Compare Insurance Rates Auto

When it comes to auto insurance, the rates can vary significantly depending on numerous factors. Understanding these variations is crucial for drivers seeking the best coverage at an affordable price. This comprehensive analysis will delve into the key elements that influence insurance rates, providing valuable insights to help you make informed decisions about your auto insurance coverage.

The Complexity of Auto Insurance Rates

Auto insurance rates are influenced by a myriad of factors, making it a complex landscape for consumers. These factors can be broadly categorized into personal, vehicle-related, and regional considerations.

Personal Factors Impacting Rates

Personal details play a significant role in determining insurance rates. Age, for instance, is a key factor; young drivers, particularly those under 25, often face higher premiums due to their perceived risk level. Additionally, gender can be a consideration in some regions, with insurers sometimes offering slightly different rates based on statistical risk profiles.

Your driving history is another critical factor. A clean driving record can lead to lower rates, while incidents like accidents or traffic violations can significantly increase your premiums. Insurers also consider your credit score, as there is a correlation between financial responsibility and the likelihood of filing claims.

| Personal Factor | Impact on Rates |

|---|---|

| Age | Higher rates for younger drivers |

| Gender | Varies by region and insurer |

| Driving History | Clean record = lower rates; violations = higher rates |

| Credit Score | Higher credit scores often lead to lower rates |

Vehicle-Related Factors

The type of vehicle you drive can also affect your insurance rates. Make and model are significant factors; certain makes and models are more expensive to insure due to their higher repair costs or increased likelihood of theft. The year of the vehicle can also play a role, with newer cars often commanding higher premiums due to their advanced safety features and higher replacement costs.

The usage of your vehicle is another consideration. Insurers may offer discounts for low-mileage drivers, as they are statistically less likely to be involved in accidents. Additionally, the purpose of your vehicle's use can impact rates; for example, using your car for business purposes might result in higher premiums.

| Vehicle Factor | Impact on Rates |

|---|---|

| Make and Model | Certain makes/models are more expensive to insure |

| Year | Newer vehicles often have higher premiums |

| Usage | Low-mileage drivers may receive discounts |

| Purpose | Business use can lead to higher rates |

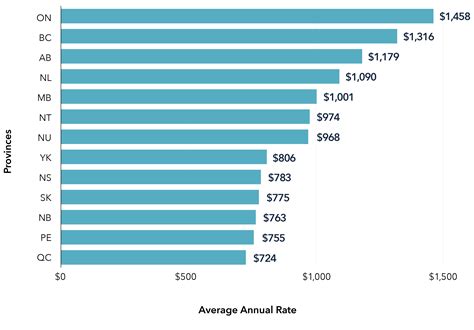

Regional Considerations

The region in which you live and drive can significantly influence your insurance rates. Location is a key factor; urban areas often have higher rates due to increased traffic and the higher likelihood of accidents and theft. The cost of living in your area can also affect rates, as it influences the cost of labor and parts for repairs.

Regional weather conditions and road quality are other considerations. Areas prone to severe weather events or those with poorly maintained roads may see higher insurance rates. Finally, the crime rate in your area can impact rates, as it affects the likelihood of vehicle theft or vandalism.

| Regional Factor | Impact on Rates |

|---|---|

| Location | Urban areas often have higher rates |

| Cost of Living | Higher cost of living = higher rates |

| Weather Conditions | Severe weather areas may have higher rates |

| Road Quality | Poor road conditions can increase rates |

| Crime Rate | Higher crime rates often lead to higher rates |

The Role of Insurance Providers

The insurance provider you choose can also significantly impact your rates. Different insurers have varying methodologies for assessing risk and setting premiums. Some may specialize in certain types of vehicles or drivers, offering more competitive rates for specific demographics.

Additionally, insurers often offer a range of discounts to attract and retain customers. These can include discounts for multiple policies (e.g., bundling auto and home insurance), safe driving, good student status, and loyalty. Taking advantage of these discounts can significantly reduce your insurance costs.

The Future of Auto Insurance Rates

The landscape of auto insurance is constantly evolving, driven by technological advancements and changing consumer behaviors. The rise of telematics and usage-based insurance is a notable trend, where insurers use real-time data from vehicles to assess risk and set premiums. This technology can reward safe drivers with lower rates, but it also raises privacy concerns for some consumers.

The sharing economy and the growing popularity of ride-sharing services are also influencing insurance rates. Insurers are developing new products and coverage options to cater to this evolving market, which can impact rates for both personal and commercial auto insurance.

Furthermore, the advancement of autonomous vehicles is poised to revolutionize auto insurance. While fully autonomous vehicles are not yet widespread, the technology is rapidly advancing, and insurers are already preparing for a future where human error is significantly reduced in accidents. This could lead to substantial changes in insurance rates and coverage.

How can I lower my auto insurance rates?

+There are several strategies to consider. First, maintain a clean driving record and improve your credit score, as these are key factors in determining rates. Shop around and compare quotes from multiple insurers, as rates can vary significantly. Take advantage of discounts, such as those for safe driving, good student status, or bundling policies. Finally, consider increasing your deductible, as this can lead to lower premiums.

Are insurance rates the same across all states?

+No, insurance rates can vary significantly between states. This variation is influenced by factors such as the cost of living, traffic density, weather conditions, and state-specific insurance regulations. For example, states with higher populations and denser traffic tend to have higher average insurance rates.

How do insurance companies determine rates for different vehicles?

+Insurers consider a range of factors when setting rates for different vehicles. These include the make, model, and year of the vehicle, as well as its safety ratings and the likelihood of theft or damage. Vehicles with advanced safety features or those that are less prone to theft often have lower insurance rates. Insurers also consider the cost of repairs and replacement parts for different vehicles.

What is usage-based insurance, and how does it affect rates?

+Usage-based insurance, also known as pay-as-you-drive insurance, is a type of policy where rates are determined based on how, when, and where you drive. Insurers use telematics devices or smartphone apps to track your driving behavior, including mileage, time of day, and driving habits. This data is used to assess your risk level and set premiums accordingly. Usage-based insurance can reward safe and cautious drivers with lower rates.