Esurance Property And Casualty Insurance Company

In the ever-evolving landscape of the insurance industry, Esurance Property and Casualty Insurance Company has established itself as a prominent player, offering innovative solutions and a customer-centric approach. With a focus on leveraging technology to streamline the insurance experience, Esurance has carved a niche for itself, catering to the modern consumer's needs. This article delves into the various facets of Esurance, exploring its history, product offerings, technological innovations, and its impact on the insurance sector.

A Legacy of Innovation: Esurance’s Journey

Esurance, a subsidiary of Allstate, traces its roots back to 1999 when it first revolutionized the insurance space with its online-centric business model. Founded by entrepreneurs with a vision to simplify insurance, Esurance quickly gained traction by offering customers the convenience of online quotes, policy management, and claims filing. This departure from traditional insurance practices laid the foundation for a digital-first insurance company that would become a household name.

Over the years, Esurance has expanded its footprint, offering a comprehensive suite of insurance products. Beyond its initial focus on auto insurance, the company has diversified into homeowners, renters, motorcycle, and even pet insurance, ensuring a holistic approach to risk management for its customers.

Product Suite: Comprehensive Protection

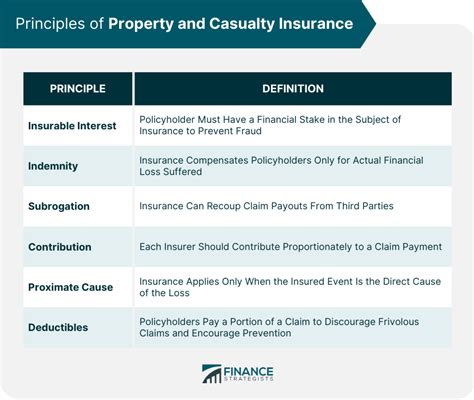

Esurance’s product portfolio is designed to cater to a wide range of needs, providing coverage for some of life’s most valuable assets. Here’s a glimpse into their key offerings:

Auto Insurance

The cornerstone of Esurance’s business, auto insurance, offers a range of coverage options, including liability, collision, comprehensive, personal injury protection, and uninsured/underinsured motorist coverage. With innovative features like usage-based insurance (UBI) and accident forgiveness, Esurance provides personalized policies that reward safe driving.

Homeowners Insurance

For homeowners, Esurance offers customizable coverage plans that protect against a variety of perils, including fire, theft, and natural disasters. Their policies also include liability protection, ensuring homeowners are covered in the event of accidents or injuries on their property.

Renters Insurance

Recognizing the needs of renters, Esurance provides affordable insurance plans that cover personal belongings and offer liability protection. With renters insurance, Esurance ensures that individuals who rent their homes or apartments are not left vulnerable to unexpected losses.

Motorcycle Insurance

Esurance’s motorcycle insurance policies provide comprehensive coverage for bikers, including liability, collision, and comprehensive protection. Additionally, they offer specialized endorsements for custom parts and accessories, ensuring that riders can customize their coverage to match their unique needs.

Pet Insurance

In a unique offering, Esurance provides pet insurance plans that cover a range of veterinary expenses, including accidents, illnesses, and even routine care. This innovative product highlights Esurance’s commitment to going beyond traditional insurance offerings.

| Insurance Type | Coverage Highlights |

|---|---|

| Auto Insurance | Liability, Collision, Comprehensive, Personal Injury Protection, UBI, Accident Forgiveness |

| Homeowners Insurance | Fire, Theft, Natural Disasters, Liability Protection |

| Renters Insurance | Personal Belongings Coverage, Liability Protection |

| Motorcycle Insurance | Liability, Collision, Comprehensive, Custom Parts Coverage |

| Pet Insurance | Accident, Illness, Routine Care Coverage |

Technological Innovations: Leading the Digital Frontier

Esurance’s dedication to technology is evident in its suite of digital tools and platforms that enhance the customer experience. Here’s an exploration of some of their key technological advancements:

Mobile App

The Esurance mobile app is a one-stop solution for policyholders, offering a seamless experience for managing policies, tracking claims, and accessing important documents. With features like GPS-enabled accident assistance and the ability to upload photos directly from the app, Esurance ensures that customers can handle insurance matters efficiently, anytime, anywhere.

Digital Claims Processing

Esurance has streamlined the claims process, making it faster and more efficient. Policyholders can initiate claims online or through the mobile app, and the company’s advanced technology allows for quick assessments and approvals. This digital-first approach ensures that customers receive timely resolutions for their claims.

Telematics and Usage-Based Insurance (UBI)

Esurance’s UBI program utilizes telematics technology to monitor driving behavior, offering discounts to safe drivers. This innovative approach not only encourages safer driving habits but also provides a more personalized insurance experience, as premiums are tailored to individual driving patterns.

AI and Machine Learning

Esurance leverages artificial intelligence and machine learning to enhance various aspects of its business. From underwriting to fraud detection, these technologies ensure more accurate risk assessments and faster, more efficient processes. Additionally, AI-powered chatbots provide instant support to customers, addressing common queries and streamlining customer service.

Industry Impact and Customer Satisfaction

Esurance’s innovative approach has not gone unnoticed within the insurance industry. The company’s focus on technology and customer convenience has set a new standard, prompting traditional insurers to adapt and modernize their offerings. Esurance’s commitment to transparency and simplicity has been well-received by customers, as reflected in its consistently high customer satisfaction ratings.

Moreover, Esurance's digital-first model has made insurance more accessible, especially for younger generations who prefer online interactions. By meeting customers where they are, Esurance has successfully built a loyal customer base that appreciates the company's modern approach to insurance.

The Future of Esurance: Expansion and Growth

Looking ahead, Esurance is poised for continued growth and expansion. With a strong focus on technological advancements and a commitment to customer satisfaction, the company is well-positioned to capture a larger market share. Esurance’s ability to adapt and innovate ensures that it remains a force to be reckoned with in the highly competitive insurance landscape.

As the company continues to enhance its product offerings and digital capabilities, Esurance is set to offer even more tailored and efficient insurance solutions. With a keen eye on emerging technologies and a customer-centric philosophy, Esurance is undoubtedly a leader in the digital transformation of the insurance industry.

What sets Esurance apart from traditional insurance companies?

+

Esurance’s focus on technology and a digital-first approach sets it apart. They offer a seamless online experience, from quote generation to policy management and claims filing. Additionally, their innovative products like usage-based insurance and pet insurance demonstrate a commitment to meeting modern customer needs.

How does Esurance ensure customer satisfaction?

+

Esurance prioritizes customer convenience and transparency. Their digital tools and platforms provide an efficient, user-friendly experience. Furthermore, their commitment to personalized coverage and timely claims processing has earned them high customer satisfaction ratings.

What is Esurance’s vision for the future of insurance?

+

Esurance aims to continue leading the digital transformation of the insurance industry. By leveraging technology and data analytics, they strive to offer more tailored, efficient, and accessible insurance solutions. Their focus remains on enhancing the customer experience and staying ahead of industry trends.