Insurance For Workers

Insurance is an essential aspect of any industry, providing financial protection and peace of mind to individuals and businesses alike. When it comes to the workforce, ensuring the well-being and security of employees is paramount. This article delves into the world of insurance for workers, exploring the various types, their significance, and how they contribute to a robust and protected workforce.

Understanding Insurance for Workers

Insurance for workers is a comprehensive term that encompasses a range of policies designed to safeguard employees from various risks and potential losses. These policies are tailored to meet the unique needs of the working population, offering financial coverage and support in the event of accidents, illnesses, injuries, or other unforeseen circumstances.

In today's dynamic and often unpredictable work environment, insurance serves as a vital safety net, ensuring that workers and their families are protected and provided for, even in the face of adversity. Whether it's a construction worker facing physical hazards on-site or an office employee dealing with potential health issues, insurance policies are tailored to address a wide array of occupational risks.

The Importance of Insurance for Workers

The significance of insurance for workers cannot be overstated. It serves as a critical pillar of support, offering numerous benefits that contribute to the overall well-being and productivity of the workforce.

Financial Security and Peace of Mind

One of the primary advantages of insurance for workers is the financial security it provides. In the event of an accident, illness, or injury, insurance policies ensure that employees have access to the necessary funds to cover medical expenses, rehabilitation costs, and even lost wages. This financial support is crucial, as it allows workers to focus on their recovery without the added stress of financial burdens.

Furthermore, insurance offers peace of mind, knowing that they and their families are protected. It eliminates the fear of unforeseen medical bills or the inability to provide for their loved ones during challenging times. This sense of security can significantly reduce stress levels and improve overall job satisfaction and performance.

Promoting Health and Safety

Insurance for workers plays a pivotal role in promoting health and safety within the workplace. Employers who invest in comprehensive insurance policies demonstrate their commitment to the well-being of their employees. By providing access to quality healthcare and supporting employees through challenging health situations, businesses foster a culture of care and responsibility.

Additionally, insurance policies often include provisions for occupational health and safety measures. This may involve covering the cost of safety equipment, training programs, and even compensation for work-related injuries. By prioritizing the safety of their workforce, employers not only reduce the risk of accidents but also enhance their reputation as responsible and ethical organizations.

Attracting and Retaining Talent

In a competitive job market, offering attractive benefits such as comprehensive insurance coverage can be a powerful tool for attracting and retaining top talent. Employees value the security and support that insurance provides, and it can often be a deciding factor when considering employment opportunities.

By investing in insurance for workers, businesses demonstrate their dedication to the long-term success and well-being of their employees. This, in turn, fosters a loyal and engaged workforce, leading to increased productivity and a positive work environment.

Types of Insurance for Workers

The insurance landscape for workers is diverse, offering a range of policies to address specific needs and risks. Let’s explore some of the most common types of insurance that cater to the working population.

Health Insurance

Health insurance is perhaps the most critical type of insurance for workers. It provides coverage for medical expenses, including doctor visits, hospital stays, prescription medications, and specialized treatments. Health insurance ensures that employees have access to necessary healthcare services without incurring significant financial strain.

Many employers offer group health insurance plans, which often provide more comprehensive coverage and lower premiums compared to individual plans. These plans may include various benefits, such as preventative care, mental health support, and even vision and dental coverage.

| Group Health Insurance Benefits | Description |

|---|---|

| Preventative Care | Coverage for regular check-ups, screenings, and vaccinations to promote overall health. |

| Mental Health Support | Access to counseling services and treatment for mental health conditions. |

| Vision and Dental Coverage | Coverage for eye examinations, corrective lenses, and dental procedures. |

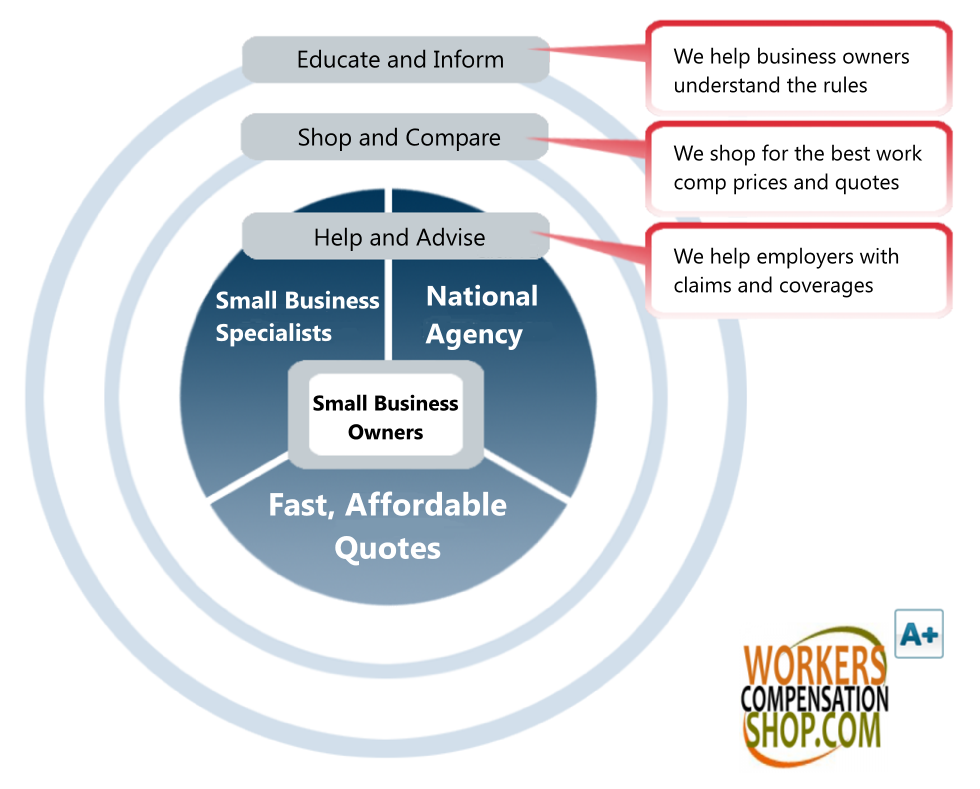

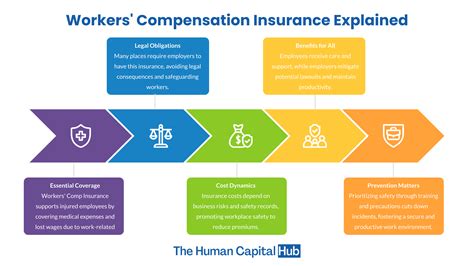

Workers’ Compensation Insurance

Workers’ compensation insurance is a specialized type of coverage that provides financial support to employees who suffer work-related injuries or illnesses. This insurance is designed to cover medical expenses, lost wages, and even rehabilitation costs associated with workplace accidents or occupational diseases.

By law, most employers are required to carry workers' compensation insurance to protect their employees. This insurance ensures that workers receive prompt and adequate medical care and compensation without having to file a lawsuit or prove negligence.

Disability Insurance

Disability insurance is crucial for workers as it provides income protection in the event of a disability that prevents them from performing their job duties. This type of insurance offers a replacement income stream, ensuring that employees can maintain their financial stability even if they are unable to work due to illness, injury, or other disabilities.

Disability insurance can be short-term or long-term, depending on the duration of the disability. Short-term disability insurance typically covers a period of a few months, while long-term disability insurance provides coverage for an extended duration, often until the employee reaches retirement age.

Life Insurance

Life insurance is an essential component of a comprehensive insurance portfolio for workers. It provides financial support to the beneficiaries of the insured individual in the event of their untimely death. Life insurance policies ensure that the deceased’s loved ones are provided for, covering expenses such as funeral costs, outstanding debts, and ongoing living expenses.

Employers often offer group life insurance plans as part of their employee benefits package. These plans typically provide a basic level of coverage, with the option for employees to purchase additional coverage to meet their specific needs and those of their families.

Real-World Examples of Insurance for Workers

To illustrate the impact and importance of insurance for workers, let’s delve into some real-world examples of how insurance has made a difference in the lives of employees and their families.

Story of Jane: A Construction Worker’s Recovery

Jane, a construction worker, suffered a severe injury while on the job. Her fall from a scaffold resulted in multiple fractures and a lengthy recovery period. Fortunately, her employer had invested in comprehensive workers’ compensation insurance.

The insurance coverage ensured that Jane received immediate medical attention and covered all her treatment costs, including surgery, physical therapy, and medications. Additionally, the insurance provided her with a portion of her regular wages during her recovery, allowing her to focus on healing without worrying about financial instability.

Jane's story highlights the critical role of insurance in providing financial support and peace of mind during challenging times. Without insurance, her recovery process would have been significantly more difficult, both physically and financially.

The Impact of Health Insurance: A Small Business Success Story

Sarah, the owner of a small bakery, recognized the importance of providing health insurance to her employees. She understood that offering competitive benefits would attract and retain talented individuals, ultimately contributing to the success of her business.

By investing in a group health insurance plan, Sarah was able to provide her employees with access to quality healthcare. This included coverage for regular check-ups, specialized treatments, and even mental health support. The insurance not only improved the overall well-being of her workforce but also reduced absenteeism and increased productivity.

Sarah's story demonstrates how insurance can be a powerful tool for small businesses to compete with larger corporations and create a positive and supportive work environment.

The Future of Insurance for Workers

As we look ahead, the landscape of insurance for workers is evolving to meet the changing needs and challenges of the modern workforce. Here are some insights into the future of insurance and its potential impact.

Digitalization and Automation

The insurance industry is embracing digitalization and automation to streamline processes and enhance efficiency. From online policy management to automated claims processing, technology is revolutionizing the way insurance operates.

In the future, workers can expect a more seamless and user-friendly insurance experience. Digital platforms will enable employees to easily access and manage their insurance policies, file claims, and track their progress in real-time. This digitalization will reduce administrative burdens and provide a more personalized and convenient insurance journey.

Embracing Telemedicine and Virtual Care

The rise of telemedicine and virtual care has transformed the healthcare landscape, and insurance is following suit. Many insurance providers are now incorporating telemedicine services into their health insurance plans, offering employees convenient access to medical professionals remotely.

Telemedicine allows workers to consult with doctors, receive diagnoses, and even obtain prescriptions without the need for in-person visits. This not only improves access to healthcare for employees in remote areas but also reduces wait times and provides a more flexible and convenient healthcare experience.

Focus on Preventative Care and Well-Being

The future of insurance for workers is likely to place a greater emphasis on preventative care and overall well-being. Insurance providers are recognizing the importance of investing in programs and initiatives that promote healthy lifestyles and prevent illnesses before they occur.

This may include offering incentives for employees to engage in wellness programs, providing access to fitness trackers and health coaching, and even covering the cost of healthy lifestyle modifications. By prioritizing preventative care, insurance companies can reduce long-term healthcare costs and improve the overall health and productivity of the workforce.

Expanding Coverage for Mental Health

Mental health is increasingly recognized as a critical aspect of overall well-being, and insurance providers are responding by expanding coverage for mental health services. In the future, workers can expect more comprehensive mental health benefits, including access to counseling, therapy, and support groups.

By removing the stigma associated with mental health and providing adequate coverage, insurance companies aim to ensure that employees receive the care they need to manage stress, anxiety, depression, and other mental health conditions. This expansion of mental health coverage is a crucial step towards creating a healthier and more supportive work environment.

FAQ: Insurance for Workers

What is the difference between workers’ compensation and disability insurance?

+Workers’ compensation insurance provides coverage for work-related injuries or illnesses, ensuring employees receive medical treatment and compensation for lost wages. On the other hand, disability insurance offers income protection for employees who become disabled due to illness or injury, regardless of whether it is work-related.

Can employees choose their own insurance plans?

+In many cases, employees have the option to choose from a range of insurance plans offered by their employer. This allows individuals to select the coverage that best suits their needs and preferences. However, certain insurance policies, such as workers’ compensation, are typically mandated by law and cannot be opted out of.

How does insurance benefit employers?

+Insurance benefits employers by providing a safety net for their workforce. It reduces the financial burden and liability associated with workplace accidents and illnesses. Additionally, offering comprehensive insurance packages can attract and retain top talent, leading to a more productive and loyal workforce.

What are some common challenges in obtaining insurance for workers?

+One common challenge is the cost of insurance, especially for small businesses. The expense of providing comprehensive insurance coverage can be a significant financial burden. Additionally, pre-existing conditions or high-risk occupations may make it challenging to obtain affordable insurance policies.

In conclusion, insurance for workers is a vital aspect of any workplace, providing financial security, peace of mind, and support for employees and their families. From health insurance to workers’ compensation and disability coverage, these policies ensure that workers are protected and cared for in various scenarios. As the insurance industry evolves, workers can expect a more digital, efficient, and personalized experience, with a greater focus on preventative care and well-being. By investing in insurance, employers create a culture of care and responsibility, fostering a healthy and productive workforce.