Company Flood Insurance

In the world of business, protecting your assets and operations from unforeseen events is paramount. One such event that can wreak havoc on companies, especially those located in low-lying or coastal areas, is flooding. Floods can cause devastating damage to physical assets, disrupt operations, and lead to significant financial losses. To safeguard against these risks, companies must explore effective strategies, and one crucial tool in their arsenal is Company Flood Insurance.

Understanding the Importance of Company Flood Insurance

Flooding is an unpredictable and pervasive natural disaster that can strike any region, regardless of its reputation for low flood risk. While many businesses are aware of the potential for floods, few fully comprehend the scope of the threat or the comprehensive protection offered by specialized insurance policies.

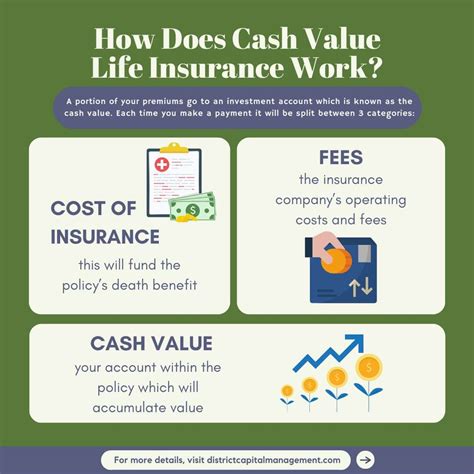

Company Flood Insurance is designed to provide financial protection against the unique risks posed by floods. Unlike standard property insurance, which often excludes or limits coverage for flood damage, these specialized policies are tailored to meet the specific needs of businesses in flood-prone areas. They offer comprehensive coverage for a wide range of damages, including structural repairs, equipment replacement, and even lost revenue due to business interruption.

Key Features and Benefits of Company Flood Insurance

One of the most significant advantages of Company Flood Insurance is its broad coverage. These policies typically include protection for the physical structure of the building, its contents, and the equipment and inventory stored within. Additionally, they often provide coverage for debris removal, which can be a significant expense in the aftermath of a flood.

Another critical benefit is the inclusion of business interruption coverage. Floods can force businesses to temporarily cease operations, resulting in a loss of revenue. Business interruption insurance helps companies cover their ongoing expenses and compensate for lost profits during this period. This feature is especially vital for small and medium-sized enterprises, which may struggle to stay afloat financially after a flood event.

Furthermore, Company Flood Insurance policies often offer flexible coverage limits to accommodate the unique needs of each business. This means that companies can tailor their policies to match the value of their assets and the level of risk they face, ensuring they have adequate protection without overspending on insurance.

| Coverage Type | Description |

|---|---|

| Structural Damage | Covers repairs to the building's foundation, walls, and roof. |

| Contents and Equipment | Provides compensation for damaged or destroyed furniture, fixtures, and machinery. |

| Business Interruption | Reimburses lost income and ongoing expenses during business closure due to flooding. |

| Debris Removal | Covers the cost of removing flood-related debris from the insured property. |

Case Study: A Real-World Example of Company Flood Insurance in Action

To illustrate the importance and effectiveness of Company Flood Insurance, let’s consider a hypothetical case study of a small manufacturing business located in a flood-prone area along a major river.

The Flood Event

During a particularly heavy rainstorm, the river overflows its banks, causing extensive flooding in the surrounding area. The manufacturing facility is inundated with water, resulting in significant damage to the building, machinery, and inventory.

In the aftermath of the flood, the business owners are faced with a daunting task: repairing the facility and getting their operations back on track. This is where their Company Flood Insurance policy proves to be a lifesaver.

The Role of Company Flood Insurance

The policy covers a wide range of expenses, providing the business with the financial resources needed to address the aftermath of the flood. Here’s a breakdown of how the insurance policy helps:

- Structural Repairs: The policy covers the cost of repairing the damaged building, including fixing the foundation, walls, and roof.

- Equipment Replacement: Machinery and equipment that were destroyed by the flood are replaced, allowing the business to resume operations as soon as possible.

- Inventory Loss: The policy compensates for the loss of raw materials and finished goods, ensuring the business can restock and continue production.

- Business Interruption: The business interruption coverage kicks in, providing financial support to cover the company's ongoing expenses, such as employee salaries and utility bills, during the period when operations are halted.

- Debris Removal: The insurance policy covers the cost of removing flood-related debris from the facility, which is essential for a safe and efficient cleanup process.

Without Company Flood Insurance, the business would likely face significant financial strain and potentially struggle to recover from the flood event. The policy provides a safety net, ensuring the business can weather the storm and emerge on the other side ready to continue serving its customers.

The Future of Company Flood Insurance: Adapting to Changing Risks

As the climate continues to change and weather patterns become more extreme, the risk of flooding is expected to increase in many regions. This evolving threat landscape underscores the need for businesses to adapt their risk management strategies, including their insurance coverage.

Adapting to Climate Change

In recent years, there has been a growing awareness of the impact of climate change on flood risk. As a result, insurance providers are adapting their policies to address these changing conditions. This includes:

- Enhanced Risk Assessment: Insurance companies are utilizing advanced modeling techniques and data analytics to more accurately assess flood risks for specific locations. This helps them offer tailored coverage options that better align with the actual risks faced by businesses.

- Incorporating Climate Change Scenarios: Some insurers are now incorporating climate change scenarios into their risk models. This allows them to offer coverage that takes into account the potential for more frequent and severe flood events in the future.

- Collaborative Risk Mitigation: Insurance providers are increasingly working with businesses and local communities to implement risk mitigation measures. This collaborative approach can include initiatives such as flood prevention infrastructure, early warning systems, and community education programs.

Emerging Technologies and Innovations

The insurance industry is also leveraging emerging technologies to enhance its ability to manage flood risk. These innovations include:

- Remote Sensing and Satellite Imagery: Advanced satellite technology is being used to monitor and assess flood risk in real-time. This data can provide insurers with valuable insights into changing conditions and help them make more informed decisions about coverage and pricing.

- Artificial Intelligence and Machine Learning: AI and machine learning algorithms are being applied to analyze vast amounts of data, including historical flood records, weather patterns, and geographic information. This enables insurers to develop more accurate risk models and offer more precise coverage options.

- Blockchain and Smart Contracts: Blockchain technology has the potential to revolutionize the insurance industry by enhancing transparency, security, and efficiency. Smart contracts, which are self-executing contracts with the terms of the agreement directly written into code, can be used to automate certain aspects of the insurance process, such as claims processing and payouts.

By embracing these technological advancements and adapting their policies to the changing risk landscape, insurance providers can better serve businesses and help them manage the growing threat of flooding.

Conclusion: A Comprehensive Approach to Flood Risk Management

Company Flood Insurance is a critical component of a comprehensive flood risk management strategy for businesses. By providing financial protection against a wide range of flood-related damages and business interruptions, these policies help companies weather the storm and emerge stronger on the other side.

As the risk of flooding continues to evolve, it is essential for businesses to stay informed about the latest advancements in flood risk assessment and management. By working closely with insurance providers and staying abreast of emerging technologies and innovations, companies can ensure they have the tools and resources needed to protect their operations and assets in an increasingly uncertain world.

How do I determine if my business is located in a flood-prone area?

+To assess your business’s flood risk, consult local flood maps and work with insurance brokers or risk management specialists. They can provide detailed information about your specific location and recommend appropriate insurance coverage.

What is the process for obtaining Company Flood Insurance?

+The process typically involves working with an insurance broker who specializes in commercial policies. They will guide you through the application process, assess your business’s unique needs, and help you choose the right coverage limits and policy features.

Are there any government programs or incentives to help businesses with flood insurance costs?

+Some governments offer programs or grants to assist businesses in obtaining flood insurance. It’s worth researching these options and consulting with local authorities or industry associations to explore any available support.