Dental Insurance Plans Ct

In the state of Connecticut, residents have a variety of dental insurance options to choose from, offering comprehensive coverage for their oral health needs. Dental insurance plans in CT play a crucial role in ensuring individuals and families have access to affordable dental care, promoting preventive measures, and providing financial protection against costly dental treatments. This article will delve into the world of dental insurance in Connecticut, exploring the different plan types, their coverage, and how they benefit residents.

Understanding Dental Insurance Plans in Connecticut

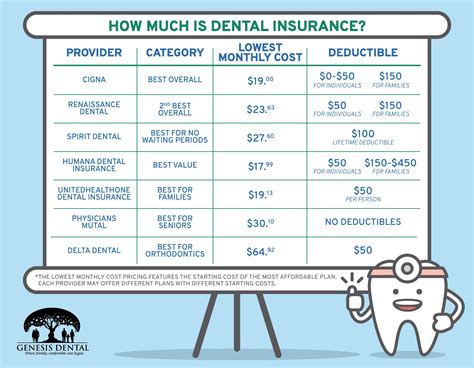

Dental insurance plans in Connecticut are designed to cover a wide range of dental services, from routine check-ups and cleanings to more complex procedures like root canals and orthodontics. These plans are typically offered by private insurance companies and are available to individuals, families, and employees through group plans provided by their employers.

Key Features of Dental Insurance Plans in CT

Connecticut dental insurance plans often include the following features:

- Network Providers: Most plans have a network of preferred dentists and specialists. By visiting an in-network provider, you can benefit from lower out-of-pocket costs.

- Preventive Care Coverage: Routine check-ups, cleanings, and X-rays are usually covered at 100%, encouraging regular dental visits for early detection and treatment of potential issues.

- Basic and Major Services: Basic services like fillings, extractions, and root canals are typically covered at a higher percentage than major services, which may include crowns, bridges, and dentures.

- Orthodontic Coverage: Some plans offer orthodontic benefits, providing financial support for braces and other orthodontic treatments.

- Annual Maximums: Dental plans often have an annual maximum benefit limit, which is the most the plan will pay out in a calendar year. This limit can vary depending on the plan and provider.

- Waiting Periods: Certain procedures, especially major ones, might have waiting periods before coverage kicks in. These periods can range from a few months to a year.

Types of Dental Insurance Plans in Connecticut

Dental insurance plans in Connecticut can be categorized into several types, each with its own set of benefits and coverage limits.

Indemnity Plans

Indemnity plans, also known as fee-for-service plans, offer the most flexibility in choosing dental providers. With these plans, you can visit any licensed dentist and be reimbursed for a portion of the fees. The percentage of coverage depends on the service received and the specific plan.

Preferred Provider Organization (PPO) Plans

PPO plans provide coverage for both in-network and out-of-network providers. However, using in-network providers often results in lower out-of-pocket costs. PPO plans are known for their flexibility and are a popular choice among Connecticut residents.

Dental Health Maintenance Organization (DHMO) Plans

DHMO plans typically offer the most affordable premiums but have a more restricted provider network. With these plans, you must choose a primary care dentist from the network and receive most of your dental care from them or their referred specialists. DHMO plans usually cover 100% of preventive care and a portion of basic and major services.

Discount Dental Plans

Discount dental plans are not traditional insurance plans. Instead, they offer members access to a network of dentists who provide services at a discounted rate. While these plans don’t cover any costs, they can save members money on dental care.

Analyzing Coverage and Benefits

When comparing dental insurance plans in Connecticut, it’s essential to analyze the coverage and benefits to determine which plan best suits your needs.

Coverage Breakdown

Let’s look at a hypothetical plan offered by a leading Connecticut insurance provider:

| Coverage Type | Percentage Covered |

|---|---|

| Preventive Care (Cleanings, Check-ups, X-rays) | 100% |

| Basic Services (Fillings, Extractions) | 80% |

| Major Services (Crowns, Root Canals) | 50% |

| Orthodontic Treatment | Up to $1,500 annually |

Benefits and Considerations

This plan offers comprehensive coverage, ensuring that routine dental care is fully covered. Basic services are covered at a reasonable rate, encouraging individuals to seek treatment for minor issues before they become more serious and costly. The major services coverage, while lower, still provides significant financial support for more complex procedures. The orthodontic benefit is particularly beneficial for families with children who may require braces.

The Impact of Dental Insurance on Oral Health

Dental insurance plans play a significant role in promoting good oral health. By providing coverage for preventive care, these plans encourage individuals to visit their dentist regularly, allowing for early detection and treatment of dental issues. This proactive approach can prevent small problems from becoming larger, more expensive concerns.

Preventive Care and Early Detection

With 100% coverage for preventive care, dental insurance plans in Connecticut incentivize individuals to prioritize their oral health. Regular dental check-ups and cleanings can identify potential issues such as cavities, gum disease, or oral cancer in their early stages, making treatment simpler and more effective.

Financial Protection for Complex Procedures

Dental insurance plans also offer financial protection for more complex and costly procedures. For example, a root canal, which can cost upwards of $1,000, is typically covered at a rate of 50% under many Connecticut plans. This means that instead of paying the full amount out of pocket, individuals with dental insurance only pay half, making these necessary procedures more affordable and accessible.

Choosing the Right Dental Insurance Plan

Selecting the right dental insurance plan in Connecticut involves considering several factors, including your oral health needs, the frequency of dental visits, and the types of procedures you might require.

Factors to Consider

- Oral Health Status: If you have good oral health and only require routine check-ups and cleanings, a plan with lower premiums and basic coverage might suffice. However, if you have a history of dental issues or are prone to certain conditions, a plan with more comprehensive coverage could be beneficial.

- Family Needs: For families, especially those with children, plans that offer orthodontic benefits or coverage for pediatric dental care are essential. These plans can provide significant financial relief when it comes to braces or other orthodontic treatments.

- Provider Network: If you have a preferred dentist or specialist, ensure that they are in-network for the plan you choose. This can save you money and provide peace of mind knowing you can continue receiving care from your trusted providers.

Comparative Analysis

Let’s compare two popular dental insurance plans available in Connecticut:

| Plan Name | Premium | Preventive Care Coverage | Basic Services Coverage | Major Services Coverage |

|---|---|---|---|---|

| Plan A | $30/month | 100% | 75% | 50% |

| Plan B | $45/month | 100% | 85% | 60% |

While Plan B offers higher coverage percentages for basic and major services, it comes at a higher premium. Plan A, on the other hand, provides good coverage at a more affordable rate. The choice between these plans would depend on an individual's specific needs and budget.

Future Implications and Industry Trends

The dental insurance landscape in Connecticut, like many other states, is continually evolving to meet the changing needs of its residents. As oral health awareness increases and the cost of dental care rises, insurance providers are adapting their plans to provide more comprehensive coverage and innovative benefits.

Industry Innovations

- Teledentistry: With the rise of telehealth services, some insurance providers are now offering teledentistry options, allowing individuals to consult with dentists remotely for minor issues or follow-up care.

- Enhanced Orthodontic Benefits: As the demand for orthodontic treatments grows, especially among adults, insurance providers are expanding their orthodontic coverage to include a wider range of treatments and more generous annual maximums.

- Value-Added Services: Some dental insurance plans now include additional benefits such as discounted vision care, prescription discounts, or even access to a wellness program.

Legislative Changes and Potential Impact

Connecticut, like other states, is also considering legislative changes to improve access to dental care. One potential change is the expansion of Medicaid dental benefits to cover a broader range of services, especially for adults. This could significantly impact the dental insurance market by providing more comprehensive coverage to a larger portion of the population.

Conclusion

Dental insurance plans in Connecticut offer residents a range of benefits and coverage options to protect their oral health. By understanding the different plan types, analyzing coverage and benefits, and considering individual needs, Connecticut residents can make informed decisions to choose the best dental insurance plan for their unique circumstances. As the industry continues to evolve, residents can look forward to more innovative and comprehensive plans that meet their oral health needs.

How do I choose the right dental insurance plan for my family?

+Consider your family’s oral health needs, the frequency of dental visits, and any specific treatments that might be required. Evaluate plans based on coverage, benefits, and provider networks to ensure they align with your family’s requirements.

What if I have a dental emergency and my dentist is not in-network?

+In such cases, your dental insurance plan will typically cover a portion of the costs, but at a lower rate than if you had used an in-network provider. It’s always best to choose an in-network dentist when possible to maximize your coverage.

Can I change my dental insurance plan during the year?

+Most dental insurance plans have specific enrollment periods, and you may only be able to change your plan during these periods. However, certain life events, like getting married or having a child, may qualify you for a special enrollment period.