Christian Ministries Insurance

Christian ministries, churches, and faith-based organizations play an integral role in the lives of millions of people worldwide. These institutions not only provide spiritual guidance and community but also often engage in various charitable and social services, making a profound impact on their communities. However, with great responsibility comes the need for adequate protection, and that’s where Christian ministries insurance comes into play.

Understanding Christian Ministries Insurance

Christian ministries insurance is a specialized form of coverage designed to meet the unique needs and risks associated with religious organizations. These policies offer comprehensive protection, ensuring that churches and ministries can continue their vital work without the fear of financial ruin due to unforeseen circumstances. From property damage to liability claims, this insurance provides a safety net for these institutions, allowing them to focus on their core mission.

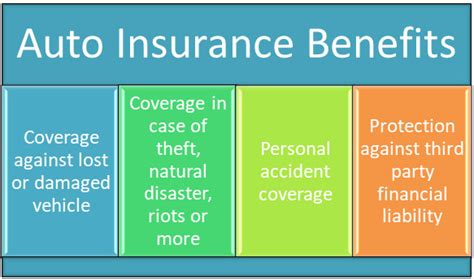

Key Coverage Areas

Property Insurance: This coverage safeguards the physical assets of the ministry, including church buildings, facilities, and any other owned properties. It protects against damages caused by natural disasters, fires, vandalism, and other perils, ensuring the ministry can quickly recover and resume operations.

Liability Insurance: Perhaps the most critical aspect, liability insurance shields the ministry from financial loss due to claims of negligence or injury. This can include slip-and-fall accidents on church premises, accidents during church-sponsored events, or even allegations of misconduct by church staff. Having adequate liability coverage is essential to protect the ministry’s financial stability and reputation.

Worker’s Compensation: Worker’s comp insurance is vital for ministries with employees, providing benefits to staff members who suffer work-related injuries or illnesses. This coverage ensures employees receive medical care and partial wage replacement, fostering a healthy and supportive work environment.

Umbrella Policies: Umbrella insurance provides additional liability coverage beyond the limits of other policies. It’s an essential layer of protection for larger ministries or those with significant assets, offering peace of mind in the face of catastrophic claims.

Special Event Insurance: For ministries hosting special events like concerts, festivals, or fundraisers, this insurance provides temporary coverage for the duration of the event, protecting against unexpected liabilities.

The Benefits of Comprehensive Insurance

Peace of Mind

One of the primary advantages of comprehensive Christian ministries insurance is the peace of mind it provides. Ministries can focus on their spiritual and community-building activities without constant worry about potential financial disasters. This security allows leaders to make strategic decisions with confidence, knowing they have the necessary protection in place.

Financial Stability

Insurance coverage ensures the financial stability of the ministry. In the event of a covered loss, the ministry won’t face the devastating impact of unexpected expenses, which could otherwise cripple their operations. This stability is crucial for long-term planning and the sustainability of the organization.

Risk Management

Insurance providers often offer risk management resources and consultations. These services help ministries identify and mitigate potential risks, enhancing safety and security within their organizations. By addressing risks proactively, ministries can reduce the likelihood of claims and maintain a safe environment for all.

Choosing the Right Insurance Provider

Selecting an insurance provider is a critical decision for any Christian ministry. Here are some key factors to consider:

Experience in Faith-Based Organizations: Choose a provider with a proven track record of insuring faith-based entities. Their understanding of the unique needs and challenges of these organizations is invaluable.

Customized Policies: Look for providers who offer customizable insurance plans. Every ministry is unique, and the ability to tailor coverage ensures the policy meets the specific needs of the organization.

Competitive Pricing: While cost is an important consideration, it shouldn’t be the sole factor. Balance affordability with the level of coverage and the provider’s reputation.

Reputation and Customer Service: Opt for a provider known for excellent customer service and a strong reputation in the industry. This ensures you receive timely and effective support when you need it most.

Risk Management Resources: Assess the provider’s commitment to risk management. Do they offer resources and tools to help ministries identify and mitigate potential risks?

The Impact of Christian Ministries Insurance

Christian ministries insurance isn’t just a financial safeguard; it’s an enabler of ministry growth and community impact. With the right coverage, ministries can expand their reach, initiate new programs, and continue to serve their communities without the constant fear of financial ruin.

Real-World Impact

Take, for instance, the story of a small rural church that faced a devastating fire, destroying their main sanctuary. Thanks to their comprehensive property insurance, the church was able to rebuild, ensuring their congregation had a place to worship and continue their community outreach programs.

Protecting the Ministry's Legacy

Christian ministries often have a rich history and a deep connection to their communities. Insurance coverage ensures that this legacy can be protected and passed on to future generations, preserving the impact and influence of the ministry.

Future Considerations

As Christian ministries continue to evolve and adapt to the changing landscape, insurance will remain a vital component of their operations. With the rise of online ministries and virtual church services, new risks and liabilities have emerged, necessitating a re-evaluation of insurance needs.

Cyber Insurance

With an increasing digital presence, ministries are vulnerable to cyberattacks and data breaches. Cyber insurance provides coverage for these emerging risks, protecting the ministry’s digital assets and ensuring the privacy and security of their congregation’s data.

Adjusting to Changing Needs

Ministries must regularly review their insurance coverage to ensure it aligns with their current operations and assets. As ministries expand their reach, acquire new properties, or initiate new programs, their insurance policies should be adjusted accordingly to maintain adequate protection.

Conclusion

Christian ministries insurance is more than just a financial investment; it’s a commitment to the longevity and sustainability of these vital institutions. By providing a safety net against unforeseen circumstances, insurance coverage empowers ministries to focus on their core mission—serving their communities and spreading their faith.

How much does Christian ministries insurance cost?

+The cost of insurance can vary widely based on the size and scope of the ministry, the type of coverage needed, and the provider. It’s best to consult with multiple providers to obtain quotes tailored to your specific needs.

Can insurance coverage be customized to meet my ministry’s unique needs?

+Absolutely! Reputable insurance providers understand that every ministry is different. They offer customizable policies to ensure your coverage aligns perfectly with your operations and assets.

What happens if I need to make a claim?

+In the event of a covered loss, you’ll need to contact your insurance provider and initiate a claim. The process can vary depending on the type of claim and the provider’s procedures. It’s beneficial to understand the steps involved and have the necessary documentation ready.

Are there any discounts or special programs for Christian ministries?

+Many insurance providers offer discounts and specialized programs for faith-based organizations. These can include discounts for multiple policies, loyalty programs, or special rates for specific types of ministries. It’s worth inquiring about these options when obtaining quotes.