Eliminating Pmi Insurance

Welcome to this comprehensive guide on the topic of eliminating Private Mortgage Insurance (PMI), a crucial aspect of homeownership that can significantly impact your financial journey. In this article, we will delve into the intricacies of PMI, explore effective strategies to eliminate it, and provide valuable insights to empower homeowners like yourself to make informed decisions.

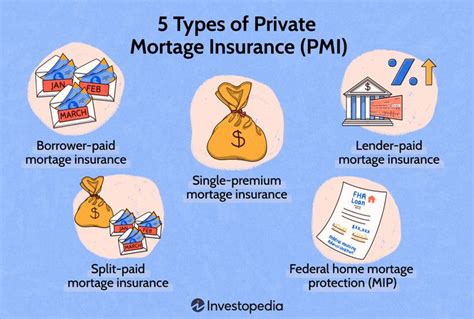

Private Mortgage Insurance, often referred to as PMI, is a common requirement for homebuyers who make a down payment of less than 20% on their mortgage. It protects the lender in case the borrower defaults on their loan, providing a safety net for financial institutions. While PMI is a standard practice, it can add a considerable cost to your monthly mortgage payments, making it an attractive target for elimination.

Understanding the Impact of PMI

Before we dive into the strategies for eliminating PMI, let’s first understand why it is a significant consideration for homeowners. PMI typically adds hundreds of dollars to your monthly mortgage payments, and over the life of your loan, these additional costs can accumulate to thousands of dollars.

Consider a hypothetical scenario: You purchase a home with a 10% down payment, resulting in a mortgage of $300,000. With a 30-year fixed-rate mortgage at 4.5% interest, your monthly payment, including PMI, could be around $1,700. Over the life of the loan, you might pay upwards of $100,000 in interest and PMI alone. Eliminating PMI, therefore, becomes a strategic financial move to reduce your long-term costs.

Strategies to Eliminate PMI

Now, let’s explore some effective strategies to bid farewell to PMI and unlock the full potential of your mortgage:

1. Refinance Your Mortgage

One of the most common and effective ways to eliminate PMI is by refinancing your mortgage. When you refinance, you essentially replace your existing mortgage with a new one, often with more favorable terms. By doing so, you can reduce your interest rate, shorten the loan term, or adjust the loan amount to reach the 20% equity threshold, which is the point at which PMI is typically no longer required.

For instance, if you've been making regular payments on your mortgage and your home's value has increased, you may have already built up enough equity to qualify for a refinance without PMI. Refinancing allows you to tap into this equity, providing you with the opportunity to reduce your monthly payments and save on long-term costs.

2. Increase Your Home’s Value

Another strategy to eliminate PMI is by increasing the value of your home. As your home’s value appreciates, your equity in the property also increases. Once you reach the 20% equity mark, you can request your lender to remove PMI from your mortgage.

There are several ways to boost your home's value, such as undertaking home improvement projects, making cosmetic upgrades, or simply waiting for the real estate market to favor you. For example, adding a deck or renovating your kitchen can significantly enhance your home's appeal and value. However, it's important to note that not all renovations yield the same return on investment, so careful planning is essential.

3. Make Extra Mortgage Payments

Accelerating your mortgage payments is another effective strategy to eliminate PMI. By making additional principal payments, you can pay off your mortgage faster and reach the 20% equity milestone sooner. This strategy is particularly beneficial if you have the financial means to make larger payments without straining your budget.

Let's say you have a 30-year mortgage, but you decide to pay an extra $200 each month towards the principal. Over time, this additional payment can significantly reduce the overall interest you pay and help you reach the PMI-free threshold more quickly. It's a disciplined approach that can yield substantial savings in the long run.

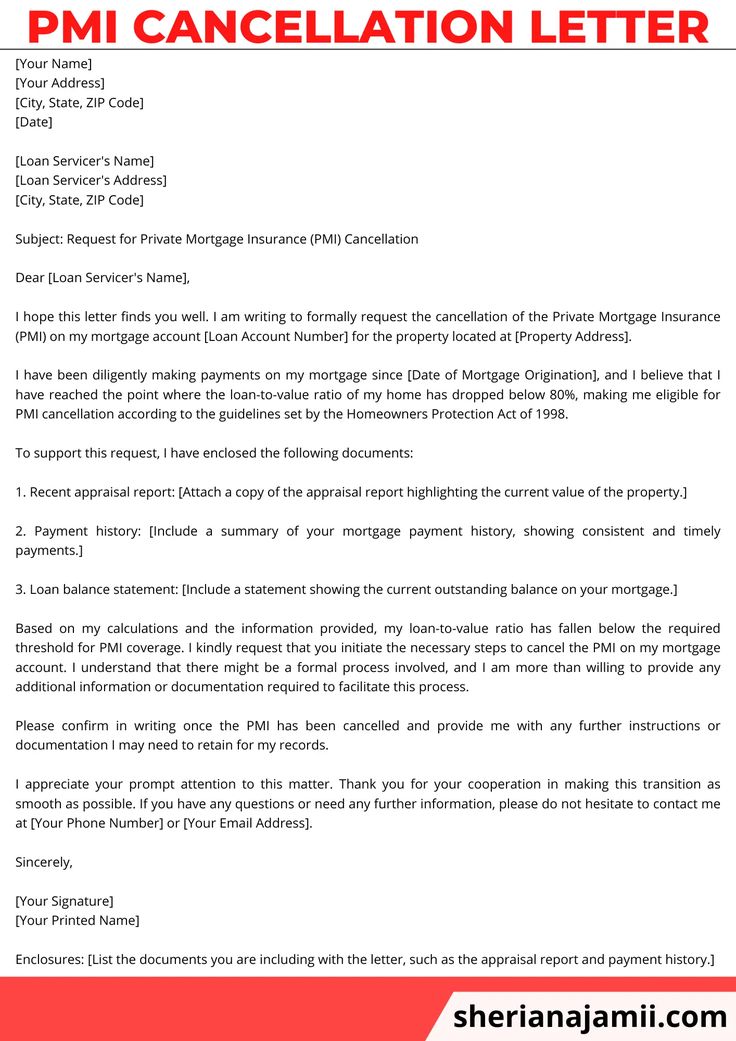

4. Request a PMI Removal

If you believe you have reached the 20% equity mark in your home, you can directly request your lender to remove PMI from your mortgage. This process is known as “requesting PMI cancellation.” Lenders are obligated to consider your request if you meet certain criteria, such as having made timely payments and maintaining a good credit score.

When requesting PMI cancellation, it's crucial to have accurate and up-to-date information about your home's value. You may need to provide documentation, such as recent appraisals or tax assessments, to support your claim. Additionally, some lenders may require you to pay a fee for the PMI removal process, so be prepared for potential expenses.

The Benefits of Eliminating PMI

Eliminating PMI offers a range of benefits that can positively impact your financial well-being and overall homeownership experience:

- Lower Monthly Payments: By removing PMI, you can significantly reduce your monthly mortgage payments, freeing up cash flow for other financial goals or investments.

- Increased Savings: Over the life of your loan, eliminating PMI can save you tens of thousands of dollars in interest and insurance costs, providing a substantial boost to your long-term savings.

- Financial Flexibility: With lower monthly payments, you gain more financial flexibility to allocate your funds towards other priorities, such as investing, saving for retirement, or covering unexpected expenses.

- Improved Cash Flow: The reduced monthly payments can improve your overall cash flow, making it easier to manage your finances and plan for the future.

- Enhanced Homeownership Experience: Eliminating PMI can reduce the stress and financial burden associated with homeownership, allowing you to enjoy your home and the sense of security it provides without the added insurance costs.

Considerations and Best Practices

While eliminating PMI is a desirable goal, it’s essential to approach the process with careful consideration and best practices in mind. Here are some key points to keep in mind:

- Assess Your Financial Situation: Before taking any steps to eliminate PMI, evaluate your financial health and ensure you have a solid understanding of your income, expenses, and overall financial goals. This assessment will help you determine the most suitable strategy for your circumstances.

- Shop Around for the Best Refinance Options: If you're considering refinancing, compare offers from multiple lenders to find the most competitive rates and terms. Shopping around can save you thousands of dollars over the life of your loan.

- Monitor Your Home's Value: Keep a close eye on your home's value and the local real estate market. Regularly reviewing property values can help you identify opportunities to eliminate PMI through increased equity.

- Understand Your Lender's Policies: Different lenders have varying policies and requirements for PMI removal. Familiarize yourself with your lender's guidelines and understand the documentation and fees associated with the process.

- Consider the Long-Term Impact: While eliminating PMI is an important financial goal, it's crucial to maintain a long-term perspective. Weigh the short-term costs and benefits against the potential savings over the life of your loan to make an informed decision.

Conclusion: Taking Control of Your Mortgage

Eliminating PMI is a powerful step towards optimizing your mortgage and enhancing your financial position. By understanding the impact of PMI, exploring the various strategies outlined in this guide, and implementing them with careful consideration, you can take control of your mortgage and unlock significant savings.

Remember, homeownership is a journey, and managing your mortgage is an essential part of that journey. By making informed decisions and staying proactive, you can navigate the complexities of PMI and work towards a more financially secure future. So, take charge, explore your options, and embark on the path to a PMI-free mortgage!

How long does it typically take to eliminate PMI through refinancing?

+The time it takes to eliminate PMI through refinancing can vary depending on several factors, including your loan terms, interest rates, and the equity in your home. On average, it can take anywhere from a few months to a couple of years to reach the 20% equity threshold required for PMI removal. However, with strategic planning and consistent extra payments, you can accelerate this process and potentially eliminate PMI sooner.

Can I eliminate PMI if I have an FHA loan?

+Yes, it is possible to eliminate PMI on an FHA loan. FHA loans typically require borrowers to pay mortgage insurance premiums (MIP) for the life of the loan or until they reach a certain loan-to-value ratio. To eliminate MIP, you need to refinance your FHA loan into a conventional mortgage, which often has different insurance requirements. Consult with a mortgage professional to understand your specific options.

What if my lender refuses to remove PMI even though I meet the 20% equity requirement?

+If your lender refuses to remove PMI despite meeting the 20% equity requirement, you may need to escalate the issue. Review your mortgage contract and any relevant documents to understand your rights and the lender’s obligations. You can also seek guidance from a financial advisor or legal professional to explore your options and ensure your rights are protected.