Compare Life Insurance Policies

Choosing the right life insurance policy is a crucial financial decision, one that requires careful consideration and an understanding of the various options available. Life insurance serves as a safety net, providing financial protection to your loved ones in the event of your untimely demise. This article aims to guide you through the process of comparing life insurance policies, helping you make an informed choice tailored to your specific needs.

Understanding Life Insurance Policies

Life insurance policies are contracts between you and an insurance company, where you agree to pay regular premiums, and in return, the insurer promises to pay a sum of money (known as the death benefit) to your beneficiaries upon your death. These policies come in different forms, each with its own set of features, benefits, and limitations.

Types of Life Insurance Policies

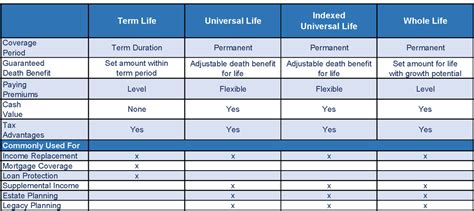

The two main categories of life insurance are term life insurance and permanent life insurance, each with several variations.

Term Life Insurance

Term life insurance provides coverage for a specific period, often ranging from 10 to 30 years. During this term, the policy pays out a death benefit if you pass away. However, if you outlive the term, the policy expires, and no benefit is paid. Term life insurance is typically more affordable than permanent life insurance, making it a popular choice for those seeking coverage for a defined period.

Permanent Life Insurance

Permanent life insurance, on the other hand, provides lifelong coverage, ensuring your beneficiaries receive a payout regardless of when you pass away. This type of insurance often includes a cash value component, which grows over time and can be accessed during your lifetime. The three primary types of permanent life insurance are:

- Whole Life Insurance: Offers consistent premiums and death benefits throughout your life. The cash value grows steadily and can be used for various purposes, such as borrowing against it or paying premiums.

- Universal Life Insurance: Provides flexibility in premium payments and death benefit amounts. You can adjust your premiums and death benefit within certain limits, making it a versatile option.

- Variable Life Insurance: Allows you to invest a portion of your premiums in different investment options, such as stocks or bonds. While this can lead to higher returns, it also carries more risk.

Key Considerations for Comparison

When comparing life insurance policies, several factors come into play. Here are some critical aspects to consider:

- Coverage Amount: Determine the amount of coverage you need based on your financial obligations and the goals you wish to achieve through the policy. This amount should be sufficient to cover your debts, provide for your family’s needs, and achieve any specific financial objectives.

- Premiums: Compare the cost of premiums between policies. Term life insurance generally has lower premiums, but permanent life insurance may offer more stability and flexibility over time.

- Policy Duration: Consider how long you need coverage. Term life insurance is ideal for covering specific periods, such as until your children become independent or your mortgage is paid off. Permanent life insurance provides lifelong coverage, ensuring your loved ones are protected regardless of when you pass away.

- Rider Options: Riders are additional benefits or features that can be added to your policy. Common riders include waivers for premium payments in case of disability, accelerated death benefits for terminal illnesses, and child riders that provide a small death benefit for your children.

- Company Reputation and Financial Stability: Research the financial stability and reputation of the insurance company. You want to ensure the company is reliable and has a track record of paying claims promptly.

- Policy Exclusions and Limitations: Understand what is not covered by the policy. Some policies may exclude certain causes of death or have waiting periods before certain benefits kick in.

- Renewability and Convertibility: Check if the policy allows for renewal or conversion to another type of policy. This can be beneficial if your needs change over time.

Analyzing Real-World Scenarios

Let’s explore some practical examples to illustrate how these considerations can impact your choice of life insurance policy.

Scenario 1: Young Family with a Mortgage

John and Sarah, a young couple with two children, recently purchased a home with a 30-year mortgage. They want to ensure their family is financially secure in the event of their untimely demise. Their primary concern is paying off the mortgage and providing for their children’s education.

In this scenario, a term life insurance policy with a duration of 25-30 years and a coverage amount sufficient to cover the remaining mortgage balance and their children’s education costs would be ideal. This ensures their family’s financial obligations are met should the worst happen.

Scenario 2: Retiree with Grandchildren

Robert, a retired individual with three grandchildren, wants to leave a legacy for his family. He has already paid off his mortgage and has sufficient savings for his retirement needs. He sees life insurance as a way to provide additional financial support to his grandchildren.

For Robert, a permanent life insurance policy, such as a whole life insurance plan, would be suitable. This would provide lifelong coverage, ensuring his grandchildren receive a death benefit whenever he passes away. The cash value component could also be used to supplement his retirement income if needed.

Scenario 3: Entrepreneur with Business Concerns

Emma, a successful entrepreneur, runs her own business. She wants to ensure her business can continue operating smoothly in the event of her death and provide financial security for her family. She also has concerns about paying off her business debts.

In Emma’s case, a combination of term and permanent life insurance might be the best approach. She could opt for a term life insurance policy with a duration matching the time it would take to repay her business debts. Simultaneously, she could consider a permanent life insurance policy, such as universal life insurance, to provide lifelong coverage for her family and ensure the business’s continuity.

Performance Analysis and Future Implications

When evaluating life insurance policies, it’s essential to consider their long-term performance and how they can impact your financial future.

Policy Performance Factors

- Claim Settlement Ratio: This ratio indicates the percentage of claims the insurance company pays out. A higher claim settlement ratio is a positive sign, indicating the company’s reliability in honoring its commitments.

- Investment Performance (for Permanent Policies): If your policy includes a cash value component, the investment performance of this cash value is crucial. Look for policies with a track record of strong investment returns.

- Renewal and Conversion Options: Policies that offer flexible renewal or conversion options provide more control over your coverage as your needs evolve.

Future Implications and Planning

Life insurance is a long-term financial commitment, and your needs may change over time. It’s important to regularly review and update your policy to ensure it aligns with your evolving circumstances.

As your family grows, your financial obligations may increase. You might need to consider increasing your coverage amount or adding riders to address specific concerns, such as long-term care needs or disability.

Additionally, as you near retirement, your focus may shift from debt repayment and family protection to legacy planning. Permanent life insurance policies can be an effective tool for estate planning, providing tax-efficient ways to transfer wealth to your heirs.

Conclusion: Choosing the Right Policy

Comparing life insurance policies is a critical step in ensuring your loved ones are financially protected. By understanding the different types of policies, analyzing your specific needs, and considering real-world scenarios, you can make an informed decision.

Remember, life insurance is not a one-size-fits-all solution. Your policy should be tailored to your unique circumstances and financial goals. Take the time to research, compare, and seek advice from financial professionals to find the best life insurance policy for your needs.

How do I know if I need life insurance?

+

Life insurance is typically recommended if you have financial dependents, such as a spouse, children, or aging parents, who rely on your income. It’s also essential if you have significant debts or financial obligations that your loved ones would need to address in your absence.

Can I change my life insurance policy once it’s in place?

+

Yes, most life insurance policies offer some level of flexibility. You can often adjust your coverage amount, add or remove riders, or convert your policy to a different type. However, these changes may impact your premiums and the overall cost of the policy.

What happens if I miss a premium payment?

+

Missed premium payments can have different consequences depending on your policy. Some policies may lapse if you miss a payment, while others may offer a grace period. It’s essential to understand the terms of your policy and make timely payments to avoid any disruptions in coverage.