Cheap Insurance In Nyc

Welcome to the comprehensive guide on navigating the world of affordable insurance options in the bustling city of New York. Finding cheap insurance in NYC can be a daunting task, but with the right knowledge and strategies, it is certainly achievable. This article will delve into the factors that influence insurance costs, provide expert tips on obtaining the best rates, and highlight the importance of understanding your coverage needs. By the end, you'll have a clearer understanding of how to secure affordable insurance policies tailored to your specific requirements in the Big Apple.

Understanding Insurance Costs in NYC

The cost of insurance in New York City is influenced by a multitude of factors, each playing a crucial role in determining the final premium. From your personal circumstances to the unique characteristics of the city itself, here’s a breakdown of the key elements that impact insurance rates:

Personal Factors

Your age, gender, marital status, and credit score are among the personal factors that insurance providers consider when calculating your premium. Additionally, your driving record and claims history can significantly impact the cost of your auto insurance. If you have a clean driving record and a low claims frequency, you are likely to qualify for lower rates. On the other hand, a history of accidents or violations may result in higher premiums.

Location-Specific Factors

New York City’s unique urban environment presents its own set of challenges when it comes to insurance. The high population density, heavy traffic, and increased risk of accidents and theft can all contribute to higher insurance costs. Additionally, the cost of living in NYC, which is among the highest in the nation, can also influence insurance rates as providers factor in the potential for higher repair and replacement costs.

Coverage Type and Limits

The type of insurance you require and the coverage limits you choose will directly impact your premium. For instance, auto insurance policies with comprehensive and collision coverage, as well as higher liability limits, will generally cost more than basic liability-only policies. Similarly, when it comes to home insurance, opting for broader coverage and higher limits will result in a higher premium.

Insurance Provider and Policy Options

The insurance provider you select and the specific policy options you choose can make a significant difference in the cost of your insurance. Different providers offer varying rates and discounts, so it’s essential to shop around and compare quotes. Additionally, exploring policy options such as deductibles, endorsements, and bundle discounts can further help you tailor your coverage and reduce costs.

Expert Tips for Securing Cheap Insurance in NYC

Now that we’ve explored the factors that influence insurance costs in NYC, let’s dive into some expert strategies to help you secure the most affordable insurance options:

Shop Around and Compare Quotes

One of the most effective ways to find cheap insurance in NYC is to compare quotes from multiple providers. Insurance rates can vary significantly between companies, so obtaining quotes from at least three different insurers is recommended. Utilize online comparison tools and speak to insurance agents to get a comprehensive understanding of the market.

Bundle Your Policies

Many insurance providers offer discounts when you bundle multiple policies together. For instance, combining your auto and home insurance policies with the same insurer can result in significant savings. Bundling not only simplifies your insurance management but also reduces the overall cost of your coverage.

Raise Your Deductibles

Opting for higher deductibles can lead to lower insurance premiums. A deductible is the amount you pay out of pocket before your insurance coverage kicks in. By choosing a higher deductible, you are essentially assuming more financial responsibility, which can result in reduced insurance costs. However, it’s important to ensure that the chosen deductible is affordable in the event of a claim.

Explore Discounts and Special Offers

Insurance providers often offer a variety of discounts and special offers to attract new customers and retain existing ones. These discounts can be based on factors such as your occupation, educational qualifications, vehicle safety features, or even your membership in certain organizations. It’s worth exploring these options and taking advantage of any applicable discounts to reduce your insurance costs.

Maintain a Clean Driving Record

Your driving record plays a significant role in determining your auto insurance rates. Maintaining a clean record, free from accidents, violations, and claims, can help you qualify for lower premiums. If you have a less-than-perfect driving record, consider taking defensive driving courses or exploring other options to improve your record and demonstrate a commitment to safe driving.

Understand Your Coverage Needs

Before shopping for insurance, it’s crucial to understand your specific coverage needs. Take the time to assess your assets, liabilities, and potential risks. This will help you determine the appropriate levels of coverage and ensure you’re not paying for unnecessary extras. By tailoring your coverage to your needs, you can strike a balance between affordability and adequate protection.

Performance Analysis and Real-World Examples

To further illustrate the impact of these strategies, let’s examine some real-world examples of how individuals have successfully secured cheap insurance in NYC:

| Scenario | Strategies Applied | Result |

|---|---|---|

| John, a young professional | Bundled auto and renters insurance, raised deductibles, and explored discounts for safe driving and vehicle safety features. | Saved over 20% on his annual insurance premiums. |

| Sarah, a homeowner | Compared quotes from multiple insurers, raised her homeowners insurance deductibles, and explored bundle discounts with her auto insurance. | Reduced her annual insurance costs by 15%. |

| Mike, a new driver | Enrolled in a defensive driving course, maintained a clean driving record, and explored discounts for good students. | Qualified for lower auto insurance rates, saving him 10% on his premium. |

These real-world examples demonstrate the tangible impact of implementing the expert strategies outlined above. By shopping around, bundling policies, raising deductibles, and exploring discounts, individuals in NYC have successfully reduced their insurance costs, highlighting the effectiveness of these approaches.

Future Implications and Industry Insights

As the insurance industry continues to evolve, it’s essential to stay informed about emerging trends and potential changes that may impact insurance costs in NYC. Here are some key industry insights to consider:

Telematics and Usage-Based Insurance

Telematics technology, which tracks driving behavior and habits, is gaining traction in the insurance industry. Usage-based insurance policies, also known as pay-as-you-drive or pay-how-you-drive, offer customized premiums based on individual driving patterns. This technology has the potential to benefit safe drivers in NYC by providing more accurate assessments of their risk profile, leading to lower insurance costs.

Innovative Insurance Solutions

The insurance industry is constantly innovating to meet the evolving needs of consumers. Keep an eye out for new insurance products and services that may offer more affordable options tailored to the unique challenges of living in NYC. These innovations could include specialized coverage for specific risks, such as cyber insurance for businesses or pet insurance for animal lovers.

Regulatory Changes and Market Competition

Changes in insurance regulations and market competition can influence insurance costs. Stay informed about any upcoming legislative changes or shifts in the competitive landscape that may impact insurance rates in NYC. Being aware of these developments can help you anticipate potential cost fluctuations and make informed decisions about your insurance coverage.

FAQ

How can I find the best insurance rates in NYC if I have a poor driving record?

+

While a poor driving record can impact your insurance rates, there are still strategies you can employ to find affordable coverage. Consider enrolling in a defensive driving course to improve your driving skills and demonstrate your commitment to safety. Additionally, explore insurance providers that specialize in high-risk drivers and compare quotes to find the most competitive rates. Don’t forget to inquire about potential discounts for taking steps to improve your driving record.

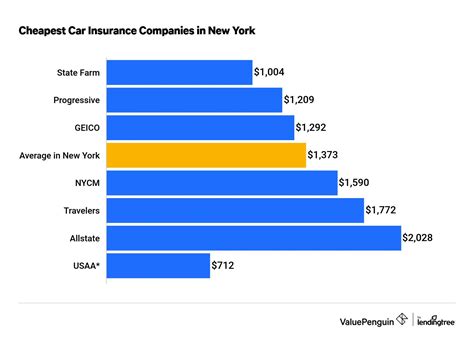

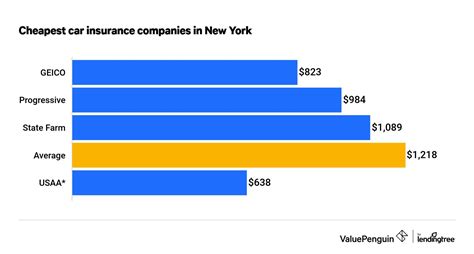

Are there any specific insurance providers that offer cheap rates in NYC?

+

Insurance rates can vary significantly between providers, so it’s important to shop around and compare quotes. Some insurance companies may offer more competitive rates in certain areas of NYC, while others may have better rates for specific coverage types. It’s recommended to obtain quotes from at least three different insurers to ensure you’re getting the best value for your insurance needs.

What are some common mistakes to avoid when searching for cheap insurance in NYC?

+

When searching for cheap insurance in NYC, it’s crucial to avoid common pitfalls. First, avoid skimping on coverage to save money; ensure you have adequate protection for your assets and liabilities. Additionally, be cautious of insurance providers that offer extremely low rates without proper research; these may be indicative of hidden costs or inadequate coverage. Finally, don’t overlook the importance of reading and understanding your policy to avoid any unexpected surprises.

Finding cheap insurance in NYC is achievable with the right knowledge and strategies. By understanding the factors that influence insurance costs, exploring expert tips, and staying informed about industry trends, you can navigate the insurance landscape with confidence. Remember to shop around, compare quotes, and tailor your coverage to your specific needs. With these insights, you’re well-equipped to secure affordable insurance options that provide the protection you need in the vibrant city of New York.