Cheap Auto Insurances

In today's world, finding affordable auto insurance is a top priority for many vehicle owners. With rising costs and various factors influencing insurance rates, it's crucial to understand the market and know where to look for the best deals. This comprehensive guide aims to shed light on the realm of cheap auto insurances, offering insights into the factors that impact rates, strategies to secure the best deals, and an in-depth analysis of the most affordable options available.

Understanding the Factors that Influence Auto Insurance Rates

Auto insurance rates are not set in stone; they vary based on a multitude of factors. Understanding these elements is the first step towards securing the most cost-effective coverage. Here’s a breakdown of the key influencers:

Demographic Factors

Your age, gender, marital status, and location play a significant role in determining insurance rates. For instance, young drivers are often considered high-risk, leading to higher premiums. Similarly, urban areas with higher accident rates may also result in elevated insurance costs.

Vehicle-Related Factors

The make, model, and year of your vehicle can greatly impact insurance costs. High-performance cars and luxury vehicles typically attract higher premiums due to their repair and replacement costs. Additionally, the safety features and anti-theft devices installed in your car can also influence rates.

Driving History

Your driving record is a crucial determinant of insurance rates. A clean driving history with no accidents or traffic violations can lead to lower premiums. Conversely, a history of accidents or moving violations may result in higher rates or even policy denial.

Insurance Coverage and Deductibles

The type and level of coverage you choose, along with the deductible amount, can significantly affect your insurance costs. Comprehensive and collision coverage, while providing more protection, also lead to higher premiums. Conversely, higher deductibles can lower your premiums but increase the out-of-pocket costs in the event of a claim.

Strategies to Secure the Best Auto Insurance Deals

Securing cheap auto insurance involves more than just comparing rates. It’s about understanding the market, leveraging discounts, and adopting safe driving practices. Here are some strategies to help you find the best deals:

Compare Multiple Quotes

Getting quotes from multiple insurance providers is essential. Each insurer uses its own formula to calculate rates, and comparing quotes can help you identify the most affordable option. Online quote comparison tools can be a convenient way to quickly assess various providers.

Bundle Your Policies

Many insurance companies offer discounts when you bundle multiple policies, such as auto and home insurance. By combining policies, you can often save a significant amount on your overall insurance costs.

Maintain a Good Credit Score

Believe it or not, your credit score can impact your insurance rates. Many insurers use credit-based insurance scores to assess risk, and a higher credit score can lead to lower premiums. Maintaining a good credit score is therefore beneficial when seeking affordable auto insurance.

Choose Higher Deductibles

Opting for a higher deductible can reduce your insurance premiums. However, it’s important to ensure that you can afford the higher deductible in the event of a claim. This strategy can be particularly effective for those with a clean driving record and a stable financial situation.

Take Advantage of Discounts

Insurance providers often offer a range of discounts, including safe driver discounts, loyalty discounts, and discounts for completing defensive driving courses. By understanding the discounts available and meeting the criteria, you can significantly reduce your insurance costs.

The Most Affordable Auto Insurance Options

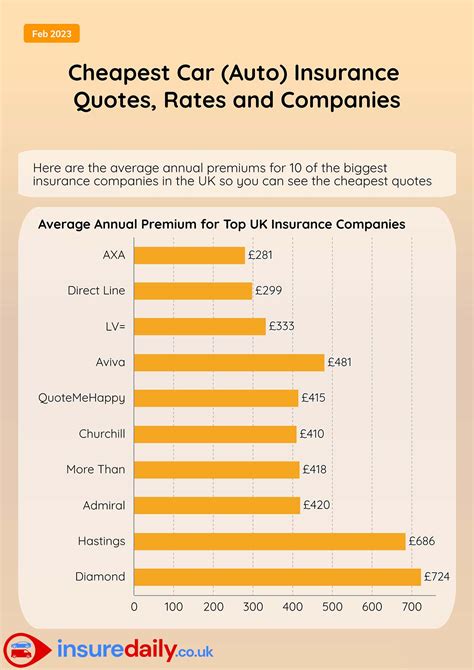

While strategies can help reduce insurance costs, it’s also important to know which insurance providers offer the most affordable rates. Here’s a breakdown of some of the most cost-effective auto insurance options available:

Geico

Geico is renowned for its competitive rates and is often considered one of the most affordable auto insurance providers. The company offers a wide range of discounts, including good student discounts, military discounts, and discounts for vehicle safety features. Additionally, Geico’s digital-first approach often results in lower overhead costs, which can be passed on to customers in the form of reduced premiums.

State Farm

State Farm is another popular choice for affordable auto insurance. The company offers a variety of coverage options and is known for its strong financial stability. State Farm provides discounts for safe driving, multiple vehicles, and even for being a good student. The company’s local agents can also provide personalized service and advice on securing the best rates.

Progressive

Progressive is a well-known insurance provider that offers a range of innovative features and competitive rates. The company’s Name Your Price tool allows customers to set their desired price range, and Progressive will suggest coverage options that fit within that range. Progressive also offers a Snapshot program, which uses telematics to monitor driving behavior and can lead to discounts for safe driving.

Esurance

Esurance is a fully digital insurance provider that offers simple, straightforward insurance policies. The company’s online-only approach allows it to keep costs low, which can translate into savings for customers. Esurance provides a range of discounts, including multi-policy discounts, safe driver discounts, and discounts for paying your premium in full.

USAA

USAA is a unique insurance provider that caters specifically to military members, veterans, and their families. The company is known for its exceptional customer service and competitive rates. USAA offers a range of discounts, including safe driver discounts, loyalty discounts, and discounts for multiple policies. Eligibility for USAA policies is restricted to military personnel and their immediate families.

Performance Analysis: Affordable Auto Insurance Providers

When it comes to affordable auto insurance, it’s not just about the price. The quality of coverage, customer service, and claim handling processes are also crucial factors. Here’s a performance analysis of some of the most affordable auto insurance providers, based on industry ratings and customer feedback:

| Insurance Provider | Financial Strength | Customer Satisfaction | Claim Handling |

|---|---|---|---|

| Geico | A++ (Superior) | 4.5/5 | Quick and efficient |

| State Farm | A++ (Superior) | 4.2/5 | Good, with a strong local presence |

| Progressive | A+ (Superior) | 4.1/5 | Innovative and efficient |

| Esurance | A (Excellent) | 4.3/5 | Simple and straightforward |

| USAA | A++ (Superior) | 4.7/5 | Exceptional, tailored to military needs |

Financial Strength Ratings: These ratings, provided by AM Best, indicate the financial strength and stability of the insurance provider. An A++ rating is the highest possible, indicating superior financial strength.

Customer Satisfaction Ratings: These ratings are based on industry surveys and customer feedback, providing an insight into the overall satisfaction levels of customers with the insurance provider.

Claim Handling Performance: This section provides a brief overview of the claim handling processes and customer experiences with each insurance provider.

Future Implications: The Evolving Landscape of Auto Insurance

The auto insurance landscape is continually evolving, influenced by technological advancements, changing consumer preferences, and regulatory shifts. Here are some key trends and implications for the future of affordable auto insurance:

Telematics and Usage-Based Insurance

Telematics technology, which tracks driving behavior through devices installed in vehicles or smartphone apps, is gaining traction. This technology allows insurance providers to offer usage-based insurance policies, where premiums are based on actual driving behavior. This shift can lead to more personalized and potentially more affordable insurance options for safe drivers.

Digital Transformation

The digital transformation of the insurance industry is set to continue, with more providers offering online-only policies and self-service options. This trend can lead to increased competition and potentially lower costs for consumers, as digital-first providers often have lower overhead costs.

Regulatory Changes

Regulatory changes, such as the introduction of autonomous vehicles and ride-sharing services, could significantly impact the auto insurance industry. These changes may lead to revised coverage requirements and potentially new types of insurance policies. Staying informed about these changes can help consumers make informed decisions about their insurance coverage.

Personalized Insurance

The future of auto insurance is moving towards more personalized coverage. With advancements in data analytics and machine learning, insurance providers can offer policies tailored to individual driving behaviors and needs. This trend has the potential to make insurance more affordable for those who adopt safe driving practices and make informed coverage choices.

Conclusion

Finding cheap auto insurance is a multifaceted process that involves understanding the factors that influence rates, adopting cost-saving strategies, and exploring the most affordable insurance providers. By staying informed about the latest trends and developments in the auto insurance landscape, consumers can make more informed choices and potentially save on their insurance costs. Remember, the key to securing the best deals is to compare options, leverage discounts, and maintain safe driving practices.

How often should I compare auto insurance quotes?

+

It’s a good idea to compare quotes annually, or whenever your policy is up for renewal. Insurance rates can change frequently, and by comparing quotes regularly, you can ensure you’re getting the best deal.

What is the best way to get multiple quotes?

+

Using an online quote comparison tool can be the most efficient way to get multiple quotes. These tools allow you to enter your information once and receive quotes from several providers.

Can my credit score really impact my insurance rates?

+

Yes, many insurance providers use credit-based insurance scores to assess risk. Maintaining a good credit score can therefore lead to lower insurance premiums.

Are there any drawbacks to choosing a higher deductible?

+

While choosing a higher deductible can reduce your premiums, it’s important to ensure you can afford the higher out-of-pocket costs in the event of a claim. If you’re unable to pay the higher deductible, you may struggle to get your car repaired or replaced.

How can I qualify for safe driver discounts?

+

Safe driver discounts are typically offered to drivers with a clean driving record, free of accidents and serious traffic violations. Some insurers may also offer discounts for completing defensive driving courses.