Cheapest But Best Car Insurance

Finding the cheapest car insurance that also offers the best coverage can be a challenging task, but it's not impossible. With a careful and strategic approach, you can secure an affordable policy that provides the protection you need without breaking the bank. This comprehensive guide will take you through the essential steps to identify and secure the best value car insurance, ensuring you're adequately covered while keeping costs to a minimum.

Understanding the Factors that Influence Car Insurance Costs

The cost of car insurance is influenced by a multitude of factors, and understanding these can help you make more informed decisions. Let’s delve into the key elements that impact insurance premiums:

Risk Factors

Insurance companies assess various risk factors when determining your premium. These include your age, gender, driving record, and the number of years you’ve been a licensed driver. Younger drivers, particularly males under the age of 25, are often considered higher risk and may face higher premiums. Similarly, a history of accidents or traffic violations can lead to increased costs.

Vehicle Type and Usage

The make, model, and year of your vehicle play a significant role in insurance costs. Sports cars and luxury vehicles generally attract higher premiums due to their increased value and higher repair costs. Additionally, the purpose for which you use your vehicle can impact your insurance rate. If you primarily use your car for business purposes or commute long distances, your insurance may be more expensive.

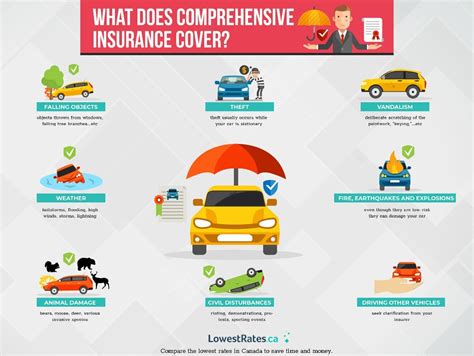

Coverage and Deductibles

The level of coverage you choose also affects your insurance costs. Comprehensive and collision coverage, which provide protection for your vehicle in various scenarios, can increase your premium. However, opting for higher deductibles (the amount you pay out of pocket before insurance coverage kicks in) can lower your premium. It’s a trade-off between immediate savings and potential future costs.

Location and Driving Habits

Your geographic location is a key factor in determining insurance rates. Areas with a higher incidence of accidents, theft, or vandalism may have higher insurance costs. Additionally, your driving habits, such as the number of miles you drive annually, can impact your premium. Insurance companies often use telematics devices or apps to track your driving behavior and offer discounts for safe driving practices.

Researching and Comparing Insurance Providers

Once you understand the factors that influence insurance costs, it’s time to start researching and comparing insurance providers. This step is crucial to finding the best value for your money.

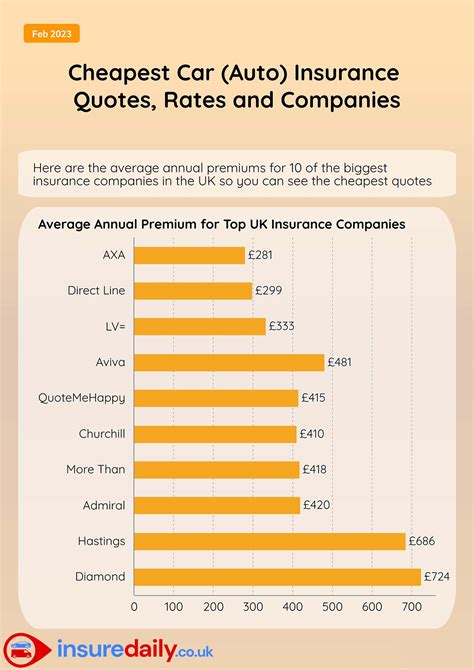

Online Quotes and Comparison Tools

Utilize online insurance quote comparison tools to quickly and easily compare policies and prices from multiple providers. These tools allow you to input your personal and vehicle details, and they’ll generate a list of quotes from various insurers. Make sure to provide accurate information to ensure the quotes are precise.

Assessing Coverage and Add-ons

When comparing quotes, pay close attention to the coverage offered. Ensure that the policies you’re considering provide the necessary coverage for your vehicle and your specific needs. Look for add-ons or endorsements that can enhance your coverage, such as rental car reimbursement or roadside assistance.

| Insurance Provider | Average Annual Premium | Coverage Options |

|---|---|---|

| Provider A | $1200 | Comprehensive, Collision, Medical Payments, Uninsured Motorist |

| Provider B | $1150 | Liability Only, Comprehensive, Personal Injury Protection |

| Provider C | $1300 | Full Coverage, Gap Insurance, Rental Car Reimbursement |

Reading Reviews and Customer Feedback

Before making a decision, research the reputation and customer satisfaction levels of the insurance providers you’re considering. Read online reviews and testimonials to gain insights into the experiences of other policyholders. This can help you identify potential red flags or areas of concern.

Negotiating and Securing the Best Deal

Once you’ve narrowed down your options, it’s time to negotiate and secure the best deal. Remember, insurance providers want your business, and you have the power to choose the policy that suits you best.

Bundling Policies

Consider bundling your car insurance with other policies, such as homeowners or renters insurance. Many insurance companies offer discounts when you purchase multiple policies from them. This can be a great way to save money while also streamlining your insurance needs.

Exploring Discounts and Special Offers

Insurance companies often provide a range of discounts to attract customers. These may include discounts for safe driving, loyalty, good student status, or even occupational or membership-related discounts. Make sure to ask about any available discounts and ensure you meet the criteria to qualify.

Understanding Policy Terms and Conditions

Before finalizing your insurance purchase, carefully review the policy’s terms and conditions. Understand the coverage limits, deductibles, and any exclusions or limitations. Ensure that the policy meets your needs and expectations. If you have any questions or concerns, don’t hesitate to reach out to the insurance provider for clarification.

Maintaining Affordable Insurance Over Time

Securing the cheapest car insurance is just the beginning. To maintain affordable insurance over time, there are several strategies you can employ.

Safe Driving Practices

Maintaining a clean driving record is crucial to keeping your insurance costs low. Avoid accidents and traffic violations, and practice safe driving habits. Many insurance companies offer discounts for accident-free periods, so the longer you go without incidents, the more you can save.

Regularly Review and Compare Policies

Insurance rates can change over time, and it’s essential to stay up-to-date with the market. Regularly review your insurance policy and compare it with other providers to ensure you’re still getting the best value. Don’t be afraid to switch insurers if you find a better deal elsewhere.

Adjust Coverage as Needed

As your life circumstances change, your insurance needs may also evolve. Review your coverage annually to ensure it still aligns with your requirements. If you’ve paid off your car or its value has significantly decreased, you may be able to reduce your coverage and save money. On the other hand, if you’ve made significant upgrades or modifications to your vehicle, you may need to increase your coverage.

Frequently Asked Questions

How can I lower my car insurance premium if I have a poor driving record?

+Improving your driving record is the most effective way to lower your insurance premium. Attend defensive driving courses to enhance your skills and reduce the likelihood of accidents. Additionally, some insurance companies offer programs that allow you to track your driving behavior and earn discounts for safe driving practices.

Are there any car insurance providers that specialize in offering low-cost policies to high-risk drivers?

+While it may be challenging, there are insurance providers that cater to high-risk drivers. These companies often have specialized programs or policies designed to offer coverage at a more affordable rate. However, it’s important to carefully review the coverage and terms to ensure they meet your needs.

What is the average cost of car insurance per month in the United States?

+The average monthly cost of car insurance in the US varies depending on factors such as location, vehicle type, and coverage. As of 2023, the national average monthly car insurance premium is approximately 145. However, this can range from as low as 75 to over $200 per month, depending on individual circumstances.

By understanding the factors that influence car insurance costs, conducting thorough research, and negotiating effectively, you can secure the cheapest car insurance that offers the best coverage. Remember, it’s essential to regularly review and adjust your policy to maintain affordable insurance over time.