Contractor Insurance

The construction industry is an integral part of the global economy, with countless contractors playing a vital role in shaping the physical infrastructure of our world. From residential builders to commercial contractors, these professionals take on diverse projects that can expose them to various risks. Recognizing and mitigating these risks is crucial for the long-term success and sustainability of their businesses.

One of the most critical aspects of risk management for contractors is insurance. Contractor insurance provides a safety net, protecting these professionals from financial losses and legal liabilities that could potentially arise from their work. In this article, we will delve into the world of contractor insurance, exploring its various facets, the importance it holds for the industry, and how it can be leveraged to ensure the prosperity of construction businesses.

Understanding Contractor Insurance: A Comprehensive Overview

Contractor insurance, often referred to as construction insurance, is a specialized form of insurance designed to address the unique risks faced by those working in the construction industry. These policies are tailored to provide coverage for a range of potential issues that contractors may encounter during the course of their projects.

Key Coverage Areas

- Liability Insurance: This is a cornerstone of contractor insurance, protecting the policyholder from financial losses resulting from claims of bodily injury or property damage caused by their work. It covers legal fees, settlements, and judgments, ensuring that contractors can continue their operations without being burdened by costly lawsuits.

- Builders Risk Insurance: This type of insurance covers the physical assets of a construction project, including the structure itself, materials, and equipment. It safeguards against losses due to fire, theft, vandalism, and natural disasters, providing financial support during the rebuilding process.

- Workers’ Compensation: Mandatory in many regions, workers’ compensation insurance provides coverage for employees who sustain work-related injuries or illnesses. It covers medical expenses, lost wages, and rehabilitation costs, ensuring that injured workers receive the care they need while protecting the contractor from potential lawsuits.

- Professional Liability Insurance: Also known as errors and omissions (E&O) insurance, this policy protects contractors from claims of negligence, mistakes, or failure to perform contractual duties. It is particularly crucial for contractors who provide professional services, such as architects or engineers.

- Commercial Property Insurance: This insurance covers the contractor’s own business property, such as offices, vehicles, and equipment. It provides financial protection in the event of damage or theft, ensuring that the contractor can quickly resume operations.

The Benefits of Contractor Insurance

Contractor insurance offers a multitude of advantages that extend beyond simply protecting against financial losses. Here are some key benefits:

- Risk Mitigation: Insurance policies provide a safety net, helping contractors manage and mitigate risks effectively. This allows them to focus on their core business activities with peace of mind.

- Enhanced Reputation: Contractors with comprehensive insurance coverage are often viewed more favorably by clients and partners. It demonstrates a commitment to professionalism and can be a competitive advantage in winning bids and securing projects.

- Financial Stability: In the event of a claim, insurance coverage ensures that contractors have the financial resources to handle the situation without disrupting their business operations or personal finances.

- Legal Compliance: Certain types of insurance, such as workers’ compensation, are legally required in many jurisdictions. Compliance with these regulations is essential to avoid penalties and maintain a good standing in the industry.

- Access to Specialized Coverage: Contractor insurance policies can be customized to fit the unique needs of the business. This allows contractors to obtain coverage for specific risks, ensuring they are adequately protected.

Selecting the Right Contractor Insurance: A Strategic Approach

With a wide array of insurance options available, choosing the right coverage for a construction business can be a complex task. Here’s a strategic approach to guide contractors in making informed decisions:

Assess Your Risks

Start by conducting a thorough risk assessment. Identify the specific hazards and liabilities associated with your type of construction work. Consider factors such as the size and scope of your projects, the locations where you operate, and the types of materials and equipment you use. This assessment will help you understand the potential risks and guide your insurance choices.

Understand Your Business Needs

Every construction business is unique, and so are its insurance requirements. Consider the following factors when evaluating your needs:

- The size of your business: Smaller businesses may require more basic coverage, while larger enterprises may need more comprehensive policies.

- The nature of your work: Different types of construction work carry varying levels of risk. For example, a residential builder may face different challenges compared to a commercial contractor working on high-rise buildings.

- Your client base: Some clients may have specific insurance requirements as a condition of doing business. Ensure that your insurance coverage aligns with these expectations.

- Your financial capacity: Insurance policies can be costly, so it’s essential to choose coverage that fits within your budget while still providing adequate protection.

Choose a Reputable Insurance Provider

The insurance market is vast, and not all providers offer the same level of service or expertise. When selecting an insurance company, consider the following:

- Experience in the Construction Industry: Look for providers who have a deep understanding of the construction business and can offer tailored policies that fit your needs.

- Financial Stability: Ensure that the insurance company is financially sound and has a strong reputation for paying claims promptly.

- Customer Service: Choose a provider with a track record of excellent customer service, as you may need their support in the event of a claim.

- Claims Handling: Inquire about their claims process and average response time. A provider with a fast and efficient claims handling process can be a significant advantage.

Customize Your Policy

Don’t settle for a one-size-fits-all insurance policy. Work with your insurance provider to customize your coverage to match your specific needs. This may involve adding endorsements or riders to your policy to ensure you have protection for all the potential risks you face.

Regularly Review and Update Your Coverage

Construction businesses are dynamic, and your insurance needs may change over time. Regularly review your policy to ensure it remains adequate as your business grows and evolves. Update your coverage whenever necessary to reflect changes in your operations, new projects, or shifts in the market.

Case Studies: Real-World Examples of Contractor Insurance in Action

Understanding the practical applications of contractor insurance can provide valuable insights into its importance and effectiveness. Let’s explore a couple of case studies:

Case Study 1: A Construction Site Fire

Imagine a general contractor working on a residential construction project. One night, a fire breaks out on the site, causing significant damage to the partially constructed building and the materials stored nearby. The contractor has a comprehensive builders risk insurance policy in place, which covers fire damage.

Thanks to this insurance coverage, the contractor can immediately begin the rebuilding process without incurring substantial financial losses. The insurance company covers the costs of repairing the structure, replacing damaged materials, and even provides temporary accommodations for the contractor’s team during the rebuilding phase.

Case Study 2: A Worker Injury on Site

A construction company specializing in commercial projects has a strong focus on safety but unfortunately experiences an accident. One of their workers sustains a serious injury while operating heavy machinery. The company has a robust workers’ compensation insurance policy.

This insurance coverage ensures that the injured worker receives the necessary medical treatment and rehabilitation services without incurring personal financial hardship. The insurance company covers the worker’s medical expenses, lost wages, and provides support for their recovery. Additionally, the contractor is protected from potential lawsuits, allowing them to maintain their focus on safety improvements and project management.

The Future of Contractor Insurance: Industry Trends and Innovations

The insurance industry is continually evolving, and contractor insurance is no exception. As technology advances and construction practices evolve, we can expect to see several trends and innovations shaping the future of this field.

Digital Transformation

The digital age has brought about significant changes in the way insurance is administered and accessed. Contractor insurance providers are increasingly leveraging technology to enhance their services. This includes the use of mobile apps for policy management, online claim filing, and real-time risk assessment tools.

Digital transformation also enables more efficient and accurate risk assessment, allowing insurers to offer more tailored policies to contractors. Additionally, the integration of artificial intelligence and machine learning can improve claim processing, leading to faster payouts and better customer satisfaction.

Data-Driven Risk Management

With the abundance of data available in the digital era, insurance providers are leveraging advanced analytics to identify and mitigate risks more effectively. By analyzing historical data, weather patterns, and even construction project data, insurers can offer more precise pricing and coverage options.

This data-driven approach allows contractors to access insurance policies that are tailored to their specific risks, ensuring more efficient risk management and cost savings.

Emerging Technologies and Construction Trends

The construction industry is rapidly adopting new technologies, such as building information modeling (BIM), drones, and robotic construction. As these technologies become more prevalent, insurance providers will need to adapt their policies to address the unique risks associated with these advancements.

For example, insurance policies may need to cover liability for injuries caused by robotic construction equipment or provide coverage for data breaches and cyber risks associated with BIM technology. Staying ahead of these emerging trends will be crucial for both contractors and insurance providers.

Sustainability and Environmental Concerns

With growing environmental awareness, the construction industry is increasingly focused on sustainable practices. Insurance providers are recognizing this shift and are developing policies that encourage and support green building initiatives.

These policies may offer incentives or discounts for contractors who adopt sustainable practices, such as using eco-friendly materials or implementing energy-efficient designs. By aligning with sustainability goals, contractors can not only reduce their environmental impact but also benefit from cost savings and improved risk management.

Conclusion: Empowering Contractors with Comprehensive Insurance

Contractor insurance is an essential tool for managing risks and ensuring the long-term success of construction businesses. By understanding the various coverage options, strategic selection processes, and real-world applications, contractors can make informed decisions to protect their operations and financial stability.

As the construction industry continues to evolve, so too will contractor insurance. By staying abreast of industry trends and innovations, contractors can leverage insurance policies to their advantage, embracing new technologies, sustainable practices, and data-driven risk management strategies. With comprehensive insurance coverage, contractors can focus on what they do best: building and shaping our world.

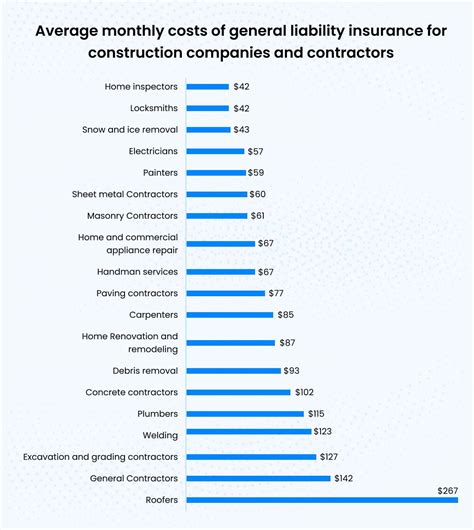

What is the average cost of contractor insurance?

+The cost of contractor insurance can vary widely depending on several factors, including the type of construction work, the size of the business, and the specific coverage needs. On average, general liability insurance for contractors can range from 600 to 1,500 per year. However, this is just a starting point, and the actual cost can be higher or lower based on individual circumstances.

Are there any discounts available for contractor insurance?

+Yes, insurance providers often offer discounts to contractors who meet certain criteria. These discounts can be for things like having multiple policies with the same insurer, having a claims-free history, or implementing safety measures that reduce risks. It’s worth discussing potential discounts with your insurance provider to see if you qualify.

How often should I review and update my contractor insurance policy?

+It’s recommended to review your insurance policy annually or whenever there are significant changes to your business. This ensures that your coverage remains adequate and up-to-date. Changes in your business operations, project scope, or even shifts in the insurance market can all be reasons to reevaluate your policy.