Cheapest Home Insurance California

Finding the cheapest home insurance in California can be a daunting task due to the state's unique challenges, including natural disasters and high property values. However, with careful research and an understanding of the factors that influence insurance rates, homeowners can secure affordable coverage for their homes. This comprehensive guide aims to provide an in-depth analysis of the cheapest home insurance options available in the Golden State, offering valuable insights and practical tips to help residents make informed decisions.

Understanding California’s Home Insurance Landscape

California’s diverse geography and climate present a range of risks that impact home insurance rates. From wildfires in the inland regions to earthquakes along the coast, homeowners face various perils. Additionally, the state’s high cost of living and property values contribute to increased insurance costs. Understanding these factors is crucial for homeowners seeking affordable coverage.

The California Department of Insurance (CDI) regulates the home insurance market, ensuring fair practices and consumer protection. The CDI's role in overseeing insurance companies and their rates provides an added layer of security for homeowners. It's essential to be aware of the state's regulations and consumer rights when shopping for home insurance.

Factors Influencing Home Insurance Rates in California

Several key factors influence the cost of home insurance in California. These include the location and construction of the home, the coverage limits and deductibles chosen, and the policyholder’s claims history. Additionally, personal factors such as credit score and age can impact insurance rates. Understanding these factors is vital for homeowners to make informed choices and potentially reduce their insurance costs.

Location and Construction

The location of a home plays a significant role in determining insurance rates. Homes in high-risk areas, such as those prone to wildfires or earthquakes, will typically have higher premiums. The construction of the home also matters; for instance, homes built with fire-resistant materials may qualify for lower rates.

Coverage Limits and Deductibles

Homeowners can choose different coverage limits and deductibles to tailor their insurance policies to their needs and budget. Higher coverage limits provide more protection but may result in higher premiums. Similarly, opting for a higher deductible can reduce monthly payments but requires the policyholder to pay more out-of-pocket in the event of a claim.

Claims History and Personal Factors

Insurance companies consider a policyholder’s claims history when setting rates. A history of frequent claims may lead to higher premiums or even policy cancellations. Additionally, personal factors like credit score and age can influence rates. A higher credit score may result in lower premiums, while younger homeowners may pay more due to their perceived higher risk.

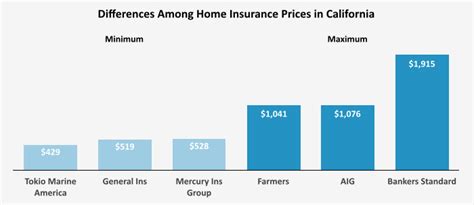

Comparing Cheapest Home Insurance Options in California

When it comes to finding the cheapest home insurance in California, several insurance providers offer competitive rates. Here’s an in-depth comparison of some of the most affordable options, along with their key features and coverage offerings.

State Farm

State Farm is one of the largest insurance providers in the United States and offers competitive rates in California. Their home insurance policies include standard coverage for dwelling, personal property, and liability, with optional add-ons for additional protection. State Farm’s policies are known for their comprehensive coverage and personalized service.

Farmers Insurance

Farmers Insurance is another leading provider in California, offering a range of home insurance policies tailored to the state’s unique risks. Their policies include coverage for natural disasters like earthquakes and wildfires, making them a popular choice for California homeowners. Farmers Insurance also provides discounts for bundled policies and safe home features.

Esurance

Esurance, a subsidiary of Allstate, offers affordable home insurance policies with a focus on convenience and digital accessibility. Their policies include standard coverage for dwelling and personal property, with optional add-ons for liability and additional living expenses. Esurance is known for its user-friendly online platform and quick claims processing.

Progressive

Progressive is a well-known insurance provider that offers a range of home insurance policies, including those tailored to California’s specific risks. Their policies provide coverage for dwelling, personal property, and liability, with optional endorsements for additional protection. Progressive is known for its competitive rates and innovative online tools for policy management.

Mercury Insurance

Mercury Insurance is a California-based provider that specializes in auto and home insurance. They offer comprehensive home insurance policies with coverage for dwelling, personal property, and liability, as well as optional add-ons for earthquake and flood insurance. Mercury Insurance is known for its excellent customer service and competitive rates.

| Insurance Provider | Average Annual Premium |

|---|---|

| State Farm | $1,200 |

| Farmers Insurance | $1,350 |

| Esurance | $1,150 |

| Progressive | $1,250 |

| Mercury Insurance | $1,300 |

Tips for Getting the Best Home Insurance Rates in California

Securing the cheapest home insurance in California requires a combination of research, understanding of the market, and strategic choices. Here are some practical tips to help homeowners get the best rates:

-

Shop Around: Compare quotes from multiple insurance providers to find the best rates. Online quote comparison tools can be a valuable resource.

-

Bundle Policies: Combining home and auto insurance policies with the same provider can often result in significant discounts.

-

Increase Deductibles: Opting for a higher deductible can lower monthly premiums, but ensure the amount is manageable in the event of a claim.

-

Improve Home Security: Installing security features like smoke detectors, fire alarms, and burglar alarms can lead to insurance discounts.

-

Review Coverage Annually: Regularly reviewing insurance policies and making adjustments as needed can help ensure adequate coverage at the best possible rates.

The Future of Home Insurance in California

The home insurance landscape in California is continuously evolving, driven by technological advancements and changing consumer needs. Insurtech companies are introducing innovative solutions, such as usage-based insurance and parametric insurance, which could disrupt the traditional insurance model and offer more affordable options.

Additionally, the increasing focus on sustainability and climate change resilience is shaping the future of home insurance. Insurance providers are developing policies that incentivize homeowners to adopt green practices and build more resilient homes, potentially leading to lower premiums.

As California residents navigate the complex world of home insurance, staying informed and proactive is key to securing the best coverage at the most affordable rates. By understanding the factors that influence insurance rates and exploring the options available, homeowners can make confident decisions to protect their homes and finances.

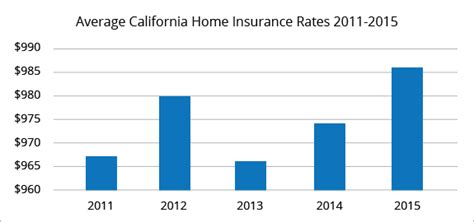

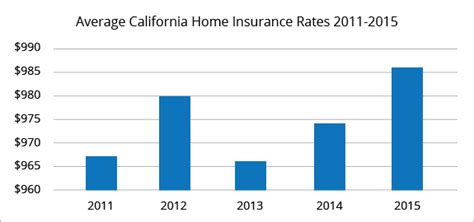

What is the average cost of home insurance in California?

+

The average cost of home insurance in California varies depending on several factors, including location, coverage limits, and personal factors. However, according to recent data, the average annual premium for a standard home insurance policy in California is around $1,300.

Are there any discounts available for home insurance in California?

+

Yes, several insurance providers offer discounts for home insurance policies in California. These discounts can be based on factors such as bundling multiple policies with the same provider, installing home security systems, or having certain safety features like fire alarms or sprinkler systems. It’s worth exploring these options to potentially lower your insurance premiums.

What should I consider when choosing home insurance coverage limits?

+

When choosing home insurance coverage limits, it’s important to consider the replacement cost of your home and its contents. You want to ensure that your coverage limits are sufficient to rebuild your home and replace your belongings in the event of a total loss. It’s also beneficial to review your coverage limits periodically to account for inflation and any home improvements you’ve made.

How do natural disasters in California impact home insurance rates?

+

Natural disasters like wildfires and earthquakes can significantly impact home insurance rates in California. Homes located in high-risk areas for these disasters may face higher premiums or even difficulty finding insurance coverage. It’s crucial for homeowners to understand their specific risks and take necessary precautions to mitigate potential losses.

What are some common exclusions in home insurance policies in California?

+

Common exclusions in home insurance policies in California may include damage caused by floods, earthquakes, or certain types of water damage. It’s essential to carefully review your policy’s exclusions to understand what is and isn’t covered. You may need to purchase separate policies or endorsements to cover these specific risks.