Insurance Cost For Car

The cost of insurance for a car is a crucial factor that every vehicle owner needs to consider. With a myriad of variables influencing insurance rates, it can be a complex and confusing topic. In this comprehensive guide, we'll delve into the world of car insurance costs, exploring the factors that affect premiums, the coverage options available, and strategies to help you save. By understanding these aspects, you'll be better equipped to navigate the insurance landscape and make informed decisions tailored to your needs.

Understanding Car Insurance Premiums

The cost of insuring a car, often referred to as the premium, is determined by a combination of factors. These include the make and model of your vehicle, your driving history, and the level of coverage you choose. Additionally, personal details such as your age, gender, and location play a significant role in determining insurance rates. Understanding these factors is the first step towards securing the right insurance coverage at a competitive price.

Vehicle-Related Factors

The make and model of your car are primary considerations for insurance providers. Vehicles with higher repair costs or those more frequently targeted by thieves often result in higher premiums. For instance, a luxury sports car may attract a higher premium compared to a standard sedan due to its higher value and potential for costly repairs.

Furthermore, the year of manufacture can also influence insurance costs. Older vehicles may have lower premiums, but they might lack modern safety features, potentially increasing the risk of accidents and claims.

| Vehicle Attribute | Impact on Insurance Cost |

|---|---|

| Make and Model | Influences repair and replacement costs, theft risk |

| Year of Manufacture | Affects safety features, repair costs, and overall risk profile |

| Vehicle Usage | Higher premiums for commercial or high-mileage vehicles |

Driver-Related Factors

Your driving history and personal details significantly influence insurance costs. A clean driving record with no accidents or traffic violations can lead to lower premiums. Conversely, a history of accidents or moving violations may result in higher insurance costs, as these indicate a higher risk to the insurer.

Additionally, age and gender play a role in insurance pricing. Young drivers, especially males under the age of 25, are often considered high-risk due to their lack of experience and higher propensity for accidents. This can lead to significantly higher insurance premiums for this demographic.

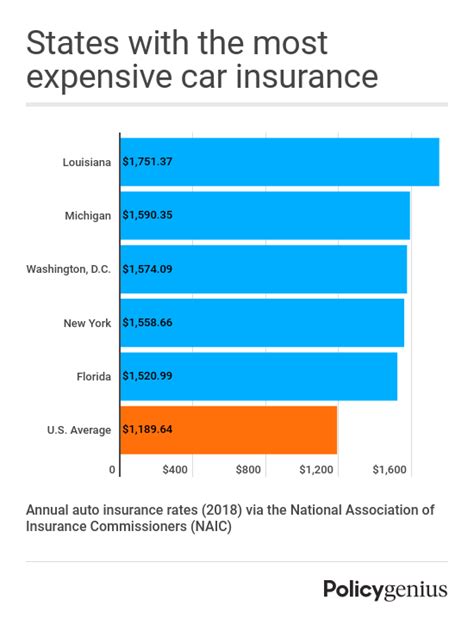

Your location is another crucial factor. Areas with a higher incidence of accidents, theft, or natural disasters may have higher insurance premiums. Urban areas, for example, often have higher premiums due to the increased risk of accidents and vehicle theft compared to rural areas.

Types of Car Insurance Coverage

Car insurance is not a one-size-fits-all proposition. There are various types of coverage to consider, each designed to protect you and your vehicle in different situations. Understanding these coverage options is essential to ensure you have the right protection for your needs.

Liability Coverage

Liability coverage is a fundamental aspect of car insurance. It protects you financially if you are found at fault in an accident that causes injury to others or damage to their property. This coverage is typically divided into bodily injury liability and property damage liability.

Bodily injury liability covers medical expenses and lost wages for individuals injured in an accident you caused. Property damage liability covers repairs or replacement costs for other people’s vehicles or property damaged in an accident for which you are responsible.

Comprehensive and Collision Coverage

Comprehensive coverage protects your vehicle against damages caused by events other than collisions. This can include theft, vandalism, natural disasters, or damage caused by animals. It provides a safety net for your vehicle against a wide range of unforeseen circumstances.

On the other hand, collision coverage comes into play when your vehicle is involved in a collision, regardless of fault. This coverage pays for repairs or the replacement of your vehicle if it’s damaged in an accident. Having both comprehensive and collision coverage provides comprehensive protection for your vehicle.

Other Coverage Options

In addition to the above, there are several other types of coverage to consider, depending on your specific needs and location:

- Uninsured/Underinsured Motorist Coverage: Protects you if you’re involved in an accident with a driver who doesn’t have insurance or doesn’t have sufficient insurance to cover the damages.

- Medical Payments Coverage: Covers medical expenses for you and your passengers, regardless of fault, after an accident.

- Rental Car Reimbursement: Provides coverage for a rental car if your vehicle is being repaired after an insured accident.

- Gap Insurance: Covers the difference between what your insurance pays and what you still owe on your car loan if your vehicle is totaled or stolen.

Strategies to Reduce Car Insurance Costs

While insurance is a necessary expense for every vehicle owner, there are strategies you can employ to reduce your insurance costs without compromising on coverage. Here are some effective ways to save on your car insurance premiums.

Shop Around and Compare Quotes

Insurance rates can vary significantly between providers, so it’s essential to shop around and compare quotes. Use online tools and resources to request quotes from multiple insurers. This allows you to identify the most competitive rates and choose the coverage that best fits your needs.

When comparing quotes, ensure you’re comparing apples to apples. Different insurers may offer different coverage options and limits, so be sure to understand exactly what each quote includes.

Choose a Higher Deductible

Opting for a higher deductible can significantly reduce your insurance premiums. A deductible is the amount you agree to pay out of pocket before your insurance coverage kicks in. By choosing a higher deductible, you’re taking on more financial responsibility in the event of a claim, which can lead to lower premiums.

However, it’s important to choose a deductible amount that you can afford. If you choose a deductible that’s too high, you may struggle to pay it if you ever need to make a claim.

Take Advantage of Discounts

Many insurance companies offer a range of discounts to their customers. These can include discounts for:

- Safe Driving: Insurers often reward drivers with clean records and no accidents or violations with lower premiums.

- Multiple Policies: Bundling your car insurance with other policies, such as home or renters insurance, can result in significant savings.

- Safety Features: Vehicles equipped with certain safety features, such as anti-lock brakes or air bags, may qualify for discounts.

- Low Mileage: If you drive fewer miles than average, you may be eligible for a low-mileage discount.

- Loyalty: Staying with the same insurer for multiple years can often lead to loyalty discounts.

Maintain a Good Driving Record

Your driving record is a significant factor in determining your insurance premiums. Maintaining a clean driving record can lead to lower premiums. Avoid accidents and traffic violations, as these can significantly increase your insurance costs. Additionally, complete a defensive driving course, as some insurers offer discounts for completing such courses.

Consider Usage-Based Insurance

Usage-based insurance (UBI) is a relatively new concept where insurance premiums are based on your actual driving behavior. With UBI, insurers monitor your driving habits, such as mileage, time of day driven, and braking and acceleration patterns. Those who drive safely and less frequently may qualify for lower premiums.

While UBI may not be suitable for everyone, it can be a great option for safe, low-mileage drivers looking to save on insurance costs.

What factors influence the cost of car insurance?

+The cost of car insurance is influenced by various factors, including the make and model of your vehicle, your driving history, the level of coverage chosen, and personal details such as age, gender, and location. These factors determine the risk profile associated with insuring your vehicle, which directly impacts the cost of your insurance premiums.

How can I reduce my car insurance costs?

+To reduce car insurance costs, you can shop around and compare quotes from different insurers, choose a higher deductible, take advantage of available discounts, maintain a good driving record, and consider usage-based insurance if you’re a safe, low-mileage driver.

What types of car insurance coverage are available?

+There are several types of car insurance coverage, including liability coverage (which protects you if you’re at fault in an accident), comprehensive coverage (for damages caused by events other than collisions), collision coverage (for collision-related damages), and additional options such as uninsured/underinsured motorist coverage, medical payments coverage, rental car reimbursement, and gap insurance.