Fema Flood Insurance Quote

Flooding is a common and costly natural disaster that can affect properties across the United States. The Federal Emergency Management Agency (FEMA) provides flood insurance through the National Flood Insurance Program (NFIP) to help individuals and businesses mitigate the financial impact of flooding. Obtaining a FEMA flood insurance quote is an essential step in understanding the potential costs and coverage options available to protect your property.

Understanding FEMA Flood Insurance

FEMA flood insurance, offered through the NFIP, is a crucial tool for homeowners, renters, and business owners to manage the risks associated with flooding. It provides financial protection for structures and their contents in designated flood-prone areas. The program aims to reduce the financial burden on individuals and the government by encouraging flood risk management and promoting the purchase of insurance in high-risk zones.

FEMA's flood insurance is unique as it is backed by the federal government, ensuring stability and reliability. It offers coverage for both residential and commercial properties, including homes, apartments, condominiums, and non-residential buildings. The program's standard policy covers up to $250,000 for the structure and up to $100,000 for its contents, although additional coverage options are available.

Determining Flood Risk and Zones

Before obtaining a flood insurance quote, it’s essential to understand your property’s flood risk and the corresponding flood zones. FEMA has designated various flood zones based on the property’s proximity to bodies of water and historical flood data. These zones range from low- to high-risk areas, with the latter requiring mandatory flood insurance for properties with federally backed mortgages.

| Flood Zone | Risk Level | Description |

|---|---|---|

| X (Moderate Risk) | Moderate | Areas with a 0.2% annual chance of flooding. |

| B (Moderate-High Risk) | Moderate to High | Areas with a 1% annual chance of flooding and a 0.2% chance of annual flash flooding. |

| A (High Risk) | High | Areas with a 1% annual chance of flooding from a large river, reservoir, or coastal area. |

| C, D, or Shaded X (Undetermined Risk) | Variable | Areas with undetermined flood risks due to data limitations. |

Understanding your property's flood zone is crucial as it directly impacts the cost and coverage options available. Properties in high-risk zones (A and B zones) will likely require more comprehensive coverage and may have higher premiums.

Obtaining a FEMA Flood Insurance Quote

Getting a FEMA flood insurance quote is a straightforward process that involves providing specific details about your property and your desired coverage. Here’s a step-by-step guide to obtaining an accurate quote:

Step 1: Determine Your Flood Zone

Start by identifying your property’s flood zone. You can find this information on FEMA’s Flood Map Service Center (MSC) website. Enter your address, and the map will display your zone designation. This step is crucial as it forms the basis for your insurance quote.

Step 2: Gather Property Details

Collect relevant information about your property, including its age, construction type, square footage, and any recent improvements or additions. These details will impact the cost and coverage options available. If you’re a renter or business owner, you’ll also need details about the building’s structure and contents.

Step 3: Choose Your Coverage

Decide on the coverage limits you require. FEMA offers two types of coverage: structural and contents. Structural coverage protects the building itself, while contents coverage protects personal belongings. Consider the replacement cost of your property and its contents to determine the appropriate coverage limits.

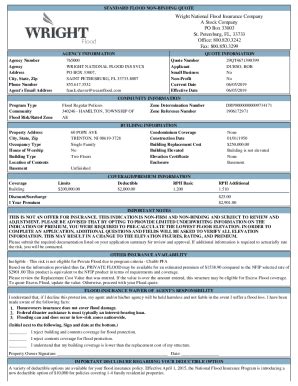

Step 4: Contact an Insurance Provider

FEMA does not sell flood insurance directly; instead, it partners with private insurance companies to offer NFIP policies. Contact an insurance provider authorized to sell NFIP policies. You can find a list of these providers on the FEMA website. Provide them with your flood zone information and property details, and they will generate a quote based on the coverage options you’ve chosen.

Step 5: Review and Customize Your Quote

Once you receive your quote, carefully review the coverage limits, deductibles, and premiums. Ensure that the coverage aligns with your needs and budget. You may also have the option to customize your policy by adding endorsements or riders to cover specific items or situations.

Step 6: Obtain Multiple Quotes (Optional)

While FEMA sets the standard coverage and premium rates, some providers may offer additional discounts or incentives. Consider obtaining quotes from multiple insurance companies to compare rates and find the best fit for your needs.

Factors Affecting FEMA Flood Insurance Quotes

Several factors influence the cost of FEMA flood insurance quotes. Understanding these factors can help you anticipate the potential costs and make informed decisions about your coverage.

Flood Zone

As mentioned earlier, the flood zone of your property is a significant determinant of your insurance costs. Properties in high-risk zones (A and B zones) generally have higher premiums due to the increased likelihood of flooding.

Building and Content Values

The replacement cost of your building and its contents also play a role in determining your insurance quote. Higher-value properties will require more extensive coverage and, consequently, higher premiums.

Deductibles

Like other insurance policies, FEMA flood insurance allows you to choose your deductible. A higher deductible can lower your premium, but it also means you’ll pay more out of pocket in the event of a claim. Consider your financial situation and risk tolerance when selecting a deductible.

Policy Options and Endorsements

FEMA offers various policy options and endorsements to tailor your coverage. These additional features can impact your premium. For example, you may choose to add coverage for additional living expenses or increase your contents coverage limit.

The Benefits of FEMA Flood Insurance

Investing in FEMA flood insurance provides several key benefits to property owners:

- Financial Protection: Flood insurance offers a safety net against the potentially devastating financial losses that flooding can cause. It covers the cost of repairs, replacements, and temporary housing, ensuring you can recover more quickly.

- Peace of Mind: Knowing that you have adequate coverage for flood-related damages provides peace of mind, especially if you live in a high-risk area. It reduces the stress and anxiety associated with potential flooding events.

- Compliance with Mortgage Requirements: If your property is located in a high-risk flood zone and you have a federally backed mortgage, flood insurance is mandatory. Having the necessary coverage ensures you meet these requirements and avoid potential penalties.

- Community Support: By purchasing flood insurance, you contribute to a broader community effort to manage flood risks. This collective approach can lead to more effective floodplain management and potentially lower premiums for all policyholders.

FAQs

Can I get flood insurance if I don’t live in a high-risk flood zone?

+Yes, even if you live in a moderate- or low-risk flood zone, you can still purchase flood insurance through the NFIP. While the premiums may be lower, it’s important to have coverage in case of unexpected flooding events.

What if I have a federally backed mortgage but my property is not in a high-risk flood zone?

+If your property is not in a designated high-risk flood zone but you have a federally backed mortgage, your lender may still require you to purchase flood insurance as a condition of your loan. It’s best to check with your lender to understand their specific requirements.

How often should I review and update my flood insurance coverage?

+It’s recommended to review your flood insurance coverage annually, especially if your property’s value or flood risk changes. Regular reviews ensure that your coverage remains adequate and aligned with your needs.