Insurance Marketplace Texas

Exploring the Insurance Marketplace in Texas: A Comprehensive Guide

The insurance landscape in Texas is diverse and dynamic, offering a wide range of options for residents and businesses alike. With a thriving market, understanding the intricacies of insurance in the Lone Star State is essential for making informed decisions. This comprehensive guide delves into the specifics of the Texas insurance marketplace, shedding light on its unique features, key players, and the factors that influence coverage and costs.

From the vibrant cities of Houston and Dallas to the vast rural areas, Texas presents a unique challenge for insurers and policyholders. The state's diverse geography, coupled with its dynamic economy, results in a complex insurance environment. This guide aims to navigate through these complexities, providing valuable insights for those seeking to understand and navigate the Texas insurance marketplace.

Understanding the Texas Insurance Ecosystem

The insurance industry in Texas is characterized by a robust and competitive market, with a diverse range of providers offering various types of coverage. From auto and home insurance to health, life, and commercial policies, the options are extensive. Let's delve into the key aspects that define the Texas insurance ecosystem.

Regulatory Environment

The Texas Department of Insurance (TDI) plays a pivotal role in overseeing the state's insurance market. It enforces regulations, protects consumers, and ensures fair practices among insurers. The TDI's influence extends to setting standards for policy terms, approving rates, and addressing consumer complaints. Understanding the regulatory landscape is crucial for both insurers and policyholders, as it directly impacts the availability and cost of insurance coverage.

Market Concentration

Texas boasts a highly concentrated insurance market, with a few large insurers dominating the scene. Companies like State Farm, Allstate, and USAA have a strong presence, offering a wide range of policies. However, the market is not limited to these giants; smaller, regional insurers also play a significant role, providing specialized coverage and tailored solutions. This concentration can influence pricing and availability, particularly in certain geographic areas or for specific types of coverage.

Diverse Risk Factors

Texas is a large and diverse state, presenting a unique set of risk factors that influence insurance rates and coverage. From natural disasters like hurricanes and tornadoes to unique geographical challenges like coastal flooding and wildfires, the state's varied climate and geography pose distinct risks. Additionally, the state's large population and diverse industries contribute to a complex risk landscape. Understanding these factors is essential for insurers when determining rates and coverage options.

Navigating the Insurance Landscape: A Deep Dive

With a solid understanding of the broader insurance ecosystem in Texas, let's delve deeper into the specifics of various insurance categories and how they function within this dynamic market.

Auto Insurance in Texas

Auto insurance is a critical component of the Texas insurance landscape, given the state's extensive road network and high vehicle ownership rates. Texas operates under a tort system, which means drivers are generally responsible for their own injuries and damages in an accident, unless they carry specific coverage types. Here's a breakdown of the key aspects of auto insurance in Texas:

- Minimum Coverage Requirements: Texas law mandates that all drivers carry at least $30,000 in bodily injury liability coverage per person, up to $60,000 per accident, and $25,000 in property damage liability coverage. However, many experts recommend carrying higher limits to provide adequate protection.

- Optional Coverage: Beyond the minimum requirements, Texas drivers can opt for additional coverage types like collision, comprehensive, uninsured/underinsured motorist (UM/UIM), and personal injury protection (PIP). These optional coverages can provide crucial protection in the event of accidents, covering medical expenses, property damage, and more.

- Factors Influencing Rates: Auto insurance rates in Texas are influenced by a variety of factors, including the driver's age, driving record, credit history, and the type of vehicle insured. Additionally, the geographic location plays a significant role, with urban areas often experiencing higher rates due to increased traffic and accident risks.

Home Insurance: A Vital Protection

Home insurance is another critical aspect of the Texas insurance market, given the state's diverse housing landscape and the risks associated with its varied climate. Here's an overview of the key elements of home insurance in Texas:

- Coverage Types: Home insurance policies in Texas typically offer dwelling coverage, which protects the structure of the home, as well as personal property coverage, which covers the contents of the home. Additionally, liability coverage is often included to protect against lawsuits resulting from accidents on the insured property.

- Endorsements and Add-ons: Texas homeowners can opt for various endorsements and add-ons to tailor their coverage. These include flood insurance, which is crucial in certain high-risk areas, earthquake coverage, and water backup coverage to protect against sewer or drain backups.

- Factors Affecting Rates: Home insurance rates in Texas are influenced by a range of factors, including the location of the home, its age and construction, the level of coverage desired, and the homeowner's claims history. Additionally, the presence of certain hazards, such as proximity to wildfire-prone areas or coastal flooding zones, can significantly impact rates.

Health Insurance: A Complex Landscape

Health insurance is a critical component of the Texas insurance market, given the state's large population and diverse healthcare needs. Texas operates under a unique healthcare system, with a significant portion of the population relying on private insurance plans. Here's an overview of the key aspects of health insurance in Texas:

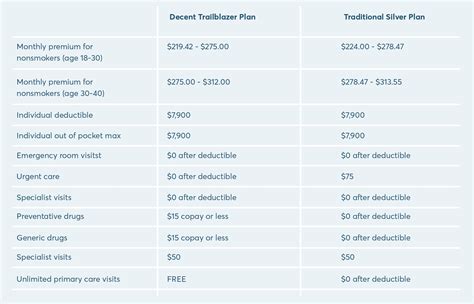

- Private Insurance Plans: A significant portion of Texans obtain health insurance through private plans, either through their employers or by purchasing individual policies. These plans offer a range of coverage options, including HMOs, PPOs, and POS plans, with varying levels of coverage and provider networks.

- Medicaid and CHIP: Texas also offers Medicaid and the Children's Health Insurance Program (CHIP) to eligible low-income residents. These programs provide essential healthcare coverage to those who might otherwise go uninsured.

- Health Insurance Exchange: Texas participates in the Health Insurance Marketplace, offering a platform for residents to compare and purchase qualified health plans. This exchange, established under the Affordable Care Act, provides a range of options for individuals and families seeking coverage.

Comparative Analysis: Texas vs. National Trends

To gain a broader perspective, let's compare the insurance landscape in Texas with national trends. This analysis will highlight the unique aspects of the Texas market and how it differs from the rest of the country.

Auto Insurance Comparison

Texas auto insurance rates tend to be higher than the national average, primarily due to the state's high population density, extensive road network, and frequent severe weather events. However, the state's diverse insurance market offers a range of options, allowing drivers to find competitive rates and coverage.

Home Insurance Comparison

Home insurance rates in Texas can vary significantly based on location and the specific risks associated with each area. Coastal regions, for instance, often experience higher rates due to the risk of hurricanes and flooding. In contrast, interior regions may offer more competitive rates, although they are not immune to risks like wildfires and severe storms.

Health Insurance Overview

Texas' health insurance market is unique, with a significant reliance on private insurance plans. The state's participation in the Health Insurance Marketplace offers residents a platform to access a range of qualified health plans. However, Texas' decision not to expand Medicaid under the Affordable Care Act has left a large portion of the population uninsured or reliant on other coverage options.

The Future of Insurance in Texas: Trends and Predictions

As we look ahead, several trends and developments are poised to shape the future of the insurance landscape in Texas. Here's a glimpse into what the industry might look like in the coming years.

Technology and Innovation

The insurance industry in Texas is embracing technology and innovation to enhance efficiency and improve customer experiences. From digital applications for policy management to the use of data analytics for risk assessment, insurers are leveraging technology to stay competitive. Additionally, the rise of telemedicine and digital health solutions is expected to transform the health insurance landscape, offering more accessible and cost-effective healthcare options.

Climate Change and Natural Disasters

Texas' susceptibility to severe weather events, including hurricanes, tornadoes, and wildfires, is a significant factor in the insurance market. As climate change continues to impact weather patterns, insurers are adapting their strategies to manage these risks. This includes developing more accurate risk models, offering specialized coverage for climate-related risks, and promoting resilience and mitigation efforts among policyholders.

Economic Factors and Market Dynamics

The dynamic nature of Texas' economy, driven by industries like oil and gas, technology, and healthcare, will continue to influence the insurance market. As these industries evolve, so too will the risk landscape, requiring insurers to adapt their coverage offerings and pricing strategies. Additionally, the state's ongoing population growth and urbanization will present new challenges and opportunities for insurers.

Conclusion: Embracing a Diverse Insurance Landscape

The insurance marketplace in Texas is a complex and dynamic environment, offering a diverse range of options to meet the unique needs of its residents and businesses. From auto and home insurance to health and commercial policies, understanding the specific nuances of each category is essential for making informed decisions. As the industry continues to evolve, embracing technology, adapting to climate change, and responding to economic shifts, policyholders can expect a more tailored and efficient insurance experience.

By staying informed and engaged with the latest developments in the Texas insurance landscape, individuals and businesses can navigate this complex market with confidence, ensuring they have the coverage they need at a price they can afford.

What are the key factors influencing insurance rates in Texas?

+

Insurance rates in Texas are influenced by a variety of factors, including the type of coverage (auto, home, health, etc.), the insured’s location, age, driving record (for auto insurance), and credit history. Additionally, the state’s diverse climate and the risk of natural disasters play a significant role in determining rates, particularly for home and auto insurance.

How can I find the best insurance rates in Texas?

+

To find the best insurance rates in Texas, it’s essential to shop around and compare quotes from multiple insurers. Utilize online comparison tools and consult with insurance agents or brokers who can provide personalized recommendations based on your specific needs and circumstances. Additionally, consider factors like the insurer’s financial stability, customer service reputation, and any discounts or policy add-ons that might be available.

What are some common insurance scams to watch out for in Texas?

+

Texas residents should be vigilant against common insurance scams, including fraudulent auto accidents, fake insurance agents, and deceptive marketing practices. Be cautious of unsolicited offers, verify the legitimacy of insurance companies and agents, and always review policy documents carefully before purchasing coverage. If in doubt, consult with the Texas Department of Insurance for guidance and protection.