Travel Insurance Comparison

Comparing Travel Insurance Plans: A Comprehensive Guide to Finding the Best Coverage

Traveling is an exhilarating experience, but unforeseen circumstances can quickly turn a dream vacation into a nightmare. This is where travel insurance steps in as a crucial safety net, offering protection and peace of mind for travelers. However, with the vast array of travel insurance plans available, choosing the right one can be daunting. In this comprehensive guide, we'll delve into the key aspects of travel insurance, helping you make an informed decision and ensure your adventures are protected.

Understanding the Basics of Travel Insurance

Travel insurance is a specialized type of insurance that covers travelers' potential risks and losses while away from home. It provides financial protection against a variety of travel-related issues, including medical emergencies, trip cancellations or interruptions, lost luggage, and more. Understanding the basics of travel insurance is essential to making an informed decision.

Types of Travel Insurance Coverage

Travel insurance plans typically offer a combination of the following coverage types:

- Medical and Dental Coverage: This covers the cost of medical treatment, including hospitalization, prescription drugs, and dental emergencies. It is crucial for travelers, especially those with pre-existing medical conditions.

- Trip Cancellation and Interruption: This coverage reimburses travelers for non-refundable expenses if their trip is canceled or interrupted due to covered reasons such as illness, natural disasters, or travel advisories.

- Emergency Evacuation: In case of a medical or natural disaster emergency, this coverage ensures travelers can be evacuated to a safe location or a medical facility capable of providing the necessary treatment.

- Lost or Delayed Luggage: If your luggage is lost, stolen, or delayed, this coverage reimburses you for essential items you need to purchase during your trip.

- Travel Delay: This coverage provides compensation for expenses incurred due to travel delays, such as meals, accommodations, and alternative transportation.

- Personal Liability: It protects travelers against claims made by third parties for bodily injury or property damage caused by the insured during their trip.

- Accidental Death and Dismemberment: This provides a benefit to the insured's beneficiaries in the event of accidental death or dismemberment during the trip.

Different travel insurance plans offer varying levels of coverage for each of these categories. It's essential to review the policy documents carefully to understand the specific terms, conditions, and limitations of each coverage type.

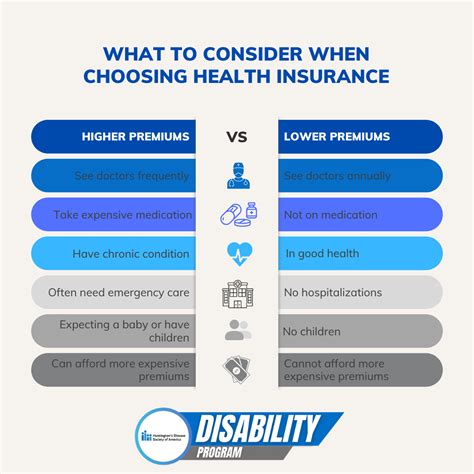

Factors Influencing Travel Insurance Premiums

The cost of travel insurance, known as the premium, can vary significantly based on several factors, including:

- Destination: The risk level associated with your travel destination can impact the premium. High-risk destinations may have higher premiums due to the increased likelihood of claims.

- Duration of Trip: Longer trips generally require higher premiums, as the risk of an incident increases with more time spent traveling.

- Age and Health of Travelers: Older travelers and those with pre-existing medical conditions may face higher premiums due to the increased risk of medical emergencies.

- Level of Coverage : The more comprehensive the coverage, the higher the premium. Travelers should carefully consider their needs and budget when choosing the level of coverage.

- Deductibles and Excess: Deductibles are the amount you must pay out of pocket before the insurance kicks in. Policies with higher deductibles often have lower premiums. Excess refers to the additional amount you pay for each claim.

- Provider and Plan Type: Different insurance providers offer various plans with unique features and pricing structures. Comparing quotes from multiple providers can help you find the best value for your needs.

Comparing Travel Insurance Plans

When comparing travel insurance plans, it's essential to consider several key factors to ensure you choose the best coverage for your needs. Here's a comprehensive breakdown of what to look for:

Coverage Limits and Deductibles

Coverage limits refer to the maximum amount the insurance provider will pay for a specific type of claim. It's crucial to ensure that the limits are sufficient to cover potential expenses. For example, if you're traveling to a country with high medical costs, ensure the medical coverage limit is adequate. Similarly, check the limits for trip cancellation, luggage loss, and other relevant coverages.

Deductibles are the amount you must pay out of pocket before the insurance coverage kicks in. Higher deductibles can lower the premium, but they also mean you'll have to pay more if you need to make a claim. Consider your risk tolerance and financial situation when choosing a plan with a suitable deductible.

Policy Exclusions and Restrictions

All travel insurance policies have exclusions and restrictions, which are specific situations or circumstances that are not covered by the policy. It's essential to carefully review the fine print to understand what is and isn't covered. Common exclusions include pre-existing medical conditions, hazardous activities like skydiving or bungee jumping, and acts of war or terrorism.

Some policies may also have geographical restrictions, limiting coverage to specific regions or countries. Ensure that your chosen policy covers all the destinations you plan to visit.

Medical Coverage Details

Medical coverage is a critical aspect of travel insurance. Look for policies that offer:

- Worldwide Coverage: Ensure the policy provides coverage regardless of where you travel.

- Adequate Coverage Limits: Medical expenses can vary widely, so ensure the policy's limits are sufficient for your needs. Consider the cost of medical treatment in the countries you'll be visiting.

- Pre-existing Condition Coverage: If you have a pre-existing medical condition, ensure the policy covers it. Some policies require additional declarations and may have specific terms and conditions.

- Emergency Medical Evacuation: This coverage ensures you can be transported to a suitable medical facility if necessary. It's a crucial aspect of medical coverage.

Trip Cancellation and Interruption Coverage

Trip cancellation and interruption coverage is essential to protect your travel investment. Consider the following when comparing plans:

- Reasons for Cancellation: Different policies cover different reasons for trip cancellation. Common covered reasons include severe weather, natural disasters, terrorism, and personal illness or injury.

- Refundability of Non-refundable Expenses: Ensure the policy covers a significant portion of your non-refundable expenses, such as flights, accommodations, and tours.

- Additional Benefits: Some policies offer extra benefits, such as trip delay coverage, missed connection coverage, and travel agency bankruptcy protection.

Lost or Delayed Luggage Coverage

Lost or delayed luggage can be a significant inconvenience during travel. Here's what to look for in this coverage:

- Coverage Limits: Ensure the policy's limits are sufficient to cover the value of your belongings. Consider the cost of replacing essential items.

- Delay Coverage: Some policies provide coverage for essential purchases if your luggage is delayed by a certain number of hours or days.

- Personal Property Coverage: This covers personal property such as cameras, laptops, and jewelry. Ensure the policy provides adequate coverage for these valuable items.

Travel Delay Coverage

Travel delays can be frustrating and costly. Look for policies that offer:

- Reasonable Delay Period: Ensure the policy covers delays after a certain number of hours, typically ranging from 4 to 12 hours.

- Comprehensive Coverage: This should include meals, accommodations, and alternative transportation expenses incurred due to the delay.

- Additional Benefits: Some policies offer coverage for missed connections and compensation for additional travel expenses.

Customer Service and Claims Process

When choosing a travel insurance plan, consider the reputation and reliability of the insurance provider. Look for companies with a strong track record of customer satisfaction and efficient claims processing.

Review online customer reviews and ratings to gauge the provider's reputation. Ensure the provider has a 24/7 emergency assistance hotline and a straightforward claims process. It's also beneficial to choose a provider with a presence in multiple countries, ensuring assistance is available regardless of where you travel.

Additional Benefits and Perks

Some travel insurance plans offer unique benefits and perks that can enhance your travel experience. These may include:

- Rental Car Coverage: This covers damage to rental cars, providing peace of mind during road trips.

- Identity Theft Protection: This assists travelers in the event of identity theft, offering monitoring and recovery services.

- Travel Assistance Services: This provides support for a range of travel-related issues, including legal assistance, translation services, and emergency cash transfers.

- Sports and Adventure Coverage: If you plan to engage in adventurous activities like skiing or hiking, ensure the policy covers these activities.

Choosing the Right Travel Insurance Plan

Now that you understand the key factors to consider when comparing travel insurance plans, it's time to choose the right one for your needs. Here's a step-by-step guide to help you make an informed decision:

- Assess Your Needs: Start by evaluating your specific travel needs. Consider the destinations, duration of your trip, and any activities you plan to engage in. Are you traveling for leisure, business, or adventure? Understanding your needs will help you choose the right coverage.

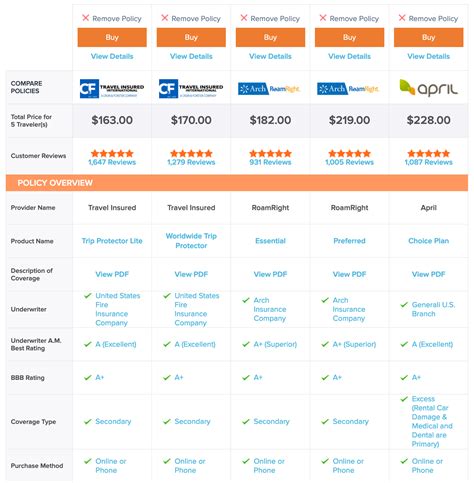

- Compare Quotes: Obtain quotes from multiple insurance providers. Compare the coverage limits, deductibles, and exclusions to find a plan that offers the best value for your needs. Online comparison tools can be helpful for this step.

- Review Policy Documents: Carefully read the policy documents to understand the terms and conditions. Pay attention to the fine print, as this is where exclusions and limitations are outlined.

- Consider Add-ons: Some policies offer optional add-ons to enhance coverage. Evaluate whether these add-ons are necessary for your trip, such as adventure sports coverage or rental car insurance.

- Check Provider Reputation: Research the reputation and financial stability of the insurance provider. Look for reviews and ratings to ensure the provider has a good track record and is likely to honor claims.

- Assess Customer Service: Evaluate the provider's customer service and claims process. Ensure they have a 24/7 emergency hotline and a straightforward claims procedure.

- Read Customer Reviews: Online reviews can provide valuable insights into the customer experience. Look for reviews that mention the policy's coverage, claims process, and overall satisfaction.

- Choose a Plan: Based on your assessment, choose a plan that offers the best coverage and value for your needs. Ensure it aligns with your budget and provides the necessary protection for your trip.

Frequently Asked Questions

Can I purchase travel insurance after I’ve already started my trip?

+In most cases, travel insurance needs to be purchased before your trip begins. This is because insurance policies are designed to cover unforeseen events that occur during the trip, not those that have already happened. Some policies may offer limited coverage for existing conditions if they are declared and insured before the trip starts.

What happens if I need to cancel my trip due to a family emergency or illness?

+If you need to cancel your trip due to a covered reason, such as a family emergency or illness, your travel insurance policy may provide trip cancellation coverage. This coverage reimburses you for non-refundable expenses, such as prepaid flights, hotels, and tours. However, it’s essential to review your policy’s terms and conditions, as certain conditions and limitations may apply.

How do I make a claim with my travel insurance provider?

+To make a claim, you’ll typically need to contact your insurance provider’s claims department and provide supporting documentation. This may include medical reports, receipts, and other evidence of your expenses. It’s important to follow the provider’s claims process and guidelines to ensure a smooth and timely reimbursement.

Are there any activities or situations that are not covered by travel insurance policies?

+Yes, all travel insurance policies have exclusions and limitations. Common exclusions include hazardous activities like skydiving or bungee jumping, acts of war or terrorism, and pre-existing medical conditions that are not declared and insured before the trip. It’s crucial to review your policy’s exclusions to understand what is and isn’t covered.

Can I extend my travel insurance coverage if my trip gets extended unexpectedly?

+In some cases, you may be able to extend your travel insurance coverage if your trip gets unexpectedly extended. However, this depends on the terms and conditions of your policy. Some policies may allow for extensions, while others may require you to purchase a new policy. It’s best to contact your insurance provider to discuss your options.