Erie Insurance Auto

When it comes to choosing the right auto insurance provider, it's crucial to consider a company that not only offers comprehensive coverage but also prioritizes customer satisfaction and delivers exceptional value. In the realm of automotive insurance, Erie Insurance has emerged as a prominent player, known for its dedication to providing reliable coverage and an unparalleled customer experience. This article aims to delve into the world of Erie Insurance Auto, exploring its unique features, benefits, and why it stands out among its competitors.

The Erie Insurance Advantage: A Comprehensive Overview

Erie Insurance, headquartered in Erie, Pennsylvania, has been a trusted name in the insurance industry for over a century. The company’s commitment to its customers and community has solidified its reputation as a reliable and customer-centric organization. Erie Insurance Auto offers a range of automotive insurance policies designed to cater to the diverse needs of drivers across the United States.

One of the key strengths of Erie Insurance Auto is its comprehensive coverage options. The company understands that every driver's needs are unique, and thus, it provides customizable policies that can be tailored to fit individual requirements. Whether you're looking for basic liability coverage, comprehensive protection for your vehicle, or additional perks like rental car reimbursement, Erie Insurance has you covered.

Erie Insurance Auto stands out from its competitors by offering a host of benefits that go beyond traditional insurance coverage. Here's a glimpse into some of the advantages that make Erie Insurance a top choice for automotive insurance:

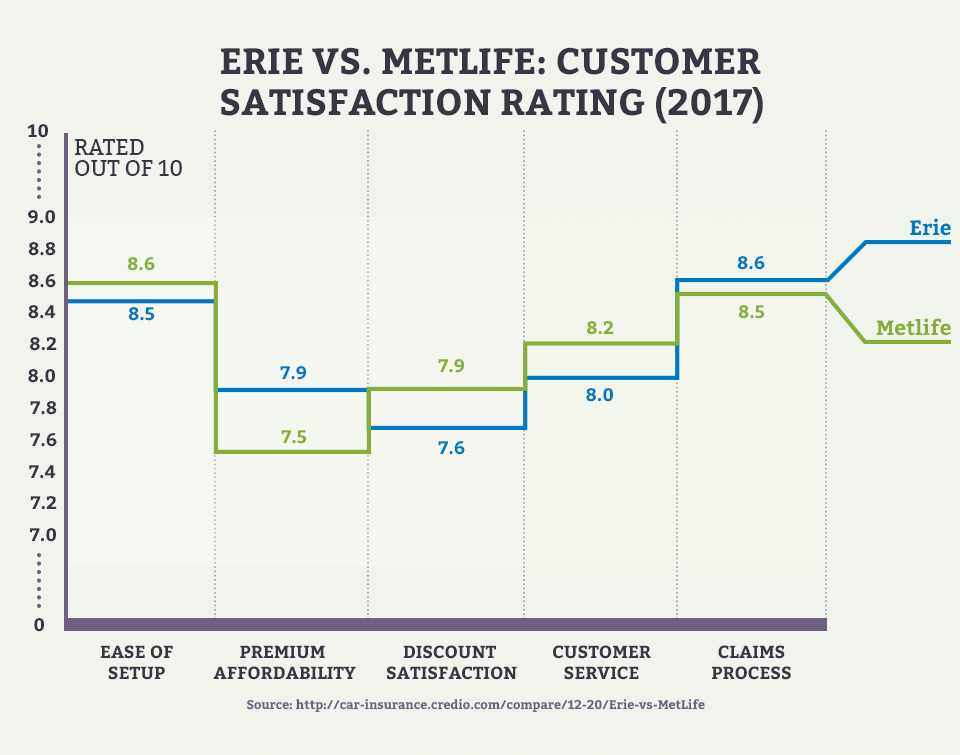

- Competitive Pricing: Erie Insurance is known for its affordable rates, making quality insurance accessible to a wide range of drivers. The company believes in providing value for money without compromising on coverage.

- Exceptional Customer Service: Erie Insurance prides itself on its customer-centric approach. The company's dedicated agents are known for their expertise, friendliness, and willingness to go the extra mile to ensure customer satisfaction. Whether you need assistance with a claim or have questions about your policy, Erie Insurance's team is always ready to help.

- Multiple Discounts: Erie Insurance understands the importance of rewarding its loyal customers. The company offers a variety of discounts, including multi-policy discounts, safe driver discounts, and even discounts for students and seniors. These incentives make it even more affordable to maintain comprehensive insurance coverage.

- Excellent Claims Process: In the unfortunate event of an accident or vehicle damage, Erie Insurance's claims process is designed to be seamless and efficient. The company's claims adjusters are known for their prompt response and fair assessments, ensuring that customers receive the compensation they deserve without unnecessary delays.

- Additional Coverage Options: Erie Insurance goes beyond the standard insurance policies. The company offers a range of optional coverages, such as pet injury coverage, rental car reimbursement, and gap insurance, providing added peace of mind for drivers.

Erie Insurance Auto: Features and Benefits

Erie Insurance Auto offers a comprehensive suite of features and benefits designed to enhance the overall insurance experience for its customers. Here’s a detailed breakdown of some of the key offerings:

1. Customizable Coverage Options

Erie Insurance understands that every driver has unique needs. Whether you’re a cautious driver with an impeccable record or someone who frequently commutes long distances, Erie Insurance provides customizable coverage options to ensure you’re adequately protected. Here’s a glimpse into some of the coverage choices available:

- Liability Coverage: This basic coverage is a legal requirement in most states and protects you financially in the event of an at-fault accident, covering bodily injury and property damage claims made against you.

- Collision Coverage: Erie Insurance's collision coverage helps pay for repairs or replacements if your vehicle is damaged in an accident, regardless of fault. This coverage provides peace of mind, ensuring your vehicle is restored to its pre-accident condition.

- Comprehensive Coverage: Beyond collision-related damages, comprehensive coverage protects against a range of non-collision incidents, including theft, vandalism, natural disasters, and animal collisions. This comprehensive protection ensures your vehicle is covered for a wide array of unforeseen events.

- Uninsured/Underinsured Motorist Coverage: In the event of an accident involving an uninsured or underinsured driver, this coverage steps in to protect you and your passengers. It covers medical expenses, property damage, and lost wages, ensuring you're not left financially burdened.

2. Discounts and Savings

Erie Insurance is committed to making insurance affordable and accessible. The company offers a range of discounts to help customers save on their auto insurance premiums. Here are some of the notable discounts available:

- Multi-Policy Discount: By bundling your auto insurance with other Erie Insurance policies, such as homeowners or renters insurance, you can enjoy significant savings. This discount rewards customers who choose Erie Insurance as their primary insurance provider.

- Safe Driver Discount: Erie Insurance recognizes and rewards safe driving habits. If you maintain a clean driving record, you may be eligible for a discount on your auto insurance premiums, making it easier to maintain comprehensive coverage.

- Student Discount: Erie Insurance understands the financial challenges faced by students. Eligible students may receive a discount on their auto insurance premiums, making it more affordable to stay protected while on the road.

- Senior Discount: Erie Insurance values its older customers and offers a discount to seniors who meet certain criteria. This incentive ensures that seniors can continue to enjoy comprehensive coverage without straining their budgets.

3. Additional Coverages and Perks

Erie Insurance goes above and beyond traditional insurance policies by offering a range of additional coverages and perks. These optional add-ons provide extra peace of mind and ensure that your insurance policy is truly tailored to your specific needs:

- Rental Car Reimbursement: In the event of a covered loss, Erie Insurance's rental car reimbursement coverage helps cover the cost of a rental vehicle while your car is being repaired. This perk ensures you can continue your daily routines without disruption.

- Pet Injury Coverage: Erie Insurance understands the special bond between pet owners and their furry friends. With pet injury coverage, you can rest assured that your beloved pets are protected in the event of an accident. This coverage helps cover veterinary expenses, providing an added layer of financial security.

- Gap Insurance: Gap insurance is particularly beneficial for drivers who have financed or leased their vehicles. In the event of a total loss, gap insurance covers the difference between the actual cash value of your vehicle and the remaining balance on your loan or lease, ensuring you're not left with a financial burden.

- Roadside Assistance: Erie Insurance's roadside assistance program provides 24/7 support for a range of emergencies, including flat tire changes, jump-starts, towing, and more. This perk ensures you have peace of mind while on the road, knowing help is just a call away.

Real-Life Testimonials: Erie Insurance Auto’s Impact

Erie Insurance Auto has left a positive impact on the lives of its customers, providing not just insurance coverage but also a sense of security and peace of mind. Here are some real-life testimonials from Erie Insurance Auto policyholders:

"Erie Insurance has been a lifesaver for me. After a bad accident, their claims process was smooth and efficient. I received fair compensation without any hassle. Their customer service is exceptional, and I feel truly valued as a customer."

- Sarah J., Erie Insurance Auto Policyholder

"I've been with Erie Insurance for over a decade, and their loyalty discounts have made a significant difference in my insurance premiums. I appreciate their commitment to rewarding long-term customers. Their coverage options are comprehensive, and I feel confident knowing I'm protected."

- Michael R., Long-Term Erie Insurance Auto Customer

"As a student, I was hesitant about the cost of auto insurance. Erie Insurance offered me a student discount, making it more affordable to maintain coverage. Their agents were friendly and explained everything clearly. I highly recommend them to fellow students."

- Emily S., Erie Insurance Auto Student Policyholder

Future Outlook: Erie Insurance Auto’s Continued Success

Erie Insurance Auto’s success is not just a result of its current offerings but also its commitment to innovation and customer satisfaction. As the automotive insurance landscape evolves, Erie Insurance remains dedicated to staying ahead of the curve, ensuring its policies and services meet the changing needs of its customers.

Erie Insurance's focus on technological advancements and digital transformations has positioned it well for the future. The company has invested in developing user-friendly platforms and mobile apps, making it easier for customers to manage their policies, file claims, and access important information on the go. This commitment to digital convenience enhances the overall customer experience.

Furthermore, Erie Insurance's dedication to community involvement and giving back has solidified its reputation as a trusted partner. The company's involvement in various charitable initiatives and support for local communities has fostered a sense of goodwill and loyalty among its customers. This positive brand image contributes to Erie Insurance's continued success and growth.

As Erie Insurance Auto continues to expand its reach and improve its services, it remains focused on maintaining its core values of exceptional customer service, comprehensive coverage, and competitive pricing. The company's commitment to its customers and its ability to adapt to changing industry trends ensure that Erie Insurance will remain a top choice for automotive insurance for years to come.

Conclusion

Erie Insurance Auto has established itself as a leader in the automotive insurance industry, offering a unique combination of comprehensive coverage, exceptional customer service, and affordable rates. The company’s commitment to its customers and its focus on providing tailored insurance solutions have earned it a reputation for excellence. Whether you’re a cautious driver or someone who commutes daily, Erie Insurance Auto has the coverage and perks to meet your needs.

With its range of customizable policies, discounts, and additional coverages, Erie Insurance ensures that its customers receive the protection and peace of mind they deserve. The company's dedication to innovation and community involvement further solidifies its position as a trusted and reliable insurance provider. As Erie Insurance continues to evolve and adapt, it remains poised to deliver exceptional value and service to its customers, making it a top choice for automotive insurance.

How does Erie Insurance Auto compare to other insurance providers in terms of coverage and pricing?

+Erie Insurance Auto offers competitive coverage options and pricing compared to other insurance providers. The company’s customizable policies allow customers to choose the coverage that suits their needs, ensuring they’re not paying for unnecessary add-ons. Additionally, Erie Insurance’s discounts and loyalty programs make it an attractive choice for those seeking affordable insurance.

What sets Erie Insurance Auto apart from its competitors in terms of customer service?

+Erie Insurance Auto prides itself on its exceptional customer service. The company’s dedicated agents are known for their expertise, friendliness, and willingness to go the extra mile. Erie Insurance’s claims process is also highly efficient, ensuring customers receive fair and prompt compensation in the event of an accident or vehicle damage.

Are there any unique perks or benefits offered by Erie Insurance Auto that other providers may not have?

+Yes, Erie Insurance Auto offers a range of unique perks and benefits. These include pet injury coverage, which provides financial protection for veterinary expenses in the event of an accident. Additionally, Erie Insurance’s rental car reimbursement coverage and gap insurance options set it apart from many competitors, offering added peace of mind and financial security.

How can I get a quote for Erie Insurance Auto coverage, and what factors determine my premium?

+Getting a quote for Erie Insurance Auto coverage is simple. You can visit their official website, where you’ll find an online quote tool. Alternatively, you can reach out to an Erie Insurance agent near you. The premium you’ll pay is determined by various factors, including your driving record, the type of vehicle you drive, your location, and the coverage options you choose.