Dental Insurance Comparison

Choosing the right dental insurance plan can be a complex process, as it involves considering various factors such as coverage, cost, and provider networks. With numerous options available in the market, it's essential to conduct a comprehensive comparison to find the plan that best suits your needs. In this article, we will delve into the world of dental insurance, exploring key aspects, and providing an in-depth analysis to assist you in making an informed decision.

Understanding Dental Insurance Plans

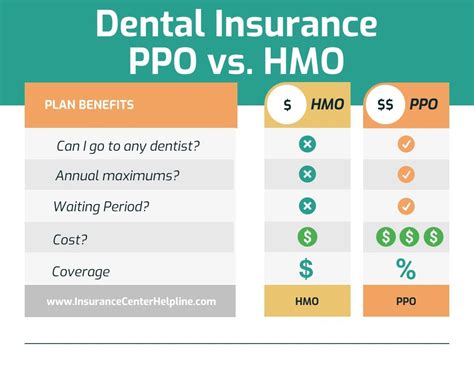

Dental insurance plans are designed to cover a portion of the costs associated with dental care, helping individuals and families manage their oral health expenses. These plans typically fall into three main categories: Indemnity Plans, Preferred Provider Organization (PPO) Plans, and Dental Health Maintenance Organization (DHMO) Plans. Each type offers distinct features and benefits, catering to different preferences and requirements.

Indemnity Plans: Traditional Coverage

Indemnity plans, often referred to as fee-for-service or reimbursement plans, provide the most flexibility when it comes to choosing dental providers. With this type of plan, you can visit any licensed dentist without restrictions. The insurance company will reimburse a certain percentage of the fees, typically ranging from 50% to 80%, for various dental procedures. Indemnity plans are ideal for those who value freedom of choice and may require specialized dental care.

Key features of Indemnity Plans include:

- Flexible Provider Choice: You can visit any dentist without network restrictions.

- Reimbursement System: Claims are submitted, and you receive a portion of the cost back.

- Coverage Percentage: Typically, 50-80% of the fees are reimbursed.

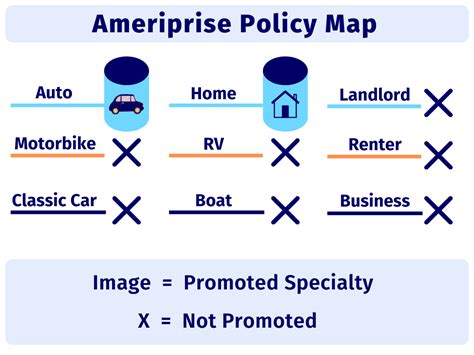

Preferred Provider Organization (PPO) Plans: Balancing Flexibility and Savings

PPO plans offer a balance between flexibility and cost savings. These plans have a network of preferred providers, and when you visit a dentist within this network, you receive higher coverage and reduced out-of-pocket expenses. PPO plans provide more comprehensive coverage compared to Indemnity plans, often covering preventive care, basic procedures, and major treatments. However, there may be limitations on out-of-network coverage.

Key aspects of PPO Plans are:

- Network of Preferred Dentists: Higher coverage and lower costs when using network providers.

- Comprehensive Coverage: Includes preventive, basic, and major procedures.

- Out-of-Network Coverage: Limited, with potentially higher out-of-pocket costs.

Dental Health Maintenance Organization (DHMO) Plans: Focus on Preventive Care

DHMO plans prioritize preventive dental care and aim to keep members healthy through regular check-ups and cleanings. These plans typically have a fixed monthly fee and cover a wide range of preventive services at 100%. DHMO plans often have a more restricted network of providers, and members must choose a primary dentist within this network. While preventive care is comprehensive, coverage for other procedures may be limited.

Key characteristics of DHMO Plans include:

- Emphasis on Preventive Care: Comprehensive coverage for check-ups and cleanings.

- Fixed Monthly Fee: A set amount, regardless of the number of visits.

- Restricted Network: Members must choose a primary dentist within the network.

Comparing Dental Insurance Plans: Key Factors

When comparing dental insurance plans, several critical factors come into play. Understanding these elements will help you make an informed decision tailored to your specific needs and preferences.

Coverage and Benefits

Coverage is a fundamental aspect of any dental insurance plan. Different plans offer varying levels of coverage for preventive, basic, and major dental procedures. It’s essential to assess your current and potential future dental needs to ensure the plan provides adequate coverage. Consider the following:

- Preventive Care: Coverage for regular check-ups, cleanings, and X-rays.

- Basic Procedures: Includes fillings, root canals, and extractions.

- Major Treatments: Coverage for crowns, bridges, and dentures.

- Orthodontic Care: Braces and Invisalign coverage (if applicable)

Cost and Deductibles

The cost of dental insurance is another crucial consideration. Plans can vary significantly in terms of premiums, deductibles, and out-of-pocket expenses. Assess your budget and determine the plan that offers the best value for your needs. Here are some cost-related factors to consider:

- Premiums: Monthly or annual fees for the insurance plan.

- Deductibles: The amount you pay before the insurance coverage kicks in.

- Copayments: Fixed amounts paid for specific procedures.

- Coinsurance: Percentage of the cost you pay after the deductible.

- Maximum Annual Benefit: The maximum amount the plan will cover in a year.

Provider Networks and Accessibility

The availability and accessibility of dental providers is a critical aspect of dental insurance plans, especially for PPO and DHMO plans with restricted networks. Consider the following when evaluating provider networks:

- Network Size: The number of dentists and specialists within the plan’s network.

- Accessibility: Proximity of network providers to your residence or workplace.

- Specialist Coverage: Ensure specialists like orthodontists are included in the network.

Plan Limitations and Exclusions

Every dental insurance plan has its limitations and exclusions. It’s crucial to understand these restrictions to avoid unexpected costs. Here are some common limitations to consider:

- Waiting Periods: Time duration before certain procedures are covered.

- Pre-Existing Conditions: Coverage limitations for existing dental issues.

- Maximum Age: Age restrictions for certain procedures or plan eligibility.

- Coverage Duration: Time limits for specific treatments or overall coverage.

Additional Benefits and Services

Some dental insurance plans offer additional benefits and services beyond basic coverage. These extras can add value to the plan and provide peace of mind. Look out for the following:

- Emergency Coverage: Coverage for unexpected dental emergencies.

- Travel Benefits: Dental care coverage when traveling outside your network.

- Dental Discount Programs: Access to discounted dental services.

- Wellness Programs: Incentives for maintaining good oral health.

Analyzing Performance and Satisfaction

To make an informed decision, it’s beneficial to assess the performance and satisfaction levels of different dental insurance plans. This information can provide insights into the overall experience and value offered by each plan. Consider the following:

Customer Satisfaction Surveys

Surveys and reviews from existing plan members can offer valuable insights into the quality of service, claim processing, and overall satisfaction. Look for reputable sources and platforms that aggregate customer feedback.

Claim Processing Efficiency

Efficient claim processing is crucial to ensure timely reimbursement. Assess the plan’s claim processing turnaround time and the ease of submitting and tracking claims.

Network Provider Satisfaction

The satisfaction of network providers can impact your overall experience. Assess the plan’s reputation among dental professionals and consider their feedback on payment processes and administrative support.

Complaint and Dispute Resolution

Understand the plan’s process for handling complaints and disputes. A transparent and effective dispute resolution process can be a significant advantage.

The Future of Dental Insurance

The dental insurance industry is continuously evolving, driven by advancements in technology, changing consumer needs, and regulatory influences. Here’s a glimpse into the potential future of dental insurance:

Digital Transformation

The digital revolution is making its mark on the dental insurance landscape. Expect to see more online platforms, mobile apps, and digital tools for managing claims, scheduling appointments, and accessing dental records. This digital shift can enhance convenience and efficiency.

Emphasis on Preventive Care

With a growing focus on preventive care, dental insurance plans may increasingly prioritize early interventions and regular check-ups. This shift can lead to better overall oral health and potentially reduce the need for costly treatments.

Incorporating Telehealth Services

Telehealth services, including virtual consultations and remote monitoring, are gaining traction in the dental industry. Dental insurance plans may integrate these services to provide remote care and improve accessibility, especially for those in remote areas.

Personalized Dental Plans

The future may see the emergence of personalized dental insurance plans tailored to individual needs. These plans could offer customizable coverage options, allowing individuals to choose the specific procedures and services they want to prioritize.

Expanded Network Access

As the dental industry evolves, we may witness an expansion of provider networks, making it easier for individuals to find in-network dentists. This can lead to increased competition among providers, potentially driving down costs and improving service quality.

Conclusion

Choosing the right dental insurance plan is a crucial decision that impacts your oral health and financial well-being. By thoroughly comparing different plans, considering key factors, and assessing performance and satisfaction levels, you can make an informed choice. Remember, the best plan for you may not be the best for someone else, so it’s essential to evaluate your unique needs and preferences. Stay tuned to the evolving dental insurance landscape, and embrace the digital tools and personalized options that may enhance your dental care experience in the future.

How do I know if my dentist is in-network for a particular plan?

+

You can verify if your dentist is in-network by checking the plan’s website or contacting the insurance provider directly. They can provide a list of network providers or help you confirm your dentist’s status.

What happens if I need a specialist, but my plan doesn’t cover it?

+

If your plan doesn’t cover specialist care, you may need to pay out-of-pocket for their services. However, some plans offer limited specialist coverage, so it’s essential to review your plan’s benefits carefully.

Are there any alternatives to traditional dental insurance plans?

+

Yes, alternatives like dental discount plans and flexible spending accounts (FSAs) can provide cost savings. Dental discount plans offer reduced rates on dental services, while FSAs allow you to set aside pre-tax income for dental expenses.