Health Insurance Businesses

Health insurance is an essential aspect of modern healthcare systems, offering individuals and families peace of mind and access to vital medical services. With rising healthcare costs and increasing complexity in treatment options, the health insurance industry plays a crucial role in providing financial protection and ensuring timely access to quality healthcare. In this comprehensive article, we will delve into the world of health insurance businesses, exploring their operations, impact, and future prospects.

Understanding Health Insurance Businesses

Health insurance businesses, also known as healthcare insurers or carriers, are entities that offer insurance policies to individuals, families, and groups, covering a range of medical expenses. These businesses operate within a complex regulatory framework, aiming to provide affordable and comprehensive coverage while maintaining financial stability. The primary goal of health insurance companies is to manage risk effectively, ensuring that policyholders receive the necessary healthcare services while controlling costs and maintaining a sustainable business model.

Key Players in the Industry

The health insurance industry is diverse, comprising various stakeholders who play crucial roles in its functioning. Here are some key players:

- Insurers: These are the insurance companies that design, market, and sell health insurance policies. They include large multinational corporations, regional health insurers, and smaller specialized providers.

- Policyholders: Individuals, families, and groups who purchase health insurance policies to protect themselves against unexpected medical expenses. Policyholders pay premiums to the insurer in exchange for coverage.

- Healthcare Providers: Doctors, hospitals, clinics, and other medical professionals who deliver healthcare services to policyholders. They are reimbursed by the insurer for the services rendered, following the terms of the insurance policy.

- Regulatory Bodies: Government agencies and organizations responsible for overseeing the health insurance industry. They enforce regulations, ensure compliance, and protect the interests of policyholders.

- Brokerages and Agents: These entities act as intermediaries between insurers and policyholders, providing advice, assistance, and guidance in selecting suitable health insurance plans.

Types of Health Insurance Policies

Health insurance policies can vary significantly in terms of coverage, cost, and benefits. Here are some common types of health insurance plans:

- Individual and Family Plans: These policies are purchased by individuals or families to cover their personal healthcare needs. They offer flexibility and can be customized to meet specific requirements.

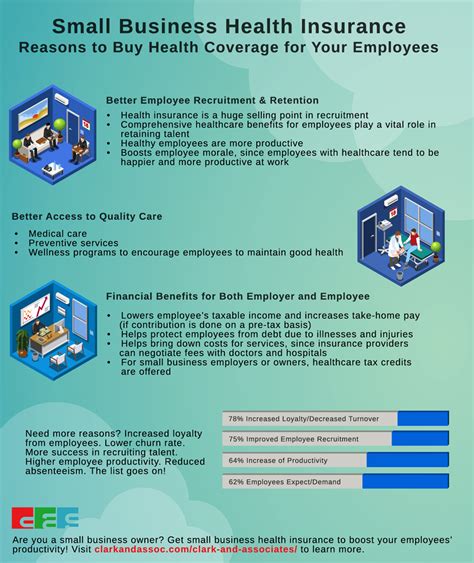

- Group Health Insurance: Many employers offer group health insurance plans as a benefit to their employees. These plans typically provide comprehensive coverage at a lower cost, as the risk is spread across a larger group.

- Medicare and Medicaid: Government-sponsored health insurance programs that provide coverage to eligible individuals based on age, disability, or income. Medicare primarily serves seniors and those with specific medical conditions, while Medicaid assists low-income individuals and families.

- Catastrophic Health Insurance: Designed to protect individuals from high medical costs associated with serious illnesses or injuries, these plans typically have lower premiums but higher deductibles.

- Short-Term Health Insurance: These plans offer temporary coverage for individuals between jobs or during transitional periods. They often have more limited benefits and exclusions compared to traditional health insurance plans.

The Role of Health Insurance in Healthcare Access

Health insurance plays a vital role in ensuring that individuals have access to necessary healthcare services. Here’s how health insurance businesses contribute to improving healthcare access:

Financial Protection

One of the primary benefits of health insurance is financial protection. By spreading the risk across a large pool of policyholders, insurers can offer coverage at a more affordable rate. This ensures that individuals and families can access healthcare services without facing devastating financial consequences due to unexpected medical expenses.

Wider Healthcare Network

Health insurance companies often have established networks of healthcare providers, including hospitals, clinics, and specialists. Policyholders can access these networks, which often offer more comprehensive and efficient care. This network system ensures that individuals can find the right healthcare professionals for their specific needs.

Preventive Care and Wellness Programs

Many health insurance policies now emphasize preventive care and wellness initiatives. Insurers encourage policyholders to take proactive steps towards maintaining their health through regular check-ups, screenings, and health education programs. By promoting preventive measures, insurers can reduce the likelihood of costly illnesses and improve overall health outcomes.

Covering Specialized Treatments

Health insurance plans cover a wide range of medical services, including specialized treatments such as surgeries, therapies, and medications. Without insurance, these treatments could be financially prohibitive for many individuals. Insurance coverage ensures that necessary specialized care is accessible to those who need it.

The Business of Health Insurance

The health insurance industry operates as a complex business, driven by various factors and considerations. Let’s explore some key aspects of how health insurance businesses operate.

Risk Assessment and Underwriting

Health insurance companies employ sophisticated risk assessment models to determine the premiums and coverage terms for their policies. Underwriting is the process of evaluating an individual’s or group’s risk profile, considering factors such as age, gender, medical history, and lifestyle. This assessment helps insurers set appropriate premiums and manage their risk portfolio effectively.

Claims Processing and Reimbursement

When policyholders receive healthcare services, they file claims with their insurance company. The claims processing team evaluates the claims, verifies the services rendered, and determines the reimbursement amount. Efficient claims processing is crucial to ensuring timely payments to healthcare providers and maintaining positive relationships with policyholders.

Network Management and Provider Relations

Health insurance businesses maintain relationships with healthcare providers to establish their networks. Negotiating contracts, setting reimbursement rates, and ensuring quality of care are essential aspects of network management. Strong provider relations are vital for offering policyholders access to a wide range of high-quality healthcare services.

Marketing and Sales Strategies

In a competitive market, health insurance companies employ various marketing and sales strategies to attract new policyholders and retain existing ones. This includes targeted advertising campaigns, online presence, and partnerships with brokers and agents. Additionally, insurers offer different plan options and customizable features to cater to the diverse needs of their target audience.

Financial Management and Sustainability

Effective financial management is critical for the long-term sustainability of health insurance businesses. Insurers must balance the costs of providing coverage with the premiums collected. They employ actuarial techniques to forecast future costs, manage investment portfolios, and ensure sufficient reserves to cover potential claims.

Challenges and Innovations in the Industry

The health insurance industry faces several challenges, but it also presents opportunities for innovation and growth. Here are some key aspects to consider:

Regulatory and Policy Changes

Health insurance businesses operate within a highly regulated environment, and changes in healthcare policies and regulations can significantly impact their operations. Insurers must stay updated with legal requirements and adapt their business models accordingly.

Rising Healthcare Costs

One of the most significant challenges in the health insurance industry is the rising cost of healthcare. Increasing medical expenses, advanced technologies, and specialized treatments contribute to higher premiums. Insurers must find ways to control costs while ensuring access to quality healthcare.

Digital Transformation

The digital revolution has transformed many industries, and health insurance is no exception. Insurers are embracing digital technologies to streamline operations, improve customer experience, and enhance data analytics. From online enrollment and claims submission to mobile apps for policy management, digital transformation is reshaping the industry.

Value-Based Care Models

The traditional fee-for-service model in healthcare is shifting towards value-based care. Insurers are increasingly adopting value-based payment models, rewarding healthcare providers for delivering high-quality, cost-effective care. This shift aims to improve healthcare outcomes while reducing overall costs.

Data Analytics and Personalized Medicine

Advancements in data analytics and personalized medicine offer exciting opportunities for health insurance businesses. By analyzing vast amounts of health data, insurers can identify patterns, predict risks, and develop tailored coverage options. Personalized medicine approaches can lead to more efficient and effective treatment plans, benefiting both policyholders and insurers.

The Future of Health Insurance

As the healthcare landscape continues to evolve, the future of health insurance holds both challenges and opportunities. Here are some key trends and considerations for the industry’s future:

Focus on Preventive Care

With a growing emphasis on preventive care and wellness, health insurance companies are likely to further integrate these initiatives into their policies. By promoting healthy lifestyles and early detection of medical conditions, insurers can reduce the need for costly treatments and improve overall population health.

Telehealth and Remote Care

The COVID-19 pandemic accelerated the adoption of telehealth services, and this trend is expected to continue. Health insurance businesses will need to adapt their coverage to include remote consultations, virtual care, and digital health solutions. Telehealth can improve access to healthcare, especially in remote areas, and reduce costs associated with in-person visits.

Personalized Coverage Options

As data analytics and personalized medicine advance, insurers can offer more tailored coverage options. By analyzing individual health profiles and risk factors, insurers can develop personalized plans that meet the specific needs of policyholders. This approach can lead to more efficient and cost-effective healthcare.

Integration of Health and Wellness Apps

Health and wellness apps have gained popularity, and health insurance companies are exploring partnerships with these platforms. By integrating health apps into their coverage, insurers can incentivize policyholders to adopt healthier lifestyles and monitor their health more effectively. This integration can lead to better health outcomes and reduced claims.

Collaborative Models with Healthcare Providers

Insurers are increasingly partnering with healthcare providers to improve care coordination and outcomes. Collaborative models, such as accountable care organizations (ACOs), aim to align the interests of insurers and providers, focusing on value-based care. These partnerships can lead to more efficient healthcare delivery and better patient experiences.

Conclusion

The health insurance industry is a critical component of modern healthcare systems, providing financial protection and access to quality medical services. As we’ve explored in this article, health insurance businesses operate within a complex landscape, facing challenges and seizing opportunities for growth and innovation. By understanding the role of health insurance, its impact on healthcare access, and the evolving trends in the industry, we can better appreciate the importance of this sector in ensuring the well-being of individuals and communities.

How do health insurance companies determine premiums for their policies?

+Health insurance companies use risk assessment models to determine premiums. These models consider factors such as age, gender, medical history, and lifestyle. By evaluating these factors, insurers can set appropriate premiums and manage their risk portfolio effectively.

What is the role of regulatory bodies in the health insurance industry?

+Regulatory bodies oversee the health insurance industry, ensuring compliance with laws and regulations. They protect the interests of policyholders, enforce standards, and promote fair practices. By regulating the industry, they aim to maintain transparency, prevent fraud, and ensure the overall well-being of consumers.

How do health insurance companies contribute to improving healthcare access?

+Health insurance companies play a crucial role in improving healthcare access by providing financial protection, offering wider healthcare networks, promoting preventive care, and covering specialized treatments. They ensure that individuals can access necessary healthcare services without facing significant financial barriers.

What are some challenges faced by the health insurance industry?

+The health insurance industry faces challenges such as rising healthcare costs, regulatory changes, and the need to adapt to digital transformation. Additionally, insurers must navigate the shift towards value-based care models and keep up with advancements in data analytics and personalized medicine.