Does Social Security Have Home Insurance

In the United States, Social Security is a federal program that provides financial support and benefits to eligible individuals, primarily through retirement, disability, and survivor benefits. However, it is important to clarify that Social Security does not offer home insurance coverage. Home insurance is a separate and distinct type of insurance policy that homeowners typically obtain to protect their property and belongings against various risks and potential damages.

Understanding Social Security and Its Purpose

Social Security, officially known as the Old-Age, Survivors, and Disability Insurance (OASDI) program, was established in 1935 as a cornerstone of the American social safety net. The program’s primary goal is to provide income security to individuals and their families during times of retirement, disability, or the loss of a primary income earner. It is funded through payroll taxes, with contributions from both employees and employers, ensuring a dedicated revenue stream for the program’s operations.

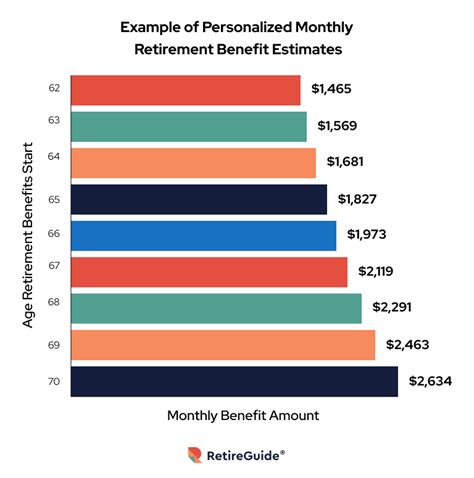

Social Security benefits are calculated based on an individual's earnings history and the age at which they choose to start receiving benefits. The program is designed to provide a basic level of financial support, but it is not intended to fully replace an individual's entire income. Instead, it serves as a safety net to help individuals maintain a certain standard of living during periods of reduced or no income.

Home Insurance: A Separate Financial Protection

Home insurance, on the other hand, is a form of property insurance that offers financial protection against damages to a homeowner’s property and its contents. This insurance coverage is designed to mitigate the financial risks associated with owning a home, which can include damages caused by natural disasters, theft, vandalism, or accidental damage. It provides homeowners with peace of mind, knowing that they are financially prepared to handle unexpected events that could otherwise result in significant financial setbacks.

There are various types of home insurance policies available, each tailored to meet the specific needs of different homeowners. These policies typically cover the structure of the home, personal belongings, and liability for accidents that occur on the property. Additionally, many home insurance policies offer optional add-ons or endorsements to provide coverage for specific risks, such as flood or earthquake damage, which may not be covered under a standard policy.

Key Components of Home Insurance

Home insurance policies generally consist of the following key components:

- Dwelling Coverage: This covers the physical structure of the home, including walls, roofs, floors, and permanent fixtures.

- Personal Property Coverage: Provides protection for personal belongings, such as furniture, electronics, and clothing.

- Liability Coverage: Protects homeowners against legal claims and medical expenses resulting from accidents that occur on their property.

- Additional Living Expenses: Covers the cost of temporary living arrangements if the home becomes uninhabitable due to a covered loss.

- Optional Coverages: Depending on the policy, homeowners can opt for additional coverage for specific risks, such as flood or earthquake insurance.

| Component | Description |

|---|---|

| Dwelling Coverage | Protects the physical structure of the home. |

| Personal Property | Covers personal belongings and possessions. |

| Liability Coverage | Provides protection against legal claims and accidents. |

| Additional Living Expenses | Covers temporary housing costs in case of a covered loss. |

| Optional Coverages | Allows for customization with specific risk coverage. |

Why Home Insurance Matters

Home insurance is crucial for homeowners as it offers financial protection in the event of unexpected losses. The cost of repairing or rebuilding a home, replacing personal belongings, and dealing with legal liabilities can be substantial. Without adequate home insurance, homeowners may face significant financial strain and even the risk of losing their homes if they are unable to cover these expenses.

Furthermore, home insurance policies often include valuable additional benefits, such as coverage for temporary living expenses, which can be a lifesaver in the event of a disaster that renders a home uninhabitable. Additionally, liability coverage provides peace of mind, knowing that homeowners are protected against potential lawsuits arising from accidents on their property.

Social Security and Homeownership

While Social Security does not provide home insurance coverage, it can indirectly impact a homeowner’s financial situation. Social Security benefits can serve as a stable source of income for retirees, allowing them to maintain their standard of living and potentially reduce financial strain. This stability can contribute to an individual’s ability to afford homeownership and manage associated expenses, including home insurance premiums.

For homeowners who rely on Social Security benefits as their primary source of income, budgeting and financial planning become crucial. They must carefully consider their expenses, including home insurance, to ensure they can maintain their policy and protect their investment. Many insurance companies offer flexible payment options and discounts to help homeowners manage the cost of home insurance, making it more accessible for those on fixed incomes.

Social Security and Home Equity

Homeownership can also have implications for Social Security benefits, particularly when it comes to home equity. Home equity refers to the value of a homeowner’s property after any debts or mortgages are paid off. This equity can be a valuable asset, especially for retirees who may need additional financial resources in their later years.

In some cases, individuals may choose to utilize their home equity to supplement their Social Security benefits. This can be done through various means, such as taking out a home equity loan or reverse mortgage. However, it is important to note that these financial decisions can have tax implications and may impact an individual's eligibility for certain Social Security benefits, such as Medicaid or Supplemental Security Income (SSI). Seeking professional financial advice is crucial before making any decisions regarding home equity and its potential impact on Social Security benefits.

The Importance of Financial Planning

When it comes to retirement and financial security, comprehensive financial planning is essential. This includes understanding and preparing for various expenses, such as home insurance, healthcare costs, and potential long-term care needs. By creating a detailed financial plan, individuals can ensure they have the necessary resources to maintain their desired standard of living throughout retirement.

Financial advisors can provide valuable guidance in this area, helping individuals navigate the complexities of retirement planning and making informed decisions about their finances. They can assist in optimizing Social Security benefits, managing investment portfolios, and understanding the impact of different financial decisions on overall financial well-being.

Conclusion

In conclusion, while Social Security provides vital financial support to eligible individuals, it does not offer home insurance coverage. Home insurance is a separate and essential form of protection that homeowners must obtain to safeguard their property and belongings. Understanding the differences between Social Security and home insurance, as well as their respective roles in financial security, is crucial for individuals to make informed decisions about their retirement planning and overall financial well-being.

Frequently Asked Questions

Can I use my Social Security benefits to pay for home insurance premiums?

+

Yes, individuals who receive Social Security benefits can use those funds to pay for home insurance premiums. However, it is important to budget carefully to ensure that all expenses, including home insurance, are covered within the available benefits.

Are there any government programs that provide home insurance for low-income homeowners?

+

While there are no government programs specifically dedicated to providing home insurance, some states and municipalities offer assistance programs for low-income homeowners. These programs may provide grants or subsidies to help cover the cost of home insurance premiums. It is advisable to research local programs and resources for more information.

How can I determine the appropriate level of home insurance coverage for my needs?

+

Determining the right level of home insurance coverage involves considering factors such as the replacement cost of your home, the value of your personal belongings, and your liability risk. Consulting with an insurance professional can help you assess these factors and choose a policy that provides adequate coverage without unnecessary costs. They can guide you through the process and ensure you have the protection you need.