Car Insurance Monthly Cost

Car insurance is an essential aspect of vehicle ownership, providing financial protection and peace of mind to drivers. The cost of car insurance, however, can vary significantly based on numerous factors, making it a topic of great interest and concern for many vehicle owners. In this comprehensive guide, we will delve into the intricacies of car insurance monthly costs, exploring the key determinants, average expenses, and strategies to find the best deals. By understanding the factors influencing insurance premiums, you can make informed decisions and potentially save significantly on your car insurance expenses.

Understanding the Determinants of Car Insurance Costs

The monthly cost of car insurance is influenced by a multitude of factors, each playing a unique role in the overall calculation of premiums. These factors can be broadly categorized into personal, vehicle-related, and geographic considerations.

Personal Factors

Your personal circumstances and driving history are significant determinants of your car insurance costs. Insurance companies assess various personal factors, including:

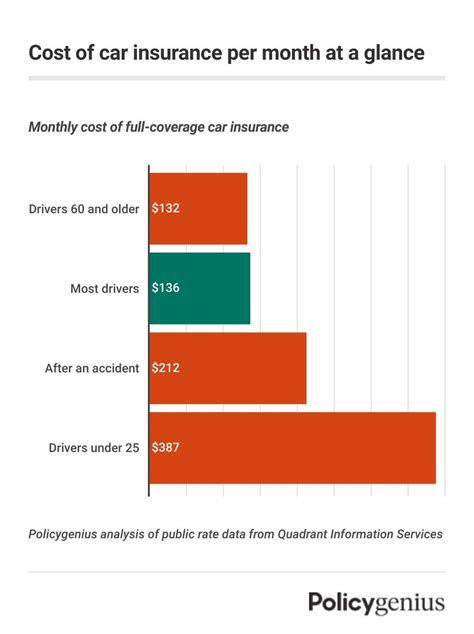

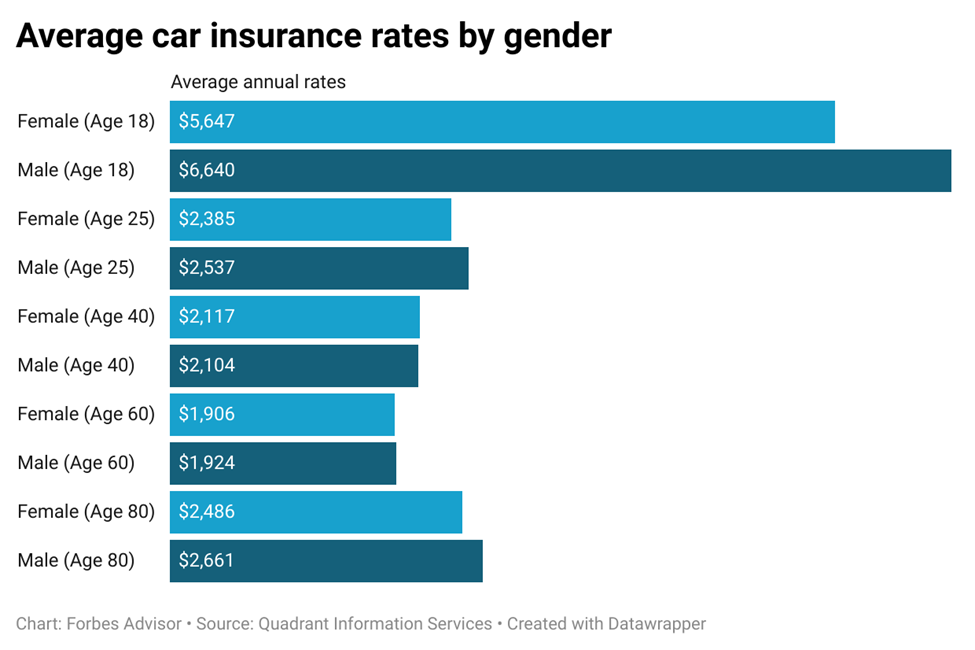

- Age and Gender: Younger drivers, particularly those under 25, often face higher insurance premiums due to their perceived higher risk. Gender can also be a factor, with some insurers charging different rates based on statistical differences in claims between male and female drivers.

- Driving Record: A clean driving record with no accidents or traffic violations can lead to lower insurance costs. Conversely, a history of accidents or moving violations may result in higher premiums.

- Credit Score: Surprisingly, your credit score can impact your insurance rates. Many insurers consider creditworthiness as an indicator of financial responsibility, and those with higher credit scores may be eligible for lower premiums.

- Marital Status: Married individuals are often considered lower risk by insurers, which can lead to reduced insurance costs.

Vehicle-Related Factors

The type of vehicle you drive and its specific characteristics can also influence insurance costs:

- Vehicle Type and Age: Sports cars and luxury vehicles typically attract higher insurance premiums due to their higher repair costs and increased likelihood of theft. Older vehicles, on the other hand, may be more affordable to insure.

- Safety Features: Vehicles equipped with advanced safety features like anti-lock brakes, airbags, and collision avoidance systems may qualify for insurance discounts.

- Annual Mileage: The number of miles you drive annually can impact your insurance rates. High-mileage drivers are often considered higher risk, leading to increased premiums.

Geographic Factors

Where you live and drive your vehicle plays a significant role in insurance costs:

- Location: Insurance rates can vary significantly based on your state and even your specific ZIP code. Urban areas often have higher insurance costs due to increased traffic and higher rates of accidents and theft.

- Traffic Density: Areas with higher traffic density and congestion tend to have higher insurance rates due to the increased likelihood of accidents.

- Crime Rates: Regions with higher crime rates, particularly those with a history of vehicle theft, may have higher insurance premiums.

Average Monthly Car Insurance Costs

The average monthly cost of car insurance can vary widely depending on the factors outlined above. According to industry data, the national average monthly premium for car insurance in the United States is approximately 120, with a range of 50 to $250 depending on individual circumstances.

| Coverage Type | Average Monthly Premium |

|---|---|

| Liability-only Coverage | $50 to $100 |

| Full Coverage (Comprehensive and Collision) | $100 to $250 |

It's important to note that these averages are just a general guideline, and your actual insurance costs may be significantly higher or lower based on your specific circumstances.

Factors Affecting Premium Variations

Several factors can cause significant variations in insurance premiums, even within the same coverage category:

- Deductibles: Choosing a higher deductible can lead to lower monthly premiums, as you’re essentially assuming more financial responsibility in the event of a claim.

- Coverage Limits: The higher the liability limits and comprehensive coverage you select, the higher your insurance premiums will be.

- Discounts: Taking advantage of insurance discounts for factors like good driving records, multiple policies, or safety features can significantly reduce your monthly costs.

Tips to Reduce Car Insurance Costs

While you can’t control all the factors that influence insurance costs, there are several strategies you can employ to potentially reduce your monthly premiums:

Shop Around

Insurance rates can vary significantly between different providers. By comparing quotes from multiple insurers, you can identify the best deal for your specific circumstances.

Choose Higher Deductibles

Opting for a higher deductible can lower your monthly premiums. However, it’s essential to ensure that you can afford the deductible in the event of a claim.

Review Your Coverage

Regularly review your insurance policy to ensure you’re not paying for unnecessary coverage. For example, if your vehicle is older and has low resale value, you may not need collision or comprehensive coverage.

Take Advantage of Discounts

Many insurers offer discounts for a variety of reasons. Common discounts include:

- Good student discount for young drivers with good grades.

- Multi-policy discount if you bundle your car insurance with other policies, such as homeowners or renters insurance.

- Safe driver discount for maintaining a clean driving record.

- Vehicle safety discounts for cars equipped with advanced safety features.

Consider Usage-Based Insurance

Usage-based insurance programs, often referred to as “pay-as-you-drive” or “telematics” insurance, allow insurers to monitor your driving habits and reward safe driving with lower premiums. These programs are particularly beneficial for low-mileage drivers and those with a history of safe driving.

Conclusion: Finding the Right Balance

Car insurance is a vital investment that provides financial protection and peace of mind. While the monthly cost of car insurance can be a significant expense, understanding the factors that influence premiums and employing strategies to reduce costs can help you find the right balance between coverage and affordability.

Frequently Asked Questions

How much does car insurance cost on average per month in the US?

+The average monthly cost of car insurance in the United States is approximately 120, but it can range from 50 to $250 depending on individual circumstances and coverage needs.

What factors influence the cost of car insurance?

+Several factors influence car insurance costs, including personal factors like age, gender, driving record, and credit score; vehicle-related factors such as type, age, safety features, and annual mileage; and geographic factors like location, traffic density, and crime rates.

Can I reduce my car insurance costs?

+Yes, there are several strategies to potentially reduce car insurance costs. These include shopping around for quotes, choosing higher deductibles, reviewing coverage to eliminate unnecessary expenses, taking advantage of available discounts, and considering usage-based insurance programs.

What is usage-based insurance, and how can it help me save on car insurance?

+Usage-based insurance, also known as pay-as-you-drive or telematics insurance, allows insurers to monitor your driving habits and offer discounts to safe drivers. It’s particularly beneficial for low-mileage drivers and those with a history of safe driving.

How often should I review my car insurance policy?

+It’s recommended to review your car insurance policy at least once a year, or whenever your personal circumstances or vehicle usage change significantly. This ensures that your coverage remains adequate and you’re not overpaying for unnecessary coverage.