your coverage.

Are there any discounts available for car insurance in California?

+Yes, there are several discounts available, including safe driver discounts, multi-policy discounts (if you bundle your car insurance with other policies like homeowners or renters insurance), and loyalty discounts for long-term customers. Some insurers also offer discounts for specific occupations or memberships.

What should I do if I'm involved in an accident in California?

+If you're involved in an accident, the first step is to ensure your safety and the safety of others involved. Call the police to report the accident and provide your insurance information to the other party. Take photos of the scene and any damage to your vehicle. Contact your insurance company as soon as possible to report the incident and begin the claims process.

Can I switch car insurance providers in California?

+Absolutely! California drivers have the freedom to choose their insurance provider and switch at any time. If you find a better deal or are dissatisfied with your current provider, you can switch your policy. Just ensure that you maintain continuous coverage to avoid gaps in your insurance history.

In conclusion, obtaining a car insurance quote in California is a crucial step toward ensuring comprehensive protection and financial security on the state’s roads. By understanding the state’s unique insurance landscape, navigating the quote process effectively, and exploring specialized coverage options, drivers can tailor their policies to their specific needs and circumstances. Additionally, by shopping around and considering the impact of credit score on insurance premiums, California drivers can obtain the best value for their insurance dollar.