Insurance Price

Welcome to this comprehensive guide exploring the intriguing world of insurance pricing. Understanding how insurance companies determine the cost of coverage is essential for both consumers and businesses alike. In this article, we will delve into the factors that influence insurance prices, providing you with an expert-level analysis and valuable insights.

Unveiling the Complexities of Insurance Pricing

Insurance pricing is a multifaceted process that takes into account numerous variables. It is an art and a science, requiring a deep understanding of risk assessment, market trends, and regulatory frameworks. By examining these factors, we can gain a clearer picture of why insurance prices vary and how they impact individuals and industries.

Risk Assessment: The Foundation of Insurance Pricing

At the core of insurance pricing lies risk assessment. Insurance companies meticulously evaluate the potential risks associated with insuring an individual or entity. This assessment considers a wide range of factors, including but not limited to:

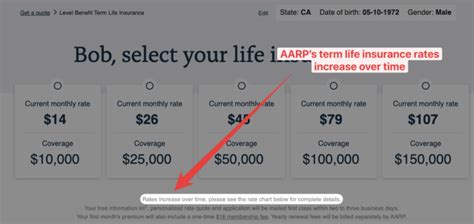

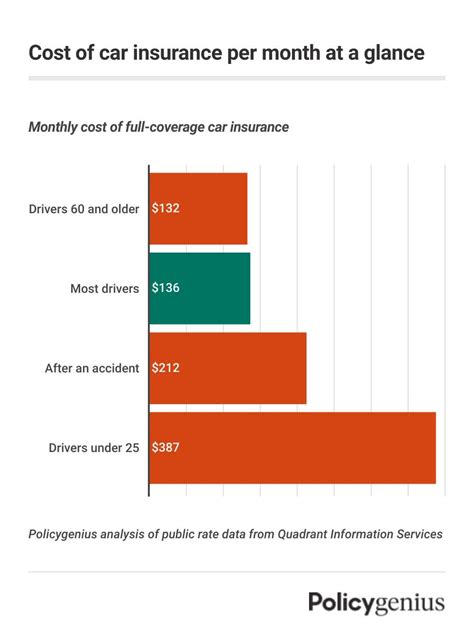

- Demographics: Age, gender, occupation, and marital status play a significant role in risk evaluation. For instance, younger drivers are often considered higher risk due to their lack of experience on the road.

- Lifestyle Factors: Habits such as smoking, alcohol consumption, and even diet can impact health insurance premiums. These factors can influence the likelihood of certain health issues and thus affect the cost of coverage.

- Claim History: Past claims made by an individual or business can impact future premiums. A history of frequent claims may indicate higher risk and result in increased insurance prices.

- Location: The geographic location of the insured property or individual can also affect insurance rates. Areas prone to natural disasters or with higher crime rates may face elevated premiums.

To illustrate the impact of risk assessment, let's consider the example of car insurance. A young driver with a history of speeding tickets and accidents will likely face higher insurance premiums compared to an experienced driver with a clean record. Insurance companies use statistical data and actuarial science to assign risk scores, which directly influence the price of insurance.

| Risk Factor | Impact on Insurance Price |

|---|---|

| Age | Younger drivers often pay higher premiums due to increased risk. |

| Claim History | Frequent claims can lead to higher premiums or even policy cancellation. |

| Location | Areas with high crime rates or natural disaster risks may have elevated insurance costs. |

Market Dynamics and Competition

The insurance market is highly competitive, and pricing strategies play a crucial role in attracting customers. Insurance companies carefully analyze market trends, competitor offerings, and consumer behavior to set competitive prices. Factors such as market share, brand reputation, and product differentiation influence the pricing decisions of insurance providers.

For instance, in a highly saturated market, insurance companies may offer promotional discounts or bundle services to attract new customers. On the other hand, in a less competitive market, companies may have more flexibility to adjust prices based on risk profiles and market demand.

Regulatory Frameworks and Compliance

Insurance pricing is subject to strict regulatory frameworks to ensure fairness and protect consumers. Government bodies and industry regulators set guidelines and standards that insurance companies must adhere to. These regulations can impact pricing by imposing maximum or minimum premium limits, defining acceptable risk assessment practices, and mandating disclosure of pricing methodologies.

For example, in the United States, state insurance departments closely monitor insurance rates to prevent excessive or discriminatory pricing. They may require insurance companies to file rate changes for approval, ensuring that prices are actuarially sound and not excessive.

The Science of Pricing: Understanding Actuarial Analysis

Actuarial analysis is the backbone of insurance pricing. Actuaries are professionals who use mathematical and statistical techniques to assess risk and determine insurance rates. They analyze vast amounts of data, including historical claims data, demographic information, and market trends, to develop sophisticated models that predict future losses.

Actuarial models take into account various factors, such as mortality rates, accident frequencies, and the likelihood of specific events. By understanding these probabilities, actuaries can calculate the expected cost of claims and set insurance premiums accordingly. This scientific approach ensures that insurance prices are based on empirical evidence and not mere speculation.

Factors Influencing Actuarial Analysis

- Mortality Tables: These tables provide statistical data on life expectancy, helping actuaries calculate the likelihood of death and set life insurance premiums.

- Loss Ratios: Actuaries analyze past claims data to determine the average loss per policy, which is a key factor in pricing property and casualty insurance.

- Market Conditions: Economic factors, such as interest rates and inflation, can impact the cost of providing insurance coverage and influence pricing decisions.

- Advancements in Technology: The insurance industry leverages technology to improve risk assessment and pricing accuracy. Advanced analytics and machine learning algorithms enable more precise predictions, leading to better-informed pricing decisions.

Actuarial analysis is an ongoing process, with models continuously refined and updated as new data becomes available. This ensures that insurance prices remain fair, accurate, and reflective of the current risk landscape.

The Impact of Insurance Pricing on Consumers and Businesses

Insurance pricing has a significant impact on both consumers and businesses. For individuals, insurance prices can influence their financial planning and decision-making. High insurance premiums may deter some from purchasing coverage, while affordable rates can encourage broader participation in the insurance market.

Businesses, on the other hand, face unique challenges when it comes to insurance pricing. Commercial insurance policies can be complex and tailored to specific industry risks. Pricing for business insurance takes into account factors such as the size of the business, its industry, and its risk management practices. Proper insurance coverage is crucial for businesses to mitigate financial losses and protect their operations.

Strategies for Managing Insurance Costs

- Risk Mitigation: Both individuals and businesses can take proactive measures to reduce their risk profiles. This may include adopting safer habits, implementing security measures, or investing in preventive maintenance. By lowering the perceived risk, insurance premiums can be reduced.

- Bundling Policies: Combining multiple insurance policies with the same provider can often result in discounted rates. This strategy is particularly beneficial for businesses that require various types of coverage.

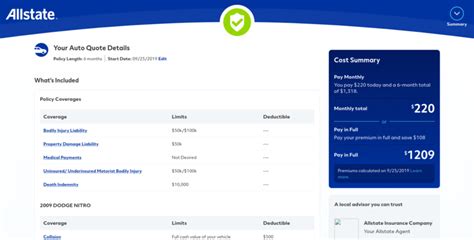

- Comparison Shopping: Consumers and businesses should explore different insurance providers and compare their offerings. Shopping around can uncover more competitive rates and additional benefits.

- Long-Term Relationships: Building a long-term relationship with an insurance provider can lead to loyalty discounts and personalized coverage options.

The Future of Insurance Pricing: Trends and Innovations

The insurance industry is constantly evolving, and pricing strategies are no exception. Several trends and innovations are shaping the future of insurance pricing, including:

Telematics and Usage-Based Insurance

Telematics technology, which uses sensors and GPS tracking, is revolutionizing the pricing of auto insurance. Usage-based insurance, or pay-as-you-drive models, offer insurance rates based on actual driving behavior. This data-driven approach rewards safe drivers with lower premiums, encouraging safer driving habits and reducing insurance costs.

Personalized Pricing

Advancements in data analytics and machine learning are enabling insurance companies to offer more personalized pricing. By analyzing individual behavior and preferences, insurance providers can tailor coverage and prices to specific needs. This approach allows for more accurate risk assessment and potentially lower premiums for individuals with favorable risk profiles.

Blockchain Technology

Blockchain, the technology behind cryptocurrencies like Bitcoin, is gaining traction in the insurance industry. Its decentralized and secure nature can enhance data sharing and transparency in insurance pricing. Blockchain can streamline the claims process, reduce fraud, and provide a more efficient platform for pricing and risk assessment.

Artificial Intelligence and Predictive Analytics

AI and predictive analytics are transforming insurance pricing by enabling more accurate risk predictions. These technologies can analyze vast amounts of data, including social media activity, purchase behavior, and sensor data, to identify patterns and predict future risks. This advanced risk assessment can lead to more precise pricing and improved risk management.

Conclusion

Insurance pricing is a complex and dynamic process that involves a multitude of factors. From risk assessment and market dynamics to regulatory frameworks and actuarial analysis, insurance companies navigate a delicate balance to determine fair and accurate prices. Understanding these factors empowers consumers and businesses to make informed decisions about their insurance coverage.

As the insurance industry continues to evolve, we can expect to see further innovations in pricing strategies. With advancements in technology and data analytics, insurance companies will be better equipped to offer personalized, data-driven pricing models. By staying informed about these trends, individuals and businesses can ensure they are getting the best value for their insurance needs.

How often do insurance companies review and adjust their pricing?

+Insurance companies typically review their pricing annually or semi-annually. This review process allows them to assess market trends, adjust for inflation, and incorporate any changes in risk assessment models. However, certain factors, such as significant changes in claims data or regulatory requirements, may prompt more frequent pricing adjustments.

Can insurance prices be negotiated?

+In some cases, insurance prices can be negotiated, especially for commercial insurance policies. Businesses with a strong risk management program or a long-term relationship with an insurance provider may be able to negotiate more favorable rates. However, for personal insurance policies, negotiation is less common and prices are often set based on standardized risk assessment models.

How do insurance companies determine rates for group insurance plans?

+Group insurance plans, such as those offered by employers, often have more favorable rates compared to individual policies. Insurance companies calculate group rates based on the collective risk of the entire group. They may consider factors like the industry, size of the group, and the demographics of the employees. Group insurance plans benefit from risk pooling, which helps spread the risk across a larger population, resulting in lower premiums.