Should I File A Claim With Liability Insurance

When faced with an unexpected incident or accident, one of the crucial decisions you might need to make is whether to file a claim with your liability insurance. Liability insurance is a vital component of your financial safety net, designed to protect you from potential legal and financial repercussions arising from accidental injuries or property damage caused by you or your assets. This comprehensive guide will help you navigate the decision-making process and understand the implications of filing a claim with your liability insurance.

Understanding Liability Insurance

Liability insurance, often an essential part of your insurance portfolio, provides coverage for various situations where you might be held legally responsible for causing harm or damage to others. This coverage is especially crucial as it protects your personal assets, including your home, savings, and investments, from being seized to pay for damages. The purpose of liability insurance is to offer financial protection and peace of mind, ensuring that you can navigate unforeseen circumstances without facing catastrophic financial losses.

When to File a Claim

Determining whether to file a liability insurance claim can be a complex decision. Here are some key considerations to guide you through this process:

Assessing the Situation

Begin by evaluating the incident thoroughly. Consider the extent of the damage, whether it was caused by you or your property, and the potential legal and financial implications. If the incident resulted in significant injuries, property damage, or substantial financial loss for the affected party, it might be prudent to file a claim.

Reviewing Your Policy

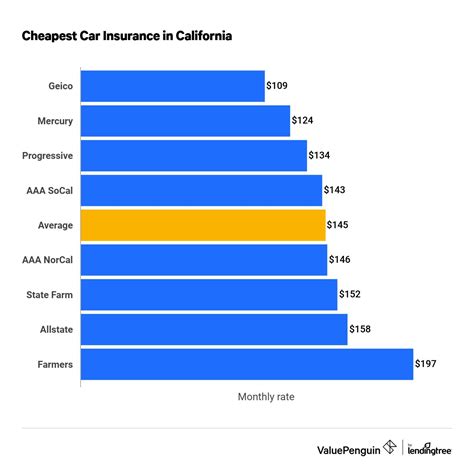

Familiarize yourself with the terms and conditions of your liability insurance policy. Different policies offer varying levels of coverage, and understanding your specific policy is crucial. Pay attention to the policy limits, deductibles, and any exclusions or limitations to ensure you make an informed decision.

| Policy Aspect | Description |

|---|---|

| Policy Limits | The maximum amount your insurer will pay for a covered claim. |

| Deductibles | The portion of the claim amount you must pay out of pocket before your insurer covers the rest. |

| Exclusions | Specific incidents or damages not covered by your policy. |

Potential Implications

Filing a liability insurance claim can have both positive and negative implications. On the one hand, it provides financial protection and ensures that the affected party receives compensation for their losses. On the other hand, it might lead to increased insurance premiums or even policy cancellations, especially if you have a history of frequent claims.

Consulting Experts

If you’re unsure about the severity of the incident or the potential implications, seeking advice from legal or insurance professionals can be beneficial. They can provide an objective assessment of the situation and guide you towards the most suitable course of action.

The Claim Process

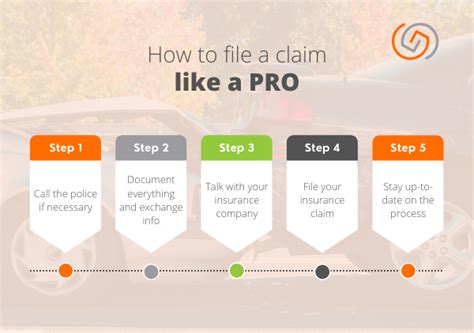

If you decide to file a liability insurance claim, here’s a general overview of the process:

Notification

Notify your insurance company promptly after the incident. Most policies require immediate notification to ensure coverage. Provide a detailed description of the incident, including the date, time, location, and any relevant witnesses.

Claim Submission

Gather all the necessary documentation and evidence related to the incident. This may include medical reports, repair estimates, police reports, or any other relevant documents. Submit these along with your claim form to your insurer.

Investigation

The insurance company will investigate the claim to assess the validity and extent of the damages. This process may involve interviewing witnesses, reviewing evidence, and evaluating the circumstances surrounding the incident.

Claim Approval or Denial

Based on the investigation, the insurance company will either approve or deny your claim. If approved, they will provide you with the necessary compensation as outlined in your policy. If denied, they will explain the reasons for the denial, which may include policy exclusions or insufficient evidence.

Appeal Process

If your claim is denied, you have the right to appeal the decision. This process typically involves providing additional evidence or arguments to support your claim. It’s essential to carefully review the reasons for denial and prepare a strong case for the appeal.

Potential Consequences of Filing a Claim

While liability insurance is designed to protect you, filing a claim can have certain consequences that you should be aware of:

Increased Premiums

Insurance companies often consider claim history when calculating premiums. Filing multiple claims within a short period may lead to increased premiums, as it signals a higher risk profile. To mitigate this, it’s advisable to file claims only when necessary and avoid making claims for minor incidents.

Policy Cancellations

In some cases, insurance companies may choose to cancel your policy if you have a history of frequent claims. This is especially true if the claims are related to high-risk activities or if the insurer deems you to be a high-risk policyholder. It’s crucial to maintain a good relationship with your insurer and avoid unnecessary claims to prevent policy cancellations.

Record Keeping

Claims made under your liability insurance policy are often recorded in databases accessible to other insurance companies. This information can impact your future insurance applications and premiums. It’s essential to keep a clean record and only file claims when absolutely necessary.

Expert Insights

According to insurance industry experts, liability insurance is a crucial component of your financial strategy, especially when you own assets or engage in activities that carry a higher risk of causing harm or damage. “It’s important to understand that liability insurance is not just a legal requirement but a necessary safeguard against unforeseen events,” says John Davis, a renowned insurance advisor.

Conclusion

Deciding whether to file a liability insurance claim is a critical decision that requires careful consideration. By understanding the implications, reviewing your policy, and seeking expert advice when needed, you can navigate this process with confidence. Remember, liability insurance is there to protect you, but it’s essential to use it responsibly to maintain a positive insurance profile.

What is liability insurance, and why is it important?

+Liability insurance is a type of coverage that protects you from financial losses arising from accidental injuries or property damage caused by you or your assets. It is crucial as it safeguards your personal assets, ensuring you can navigate unforeseen circumstances without facing catastrophic financial consequences.

When should I consider filing a liability insurance claim?

+Consider filing a claim when an incident results in significant injuries, property damage, or substantial financial loss for the affected party. It’s essential to assess the situation, review your policy, and consult experts if needed to make an informed decision.

What are the potential consequences of filing a liability insurance claim?

+Filing a claim can lead to increased insurance premiums or even policy cancellations, especially if you have a history of frequent claims. It’s crucial to file claims only when necessary to maintain a positive insurance profile and avoid unnecessary financial burdens.