Cheap Plpd Auto Insurance Michigan

Michigan, known for its vibrant automotive culture and unique insurance regulations, presents a challenging landscape for drivers seeking affordable car insurance. The state's no-fault insurance system, while designed to provide comprehensive coverage, can make it difficult to find basic liability insurance at a reasonable price. However, understanding the nuances of Michigan's insurance market and knowing the right strategies can help drivers secure cheap PLPD auto insurance.

Understanding Michigan’s Unique Insurance Landscape

Michigan’s insurance laws are distinct, primarily due to its no-fault auto insurance system. This system requires drivers to carry personal injury protection (PIP) coverage, which pays for medical expenses and lost wages in the event of an accident, regardless of fault. While this ensures comprehensive coverage, it also contributes to higher insurance premiums. Additionally, Michigan has a high-risk pool known as the Michigan Automobile Insurance Placement Facility (MAIPF), which provides coverage to drivers who are unable to obtain insurance through standard means. This is an important safety net for high-risk drivers, but it also affects overall insurance rates.

Another unique aspect of Michigan's insurance market is the Unlimited PIP option. This coverage type, which is mandatory unless specifically waived, provides unlimited medical benefits for accident victims. While this offers extensive protection, it significantly increases insurance premiums. Therefore, understanding these nuances is crucial for drivers seeking cheap PLPD insurance in Michigan.

What is PLPD Auto Insurance and Why Choose It in Michigan

PLPD, or Personal Liability and Property Damage, is a type of car insurance that provides bodily injury liability and property damage liability coverage. It is a basic form of insurance that covers the policyholder against claims for bodily injury or property damage caused to others in an accident for which they are at fault. In Michigan, PLPD insurance is a cost-effective option for drivers who want to meet the state’s minimum insurance requirements without the extensive coverage of a full-fledged policy.

Opting for PLPD insurance in Michigan can be a strategic decision for drivers who have older vehicles or those who are on a tight budget. By choosing this coverage, drivers can legally operate their vehicles while keeping insurance costs down. However, it's important to note that PLPD insurance does not provide coverage for the policyholder's own injuries or vehicle damage. Therefore, it is crucial to carefully assess one's individual needs and risks before opting for PLPD insurance.

Benefits of PLPD Insurance in Michigan

- Affordability: PLPD insurance is often the most cost-effective option, especially for drivers with older vehicles or those on a budget.

- Compliance with State Laws: It ensures drivers meet Michigan’s minimum insurance requirements, avoiding legal penalties.

- Customizable Coverage: Policyholders can tailor their coverage to their specific needs and budget, adding or removing optional coverage as required.

Considerations for PLPD Insurance

While PLPD insurance offers significant cost savings, it is essential to understand its limitations. This type of insurance does not cover the policyholder’s own injuries or vehicle damage, which can lead to significant out-of-pocket expenses in the event of an accident. Therefore, drivers should carefully weigh their financial situation and risk tolerance before opting for PLPD insurance.

| PLPD Insurance Coverage | Description |

|---|---|

| Bodily Injury Liability | Covers medical expenses and lost wages of injured parties in an accident caused by the policyholder. |

| Property Damage Liability | Pays for repairs or replacement of property damaged in an accident caused by the policyholder. |

Strategies for Finding Cheap PLPD Auto Insurance in Michigan

Finding cheap PLPD auto insurance in Michigan requires a combination of understanding the market, comparing quotes, and utilizing specific strategies. Here are some effective approaches:

Shop Around and Compare Quotes

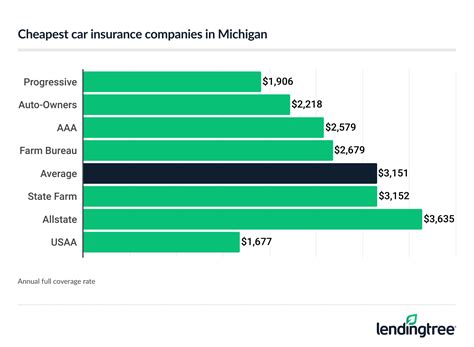

The Michigan insurance market is competitive, and rates can vary significantly between providers. It is essential to compare quotes from multiple insurers to find the best deal. Online comparison tools can be a convenient way to quickly get quotes from various providers. When comparing, pay attention to not only the price but also the coverage details and any additional perks or discounts offered.

Utilize Discounts and Bundles

Insurers often offer discounts to attract customers and reward loyalty. Common discounts include safe driver discounts, multi-policy discounts (for bundling car insurance with other policies like homeowners or renters insurance), and good student discounts for young drivers. Additionally, some insurers offer bundles that can provide significant savings. For example, bundling home and auto insurance can often result in a substantial discount.

Improve Your Driving Record

Your driving record is a significant factor in determining your insurance rates. A clean driving record can lead to lower premiums, while a history of accidents or traffic violations can significantly increase your rates. To improve your driving record, practice safe driving habits, avoid aggressive driving, and consider taking a defensive driving course, which can often result in a discount from your insurer.

Consider Usage-Based Insurance

Usage-based insurance, also known as pay-as-you-drive or telematics, is an innovative approach where insurance rates are based on your actual driving behavior. This type of insurance uses a device or app to track your driving habits, such as mileage, time of day, and braking patterns. Insurers then use this data to offer customized rates. For drivers with safe and conservative driving habits, usage-based insurance can lead to significant savings.

Explore High-Risk Insurance Options

If you’ve been deemed a high-risk driver, you may need to turn to specialized insurance providers. Michigan’s Michigan Automobile Insurance Placement Facility (MAIPF) is a state-mandated high-risk pool that can provide coverage to drivers who are unable to obtain insurance through standard means. While rates may be higher, it ensures that high-risk drivers can legally operate their vehicles.

Analyzing the Cost of PLPD Auto Insurance in Michigan

The cost of PLPD auto insurance in Michigan can vary widely depending on several factors. These include the insurer, the policyholder’s driving record, the type of vehicle insured, and the coverage limits chosen. On average, Michigan drivers can expect to pay around 300 to 600 per year for PLPD insurance. However, this can vary significantly, with some drivers paying as little as 200 per year and others paying upwards of 1,000.

It's important to note that while PLPD insurance offers a cost-effective solution for meeting Michigan's insurance requirements, it provides limited coverage. Policyholders should carefully assess their needs and risks to ensure they have adequate coverage. For those seeking more comprehensive coverage, other types of insurance policies, such as full-coverage or collision insurance, may be more suitable, albeit at a higher cost.

Factors Affecting PLPD Insurance Costs

- Driving Record: A clean driving record can lead to significant savings, while accidents and violations can increase premiums.

- Vehicle Type: The make, model, and age of your vehicle can impact your insurance rates. Newer, more expensive vehicles often result in higher premiums.

- Coverage Limits: The amount of coverage you choose can greatly affect your premium. Higher coverage limits generally result in higher premiums.

- Insurer: Different insurers have varying rates and policies. It’s important to compare quotes from multiple insurers to find the best deal.

Saving Strategies for PLPD Insurance

To save on PLPD insurance costs, consider the following strategies:

- Bundle your insurance policies to take advantage of multi-policy discounts.

- Maintain a clean driving record to qualify for safe driver discounts.

- Explore usage-based insurance options if you have safe driving habits.

- Shop around and compare quotes to find the most competitive rates.

Tips for Maintaining Cheap PLPD Auto Insurance in Michigan

Maintaining cheap PLPD auto insurance in Michigan requires a proactive approach. Here are some tips to help keep your insurance costs low:

Regularly Review and Update Your Policy

Insurance needs can change over time, so it’s important to regularly review your policy to ensure it still meets your requirements. Life events such as getting married, buying a new home, or adding a teen driver to your policy can all impact your insurance needs. By staying on top of these changes, you can ensure your policy remains up-to-date and you’re not overpaying for unnecessary coverage.

Maintain a Good Driving Record

A clean driving record is one of the best ways to keep your insurance costs low. Avoid accidents and traffic violations, as these can significantly increase your premiums. If you do have an accident or violation, be sure to shop around for new quotes, as different insurers may view your record differently and offer varying rates.

Take Advantage of Discounts and Promotions

Insurers often offer a variety of discounts to attract and retain customers. These can include safe driver discounts, multi-policy discounts, and good student discounts. Keep an eye out for promotions and special offers, as these can provide significant savings. Don’t hesitate to ask your insurer about available discounts and how you can qualify for them.

Consider Increasing Your Deductible

Increasing your deductible can lead to significant savings on your insurance premiums. A deductible is the amount you pay out of pocket before your insurance coverage kicks in. By choosing a higher deductible, you’re essentially taking on more financial responsibility in the event of a claim, which can result in lower premiums. However, it’s important to choose a deductible amount that you’re comfortable paying if needed.

The Future of PLPD Auto Insurance in Michigan

The future of PLPD auto insurance in Michigan is likely to be shaped by several key factors. First, technological advancements are expected to play a significant role. The increasing use of telematics and usage-based insurance models could offer more personalized and potentially cheaper insurance options for drivers. Additionally, the rise of electric vehicles and autonomous driving technology may lead to changes in insurance requirements and coverage needs.

Furthermore, regulatory changes could also impact the landscape of PLPD insurance in Michigan. While the state's unique no-fault system is currently a key factor in insurance costs, any changes to this system could significantly alter the market. It's important for drivers to stay informed about potential regulatory changes and their potential impact on insurance rates.

Potential Changes and Their Impact

- Telematics and Usage-Based Insurance: These models could offer more tailored and potentially cheaper insurance options for drivers with good driving habits.

- Electric Vehicles and Autonomous Driving: The adoption of these technologies may lead to changes in insurance requirements and potential cost savings.

- Regulatory Changes: Any alterations to Michigan’s no-fault system or other insurance regulations could significantly impact insurance rates and coverage options.

Staying Informed and Adapting to Changes

In the rapidly evolving world of automotive insurance, staying informed about new technologies, regulatory changes, and market trends is crucial. By keeping abreast of these developments, drivers can make more informed decisions about their insurance coverage and potentially benefit from cost savings and improved coverage options.

What is the minimum liability insurance required in Michigan?

+The minimum liability insurance required in Michigan is 20,000 for bodily injury per person, 40,000 for bodily injury per accident, and $10,000 for property damage per accident.

Can I get PLPD insurance if I have a poor driving record in Michigan?

+Yes, PLPD insurance is designed to provide basic liability coverage and is often a viable option for drivers with poor driving records. However, it’s important to note that a poor driving record can lead to higher premiums.

Are there any alternatives to PLPD insurance in Michigan for drivers on a budget?

+While PLPD insurance is generally the most affordable option, drivers on a tight budget can consider usage-based insurance or high-risk insurance options, such as those provided by the Michigan Automobile Insurance Placement Facility (MAIPF), to find more cost-effective coverage.