Claim Phone At&T Insurance

In today's fast-paced world, our smartphones have become an integral part of our lives, serving as essential tools for communication, work, and entertainment. As such, protecting these devices against damage, theft, or loss is crucial. AT&T offers a comprehensive insurance program designed to provide peace of mind for its customers. This article will delve into the intricacies of the AT&T Claim Phone Insurance program, exploring its features, benefits, and the process of making a claim. By the end, you'll have a comprehensive understanding of this insurance offering and be equipped to make an informed decision about protecting your valuable smartphone.

Understanding AT&T Claim Phone Insurance

AT&T’s Claim Phone Insurance program is a service designed to safeguard your smartphone against unforeseen events. It offers coverage for a range of situations, including accidental damage, liquid damage, mechanical defects, and even loss or theft. By enrolling in this insurance plan, you gain access to a network of authorized repair centers and receive support throughout the claims process.

Key Features and Benefits

The AT&T Claim Phone Insurance program boasts several notable features and benefits:

- Comprehensive Coverage: It provides coverage for a wide array of smartphone issues, ensuring you’re protected against a variety of potential problems.

- Nationwide Repair Network: AT&T has partnered with numerous repair centers across the country, making it convenient to find a nearby location for repairs or replacements.

- Quick Claim Processing: The insurance program is designed to streamline the claims process, allowing for swift resolution of your issues.

- Multiple Payment Options: Customers have the flexibility to choose from various payment methods, including monthly installments, to suit their financial preferences.

- Dedicated Customer Support: AT&T offers a dedicated support team to guide you through the claims process, ensuring a seamless experience.

Eligibility and Enrollment

To be eligible for AT&T Claim Phone Insurance, you must be an AT&T customer with an active postpaid wireless plan. The insurance program is available for a monthly fee, which varies depending on the value of your smartphone. Enrollment can be done online through the AT&T website or by contacting their customer support team.

The Claims Process: A Step-by-Step Guide

Making a claim with AT&T’s insurance program is designed to be straightforward and user-friendly. Here’s a detailed guide to walk you through the process:

Step 1: Report the Incident

As soon as you experience an issue with your smartphone, it’s crucial to report it to AT&T. You can do this by contacting their customer support team via phone or online chat. Provide them with the details of the incident, including the date, time, and circumstances leading to the damage or loss.

Step 2: Verify Eligibility

AT&T’s support team will verify your eligibility for the insurance program. This involves checking your account status, the type of insurance you have, and the terms of your coverage.

Step 3: Submit Supporting Documentation

To support your claim, you’ll need to provide relevant documentation. This may include photos or videos of the damaged phone, receipts or proof of purchase, and any other evidence that can help substantiate your claim.

Step 4: Choose a Repair Option

Once your claim is approved, you’ll have the option to choose between a repair or a replacement. AT&T will guide you through the process, providing details on authorized repair centers or replacement options.

Step 5: Complete the Repair or Receive the Replacement

If you opt for a repair, take your smartphone to an authorized repair center. They will assess the damage and provide an estimate for the repairs. Once approved, the repair process will begin. If you choose a replacement, AT&T will guide you through the process of selecting and receiving a new device.

Step 6: Finalize the Claim

After the repair is completed or the replacement device is received, you’ll need to finalize the claim with AT&T. This involves providing any additional documentation or confirmation of the repair or replacement. AT&T will then process the final steps of your claim, ensuring you’re satisfied with the resolution.

Real-Life Scenarios: How AT&T Claim Phone Insurance Helps

Let’s explore a few real-life scenarios to understand how AT&T’s insurance program can provide valuable assistance:

Accidental Damage

Imagine you accidentally drop your phone, causing the screen to crack. With AT&T Claim Phone Insurance, you can report the incident, submit photos of the damage, and receive guidance on finding an authorized repair center. The insurance program covers the cost of the repair, saving you from a costly out-of-pocket expense.

Liquid Damage

Your phone has accidentally been exposed to water, and now it’s not functioning properly. AT&T’s insurance program covers liquid damage, so you can file a claim and receive assistance in getting your phone repaired or replaced. This ensures your device is restored to its full functionality.

Theft or Loss

Unfortunately, your smartphone has been stolen or lost. AT&T’s insurance program provides coverage for such incidents, allowing you to report the theft or loss and receive support in obtaining a replacement device. This helps minimize the impact of the loss and ensures you’re back up and running with a new phone.

Performance Analysis and Customer Feedback

AT&T’s Claim Phone Insurance program has received positive feedback from customers who have experienced the benefits of the service. Many users appreciate the comprehensive coverage, the convenience of the nationwide repair network, and the efficient claims process. The program has proven to be a valuable asset for those seeking peace of mind and protection for their smartphones.

Customer Testimonials

Here’s what some satisfied customers have to say about their experience with AT&T’s insurance program:

"I was initially hesitant about insurance, but when my phone slipped out of my hand and the screen shattered, I was glad I had it. The repair process was seamless, and I couldn't be happier with the service."

- Sarah, AT&T Customer

"I never imagined I'd need insurance for my phone, but when it was stolen, I was grateful for the support I received. AT&T guided me through the process, and I was able to get a replacement quickly. It was a stressful situation, but they made it much easier to handle."

- Michael, AT&T Subscriber

Future Implications and Industry Trends

As technology continues to advance and smartphones become even more integral to our lives, the demand for robust insurance programs is expected to grow. AT&T recognizes this trend and is committed to enhancing its insurance offerings to meet the evolving needs of its customers.

Potential Future Developments

- Enhanced Coverage Options: AT&T may explore expanding its insurance program to include additional coverage for emerging technologies, such as foldable screens or advanced camera systems.

- Digital Claims Process: The company could further streamline the claims process by introducing a digital platform that allows customers to report incidents, upload documentation, and track their claims progress in real-time.

- Collaborations with Device Manufacturers: AT&T might partner with smartphone manufacturers to offer exclusive insurance packages tailored to specific device models, providing even more specialized coverage.

Conclusion

AT&T’s Claim Phone Insurance program is a comprehensive and customer-centric solution designed to protect your smartphone. With its wide-ranging coverage, convenient repair network, and efficient claims process, it offers peace of mind and valuable support in times of need. As the world of technology advances, AT&T is well-positioned to continue evolving its insurance offerings to meet the changing demands of its customers.

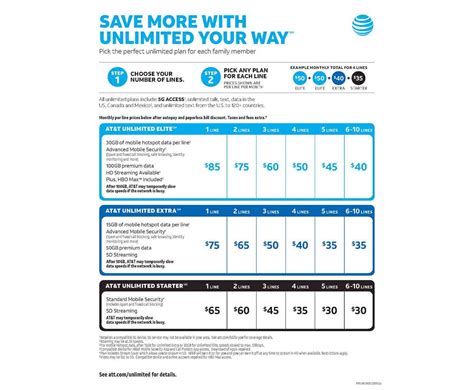

How much does AT&T Claim Phone Insurance cost?

+The cost of AT&T Claim Phone Insurance varies depending on the value of your smartphone. Typically, it ranges from 9 to 14 per month. The exact cost can be determined by checking your AT&T account or contacting their customer support.

What is the coverage limit for AT&T Claim Phone Insurance?

+The coverage limit for AT&T Claim Phone Insurance varies based on the plan you choose. It can range from 499 to 1,000, depending on the value of your smartphone and the level of coverage you select.

Can I enroll in AT&T Claim Phone Insurance if I already have a damaged phone?

+Unfortunately, AT&T’s insurance program typically requires that you enroll before the damage occurs. Existing damage is not covered by the insurance, so it’s best to enroll when you first purchase your smartphone.