Cheap Affordable Car Insurance

When it comes to finding cheap and affordable car insurance, many drivers are faced with the challenge of navigating through a complex web of insurance providers, policies, and pricing structures. With a myriad of options available, it can be overwhelming to choose the best coverage at the most economical rate. However, with the right knowledge and a strategic approach, it is possible to secure affordable car insurance without compromising on quality.

In this comprehensive guide, we delve into the world of car insurance, offering expert insights and practical tips to help you secure the most cost-effective coverage tailored to your specific needs. Whether you're a seasoned driver or a novice on the road, this article will equip you with the tools to make informed decisions and potentially save you a significant sum on your insurance premiums.

Understanding Car Insurance: The Fundamentals

Before we dive into the strategies for obtaining affordable car insurance, it’s crucial to grasp the basics of car insurance and how it operates. Car insurance is a legal requirement in most countries, designed to protect drivers, passengers, and other road users in the event of an accident or other vehicle-related incidents. It provides financial coverage for potential damages, injuries, and liabilities arising from these incidents.

Car insurance policies typically include a combination of the following coverages:

- Liability Coverage: This is the most fundamental type of car insurance, covering the policyholder's legal responsibility for bodily injury and property damage caused to others in an accident.

- Collision Coverage: This coverage pays for the repair or replacement of the insured vehicle if it's damaged in an accident, regardless of fault.

- Comprehensive Coverage: This provides protection for damages caused by events other than collisions, such as theft, vandalism, natural disasters, or damage caused by animals.

- Medical Payments Coverage: Also known as Personal Injury Protection (PIP), this coverage pays for the medical expenses of the policyholder and their passengers, regardless of fault.

- Uninsured/Underinsured Motorist Coverage: This coverage protects the policyholder in the event of an accident with a driver who has no insurance or insufficient insurance coverage.

The cost of car insurance varies widely based on numerous factors, including the type and amount of coverage, the driver's age, gender, driving record, and the make and model of the vehicle. Understanding these factors and how they influence insurance premiums is key to finding the most affordable option.

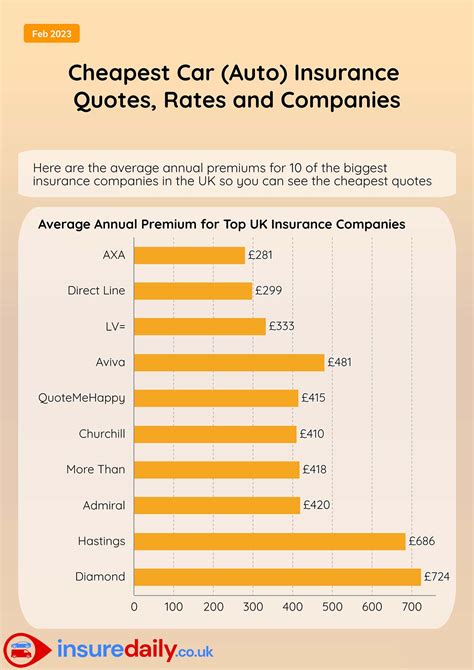

Researching and Comparing Insurance Providers

One of the most effective ways to find cheap car insurance is by conducting thorough research and comparing quotes from multiple insurance providers. With the advent of online comparison tools, this process has become significantly easier and more efficient.

When researching insurance providers, consider the following factors:

- Financial Stability: Ensure the insurer is financially stable and has a good track record of paying claims. You can check their financial strength ratings from reputable agencies like AM Best, Moody's, or Standard & Poor's.

- Coverage Options: Evaluate the range of coverage options offered by the insurer. Some providers specialize in certain types of coverage, while others offer more comprehensive plans. Ensure the provider can offer the specific coverages you require.

- Customer Service and Claims Handling: Read reviews and feedback from existing and past customers to gauge the insurer's customer service quality and claims handling efficiency. Prompt and efficient claims processing is crucial in the event of an accident.

- Discounts and Incentives: Many insurers offer a variety of discounts to attract customers. These may include multi-policy discounts (if you bundle your car insurance with other types of insurance, such as home or life insurance), good student discounts, safe driver discounts, and more. Make sure to inquire about these discounts and take advantage of them if eligible.

- Online Presence and Digital Tools: In today's digital age, many insurers offer online platforms and mobile apps for policy management, claims filing, and other services. These tools can significantly streamline the insurance process and save you time and effort. Consider choosing an insurer with robust digital capabilities if this aligns with your preferences.

Once you've identified a shortlist of potential insurers, use online comparison tools or directly request quotes from each provider. Ensure you're comparing apples to apples by requesting quotes for the same coverage levels and limits from each insurer. This will help you identify the most affordable option that meets your specific needs.

Online Comparison Tools

Online comparison tools are a convenient and efficient way to compare insurance quotes from multiple providers in one place. These tools allow you to input your information once and receive multiple quotes, saving you the time and effort of requesting quotes individually from each insurer.

Some popular online comparison tools include:

- GEICO: This tool allows you to compare quotes from multiple insurers, including GEICO itself, and provides an easy-to-use interface for reviewing and selecting the best option.

- Progressive: Progressive's online quote tool offers real-time comparisons of insurance rates from various providers, helping you find the most affordable coverage.

- Esurance: Esurance provides an online platform that not only compares quotes but also offers a seamless digital experience for policy management and claims filing.

- InsureMe: This tool connects you with multiple insurance agents who can provide quotes and assist you in choosing the best coverage.

When using these tools, ensure you provide accurate and detailed information to receive the most accurate quotes. Additionally, keep in mind that these tools may not always have access to every insurer in your area, so it's beneficial to also directly contact insurers you're interested in.

Directly Contacting Insurers

While online comparison tools are convenient, directly contacting insurers can sometimes yield better results. By speaking directly with an insurance agent or customer service representative, you can discuss your specific needs and circumstances in detail, allowing them to provide personalized recommendations and quotes.

When contacting insurers directly, consider the following steps:

- Gather Information: Before contacting the insurer, have the necessary information ready, including your driver's license number, vehicle identification number (VIN), make and model of your car, and your driving record (if available). This will help speed up the quote process.

- Ask About Discounts: Inquire about the discounts the insurer offers. Many providers have a range of discounts for safe driving, good student status, bundling policies, and more. Ensure you understand all the available discounts and how you can qualify for them.

- Discuss Coverage Options: Discuss the different coverage options available and their associated costs. Ensure you understand the limits and exclusions of each coverage to make an informed decision.

- Compare Quotes: Once you've gathered quotes from several insurers, compare them side by side. Consider not just the cost but also the coverage limits, deductibles, and any additional benefits or perks offered.

- Negotiate: If you find an insurer that offers the coverage you need at a competitive rate, don't be afraid to negotiate. Many insurers are willing to adjust their quotes to compete for your business, especially if you have a good driving record or other desirable attributes.

By thoroughly researching and comparing insurance providers, you can ensure you're getting the best value for your money and the coverage that best suits your needs.

Optimizing Your Insurance Premiums

In addition to comparing quotes and choosing the right insurer, there are several strategies you can employ to optimize your insurance premiums and make them more affordable.

Review Your Coverage Levels

One of the most effective ways to reduce your insurance premiums is by reviewing your coverage levels and making sure they align with your needs. If you have an older vehicle with a low resale value, for instance, you may not need as much comprehensive or collision coverage as someone with a newer, more expensive car.

Consider the following when reviewing your coverage levels:

- Collision and Comprehensive Coverage: If your vehicle is older or has a low resale value, you may want to consider increasing your deductible or dropping these coverages altogether. This can significantly reduce your premiums, especially if you have a clean driving record and are a low-risk driver.

- Liability Coverage: Liability coverage is mandatory in most states, but the required minimum limits may not be sufficient to protect your assets in the event of a serious accident. Consider increasing your liability limits to ensure you're adequately protected.

- Uninsured/Underinsured Motorist Coverage: This coverage is crucial, as it protects you in the event of an accident with a driver who has no or insufficient insurance. Ensure you have adequate coverage limits to protect yourself and your passengers.

- Personal Injury Protection (PIP) or Medical Payments Coverage: These coverages pay for medical expenses following an accident, regardless of fault. Evaluate your health insurance coverage and determine if you need high limits for these coverages. If you have comprehensive health insurance, you may be able to reduce your PIP or medical payments coverage limits to lower your premiums.

By carefully reviewing your coverage levels and making adjustments where necessary, you can strike a balance between affordability and adequate protection.

Explore Discounts and Savings Opportunities

Insurance providers offer a wide range of discounts to attract and retain customers. By taking advantage of these discounts, you can significantly reduce your insurance premiums.

Here are some common discounts you may be eligible for:

- Multi-Policy Discounts: Many insurers offer discounts when you bundle your car insurance with other types of insurance, such as home, renters, or life insurance. By doing so, you can save a significant amount on your overall insurance costs.

- Safe Driver Discounts: If you have a clean driving record with no accidents or serious traffic violations, you may qualify for safe driver discounts. These discounts reward responsible driving and can result in substantial savings.

- Good Student Discounts: If you're a young driver or have young drivers in your household, consider inquiring about good student discounts. Many insurers offer discounts to students who maintain a certain GPA or are on the honor roll.

- Low Mileage Discounts: If you drive fewer miles annually, you may be eligible for a low-mileage discount. Some insurers use telematics devices or smartphone apps to track your mileage and driving habits, offering discounts based on your actual usage.

- Payment Method Discounts: Some insurers offer discounts if you pay your premiums in full upfront or if you choose electronic billing and payment options.

- Vehicle Safety Discounts: If your vehicle has certain safety features, such as anti-lock brakes, air bags, or anti-theft devices, you may qualify for safety discounts. These features reduce the risk of accidents and can result in lower premiums.

When speaking with insurance agents or customer service representatives, be sure to ask about all the discounts you may be eligible for. Every insurer has different discount programs, so it's worth exploring your options to find the best deal.

Maintain a Good Driving Record

Your driving record plays a significant role in determining your insurance premiums. Insurance companies use your driving history to assess your risk level and set your premiums accordingly. The more serious violations and accidents on your record, the higher your insurance rates are likely to be.

To keep your insurance premiums as low as possible, it's crucial to maintain a clean driving record. Here are some tips to help you achieve this:

- Obey Traffic Laws: Follow all traffic laws, including speed limits, traffic signals, and other regulations. Avoid reckless driving behaviors such as speeding, aggressive driving, or driving under the influence.

- Avoid Distracted Driving: Distracted driving is a major cause of accidents. Stay focused on the road and avoid using your phone or other distractions while driving.

- Practice Defensive Driving: Defensive driving involves anticipating potential hazards and responding safely. By practicing defensive driving techniques, you can reduce your risk of accidents and maintain a clean driving record.

- Complete Defensive Driving Courses: Many insurers offer discounts to drivers who complete approved defensive driving courses. These courses can help improve your driving skills and may result in lower premiums.

- Consider a Telematics Program: Some insurers offer telematics programs that use devices or smartphone apps to track your driving behavior. These programs can reward safe driving habits with lower premiums. However, keep in mind that these programs may also penalize risky driving behaviors, so it's important to drive safely if you participate in such a program.

By maintaining a good driving record, you can demonstrate to insurers that you're a responsible and low-risk driver, which can lead to more affordable insurance premiums.

Exploring Alternative Insurance Options

In addition to traditional car insurance providers, there are alternative options available that can offer more affordable coverage for certain drivers.

Pay-As-You-Drive (PAYD) Insurance

Pay-As-You-Drive insurance, also known as usage-based insurance or telematics insurance, is an alternative insurance model that bases premiums on your actual driving behavior and mileage. This type of insurance uses telematics devices or smartphone apps to track your driving habits, such as speed, acceleration, braking, and mileage.

PAYD insurance can be an attractive option for drivers who:

- Drive infrequently or have low annual mileage.

- Have a history of safe and responsible driving.

- Are comfortable with their driving habits being monitored.

PAYD insurance offers several benefits, including:

- Personalized Premiums: Your premiums are based on your actual driving behavior, so if you drive safely and responsibly, you may qualify for lower rates.

- Incentives for Safe Driving: Many PAYD programs offer rewards or discounts for maintaining safe driving habits, such as avoiding hard braking or excessive speeding.

- Flexibility and Convenience: PAYD insurance provides flexibility in terms of coverage options and payment methods. Some programs allow you to pay premiums monthly or even weekly, making it more affordable for those with limited financial resources.

However, it's important to note that PAYD insurance may not be suitable for everyone. If you have a history of risky driving or live in an area with high accident rates, your premiums may be higher with PAYD insurance compared to traditional policies. Additionally, some drivers may find the monitoring aspect of PAYD insurance intrusive or uncomfortable.

Peer-to-Peer Insurance

Peer-to-peer (P2P) insurance is a relatively new concept in the insurance industry that allows drivers to pool their resources and share the risk of car accidents. In a P2P insurance model, a group of drivers come together and contribute to a shared pool of funds. When an insured driver has an accident, the pool of funds is used to cover the costs, with each driver contributing a portion based on their risk level.

P2P insurance can be an attractive option for drivers who:

- Have a strong sense of community and trust in their fellow drivers.

- Are comfortable with a more collaborative and flexible insurance model.

- Want to have more control over their insurance coverage and costs.

P2P insurance offers several benefits, including:

- Lower Premiums: P2P insurance often results in lower premiums compared to traditional insurance, as the risk is spread across a larger group of drivers.

- Customizable Coverage: P2P insurance allows drivers to customize their coverage levels and deductibles to suit their individual needs and budgets.

- Community-Based Support: In a P2P insurance model, drivers often have access to a supportive community of fellow drivers who can provide advice, assistance, and support in the event of an accident.

However, P2P insurance also comes with some potential drawbacks. The risk pool may be smaller and less diverse, which can lead to higher premiums if there are a significant number of claims. Additionally, P2P insurance may not be as widely available as traditional insurance and may have more limited coverage options.

Comparing Alternative Insurance Options

When considering alternative insurance options, it’s important to compare them carefully with traditional insurance providers. While alternative options may offer certain advantages, such as lower premiums or more flexibility, they may also have limitations in terms of coverage, claims handling, and overall reliability.

Here are some factors to consider when comparing alternative insurance options:

- Coverage Options: Ensure that the alternative insurance option provides the coverage levels and limits you require. Compare the coverage details, including any exclusions or limitations, to ensure they meet your needs.

- Claims Handling: Research the claims handling process and customer service reputation of the alternative insurer. Make sure they have a proven