Cost Of Business Insurance For Small Business

Introduction

Small businesses are the backbone of many economies, but they often face unique challenges and risks. One crucial aspect of running a successful small business is understanding and managing the various costs associated with insurance. Business insurance provides a safety net for entrepreneurs, offering protection against potential financial losses and ensuring the long-term viability of their ventures. In this comprehensive guide, we will delve into the factors that influence the cost of business insurance for small businesses, explore different coverage options, and provide insights to help you make informed decisions.

The Importance of Business Insurance for Small Enterprises

Small businesses, by their very nature, are more vulnerable to unexpected events and liabilities. Whether it’s a slip and fall accident on your premises, a product defect claim, or a data breach, these incidents can lead to costly legal battles and damage your reputation. Business insurance acts as a financial safeguard, covering potential losses and helping you mitigate risks effectively.

Additionally, certain types of insurance are mandatory in many jurisdictions. For instance, if you have employees, you are likely required to carry workers' compensation insurance to protect them in the event of work-related injuries or illnesses. Understanding and complying with these legal requirements is essential for the smooth operation of your business.

Factors Influencing the Cost of Business Insurance

The cost of business insurance for small businesses can vary significantly depending on several key factors. Here’s a closer look at some of the most influential aspects:

Industry and Business Type

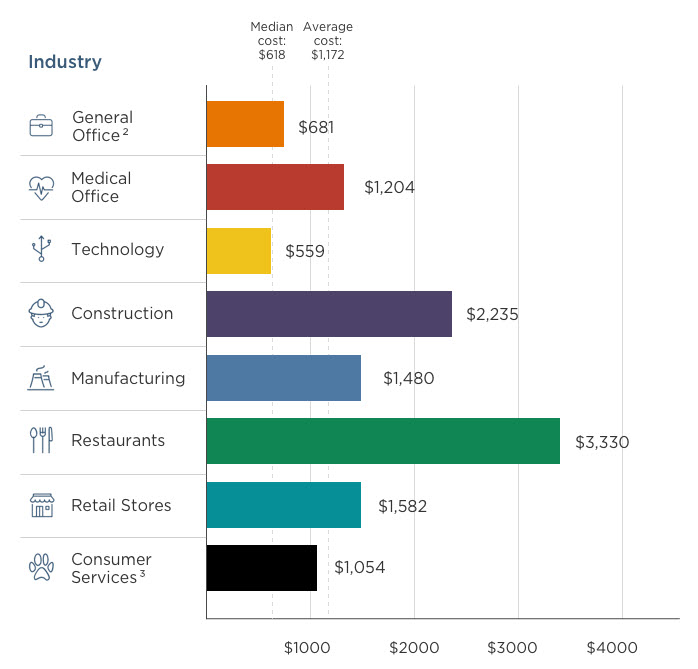

The nature of your business and the industry you operate in play a crucial role in determining insurance costs. High-risk industries, such as construction or manufacturing, typically face higher insurance premiums due to the increased likelihood of accidents and injuries. On the other hand, low-risk industries like consulting or e-commerce may enjoy more affordable insurance rates.

Consider the specific risks associated with your industry. For example, if you own a restaurant, you'll need to account for the potential hazards of food safety, fires, and customer injuries. On the other hand, a tech startup might prioritize cyber liability insurance to protect against data breaches and online security threats.

Business Location

The geographic location of your business can significantly impact insurance costs. Areas prone to natural disasters like hurricanes, floods, or earthquakes will likely have higher insurance premiums to cover the increased risk. Similarly, businesses located in high-crime areas may face higher costs for property insurance to protect against theft or vandalism.

Size and Growth of Your Business

The size of your business, including the number of employees, revenue, and assets, is a critical factor in insurance pricing. Larger businesses often require more comprehensive coverage and may face higher premiums. However, small businesses can also experience fluctuations in insurance costs as they grow, expand operations, or add new services.

Claims History

Your business’s claims history is a significant factor in determining insurance rates. Insurance providers closely analyze past claims to assess the risk associated with insuring your business. A history of frequent or costly claims may result in higher premiums or even difficulty obtaining coverage. Maintaining a clean claims record can help keep insurance costs down.

Policy Coverage and Deductibles

The level of coverage you choose and the deductibles you select can significantly impact your insurance costs. Opting for higher coverage limits and lower deductibles generally results in higher premiums. It’s essential to find the right balance between affordability and adequate protection for your specific needs.

Common Types of Business Insurance and Their Costs

The specific types of business insurance you need will depend on the nature of your operations and the unique risks you face. Here’s an overview of some common types of business insurance and their associated costs:

General Liability Insurance

General liability insurance is a fundamental coverage for most small businesses. It protects against third-party claims, including bodily injury, property damage, and personal and advertising injury. The cost of general liability insurance can vary widely, typically ranging from a few hundred to a few thousand dollars annually, depending on your business’s size and risk profile.

Professional Liability Insurance (Errors and Omissions)

Professional liability insurance, also known as errors and omissions (E&O) insurance, is essential for businesses providing professional services. It covers legal costs and damages resulting from mistakes, negligence, or failure to perform services adequately. The cost of E&O insurance can vary based on your industry and the specific services you offer. For example, a software development firm may pay a different rate than a marketing agency.

Workers’ Compensation Insurance

Workers’ compensation insurance is often mandatory for businesses with employees. It provides coverage for work-related injuries and illnesses, including medical expenses and lost wages. The cost of workers’ comp insurance is typically calculated as a percentage of your payroll and can vary based on the risk level of your industry and the state in which you operate.

Commercial Property Insurance

Commercial property insurance protects your business’s physical assets, including buildings, equipment, and inventory. The cost of this insurance depends on the value of your property and its location. Businesses with valuable assets or located in high-risk areas may face higher premiums.

Business Owner’s Policy (BOP)

A Business Owner’s Policy (BOP) is a cost-effective bundle of insurance coverages tailored for small businesses. It typically includes general liability insurance, commercial property insurance, and business interruption insurance. BOPs can provide comprehensive protection at a more affordable rate compared to purchasing each coverage separately.

Cyber Liability Insurance

With the increasing reliance on technology and the rise of cyber threats, cyber liability insurance has become crucial for many businesses. This insurance covers costs associated with data breaches, hacking, and other cyber incidents. The cost of cyber liability insurance can vary based on the size and nature of your business, as well as the level of coverage you choose.

Tips for Managing Business Insurance Costs

While business insurance is essential, it’s understandable that small business owners want to keep costs under control. Here are some strategies to help manage and potentially reduce your insurance expenses:

Shop Around and Compare Quotes

Don’t settle for the first insurance quote you receive. Shop around and compare rates from multiple providers. Different insurers may offer varying prices and coverage options for the same level of protection. Utilize online tools and insurance brokers to streamline the comparison process.

Bundle Your Insurance Policies

Bundling your insurance policies, such as combining general liability and commercial property insurance, can often result in significant cost savings. Many insurers offer discounts when you purchase multiple policies from them.

Consider Higher Deductibles

Opting for higher deductibles can reduce your insurance premiums. However, it’s essential to ensure that you have the financial resources to cover the deductible in the event of a claim. Higher deductibles may not be suitable for all businesses, especially those with limited cash flow.

Implement Risk Management Strategies

Proactively managing risks can help reduce insurance costs over time. Implement safety protocols, employee training programs, and cybersecurity measures to minimize the likelihood of accidents and claims. A strong risk management profile can make your business more attractive to insurers and potentially lead to lower premiums.

Stay Up-to-Date with Coverage

Regularly review your insurance coverage to ensure it aligns with your business’s current needs and growth. As your business evolves, so too should your insurance policies. Failing to keep up with coverage changes may leave you underinsured and vulnerable to unexpected costs.

Conclusion: Navigating the Cost of Business Insurance

Understanding the cost of business insurance for small businesses is a critical aspect of running a successful and sustainable venture. By familiarizing yourself with the various factors that influence insurance costs and exploring the different coverage options available, you can make informed decisions to protect your business effectively. Remember, while insurance may represent an additional expense, it provides invaluable peace of mind and financial security in the face of unforeseen events.

Stay vigilant, manage risks proactively, and don't hesitate to seek expert advice from insurance professionals to ensure your business remains well-protected at a cost that aligns with your budget.

How often should I review my business insurance policies?

+It’s recommended to review your insurance policies annually or whenever significant changes occur in your business, such as expansion, new products/services, or hiring additional employees. Regular reviews ensure your coverage remains adequate and up-to-date.

Can I negotiate business insurance rates with providers?

+While insurance rates are primarily based on objective factors, you can negotiate certain aspects. For instance, discussing your business’s risk management strategies and claiming history with providers may lead to more favorable rates.

What are some common mistakes small businesses make regarding insurance?

+Common mistakes include underestimating risks, failing to review coverage regularly, and choosing policies solely based on cost without considering the scope of coverage. It’s crucial to strike a balance between affordability and adequate protection.