Cat Insurance Quotes

Welcome to a comprehensive guide on cat insurance quotes, a vital aspect of pet ownership that ensures the well-being of our feline friends. As responsible cat owners, understanding the intricacies of pet insurance and how to obtain accurate quotes is essential. In this article, we will delve into the world of cat insurance, exploring the factors that influence quotes, the benefits it offers, and how to navigate the process with ease.

Understanding Cat Insurance Quotes

Cat insurance quotes are personalized estimates provided by insurance companies to cover the healthcare expenses of your beloved feline companion. These quotes vary based on numerous factors, ensuring that each pet owner receives a tailored plan suited to their needs. Let’s explore the key aspects that influence these quotes.

Factors Influencing Cat Insurance Quotes

- Age and Breed: Younger cats often attract lower insurance premiums, as they are generally healthier and less prone to age-related ailments. Certain breeds, like Persians or Siamese, may have inherent health issues that impact insurance costs.

- Coverage Type: Insurance providers offer various coverage plans, including accident-only, illness-only, or comprehensive plans covering both. The type of coverage chosen significantly affects the quote.

- Deductibles and Co-pays: Similar to human health insurance, cat insurance quotes may involve deductibles (the amount you pay before coverage kicks in) and co-pays (the percentage of costs you share with the insurer). Higher deductibles and co-pays can lead to lower premiums.

- Location and Lifestyle: Your cat’s geographic location and lifestyle can impact insurance costs. Urban areas with higher veterinary costs may result in higher quotes. Additionally, outdoor cats or those with an active lifestyle may face increased risks, affecting insurance rates.

- Pre-existing Conditions: Cats with pre-existing health conditions may face challenges in obtaining insurance or may require specific coverage plans tailored to their needs, potentially impacting the quote.

Understanding these factors is crucial when seeking cat insurance quotes. By considering these variables, pet owners can make informed decisions to secure the best coverage for their furry friends.

The Benefits of Cat Insurance

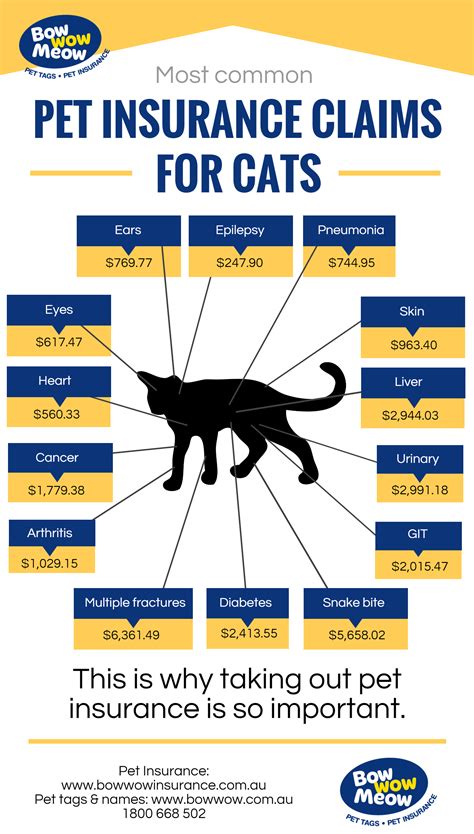

Cat insurance offers a range of advantages that extend beyond financial protection. Here are some key benefits:

Peace of Mind and Early Treatment

Having cat insurance provides peace of mind, knowing that unexpected veterinary expenses are covered. This encourages pet owners to seek prompt medical care for their cats, ensuring early detection and treatment of potential health issues. Early intervention often leads to better outcomes and reduced long-term costs.

Comprehensive Coverage

Cat insurance plans can offer comprehensive coverage, including accident and illness protection. This means that whether your cat sustains an injury or develops an illness, the costs are covered. Some plans even provide routine care coverage, such as vaccinations and check-ups, ensuring your cat receives the best possible care throughout their life.

Specialized Treatments and Advanced Care

With cat insurance, pet owners have access to a wider range of treatment options. This includes specialized procedures, advanced diagnostics, and even alternative therapies. Insurance coverage allows for more personalized and comprehensive care, ensuring your cat receives the highest standard of veterinary attention.

Financial Protection and Budgeting

Cat insurance provides financial protection against unexpected veterinary bills. By paying regular premiums, pet owners can budget effectively for their cat’s healthcare needs. This ensures that unforeseen expenses do not strain their finances, allowing them to focus on their cat’s well-being.

Obtaining Accurate Cat Insurance Quotes

To obtain accurate cat insurance quotes, consider the following steps:

Research Multiple Providers

Explore different insurance providers to compare quotes and coverage options. Research their reputation, customer reviews, and the specific benefits they offer. This comprehensive approach ensures you find the best plan for your cat’s needs.

Understand Coverage Options

Familiarize yourself with the various coverage options available, such as accident-only, illness-only, or comprehensive plans. Assess your cat’s health history and future risks to determine the most suitable coverage type. This ensures you receive a quote tailored to your cat’s unique requirements.

Provide Accurate Information

When requesting quotes, provide accurate and detailed information about your cat’s age, breed, and health history. Disclose any pre-existing conditions or known risks to ensure the quote reflects your cat’s actual needs. Honesty is crucial to obtaining an accurate and reliable quote.

Consider Deductibles and Co-pays

Evaluate the impact of deductibles and co-pays on your insurance costs. While higher deductibles and co-pays may result in lower premiums, consider your financial capacity and willingness to share costs. Strike a balance that aligns with your budget and provides adequate coverage for your cat.

Explore Additional Benefits

Look beyond basic coverage and explore additional benefits offered by insurance providers. These may include wellness plans, coverage for alternative therapies, or discounts on certain veterinary services. Consider these add-ons to enhance the overall value of your insurance plan.

Navigating the Cat Insurance Landscape

The world of cat insurance can be complex, with numerous providers and coverage options. Here are some additional considerations to navigate this landscape effectively:

Read the Fine Print

When comparing quotes, pay close attention to the fine print. Understand the specific exclusions, limitations, and waiting periods associated with each plan. This ensures you are fully aware of what is and isn’t covered, avoiding any surprises down the line.

Review Policy Renewals

Insurance policies often have renewal periods. Review your policy annually to ensure it continues to meet your cat’s needs. Consider any changes in your cat’s health or lifestyle that may impact the coverage required. Regular reviews allow for adjustments to be made, ensuring ongoing protection.

Utilize Online Resources

Online resources and comparison websites can be valuable tools when researching cat insurance. These platforms provide a comprehensive overview of various providers, allowing you to compare quotes, coverage options, and customer experiences. Utilize these resources to make an informed decision.

Consult Veterinary Professionals

Discuss your insurance options with your veterinarian. They can provide valuable insights into the coverage your cat may require based on their health history and breed-specific risks. Their expertise can guide you towards the most suitable insurance plan.

Consider Group Plans

If you have multiple pets, consider group plans or multi-pet discounts. Some insurance providers offer discounts when insuring multiple pets, making it more cost-effective. Group plans can provide comprehensive coverage for all your furry family members.

The Future of Cat Insurance

The cat insurance industry is constantly evolving, driven by advancements in veterinary medicine and changing consumer needs. Here are some potential future developments:

Advanced Diagnostics and Treatments

As veterinary medicine progresses, insurance providers may expand their coverage to include advanced diagnostics and cutting-edge treatments. This ensures that cats have access to the latest medical innovations, improving their overall healthcare experience.

Telemedicine and Digital Solutions

The integration of telemedicine and digital solutions into veterinary care may influence cat insurance. Insurance providers may offer coverage for virtual consultations and remote monitoring, providing convenient and accessible healthcare options for pet owners.

Wellness and Preventative Care

Emphasis on wellness and preventative care is likely to increase. Insurance plans may offer enhanced coverage for routine check-ups, vaccinations, and preventative treatments, promoting proactive healthcare for cats.

Personalized Plans

Insurance providers may move towards more personalized plans, taking into account individual cat’s health histories, genetic predispositions, and lifestyle factors. This tailored approach ensures that insurance coverage is highly customized to each cat’s unique needs.

How much does cat insurance typically cost?

+The cost of cat insurance can vary widely based on factors such as age, breed, coverage type, and location. On average, premiums range from 10 to 50 per month. However, it’s essential to compare quotes from different providers to find the most suitable plan for your cat’s needs.

What is the best age to get cat insurance?

+The best age to get cat insurance is when your cat is young and healthy. Insurance providers often offer lower premiums for younger cats, and starting coverage early ensures protection throughout their life. However, it’s never too late to consider insurance, even for older cats.

Are there any exclusions in cat insurance policies?

+Yes, cat insurance policies typically have exclusions. Common exclusions include pre-existing conditions, routine grooming, behavioral issues, and intentional injuries. It’s crucial to review the fine print of your policy to understand what is and isn’t covered.