Cheap House Insurance

House insurance, often referred to as homeowners insurance or home insurance, is an essential aspect of protecting your home and belongings. While it is crucial to have adequate coverage, many homeowners seek affordable options without compromising on the quality of protection. In this comprehensive guide, we will delve into the world of cheap house insurance, exploring the factors that influence its cost, providing strategies to secure the best deals, and offering valuable insights to ensure you make informed decisions.

Understanding the Factors Affecting House Insurance Costs

The cost of house insurance is influenced by a multitude of factors, each playing a unique role in determining the final premium. By understanding these factors, homeowners can make informed choices and potentially reduce their insurance expenses.

Location and Geographical Risks

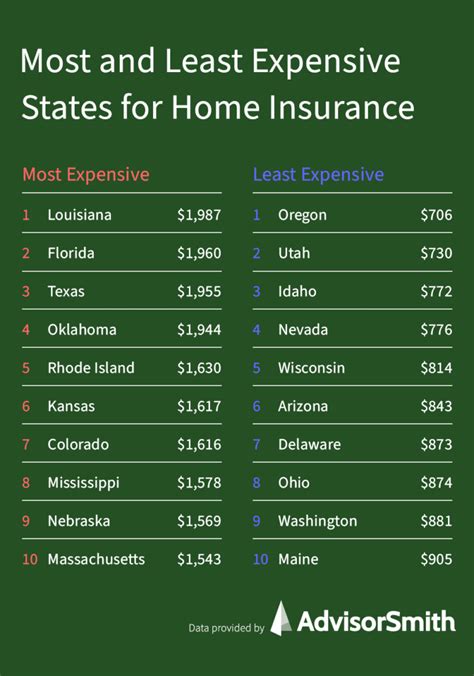

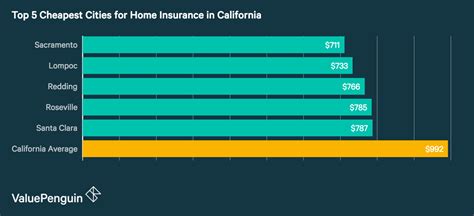

One of the primary factors that insurance providers consider is the location of your home. Different regions face varying levels of risk, whether it’s due to natural disasters like hurricanes, floods, or wildfires, or other factors such as crime rates and proximity to fire stations. Areas prone to these risks often result in higher insurance premiums.

For instance, coastal regions known for frequent hurricanes may face significantly higher insurance costs compared to inland areas. Similarly, regions with a high incidence of burglaries or vandalism might also see increased premiums.

Home Value and Replacement Cost

The value of your home and its contents plays a crucial role in determining insurance costs. Insurance providers assess the replacement cost of your home, which includes the cost of rebuilding it from the ground up, along with the cost of replacing your belongings. Homes with higher values or those located in areas with high construction costs will generally require more expensive insurance policies.

Age and Condition of the Property

The age and overall condition of your home can impact insurance rates. Older homes may require more frequent repairs or have outdated electrical or plumbing systems, increasing the risk of accidents or damages. As a result, insurance providers may charge higher premiums for older properties.

Additionally, homes in need of significant repairs or those with known structural issues may also face increased insurance costs. Insurance providers assess these factors to determine the potential risks associated with the property.

Type of Coverage and Deductibles

The type of coverage you choose and the deductibles you opt for can significantly impact your insurance costs. Different coverage options, such as comprehensive coverage, liability coverage, or specific endorsements for valuable items, come with varying price tags. Similarly, choosing a higher deductible can lower your premium, as you’ll be responsible for a larger portion of any claims.

Claims History and Credit Score

Your insurance claims history is an essential factor in determining your insurance rates. A history of frequent claims can lead to increased premiums, as insurance providers view it as a higher risk. On the other hand, a clean claims history may result in more favorable rates.

Additionally, your credit score can also play a role in determining insurance costs. Insurance providers often use credit-based insurance scores to assess the risk associated with insuring a property. A higher credit score may result in more affordable insurance rates.

Strategies to Find Cheap House Insurance

While the cost of house insurance is influenced by various factors, there are strategies you can employ to secure the best deals and potentially reduce your insurance expenses. Here are some effective approaches to finding cheap house insurance:

Compare Multiple Quotes

One of the most effective ways to find cheap house insurance is by comparing quotes from multiple providers. Insurance rates can vary significantly between companies, even for the same level of coverage. By obtaining quotes from various insurers, you can identify the most affordable option that meets your needs.

Online comparison tools and insurance marketplaces can be valuable resources for gathering quotes from multiple providers in a short amount of time. These platforms allow you to input your information once and receive multiple quotes, making the comparison process more efficient.

Bundle Policies

Bundling your insurance policies, such as combining your house insurance with your auto insurance, can often lead to significant savings. Many insurance providers offer discounts when you bundle multiple policies with them. By doing so, you not only simplify your insurance management but also potentially reduce your overall insurance costs.

When bundling policies, ensure that you’re still receiving the appropriate level of coverage for each aspect. While savings are important, it’s crucial to maintain adequate protection for your home and belongings.

Raise Your Deductibles

Choosing a higher deductible can result in lower insurance premiums. A deductible is the amount you pay out of pocket before your insurance coverage kicks in. By opting for a higher deductible, you’re essentially agreeing to bear more of the financial responsibility in the event of a claim. This shift in financial burden results in reduced insurance costs.

However, it’s essential to carefully consider your financial situation before increasing your deductible. While a higher deductible can save you money in the long run, it’s crucial to ensure that you have the means to cover the deductible in the event of a claim.

Review Coverage Levels

Regularly reviewing your coverage levels is crucial to ensuring you have the appropriate amount of insurance while also managing costs. Over time, your needs may change, and your coverage should reflect those changes. By reviewing your policy annually or after significant life events, you can make adjustments to align your coverage with your current circumstances.

For example, if you’ve made significant upgrades to your home, such as renovations or additions, you may need to increase your coverage to adequately protect your new investments. Similarly, if your family size has changed or your possessions have increased in value, you may need to adjust your coverage accordingly.

Consider Discounts and Special Programs

Many insurance providers offer discounts and special programs that can reduce your insurance costs. These discounts may be based on factors such as your profession, the safety features of your home, or your loyalty to the insurance provider. It’s worth exploring these options to see if you qualify for any additional savings.

For instance, homeowners who have installed security systems, smoke detectors, or fire sprinklers may be eligible for discounts. Additionally, some insurance providers offer loyalty discounts for long-term customers or provide discounts for homeowners who bundle their insurance policies with other services, such as home monitoring or identity theft protection.

Best Practices for Cheap House Insurance

To further optimize your house insurance costs, it’s essential to follow some best practices. By implementing these strategies, you can ensure you’re getting the most value for your insurance dollars.

Maintain a Good Claims History

A clean claims history can be a significant factor in obtaining affordable house insurance. Insurance providers view homeowners with a history of frequent claims as higher risks. By avoiding unnecessary claims and maintaining a good claims history, you can potentially secure more favorable insurance rates.

It’s important to note that while it’s beneficial to avoid unnecessary claims, you should never hesitate to file a claim when it’s warranted. Insurance is designed to protect you in the event of unforeseen circumstances, and utilizing it appropriately is part of responsible financial management.

Improve Your Home’s Safety and Security

Investing in improving the safety and security of your home can not only provide peace of mind but also potentially lead to insurance discounts. Insurance providers often offer discounts for homes equipped with security systems, smoke detectors, fire sprinklers, and other safety measures. By taking proactive steps to enhance your home’s safety, you can reduce the risk of accidents and potential claims, resulting in lower insurance costs.

Additionally, consider making your home more resilient to natural disasters, such as installing hurricane shutters or reinforcing your roof. These measures not only protect your home but can also lead to insurance discounts, as they reduce the likelihood of significant damage in the event of a disaster.

Regularly Maintain Your Home

Proper maintenance of your home is not only essential for its longevity but can also impact your insurance costs. Insurance providers may view homes that are well-maintained as lower risks, as they are less likely to require frequent repairs or face significant damage. By regularly maintaining your home, you can potentially avoid costly repairs and reduce the risk of accidents or claims, leading to more affordable insurance rates.

This includes tasks such as regularly inspecting and maintaining your roof, plumbing, and electrical systems, as well as keeping your home clean and free from potential hazards. By being proactive in your home maintenance, you can ensure its longevity and potentially save on insurance costs.

Future Implications and Considerations

As the insurance industry continues to evolve, it’s essential to stay informed about potential changes and considerations that may impact the cost and availability of cheap house insurance. Here are some future implications and factors to keep in mind:

Changing Risk Factors

The risk factors that insurance providers consider can evolve over time. As climate change continues to impact weather patterns and natural disasters become more frequent and severe, insurance providers may adjust their risk assessments accordingly. This could result in increased insurance costs for homeowners in regions prone to these risks.

It’s important to stay updated on the changing risk factors in your region and understand how they may impact your insurance costs. By being proactive and implementing measures to mitigate these risks, you can potentially reduce the impact on your insurance premiums.

Technological Advancements

Advancements in technology are constantly shaping the insurance industry. From the use of artificial intelligence in risk assessment to the development of smart home devices that can enhance home security, technology is playing an increasingly important role in insurance. These advancements can lead to more accurate risk assessments and potentially result in more affordable insurance options.

As a homeowner, staying informed about these technological advancements and considering their potential impact on your insurance costs is essential. By adopting smart home technologies or exploring insurance providers that utilize advanced risk assessment tools, you may be able to access more affordable insurance options.

Regulatory Changes

Insurance regulations are subject to change, and these changes can impact the cost and availability of insurance. For example, changes in state or federal laws regarding insurance coverage or premiums can influence the rates offered by insurance providers. It’s crucial to stay updated on any regulatory changes that may affect your insurance coverage and costs.

Additionally, changes in the insurance market, such as the entry or exit of insurance providers, can also impact the availability and cost of insurance. By staying informed about these market dynamics, you can make more informed decisions when choosing insurance providers and policies.

FAQ

How can I lower my house insurance costs without compromising on coverage?

+To lower your house insurance costs without compromising on coverage, consider raising your deductibles, reviewing your coverage levels to ensure you’re not overinsured, and exploring discounts and special programs offered by insurance providers. Additionally, maintaining a good claims history and improving your home’s safety and security can also lead to savings.

What factors should I consider when comparing house insurance quotes?

+When comparing house insurance quotes, consider factors such as the coverage limits, deductibles, additional coverage options, and any exclusions or limitations. Additionally, evaluate the financial stability and reputation of the insurance provider, as well as their customer service and claims handling processes.

Are there any government programs or assistance available for affordable house insurance?

+Some states or municipalities offer programs or assistance for affordable house insurance, particularly for low-income homeowners or those living in high-risk areas. It’s worth researching any available programs in your area and exploring your eligibility.

In conclusion, finding cheap house insurance involves a combination of understanding the factors that influence insurance costs, employing effective strategies to compare quotes and secure the best deals, and implementing best practices to maintain affordable insurance rates. By staying informed about changing risk factors, technological advancements, and regulatory changes, homeowners can make informed decisions to protect their homes and belongings while managing insurance costs effectively.