Commercial Property Insurance Quote

Commercial property insurance is an essential component of any business's risk management strategy. It provides financial protection against various potential losses and damages that could occur to your commercial property, ensuring the continuity and stability of your operations. Obtaining a commercial property insurance quote is a crucial step in understanding and securing the right coverage for your business needs. In this comprehensive guide, we will delve into the intricacies of commercial property insurance, exploring its importance, coverage options, and the process of obtaining a tailored quote. By the end of this article, you will have a clear understanding of how to navigate the commercial insurance landscape and make informed decisions to protect your business assets.

Understanding Commercial Property Insurance

Commercial property insurance is a specialized type of coverage designed to safeguard businesses from a wide range of property-related risks. It offers protection for the physical assets and structures that your business owns or leases, such as buildings, offices, warehouses, and any equipment or inventory housed within them. The primary goal of this insurance is to provide financial support in the event of losses or damages caused by unforeseen events, ensuring that your business can quickly recover and resume operations.

Unlike personal property insurance, which typically covers residences and their contents, commercial property insurance is tailored to meet the unique needs of businesses. It takes into account the specific risks and vulnerabilities associated with various industries and business operations. Whether you run a retail store, manage an office space, operate a manufacturing facility, or provide professional services, commercial property insurance can be customized to address your specific coverage requirements.

Key Coverage Elements

Commercial property insurance policies typically include several key coverage elements that provide protection against a wide range of potential risks. These elements may vary depending on the provider and the specific needs of your business, but here are some of the most common coverage components:

- Building Coverage: This protects the physical structure of your business premises, including the walls, roofs, floors, and any permanent fixtures. It covers damages caused by perils such as fire, windstorms, hail, vandalism, and more.

- Business Personal Property Coverage: This covers the contents of your business, including furniture, equipment, inventory, and supplies. It provides financial support in the event of loss or damage due to covered perils.

- Business Income Coverage: Also known as business interruption insurance, this coverage helps replace lost income and cover ongoing expenses if your business operations are disrupted due to a covered loss. It ensures that you can maintain your financial obligations during the recovery period.

- Extra Expense Coverage: This coverage assists with additional expenses incurred during the recovery process, such as temporary relocation costs, increased payroll costs, or extra advertising expenses to regain lost customers.

- Equipment Breakdown Coverage: This optional coverage provides protection against sudden and accidental breakdowns of equipment, including mechanical or electrical failures. It can be especially beneficial for businesses that rely heavily on specialized machinery or technology.

- Ordinance or Law Coverage: If your building is damaged and local building codes have changed since its original construction, this coverage helps cover the increased costs of rebuilding to meet current code requirements.

Factors Influencing Commercial Property Insurance Quotes

When seeking a commercial property insurance quote, it's essential to understand the various factors that can influence the cost and coverage options. These factors help insurance providers assess the risk associated with your business and determine an appropriate premium. Here are some key considerations:

Business Location

The location of your business plays a significant role in determining your insurance premium. Factors such as crime rates, weather patterns, and proximity to potential hazards like flood zones or industrial areas can impact the risk level and subsequently affect your insurance costs.

Business Type and Size

The nature and size of your business are crucial factors in assessing risk. Different industries face unique challenges and vulnerabilities. For instance, a manufacturing facility may have higher risks associated with equipment failures or fires compared to a professional services firm. Additionally, the size of your business, measured by revenue or number of employees, can influence the scope of coverage required and the associated costs.

Building Construction and Age

The construction materials and age of your building can impact the cost of insurance. Older buildings may require more extensive coverage due to potential structural issues or outdated electrical systems. Modern construction methods and materials, on the other hand, may offer more resistance to certain perils, leading to lower insurance costs.

Coverage Limits and Deductibles

The coverage limits you choose for your policy will directly impact your premium. Higher coverage limits provide more protection but also result in higher costs. Similarly, selecting a higher deductible, which is the amount you agree to pay out of pocket before insurance coverage kicks in, can lower your premium.

Security Measures and Loss Prevention

Implementing effective security measures and loss prevention strategies can significantly reduce your insurance costs. This includes installing fire suppression systems, alarm systems, security cameras, and implementing robust employee training programs to minimize the risk of accidents or theft.

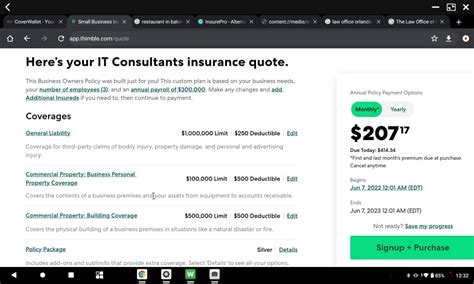

Obtaining a Commercial Property Insurance Quote

To obtain a commercial property insurance quote, you'll need to provide detailed information about your business and its specific needs. Here's a step-by-step guide to help you navigate the quote process:

Step 1: Gather Necessary Information

Before reaching out to insurance providers, ensure you have the following information readily available:

- Business name, address, and contact details

- Description of your business operations and any unique risks associated with your industry

- Details about the physical structure(s) you wish to insure, including square footage, construction materials, and age

- List of valuable assets, equipment, and inventory you want covered

- Estimated annual revenue and number of employees

- Any existing security measures or loss prevention programs in place

Step 2: Compare Multiple Quotes

Reach out to several reputable insurance providers and request quotes. Provide them with the information you've gathered to ensure accurate and tailored quotes. Compare the quotes based on coverage options, premiums, deductibles, and any additional benefits or discounts offered.

Step 3: Review Coverage Options

Carefully examine the coverage options provided in each quote. Ensure that the policy covers all the critical aspects of your business, including building coverage, business personal property, business income, and any additional coverages specific to your industry. Verify that the limits and deductibles align with your risk tolerance and financial capabilities.

Step 4: Consider Additional Coverages

Evaluate whether you require any optional coverages based on your business needs. For example, if you have specialized equipment or technology, consider adding equipment breakdown coverage. If your business is located in a high-risk area for natural disasters, flood or earthquake insurance may be worth considering.

Step 5: Negotiate and Finalize

If you're satisfied with a particular quote, negotiate with the insurance provider to explore any potential discounts or additional benefits. Finalize the policy by reviewing and signing the necessary documentation, ensuring that you understand all the terms and conditions.

Frequently Asked Questions

What is the difference between commercial property insurance and general liability insurance?

+Commercial property insurance specifically protects your business's physical assets and structures, while general liability insurance provides coverage for third-party claims related to bodily injury or property damage caused by your business operations. General liability insurance is crucial for protecting your business from legal liabilities, whereas commercial property insurance focuses on safeguarding your physical assets.

How often should I review and update my commercial property insurance policy?

+It's recommended to review your policy annually or whenever significant changes occur in your business. This ensures that your coverage remains adequate and up-to-date. Changes may include expansion or relocation, acquiring new equipment or inventory, or implementing new security measures.

Can I bundle my commercial property insurance with other business insurance policies?

+Yes, many insurance providers offer bundled packages that combine commercial property insurance with other essential business insurance policies, such as general liability, business interruption, and professional liability insurance. Bundling can often result in cost savings and simplified policy management.

What steps can I take to reduce my commercial property insurance premiums?

+To lower your premiums, consider implementing loss prevention measures such as installing security systems, fire suppression equipment, and regular maintenance of your building and equipment. Additionally, increasing your deductible and reviewing your coverage limits to align with your business's actual needs can also lead to cost savings.

How do I file a claim for commercial property insurance?

+In the event of a covered loss, promptly contact your insurance provider to initiate the claim process. They will guide you through the necessary steps, which typically involve providing documentation of the loss, such as photographs, invoices, and estimates of damages. It's crucial to act promptly and follow the insurer's instructions to ensure a smooth and efficient claims process.

By understanding the importance of commercial property insurance, evaluating the various coverage options, and obtaining tailored quotes, you can make informed decisions to protect your business assets effectively. Remember, commercial property insurance is a vital component of your business’s overall risk management strategy, ensuring its long-term stability and resilience in the face of unforeseen events.