Cheap Vehicle Insurance Companies

When it comes to vehicle insurance, finding the right coverage at an affordable price is a top priority for many drivers. With numerous insurance companies offering a wide range of policies, it can be daunting to navigate the market and identify the cheapest options without compromising on quality. This comprehensive guide aims to shed light on the cheapest vehicle insurance companies, helping you make an informed decision to protect your vehicle and wallet.

Understanding Cheap Vehicle Insurance

Before delving into specific insurance companies, it's essential to understand the factors that influence insurance costs. Vehicle insurance rates are determined by a combination of individual characteristics, vehicle details, and the insurer's pricing strategies. Here's a breakdown of the key elements:

- Driver Profile: Your age, gender, driving record, and credit score significantly impact insurance rates. Younger drivers and those with a history of accidents or traffic violations may face higher premiums.

- Vehicle Details: The make, model, year, and safety features of your vehicle play a role in insurance costs. Generally, newer and more expensive vehicles tend to have higher insurance rates.

- Coverage Type and Limits: The level of coverage you choose, such as liability-only or comprehensive coverage, affects the overall cost. Higher coverage limits typically result in higher premiums.

- Insurance Company's Risk Assessment: Each insurer has its own methodology for assessing risk and setting rates. Some companies may offer lower rates for certain driver profiles or vehicles, while others may specialize in specific markets.

Now, let's explore some of the cheapest vehicle insurance companies in the market, along with their unique features and offerings.

Progressive

Progressive has established itself as one of the leading insurance providers in the United States, offering a wide range of coverage options at competitive rates. Here's what makes Progressive a top choice for budget-conscious drivers:

- Discounts: Progressive provides a variety of discounts, including those for safe driving, bundling multiple policies, and enrolling in their Snapshot program, which tracks driving behavior to offer personalized rates.

- Personalized Quotes: With Progressive's online quoting tool, you can receive customized quotes based on your specific needs and preferences. This allows for a transparent and tailored insurance experience.

- Comprehensive Coverage: Progressive offers a range of coverage options, including liability, collision, comprehensive, and medical payments insurance. You can tailor your policy to meet your requirements without paying for unnecessary coverage.

- Digital Convenience: Progressive's mobile app and online platform provide easy access to policy management, claims filing, and billing. This digital convenience adds to the overall affordability and customer satisfaction.

| Coverage Type | Average Annual Premium |

|---|---|

| Liability-Only | $500 - $800 |

| Full Coverage | $1,200 - $1,500 |

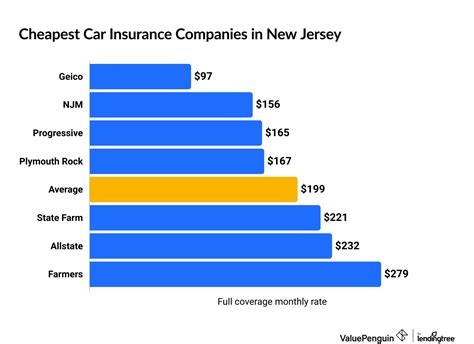

Geico

Geico, short for Government Employees Insurance Company, has been a prominent player in the insurance industry for decades. Known for its catchy advertising campaigns, Geico offers competitive rates and a seamless online experience:

- Military and Government Discounts: As its name suggests, Geico originally catered to government employees and military personnel. It continues to offer special discounts to these groups, making it an attractive option for those serving or affiliated with the government.

- Digital Convenience: Geico's online platform and mobile app provide an efficient and user-friendly experience for policy management, billing, and claims filing. You can easily adjust your coverage, pay bills, and access policy documents from anywhere.

- Wide Range of Coverage Options: Geico offers a comprehensive suite of insurance products, including auto, homeowners, renters, and life insurance. This allows you to bundle multiple policies and potentially save more.

- Flexible Payment Options: Geico provides various payment plans, including monthly, semi-annual, and annual payments, to accommodate different financial situations.

| Coverage Type | Average Annual Premium |

|---|---|

| Liability-Only | $450 - $750 |

| Full Coverage | $1,000 - $1,300 |

State Farm

State Farm is one of the largest insurance providers in the United States, offering a wide range of insurance products and services. While known for its personalized customer service, State Farm also provides competitive rates for vehicle insurance:

- Local Agent Network: State Farm operates through a network of local agents, providing personalized assistance and guidance. This human touch can be valuable, especially for those who prefer face-to-face interactions.

- Discounts: State Farm offers various discounts, including those for safe driving, multiple vehicles, and student drivers. Additionally, they provide discounts for drivers who install specific safety features in their vehicles.

- Comprehensive Coverage Options: State Farm provides a comprehensive range of coverage options, including liability, collision, comprehensive, and rental car insurance. They also offer specialized coverage for classic cars and rideshare drivers.

- Claim Satisfaction: State Farm is known for its efficient claims handling process, ensuring timely and fair settlements. This aspect contributes to customer satisfaction and peace of mind.

| Coverage Type | Average Annual Premium |

|---|---|

| Liability-Only | $550 - $850 |

| Full Coverage | $1,100 - $1,400 |

Esurance

Esurance, a subsidiary of Allstate, focuses on providing a seamless digital insurance experience. Here's why Esurance is a popular choice for tech-savvy drivers seeking affordable insurance:

- Digital Convenience: Esurance's online platform and mobile app offer a user-friendly experience for policy management, billing, and claims filing. You can easily adjust coverage, pay bills, and access policy documents digitally.

- Discounts: Esurance provides a range of discounts, including those for safe driving, bundling multiple policies, and enrolling in their DriveSense program, which uses telematics to track driving behavior and offer personalized rates.

- Coverage Options: Esurance offers a variety of coverage options, including liability, collision, comprehensive, and medical payments insurance. They also provide specialized coverage for rideshare drivers and classic cars.

- Claims Handling: Esurance has a dedicated claims team that is readily available to assist customers. They offer a quick and efficient claims process, ensuring timely settlements.

| Coverage Type | Average Annual Premium |

|---|---|

| Liability-Only | $400 - $700 |

| Full Coverage | $900 - $1,200 |

Conclusion

Finding cheap vehicle insurance requires a careful consideration of your specific needs, driving profile, and the offerings of different insurance companies. While the companies mentioned above provide competitive rates, it's essential to compare quotes and tailor your coverage to your requirements. Remember, the cheapest option may not always be the best fit for your situation, so take the time to assess your needs and choose an insurance provider that offers a balanced combination of affordability and comprehensive coverage.

Frequently Asked Questions

What factors determine vehicle insurance rates?

+Vehicle insurance rates are influenced by various factors, including your age, driving record, credit score, the make and model of your vehicle, and the coverage limits you choose. Insurance companies assess these factors to determine the level of risk associated with insuring you, which directly impacts the cost of your premium.

How can I find the cheapest vehicle insurance for my needs?

+To find the cheapest vehicle insurance, compare quotes from multiple providers. Consider your specific needs and preferences, such as the level of coverage you require and any additional services or discounts that are important to you. Online quote comparison tools can be a helpful starting point.

Are there any ways to lower my vehicle insurance costs?

+Yes, there are several strategies to reduce your vehicle insurance costs. These include maintaining a clean driving record, enrolling in defensive driving courses, increasing your deductible, and bundling multiple insurance policies (such as auto and home insurance) with the same provider. Additionally, exploring discounts offered by insurance companies, such as safe driver discounts or student discounts, can help lower your premiums.

What should I consider when choosing a vehicle insurance company?

+When choosing a vehicle insurance company, consider factors such as the company’s financial stability, customer service reputation, coverage options, and claims handling process. It’s also important to assess the company’s digital capabilities, especially if you prefer managing your insurance policy online or through a mobile app.

Can I get cheap vehicle insurance if I have a poor driving record?

+Obtaining cheap vehicle insurance with a poor driving record can be challenging, as insurance companies consider driving history as a significant factor in assessing risk. However, it’s still possible to find affordable coverage by comparing quotes from different providers, exploring specialized insurance programs for high-risk drivers, and focusing on improving your driving record over time.