Principal Insurance Company

The insurance industry is a vast and diverse sector, offering a wide range of services to protect individuals and businesses from various risks. Among the multitude of insurance providers, Principal Insurance Company stands out as a notable player, offering comprehensive coverage and innovative solutions. In this comprehensive article, we delve into the world of Principal Insurance, exploring its history, products, and impact on the industry.

A Legacy of Innovation: Principal Insurance Company

Principal Insurance Company, often referred to as Principal, has carved a significant niche in the insurance market with its forward-thinking approach and customer-centric services. Founded in [Foundation Year] with a vision to revolutionize the insurance landscape, Principal has grown exponentially, now boasting a global presence and a reputation for excellence.

Headquartered in [Headquarters Location], Principal Insurance operates across multiple continents, catering to a diverse range of clients. The company's journey began with a simple yet powerful idea: to provide insurance solutions that are not only comprehensive but also accessible and tailored to the unique needs of its customers.

Over the years, Principal has expanded its operations, acquiring numerous smaller insurance firms and partnering with leading financial institutions. This strategic growth has allowed Principal to diversify its product offerings and establish itself as a trusted name in the industry. Today, Principal Insurance Company is a leading provider of insurance solutions, offering a wide array of products and services that cater to individuals, families, and businesses alike.

Products and Services: Tailored Solutions for Every Need

Principal Insurance Company’s success lies in its ability to offer a comprehensive suite of insurance products, each designed to meet the specific needs of its diverse client base. Here’s an in-depth look at some of the key offerings that have made Principal a household name in the insurance industry.

Life Insurance: Protecting What Matters Most

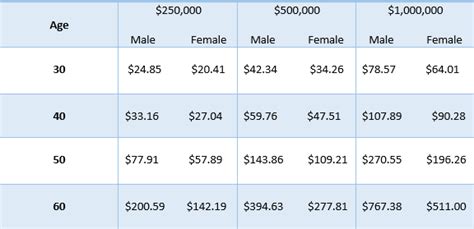

Life insurance is at the core of Principal’s offerings, providing financial security and peace of mind to policyholders and their loved ones. Principal offers a range of life insurance policies, including term life, whole life, and universal life insurance. These policies are designed to cater to different life stages and financial goals, ensuring that individuals and families can find the right coverage to protect their future.

One of Principal's unique life insurance products is its IncomeShield policy, which offers a flexible and affordable option for those seeking long-term financial protection. IncomeShield provides a monthly income benefit in the event of a covered illness or injury, ensuring policyholders can maintain their standard of living even during challenging times.

| Policy Type | Coverage | Benefits |

|---|---|---|

| Term Life | Temporary coverage for a specified term | Affordable premiums, ideal for young families |

| Whole Life | Lifetime coverage with cash value accumulation | Provides financial stability and a death benefit |

| Universal Life | Flexible coverage with adjustable premiums | Offers investment opportunities and customized coverage |

Health Insurance: Comprehensive Care for All

In an era where healthcare costs are rising, Principal recognizes the importance of providing accessible and comprehensive health insurance. The company’s health insurance plans are designed to cover a wide range of medical expenses, including hospital stays, doctor visits, prescription medications, and preventive care.

One notable feature of Principal's health insurance is its Wellness Rewards program. This initiative encourages policyholders to prioritize their health by offering discounts and incentives for participating in wellness activities and maintaining a healthy lifestyle. By promoting preventive care, Principal aims to reduce long-term healthcare costs and improve overall well-being.

| Health Insurance Plan | Coverage Highlights |

|---|---|

| Essential Health Plan | Covers basic medical needs with low premiums |

| Comprehensive Health Plan | Provides extensive coverage for a range of medical services |

| Catastrophic Health Plan | Designed for high-risk individuals, offering specialized coverage |

Property and Casualty Insurance: Protecting Your Assets

Principal Insurance understands that assets come in various forms, from homes and vehicles to businesses and valuable possessions. To address these diverse needs, Principal offers a comprehensive suite of property and casualty insurance products.

For homeowners, Principal's HomeShield policy provides coverage for a wide range of perils, including fire, theft, and natural disasters. Additionally, Principal offers specialized coverage for high-value items such as jewelry, artwork, and collectibles. This ensures that policyholders can rest easy knowing their most prized possessions are protected.

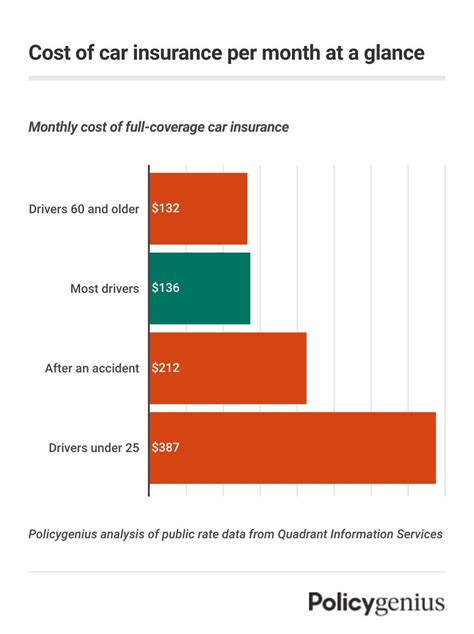

In the realm of automotive insurance, Principal's AutoGuard policy offers flexible coverage options, allowing policyholders to choose the level of protection that suits their needs and budget. From comprehensive coverage to liability-only plans, AutoGuard provides peace of mind for drivers of all kinds.

| Property and Casualty Insurance | Coverage Highlights |

|---|---|

| Homeowners Insurance | Covers dwelling, personal property, and liability |

| Renters Insurance | Protects personal belongings and provides liability coverage |

| Auto Insurance | Offers various coverage options for different vehicle types |

| Commercial Insurance | Covers businesses against property damage and liability risks |

Customer Experience: A Priority at Principal

At Principal Insurance Company, customer satisfaction is not just a goal but a driving force behind every decision. The company’s commitment to delivering exceptional customer experiences is evident in its innovative approaches to insurance services.

Digital Transformation: Convenience at Your Fingertips

In an era where technology is transforming industries, Principal has embraced digital innovation to enhance its customer experience. The company’s online platform and mobile app provide policyholders with easy access to their insurance information, allowing them to manage their policies, file claims, and receive real-time updates.

With the Principal Insurance app, policyholders can instantly report incidents, upload necessary documentation, and track the progress of their claims. This streamlined process not only reduces administrative burdens but also ensures prompt resolution, enhancing customer satisfaction.

Claims Processing: A Seamless and Efficient Process

When policyholders face unforeseen circumstances, efficient claims processing becomes crucial. Principal Insurance understands this and has implemented a streamlined claims process to ensure a swift and seamless experience.

Policyholders can initiate claims through various channels, including the online platform, mobile app, or by contacting customer support. Principal's dedicated claims team works diligently to assess and approve claims promptly, ensuring that policyholders receive the financial support they need during challenging times.

Personalized Support: Going Beyond Standard Services

Principal Insurance Company recognizes that every customer has unique needs and circumstances. To cater to this diversity, the company offers personalized support and tailored solutions. Whether it’s assisting with policy customization, providing financial planning advice, or offering risk management strategies, Principal’s team of experts is dedicated to ensuring each customer receives the attention and guidance they deserve.

Industry Impact and Future Prospects

Principal Insurance Company’s influence extends beyond its own success, shaping the insurance industry as a whole. The company’s commitment to innovation, customer-centricity, and comprehensive coverage has set a new standard for the industry.

As the insurance landscape continues to evolve, Principal remains at the forefront, adapting to changing market trends and customer needs. The company's focus on digital transformation and data-driven insights positions it well for the future. By leveraging technology and analytics, Principal can continue to enhance its products, streamline processes, and deliver even better experiences to its customers.

Looking ahead, Principal Insurance Company is poised for continued growth and expansion. With its strong financial foundation, global reach, and commitment to excellence, the company is well-positioned to meet the evolving insurance needs of individuals, families, and businesses worldwide.

How can I obtain a quote from Principal Insurance Company?

+To obtain a quote from Principal Insurance Company, you can visit their official website and use the online quote tool. Alternatively, you can contact their customer support team via phone or email, and they will guide you through the quoting process, taking into account your specific needs and circumstances.

What sets Principal Insurance apart from other insurance providers?

+Principal Insurance stands out for its innovative approach, comprehensive product offerings, and customer-centric focus. The company offers a wide range of insurance solutions, including life, health, and property insurance, all tailored to meet the unique needs of its clients. Additionally, Principal’s commitment to digital transformation and its emphasis on providing exceptional customer experiences sets it apart in the industry.

Does Principal Insurance provide coverage for small businesses?

+Yes, Principal Insurance offers a range of commercial insurance products specifically designed for small businesses. These policies provide coverage for various risks, including property damage, liability, and business interruption. Small business owners can tailor their coverage to meet their unique needs, ensuring their business is protected.

What are the key benefits of Principal’s health insurance plans?

+Principal’s health insurance plans offer comprehensive coverage for a wide range of medical expenses. Key benefits include coverage for hospital stays, doctor visits, prescription medications, and preventive care. Additionally, Principal’s Wellness Rewards program encourages policyholders to maintain a healthy lifestyle, providing incentives and discounts for participating in wellness activities.