Employee Health Insurance

In today's dynamic business landscape, ensuring the well-being of employees has become a cornerstone of successful organizations. Health insurance stands as a pivotal component in fostering a healthy workforce, boosting morale, and enhancing productivity. This article delves into the multifaceted world of employee health insurance, shedding light on its intricacies and highlighting its indispensable role in the modern workplace.

Understanding Employee Health Insurance: A Comprehensive Overview

Employee health insurance, a cornerstone of corporate welfare programs, plays a pivotal role in safeguarding the well-being of employees and their families. It provides financial protection against unforeseen medical expenses, offering a safety net that promotes peace of mind and facilitates access to quality healthcare.

In the intricate landscape of employee benefits, health insurance stands as a beacon of stability, ensuring that employees can navigate the complexities of healthcare systems with confidence. By offering a comprehensive array of coverage options, employers demonstrate a profound commitment to the holistic welfare of their workforce, fostering an environment of trust and loyalty.

The Evolution of Employee Health Insurance

The history of employee health insurance is a testament to the evolving nature of corporate responsibility. Initially conceived as a means to attract and retain top talent, it has metamorphosed into a cornerstone of employee satisfaction and retention strategies. Over the years, the scope and depth of coverage have expanded significantly, reflecting the changing dynamics of healthcare needs and technological advancements.

In the early days, employee health insurance was a novel concept, primarily reserved for high-level executives and key personnel. However, as societal awareness of healthcare rights grew, and legal frameworks evolved, it became an essential component of the employment package for a broader spectrum of workers. This evolution was driven by a collective realization that a healthy workforce is not only beneficial for individual employees but also instrumental in driving organizational success.

| Key Milestones in Employee Health Insurance | Impact |

|---|---|

| Introduction of Group Health Plans (1920s) | Enabled broader coverage, paving the way for more inclusive healthcare access. |

| Passage of the Affordable Care Act (2010) | Mandated employer contributions, ensuring more equitable healthcare coverage. |

| Rise of Telemedicine (2020s) | Expanded access to healthcare services, particularly during the pandemic. |

The Benefits of Comprehensive Coverage

Comprehensive employee health insurance packages offer a multitude of advantages, transcending mere financial protection. They foster a sense of security, knowing that medical emergencies or long-term illnesses will not derail one’s financial stability. This peace of mind can significantly impact an employee’s overall well-being and work performance.

Furthermore, comprehensive coverage encourages a proactive approach to healthcare. With a wide array of services covered, employees are more likely to prioritize regular check-ups, preventive care, and early intervention, leading to better health outcomes. This, in turn, translates to reduced absenteeism and presenteeism, contributing to a more productive and engaged workforce.

The benefits of comprehensive coverage are not limited to physical health. Many modern health insurance plans also include mental health services, recognizing the growing importance of emotional well-being in the workplace. This holistic approach to healthcare coverage is a testament to the evolving nature of employee benefits, reflecting a deeper understanding of the diverse needs of the modern workforce.

The Role of Employee Health Insurance in Organizational Success

Employee health insurance is not merely a contractual obligation; it is a strategic investment in the future of the organization. By prioritizing the health and well-being of their workforce, employers foster a culture of trust and loyalty, which forms the bedrock of sustainable business success.

Attracting and Retaining Top Talent

In a competitive job market, employee health insurance is a powerful tool for attracting and retaining top talent. It serves as a significant differentiator, allowing employers to offer a compelling benefits package that sets them apart from their competitors. For job seekers, a comprehensive health insurance plan can be a deciding factor in choosing one employer over another.

Furthermore, offering competitive health insurance demonstrates an employer's commitment to the long-term well-being of its employees. This commitment fosters a sense of loyalty, as employees feel valued and appreciated. As a result, employee retention rates can increase, leading to a more stable and experienced workforce, which is instrumental in driving organizational success.

Enhancing Employee Morale and Productivity

The impact of employee health insurance extends beyond the realm of recruitment and retention. It plays a pivotal role in boosting employee morale and productivity. When employees have access to quality healthcare, they feel more valued and motivated. This sense of appreciation can translate into increased job satisfaction and a more positive work environment.

Additionally, comprehensive health insurance coverage can reduce absenteeism and presenteeism, which are often linked to poor health. By encouraging employees to prioritize their health, employers can create a more productive workforce. This, in turn, leads to improved business performance and increased organizational success.

Building a Healthy Workforce

Employee health insurance is a key component in building a healthy workforce. By providing access to a wide range of healthcare services, employers can encourage employees to take a proactive approach to their health. This includes regular check-ups, preventive care, and early detection of potential health issues.

A healthy workforce is not only more productive but also less likely to experience costly medical emergencies. By investing in employee health, organizations can reduce their healthcare-related costs in the long run. This investment in preventative care can lead to significant savings and contribute to the overall financial health of the organization.

Best Practices for Implementing Employee Health Insurance

Implementing an effective employee health insurance program requires careful planning and consideration of various factors. It involves a delicate balance between providing comprehensive coverage and keeping costs manageable for both the employer and the employees.

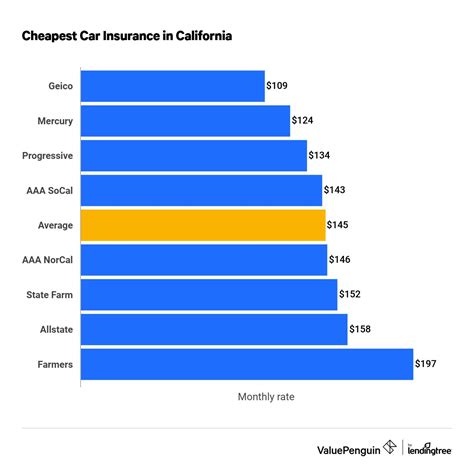

Choosing the Right Health Insurance Provider

Selecting a reputable and reliable health insurance provider is the first critical step. It is essential to choose a provider with a strong track record of delivering quality healthcare services and managing claims efficiently. Consider factors such as the provider’s network of healthcare professionals, the range of services covered, and their reputation for customer service and claim processing.

Research and compare different providers to find the one that best aligns with your organization's needs and values. Seek recommendations from other businesses, and don't hesitate to negotiate for better rates or customized plans that meet your specific requirements.

Tailoring the Health Insurance Plan to Your Workforce

One size does not fit all when it comes to employee health insurance. It is crucial to understand the unique needs and demographics of your workforce to design a plan that offers the right balance of coverage and affordability. Conduct surveys or focus groups to gather insights into the healthcare concerns and preferences of your employees.

Consider offering a range of plan options to cater to different needs. For instance, provide a basic plan with lower premiums for younger, healthier employees, and more comprehensive plans with higher coverage for those with pre-existing conditions or family members requiring specialized care. This approach ensures that employees can choose a plan that best suits their individual circumstances.

Educating Employees on the Benefits of Health Insurance

Many employees may not fully understand the value of health insurance or how to maximize its benefits. It is essential to provide comprehensive education and resources to help employees navigate their health insurance plans effectively.

Host educational workshops or webinars to explain the intricacies of the plan, including coverage limits, co-pays, deductibles, and the process for filing claims. Provide easy-to-understand materials that detail the services covered and how to access them. Consider offering personalized advice sessions to help employees make informed decisions about their healthcare.

Additionally, encourage employees to take advantage of preventive care services and wellness programs. These initiatives can help identify health issues early on, potentially reducing the need for more costly treatments down the line. By investing in employee education, organizations can ensure that their workforce fully appreciates the value of their health insurance benefits.

Future Trends in Employee Health Insurance

The landscape of employee health insurance is continuously evolving, driven by advancements in technology, shifts in societal attitudes towards healthcare, and changing employee expectations. Staying abreast of these trends is crucial for employers to remain competitive and meet the evolving needs of their workforce.

Embracing Digital Health Solutions

The integration of digital health solutions is one of the most prominent trends in employee health insurance. From telemedicine platforms that enable virtual consultations with healthcare professionals to mobile apps that track health metrics and provide personalized health recommendations, digital health solutions are transforming the way employees access and manage their healthcare.

By leveraging these technologies, employers can offer more convenient and accessible healthcare services to their employees. For instance, telemedicine can reduce the need for physical visits to healthcare facilities, saving time and resources for both employees and employers. Additionally, digital health platforms can provide employees with real-time access to their health records and facilitate better communication with healthcare providers.

Focus on Preventive Care and Wellness

There is a growing recognition among employers that investing in preventive care and wellness programs can lead to significant long-term health benefits for employees. As a result, we are seeing a shift towards health insurance plans that prioritize preventive measures and holistic well-being.

This trend involves offering coverage for a wide range of preventive services, such as annual check-ups, screenings, immunizations, and mental health counseling. Additionally, employers are incorporating wellness programs into their health insurance offerings, which may include incentives for employees to adopt healthier lifestyles, such as smoking cessation programs, weight management initiatives, or stress management workshops.

Personalized Health Insurance Plans

The future of employee health insurance is moving towards more personalized plans that cater to the unique needs of individual employees. This shift is driven by advancements in data analytics and a deeper understanding of the diverse health profiles within the workforce.

Personalized health insurance plans take into account factors such as an employee's age, gender, health history, and lifestyle habits to tailor coverage accordingly. For example, an employee with a history of heart disease may receive additional coverage for cardiovascular health services, while an employee with a family history of cancer may have enhanced coverage for cancer screenings and treatments. By offering personalized plans, employers can provide more targeted and effective healthcare solutions to their workforce.

Conclusion

Employee health insurance is a multifaceted and dynamic aspect of the modern workplace, offering a myriad of benefits that extend far beyond financial protection. It serves as a powerful tool for employers to attract and retain top talent, enhance employee morale and productivity, and build a healthy, resilient workforce.

As we navigate the evolving landscape of employee health insurance, it is essential to stay informed about the latest trends and best practices. By embracing digital health solutions, prioritizing preventive care and wellness, and offering personalized health insurance plans, employers can ensure they are providing the best possible benefits to their workforce. Ultimately, this investment in employee health and well-being will pay dividends in the form of a more engaged, productive, and satisfied workforce, driving organizational success and sustainability.

What are the key components of a comprehensive employee health insurance plan?

+A comprehensive employee health insurance plan typically includes coverage for a wide range of medical services, such as hospital stays, doctor visits, prescription medications, and preventive care. It may also cover specialized services like dental, vision, and mental health care. Additionally, it often provides financial protection through features like co-pays, deductibles, and out-of-pocket maximums.

How can employers choose the right health insurance provider for their workforce?

+Employers should consider factors such as the provider’s reputation, the scope of their healthcare network, the range of services covered, and their claims processing efficiency. It’s beneficial to solicit recommendations from other businesses and negotiate for customized plans that align with the specific needs of the workforce.

What are some strategies to encourage employees to take advantage of their health insurance benefits?

+Employers can host educational workshops to explain the benefits of the insurance plan, provide easy-to-understand materials detailing covered services, and offer personalized advice sessions. Additionally, incorporating wellness programs and incentives for healthy behaviors can encourage employees to prioritize their health.