Dental Insurance Ga Plans

Dental insurance is an essential aspect of healthcare coverage, providing individuals and families with access to affordable and comprehensive dental care. In the state of Georgia, residents have a wide range of dental insurance plans to choose from, each offering unique benefits and coverage options. Understanding the available plans and their features is crucial for making an informed decision to ensure optimal oral health and financial well-being.

Understanding Dental Insurance Plans in Georgia

The dental insurance landscape in Georgia is diverse, catering to various needs and preferences. From individual policies to family plans, and from basic coverage to comprehensive options, there’s a plan suited for every resident. These plans typically cover a range of dental services, including preventive care, restorative procedures, and in some cases, orthodontic treatments.

One of the key factors to consider when selecting a dental insurance plan is the network of dentists and providers. In Georgia, many insurance companies partner with specific dental practices, forming a network. Enrollees receive the best benefits and discounted rates when they visit dentists within this network. It's important to research and choose a plan that has a network of providers conveniently located near your home or workplace.

Key Features of Dental Insurance Plans in GA

Dental insurance plans in Georgia often include a combination of the following features:

- Preventive Care Coverage: Most plans cover essential preventive services like dental cleanings, check-ups, and X-rays. These services are crucial for maintaining good oral health and can help identify potential issues early on.

- Restorative Procedures: Coverage for restorative work, such as fillings, root canals, and extractions, is commonly included in dental insurance plans. The level of coverage may vary depending on the plan and the specific procedure.

- Orthodontic Treatment: Some dental insurance plans offer benefits for orthodontic treatments, including braces and clear aligners. These plans often have separate deductibles and maximums, and coverage may be limited to certain age groups.

- Maximum Annual Benefits: Each plan sets a maximum amount of coverage it provides per year. This limit applies to all covered services and can range from a few thousand dollars to upwards of $5,000 or more.

- Deductibles and Copayments: Like most insurance plans, dental insurance often requires enrollees to pay a deductible before coverage begins. Copayments, or co-insurance, are also common, where the insured pays a percentage of the cost for covered services.

- Waiting Periods: Certain procedures, especially major ones like crowns or bridges, may have waiting periods before coverage kicks in. This period can vary from plan to plan and may be as long as 12 months.

Additionally, it's worth noting that dental insurance plans in Georgia, and elsewhere, typically do not cover cosmetic procedures like teeth whitening or dental implants purely for aesthetic reasons. However, some plans may provide coverage if these procedures are deemed medically necessary.

Top Dental Insurance Providers in Georgia

Several reputable insurance companies offer a wide range of dental insurance plans in Georgia. Here’s an overview of some of the top providers and their offerings:

Delta Dental of Georgia

Delta Dental is one of the largest dental insurance providers in the United States and offers a variety of plans in Georgia. Their plans are known for their comprehensive coverage and large network of participating dentists. Delta Dental’s plans often include preventive care, basic restorative services, and orthodontic benefits, with varying maximum annual benefits.

| Plan Name | Annual Maximum | Orthodontic Coverage |

|---|---|---|

| DeltaCare® USA | $1,500 | Limited |

| Delta Dental PPO | $1,500 - $2,000 | Yes |

| Delta Dental Premier | $1,500 | No |

Cigna Dental

Cigna is a well-known health insurance provider that offers a range of dental plans. Their plans in Georgia typically cover preventive care, basic and major restorative services, and orthodontic treatments. Cigna’s network includes a wide variety of dental providers, making it convenient for enrollees to find a dentist nearby.

| Plan Name | Annual Maximum | Orthodontic Coverage |

|---|---|---|

| Cigna Dental Maintenance Organization (DMO) | $1,500 | Limited |

| Cigna Dental Preferred Provider Organization (PPO) | $1,500 - $2,500 | Yes |

| Cigna Dental Indemnity | $1,500 | No |

MetLife Dental

MetLife is another prominent insurance provider with a strong presence in the dental insurance market. Their plans in Georgia offer comprehensive coverage, including preventive, basic, and major restorative services. MetLife’s plans often include orthodontia benefits and have a large network of participating dentists.

| Plan Name | Annual Maximum | Orthodontic Coverage |

|---|---|---|

| MetLife PPO | $1,500 - $2,000 | Yes |

| MetLife Indemnity | $1,500 | No |

| MetLife DMO | $1,500 | Limited |

Selecting the Right Dental Insurance Plan

Choosing the right dental insurance plan involves careful consideration of several factors. Here’s a step-by-step guide to help you make an informed decision:

- Identify Your Needs: Assess your current and future dental care requirements. Consider factors like the number of people in your household, the state of your oral health, and any potential future treatments you might need.

- Research Plan Options: Look into the various plans offered by top providers like Delta Dental, Cigna, and MetLife. Compare their features, coverage limits, and network of providers to find the best fit for your needs.

- Evaluate Costs: Consider the premium, deductibles, and copayments associated with each plan. While a plan with lower premiums might seem appealing, it may have higher out-of-pocket costs. Balance the cost with the coverage and benefits provided.

- Check Network Providers: Ensure that your preferred dentist or dental practice is included in the plan's network. If not, you might have to switch providers or opt for a plan with a more extensive network.

- Read the Fine Print: Pay close attention to the plan's coverage details, including waiting periods, exclusions, and any limitations on certain procedures. Understanding these nuances can prevent unexpected surprises later.

- Compare Benefits: Look beyond the basic coverage and compare the additional benefits offered by different plans. Some plans might provide discounts on vision or hearing care, or even include wellness programs.

- Consider Flexibility: If you anticipate significant changes in your oral health needs, choose a plan that offers flexibility. This might include the ability to upgrade your coverage or add additional services as needed.

Future of Dental Insurance in Georgia

The dental insurance landscape in Georgia is evolving, driven by advancements in dental technology, changing consumer preferences, and ongoing healthcare reforms. Here are some trends and predictions for the future of dental insurance in the state:

Expansion of Tele-Dental Services

Telehealth, including tele-dental services, is gaining traction in the healthcare industry. In the future, we can expect to see more dental insurance plans covering virtual consultations and remote monitoring. This can improve access to dental care, especially for those in rural areas or with limited mobility.

Focus on Preventive Care

Preventive care is a cornerstone of oral health, and insurance providers are likely to continue emphasizing its importance. We may see an increase in plans that offer incentives for regular check-ups and cleanings, helping to catch potential issues early and reduce the need for more extensive (and costly) treatments.

Integration of Dental and Overall Health

There’s growing recognition of the link between oral health and overall systemic health. In the future, dental insurance plans might become more integrated with medical insurance, offering holistic coverage that considers the mouth as an integral part of the body. This integration could lead to better coordination of care and improved health outcomes.

Advancements in Orthodontic Coverage

Orthodontic treatments are becoming increasingly common, and insurance providers are likely to expand their coverage in this area. We might see plans that offer more comprehensive orthodontic benefits, including coverage for clear aligners and other aesthetic procedures that improve dental health.

Emphasis on Education and Wellness

Dental insurance providers are expected to continue investing in educational initiatives and wellness programs. These efforts can help enrollees understand the importance of oral hygiene and make informed decisions about their dental care. This could lead to better oral health outcomes and potentially lower overall healthcare costs.

Conclusion

Choosing the right dental insurance plan in Georgia is a critical decision that impacts your oral health and financial well-being. By understanding the key features of different plans, researching top providers, and considering future trends, you can make an informed choice. Remember, dental insurance is an investment in your health, and with the right plan, you can ensure that you and your family receive the care you need to maintain healthy smiles.

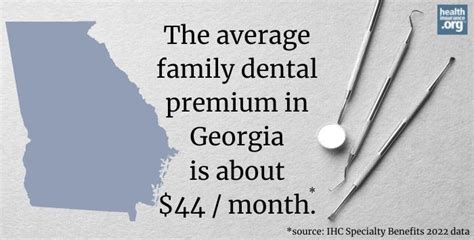

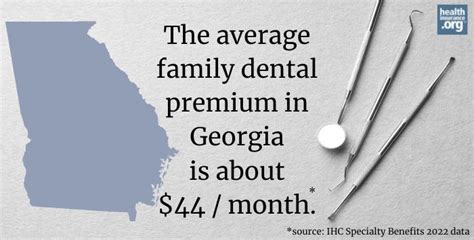

What is the average cost of dental insurance in Georgia?

+

The cost of dental insurance in Georgia can vary significantly based on factors like the type of plan, coverage limits, and the number of people insured. On average, individual plans can range from 30 to 50 per month, while family plans can cost upwards of $150 per month. It’s important to note that these are just estimates, and actual costs can vary greatly depending on the specific plan and provider.

Do all dental insurance plans cover emergency dental treatments?

+

Emergency dental treatments are typically covered by most dental insurance plans. However, the specific coverage and limits can vary. Some plans may have separate deductibles and maximums for emergency procedures, while others might include them under the regular coverage limits. It’s crucial to review your plan’s details to understand the exact coverage for emergency treatments.

Can I use my dental insurance plan when traveling outside of Georgia?

+

The ability to use your dental insurance plan when traveling outside of Georgia depends on the specific plan and provider. Some plans have a nationwide network, allowing you to visit any dentist within the United States. Others may have more limited networks or only cover out-of-network treatments at a higher cost. It’s advisable to check with your insurance provider to understand the coverage details when traveling.

How often should I schedule dental check-ups with my insurance plan’s coverage in mind?

+

Dental insurance plans typically cover two check-ups and cleanings per year. However, the frequency of check-ups can also depend on your oral health status and any specific recommendations from your dentist. It’s generally recommended to visit your dentist at least once every six months for a check-up and cleaning to maintain good oral health and catch any potential issues early on.