Cheap Car Liability Insurance

In the realm of automotive insurance, liability coverage is a crucial component that safeguards drivers and vehicle owners from financial ruin in the event of an accident. This coverage, often referred to as third-party insurance, protects the insured against claims arising from bodily injury or property damage caused by their vehicle. For many drivers, especially those on a budget, finding cheap car liability insurance is a top priority.

The cost of liability insurance can vary significantly depending on numerous factors, including the driver's location, driving history, and the chosen coverage limits. This article aims to provide an in-depth guide to understanding and acquiring affordable liability insurance, offering valuable insights and strategies to secure the best rates while maintaining essential coverage.

Understanding Car Liability Insurance

Car liability insurance is a critical component of any driver’s insurance portfolio. It serves as a financial safety net, protecting individuals from the potentially devastating costs of an accident they cause. Understanding the ins and outs of liability insurance is essential for drivers to make informed decisions about their coverage and ensure they are adequately protected.

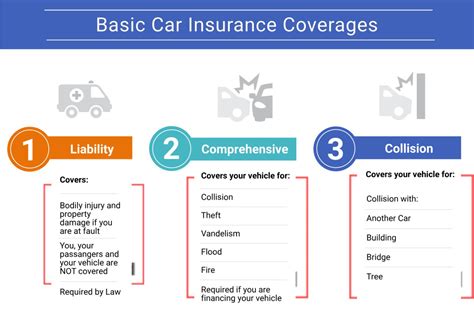

This type of insurance typically covers two main areas: bodily injury liability and property damage liability. Bodily injury liability covers medical expenses, lost wages, and pain and suffering for individuals injured in an accident caused by the insured driver. Property damage liability, on the other hand, covers the cost of repairing or replacing property, such as other vehicles, buildings, or even personal property, damaged in an accident caused by the insured.

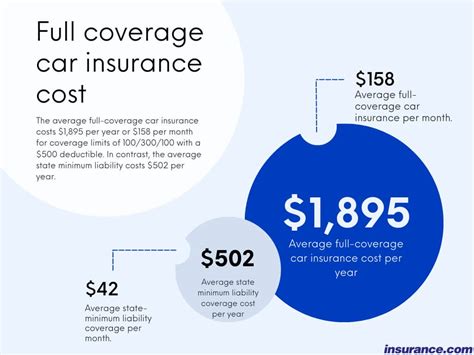

The coverage limits for liability insurance are usually expressed as three numbers, such as 100/300/100. These numbers represent the maximum amount the insurer will pay for bodily injury liability per person, the maximum for all injuries in an accident, and the property damage liability limit, respectively. It's crucial to choose limits that align with your financial ability to pay out-of-pocket if needed, as well as to ensure adequate protection against potential claims.

Key Considerations for Liability Coverage

- State Requirements: Every state has its own minimum liability insurance requirements. While these minimums provide a starting point, they may not offer sufficient protection in the event of a serious accident. It’s advisable to consider higher limits to ensure comprehensive coverage.

- Personal Assets: Liability insurance protects your personal assets in the event of a claim. If you have significant assets, such as a home or investments, higher liability limits can provide added protection against potential lawsuits.

- Cost-Benefit Analysis: While it’s essential to find affordable insurance, it’s equally important not to skimp on coverage. A serious accident can result in substantial claims, so balancing cost with adequate coverage is crucial.

Strategies for Finding Cheap Liability Insurance

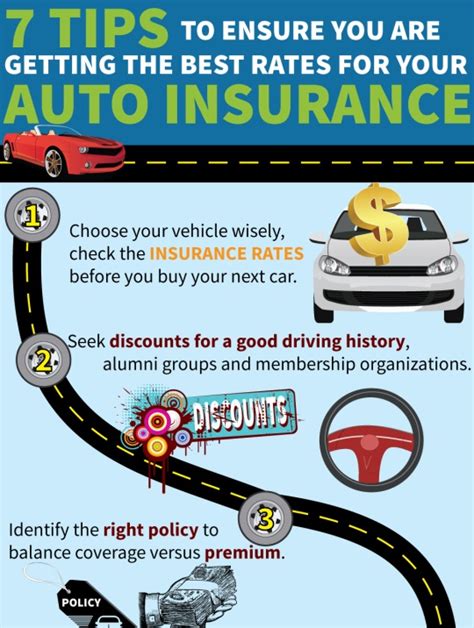

Securing cheap car liability insurance requires a combination of research, comparison, and understanding of the factors that influence rates. Here are some strategies to help drivers find the most affordable coverage without compromising on quality:

Shop Around and Compare Quotes

The insurance market is highly competitive, and rates can vary significantly between providers. Shopping around and comparing quotes is a fundamental step in finding the best deal. Online quote comparison tools can provide a quick and convenient way to view rates from multiple insurers. However, it’s essential to ensure that the quotes are for identical coverage to make accurate comparisons.

When comparing quotes, pay attention to the coverage limits and any additional features or exclusions. Some insurers may offer lower rates but with more restrictive policies. It's crucial to understand the fine print to ensure the policy meets your needs.

Consider Bundle Discounts

Many insurance companies offer discounts when customers bundle multiple policies, such as auto and home insurance. Bundling can lead to significant savings, especially if you’re already in the market for multiple types of insurance.

Additionally, some insurers provide discounts for bundling different types of auto insurance. For example, you might save by bundling liability insurance with collision and comprehensive coverage or adding other optional coverages like rental car reimbursement or roadside assistance.

Explore Usage-Based Insurance

Usage-based insurance, also known as pay-as-you-drive or telematics insurance, is an innovative approach that bases premiums on actual driving behavior rather than traditional rating factors. This type of insurance can be an excellent option for safe drivers who don’t rack up many miles on their vehicles.

With usage-based insurance, drivers install a tracking device or use a smartphone app that monitors their driving habits, including miles driven, time of day, and driving behavior. Safe driving habits, such as avoiding hard braking and speeding, can lead to substantial discounts on liability insurance premiums.

| Provider | Usage-Based Program |

|---|---|

| State Farm | Drive Safe & Save |

| Progressive | Snapshot |

| Allstate | Drivewise |

Maintain a Clean Driving Record

Your driving record is a significant factor in determining liability insurance rates. A clean record, free of accidents and violations, can lead to substantial savings. Conversely, a record with multiple accidents or moving violations can significantly increase premiums.

If you have a less-than-perfect driving record, consider taking a defensive driving course. Completing such a course can demonstrate to insurers that you're committed to improving your driving skills and may lead to a reduction in premiums.

Increase Your Deductible

Increasing your deductible, the amount you pay out-of-pocket before your insurance kicks in, can lead to lower premiums. This strategy works best for drivers who have sufficient savings to cover a higher deductible in the event of a claim. It’s essential to ensure that your deductible is affordable and won’t cause financial hardship if you need to make a claim.

Performance Analysis: Real-World Savings

To illustrate the potential savings drivers can achieve by employing the strategies outlined above, let’s consider a real-world example. Imagine a driver, John, who is seeking to reduce his liability insurance costs.

John starts by shopping around and comparing quotes from multiple insurers. He discovers that by bundling his auto and home insurance policies, he can save 15% on his liability insurance premium. Additionally, he enrolls in a usage-based insurance program and, by maintaining safe driving habits, reduces his premium by another 10%.

Furthermore, John takes a defensive driving course, which results in a 5% discount on his liability insurance. By implementing these strategies, John achieves a total savings of 30% on his liability insurance premium, demonstrating the significant impact of proactive measures in finding affordable coverage.

Expert Tips for Optimal Savings

- Review Your Policy Annually: Insurance rates and your personal circumstances can change over time. Conduct an annual review of your policy to ensure you’re still getting the best rate and that your coverage aligns with your current needs.

- Understand Discounts: Many insurers offer a wide range of discounts, from multi-policy bundles to good student discounts. Ensure you’re taking advantage of all applicable discounts to maximize your savings.

- Consider Higher Deductibles Carefully: While increasing your deductible can lead to lower premiums, it’s essential to ensure you can afford the higher out-of-pocket cost in the event of a claim. Weigh the potential savings against your financial situation.

Future Implications and Industry Trends

The insurance industry is continually evolving, and several trends are likely to impact the availability and cost of car liability insurance in the future.

Telematics and Data Analytics

The increasing adoption of telematics and data analytics is transforming the insurance landscape. Usage-based insurance, as mentioned earlier, is becoming more prevalent, offering tailored premiums based on individual driving behavior. As this technology advances and becomes more widespread, it could lead to more accurate pricing and potentially lower rates for safe drivers.

Connected Vehicles and Autonomous Technology

The rise of connected vehicles and the development of autonomous driving technology are poised to have a significant impact on car insurance. As vehicles become more connected and self-driving capabilities advance, the potential for safer driving and reduced accidents could lead to lower liability insurance rates. However, the legal and regulatory landscape surrounding autonomous vehicles is still evolving, and it may take some time for these potential savings to materialize.

Data-Driven Underwriting

Insurers are increasingly leveraging advanced data analytics to refine their underwriting processes. By analyzing vast amounts of data, insurers can more accurately assess risk and price policies accordingly. This trend could lead to more precise and fair pricing for liability insurance, ensuring that drivers pay rates that reflect their individual risk profiles.

Conclusion: Empowering Drivers to Find Affordable Liability Coverage

Cheap car liability insurance is within reach for many drivers, provided they understand the factors that influence rates and employ strategic approaches to comparison shopping and policy selection. By staying informed about industry trends and taking advantage of innovative insurance offerings, such as usage-based programs, drivers can secure the coverage they need at a price that fits their budget.

As the insurance landscape continues to evolve, staying proactive and informed is key to navigating the market and finding the best deals. With the right approach, drivers can protect themselves and their assets without breaking the bank.

What is the minimum liability insurance required by law?

+

Minimum liability insurance requirements vary by state. It’s essential to check your state’s specific regulations to ensure you meet the legal minimum. However, it’s generally advisable to carry higher limits to provide adequate protection.

How much can I save by bundling my insurance policies?

+

The savings from bundling insurance policies can vary widely depending on your specific circumstances and the insurer. On average, you can expect savings of around 5-15% when bundling auto and home insurance policies.

Are usage-based insurance programs available nationwide?

+

Usage-based insurance programs are offered by many major insurers and are available in most states. However, the availability and specifics of these programs may vary, so it’s best to check with your insurer or shop around to find the best option in your area.

Can I switch to usage-based insurance mid-policy term?

+

In most cases, you can switch to a usage-based insurance program at any time during your policy term. However, it’s best to consult with your insurer to understand the process and any potential implications for your current policy.