Farmers Home Insurance Company

Farmers Home Insurance Company, often simply known as Farmers Insurance, is a prominent name in the insurance industry, offering a comprehensive range of services to policyholders across the United States. With a rich history spanning over a century, Farmers Insurance has established itself as a trusted provider, offering protection and peace of mind to homeowners, renters, and businesses alike. In this in-depth article, we will delve into the history, services, and impact of Farmers Home Insurance Company, exploring its evolution, key offerings, and the reasons behind its success.

A Century of Service: The History of Farmers Insurance

The story of Farmers Insurance began in 1928, a time when the concept of insurance was still relatively new and evolving. Founded by Thomas E. Leavey and John C. Tyler, the company was initially known as Farmers Automobile Inter-Insurance Exchange. The idea behind its creation was to provide affordable and reliable automobile insurance to farmers and rural residents, who often faced higher premiums due to their remote locations.

Over the years, Farmers Insurance expanded its reach and diversified its offerings. In 1938, it acquired the California State Automobile Association (CSAA), which further solidified its presence in the West Coast market. This acquisition not only expanded its customer base but also enhanced its financial stability, allowing for continued growth and innovation.

The post-World War II era saw a significant shift in the insurance industry, and Farmers Insurance was at the forefront of this transformation. The company recognized the changing needs of its customers and expanded its services to include homeowners' insurance, umbrella policies, and a range of business insurance solutions. This strategic move positioned Farmers as a comprehensive provider, catering to the evolving needs of its policyholders.

In the late 20th century, Farmers Insurance continued to adapt and innovate. It embraced technological advancements, implementing computer systems to streamline operations and enhance customer service. The company also expanded its reach beyond the West Coast, establishing a nationwide presence through acquisitions and strategic partnerships. This period of growth and modernization laid the foundation for Farmers Insurance to become a leading force in the insurance industry.

Comprehensive Services: The Offerings of Farmers Insurance

Today, Farmers Insurance is a multifaceted company, offering a wide array of insurance products and services. Let’s explore some of its key offerings:

Homeowners’ Insurance

Farmers Insurance is renowned for its comprehensive homeowners’ insurance policies. These policies provide coverage for a wide range of potential risks, including damage from fires, storms, theft, and vandalism. Additionally, Farmers offers various endorsements and optional coverages to tailor policies to the specific needs of each homeowner.

| Coverage Options | Description |

|---|---|

| Dwelling Coverage | Protects the physical structure of the home. |

| Personal Property Coverage | Covers belongings inside the home, including furniture, electronics, and clothing. |

| Liability Coverage | Provides protection against lawsuits and medical claims for injuries that occur on the insured property. |

| Additional Living Expenses | Covers temporary living expenses if the home becomes uninhabitable due to a covered loss. |

Farmers Insurance also offers specialized homeowners' insurance policies for unique properties, such as vacation homes, mobile homes, and high-value homes.

Automobile Insurance

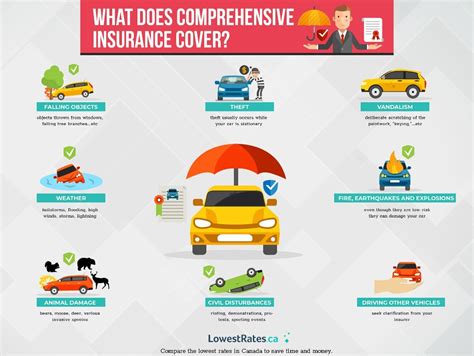

The company’s roots in automobile insurance remain a core strength. Farmers Insurance provides a range of auto insurance policies, offering coverage for liability, collision, comprehensive damage, and medical expenses. Additionally, Farmers has introduced innovative features such as usage-based insurance, where premiums are determined based on the driver’s actual usage and driving behavior.

Business Insurance

Recognizing the diverse needs of businesses, Farmers Insurance offers a comprehensive business insurance portfolio. This includes coverage for small businesses, large corporations, and specialized industries. Policies can be tailored to include property damage, liability, business interruption, and workers’ compensation, ensuring that businesses are protected against a wide range of risks.

Life and Health Insurance

Farmers Insurance also provides life and health insurance solutions. Life insurance policies offer financial protection to beneficiaries in the event of the insured’s death, while health insurance plans help policyholders manage the costs of medical care and prescription drugs. Farmers Insurance strives to make these essential coverages accessible and affordable to a broad range of individuals and families.

Additional Services and Benefits

Beyond its core insurance offerings, Farmers Insurance provides a range of additional services and benefits to its policyholders. These include:

- 24/7 customer service and claims support

- Discounts for bundled policies and safe driving practices

- Online account management and digital resources

- Claims forgiveness options

- Identity theft protection services

Impact and Recognition: Farmers Insurance in the Industry

The impact of Farmers Insurance extends far beyond its policyholders. The company has become a prominent player in the insurance industry, influencing trends and shaping best practices. Its success can be attributed to several key factors:

Innovation and Adaptability

Farmers Insurance has consistently demonstrated a willingness to embrace innovation. From its early days providing automobile insurance to rural residents to its recent forays into usage-based insurance, the company has shown a commitment to staying ahead of the curve. This adaptability has allowed Farmers to remain relevant and competitive in a rapidly evolving industry.

Customer-Centric Approach

At its core, Farmers Insurance prioritizes the needs and satisfaction of its policyholders. The company’s focus on customer service excellence is evident in its 24⁄7 support, efficient claims processing, and personalized policy options. This customer-centric approach has not only earned Farmers a loyal customer base but has also set a standard for other insurance providers to follow.

Financial Strength and Stability

With a long history of financial stability, Farmers Insurance is a trusted partner for policyholders. The company’s strong financial position, as evidenced by its ratings from reputable agencies such as A.M. Best and Standard & Poor’s, provides assurance to customers that their policies are secure and backed by a reliable insurer.

Community Engagement and Philanthropy

Beyond its business operations, Farmers Insurance is actively involved in community initiatives and philanthropy. The company supports various causes, including education, disaster relief, and environmental sustainability. This commitment to social responsibility further enhances its reputation as a responsible corporate citizen.

Industry Awards and Recognition

The industry has recognized Farmers Insurance for its excellence and impact. The company has received numerous accolades, including recognition for its customer service, claims handling, and overall business performance. These awards validate Farmers’ position as a leading insurance provider and reinforce its commitment to delivering exceptional value to its customers.

Conclusion: A Legacy of Trust and Innovation

Farmers Home Insurance Company, or Farmers Insurance, has established itself as a cornerstone of the insurance industry. With a century of service, the company has evolved from a provider of automobile insurance to a comprehensive, customer-centric insurer offering a wide range of policies and services. Its history of innovation, financial strength, and commitment to its policyholders and communities have solidified its position as a trusted partner for individuals and businesses across the United States.

As the insurance landscape continues to evolve, Farmers Insurance remains at the forefront, adapting to meet the changing needs of its customers. Its legacy of trust and innovation serves as a testament to its enduring impact on the industry and its role in providing security and peace of mind to policyholders.

How does Farmers Insurance ensure prompt and efficient claims processing?

+Farmers Insurance has implemented a comprehensive claims management system, ensuring a swift and efficient process. The company’s network of claims adjusters and a dedicated claims department work together to promptly assess and resolve claims, often providing updates and assistance within 24 hours of a reported incident.

What sets Farmers Insurance apart from its competitors in the industry?

+Farmers Insurance stands out for its customer-centric approach, innovative offerings, and financial stability. The company’s focus on personalized service, including 24⁄7 support and tailored policy options, sets it apart. Additionally, its commitment to embracing new technologies and adapting to changing customer needs positions Farmers as a forward-thinking insurer.

How does Farmers Insurance support its agents and staff in delivering excellent service?

+Farmers Insurance invests heavily in training and development programs for its agents and staff. These programs cover a range of topics, including product knowledge, customer service skills, and ethical practices. By ensuring its representatives are well-prepared and knowledgeable, Farmers enhances the overall customer experience.