Expat Health Insurance

Health insurance is a critical aspect of life, especially for individuals living and working abroad. Expat health insurance provides coverage and peace of mind to expatriates, ensuring they have access to quality healthcare services during their time away from home. In this comprehensive guide, we will delve into the world of expat health insurance, exploring its importance, key features, and how it can benefit individuals embarking on international adventures.

The Importance of Expat Health Insurance

When individuals decide to live and work in a foreign country, they often encounter unique healthcare challenges. Medical systems, costs, and accessibility can vary significantly from one country to another. Expat health insurance serves as a safeguard, offering comprehensive coverage and ensuring that expatriates receive the necessary medical attention without financial strain.

The benefits of expat health insurance are numerous. Firstly, it provides access to a network of reputable healthcare providers, ensuring expatriates receive quality care. Secondly, it offers financial protection, as medical expenses abroad can be significantly higher than at home. Additionally, expat health insurance often includes features such as emergency assistance, evacuation coverage, and access to specialist care, making it an invaluable asset for those living abroad.

Understanding the Key Features of Expat Health Insurance

Expat health insurance policies are designed to cater to the specific needs of individuals living abroad. Here are some key features to consider when evaluating expat health insurance options:

Worldwide Coverage

Expat health insurance policies typically offer worldwide coverage, ensuring that individuals are protected regardless of their location. This is especially crucial for those who travel frequently or reside in multiple countries.

For instance, consider a software developer working for a multinational company. They might be required to travel between different countries for project assignments. With worldwide coverage, their health insurance remains valid, providing them with the necessary medical support during their travels.

Comprehensive Benefits

Expat health insurance policies aim to provide comprehensive coverage, including a range of benefits. These may include:

- Hospitalization and Surgical Expenses: Coverage for inpatient treatment, surgeries, and associated costs.

- Outpatient Care: Coverage for consultations, diagnostic tests, and medications.

- Dental and Vision Care: Coverage for routine dental check-ups, vision tests, and corrective procedures.

- Mental Health Support: Access to counseling services and psychiatric care.

- Emergency Evacuation: Coverage for emergency transportation and medical evacuation in critical situations.

Pre-existing Condition Coverage

One of the significant concerns for expatriates is the management of pre-existing medical conditions. Expat health insurance policies often offer coverage for pre-existing conditions, subject to certain conditions and waiting periods. This ensures that expatriates can continue their treatment and manage their health effectively while abroad.

Travel Assistance and Support

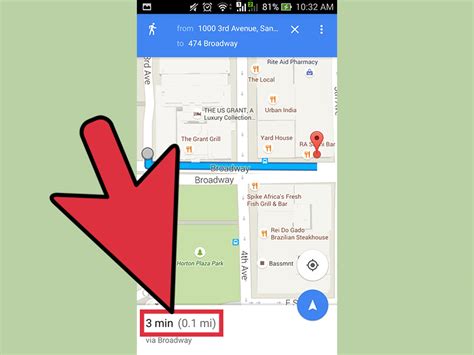

Expat health insurance policies frequently include travel assistance services, providing expatriates with support during their journeys. This can include assistance with lost travel documents, emergency travel arrangements, and even language interpretation services.

How to Choose the Right Expat Health Insurance

Selecting the appropriate expat health insurance policy is crucial to ensure adequate coverage and peace of mind. Here are some factors to consider when making your choice:

Assess Your Needs

Evaluate your specific healthcare needs and the requirements of your destination country. Consider factors such as the prevalence of certain medical conditions, the availability of healthcare facilities, and the cost of medical services. Tailor your insurance coverage to address these unique circumstances.

Compare Policies

Research and compare different expat health insurance policies to find the one that best suits your needs. Consider the coverage limits, exclusions, and any additional benefits offered. Look for policies with flexible plans that allow you to customize your coverage based on your preferences.

Network of Healthcare Providers

Review the network of healthcare providers associated with the insurance policy. Ensure that the network includes reputable hospitals, clinics, and specialists in your destination country. Access to a comprehensive network can provide you with greater flexibility and ease of access to medical care.

Reputation and Financial Stability

Choose an insurance provider with a solid reputation and financial stability. Research the company’s history, customer reviews, and financial ratings to ensure they can provide reliable coverage and honor their commitments.

Customer Support and Claims Process

Inquire about the customer support services offered by the insurance provider. Ensure that they have a dedicated team to assist you with any inquiries or claims. A seamless and efficient claims process is essential to ensure prompt reimbursement for your medical expenses.

Real-Life Examples of Expat Health Insurance Benefits

Let’s explore some real-life scenarios to understand the impact of expat health insurance:

Scenario 1: Emergency Medical Evacuation

Imagine an expatriate teacher working in a remote area of a foreign country. They suffer a severe injury and require immediate medical attention. With expat health insurance, they have access to emergency medical evacuation services. The insurance provider coordinates their transportation to a specialized medical facility, ensuring they receive the necessary care promptly.

Scenario 2: Managing Chronic Conditions

An expatriate entrepreneur moves to a new country with a pre-existing chronic condition. Their expat health insurance policy includes coverage for their condition, allowing them to continue their treatment and access the necessary medications. The insurance provider assists with finding local healthcare providers who specialize in their condition, ensuring ongoing management and support.

Scenario 3: Travel-Related Injuries

A group of expatriates go on a hiking trip in a mountainous region. Unfortunately, one of them suffers a fall and sustains injuries. Their expat health insurance policy covers emergency medical treatment, ensuring they receive prompt care. Additionally, the insurance provider arranges for their safe return to their primary residence, providing support throughout the entire process.

Future Implications and Innovations in Expat Health Insurance

The field of expat health insurance is evolving to meet the changing needs of expatriates. Here are some future implications and innovations to watch for:

- Telemedicine Integration: Expat health insurance policies are incorporating telemedicine services, allowing expatriates to consult with healthcare professionals remotely. This enhances accessibility and provides convenient medical advice, especially in remote areas.

- Wellness Programs: Insurance providers are introducing wellness initiatives to promote healthy lifestyles among expatriates. These programs may include discounts on gym memberships, access to nutritional counseling, and stress management resources.

- AI-Assisted Claims Processing: Artificial intelligence is being utilized to streamline the claims process. AI algorithms can analyze medical records and expedite reimbursement, reducing the time and effort required for expatriates to receive their benefits.

- Global Healthcare Networks: Insurance companies are expanding their global healthcare networks, partnering with reputable medical facilities worldwide. This ensures that expatriates have access to a wider range of high-quality healthcare options, regardless of their location.

How much does expat health insurance typically cost?

+The cost of expat health insurance can vary depending on factors such as age, destination country, coverage limits, and the chosen insurance provider. On average, premiums can range from a few hundred to a few thousand dollars per year. It’s important to compare policies and understand the coverage provided to make an informed decision.

Can I customize my expat health insurance policy?

+Yes, many expat health insurance policies offer customizable options. You can often choose different coverage levels, deductibles, and additional benefits to suit your specific needs and budget. It’s recommended to review the available options and select the coverage that aligns with your healthcare requirements.

What happens if I need medical treatment in a country with a different language?

+Expat health insurance policies often include language assistance services. These services can provide translation and interpretation support during medical consultations and interactions with healthcare providers. This ensures effective communication and understanding of your medical needs.