How To Search For Car Insurance

Finding the right car insurance can be a complex process, but with the right approach and understanding of the key factors involved, you can ensure you get the best coverage for your needs. This comprehensive guide will take you through the essential steps and considerations to make informed decisions when searching for car insurance.

Understanding Your Insurance Needs

Before diving into the search, it’s crucial to assess your specific insurance requirements. Consider factors such as the value of your vehicle, your personal risk tolerance, and any additional coverage you might need. For instance, if you own an expensive car, you’ll want comprehensive coverage to protect against theft and damage. On the other hand, a basic liability policy might suffice for an older, less valuable vehicle.

Another critical aspect is understanding your state's mandatory insurance requirements. Each state has its own laws regarding the minimum level of coverage you must carry. Failure to meet these requirements can result in legal consequences and financial penalties.

Assessing Your Risk Profile

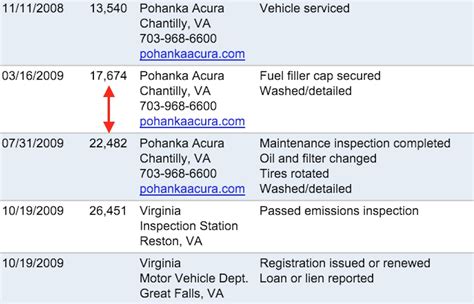

Your risk profile is a significant determinant of the insurance rates you’ll receive. Factors like your age, driving record, and the number of years you’ve been a licensed driver all play a role. Younger drivers, for example, are often considered higher risk and may face higher premiums. Similarly, a history of accidents or traffic violations can impact your insurance rates negatively.

However, it's not all bad news. Safe drivers with clean records can often benefit from significant discounts. Some insurance providers also offer incentives for drivers who have completed defensive driving courses or have installed safety features in their vehicles.

| Risk Factor | Impact on Insurance |

|---|---|

| Age | Younger drivers often pay more. |

| Driving Record | Clean records can lead to discounts. |

| Safety Features | Certain features may reduce premiums. |

Researching Insurance Companies

With a clear understanding of your needs and risk profile, the next step is to research and compare insurance companies. This is a critical phase as it can significantly impact the coverage and rates you ultimately secure.

Comparing Insurance Providers

Start by creating a shortlist of reputable insurance companies. You can use online resources, consumer reviews, and recommendations from friends and family to narrow down your options. Look for companies with a solid financial standing and a good track record of customer satisfaction.

Once you have a list of potential providers, delve deeper into their offerings. Compare the types of coverage they provide, the limits and deductibles they offer, and any additional perks or benefits they include in their policies. For instance, some companies might offer roadside assistance or rental car coverage as part of their standard policies.

Don't forget to explore the customer service aspect. You want an insurance company that is responsive, helpful, and easy to work with, especially in the event of a claim. Read reviews and testimonials to gauge the level of service you can expect.

Understanding Coverage Options

Car insurance policies typically offer a range of coverage options. Understanding these options is crucial to ensure you get the right level of protection for your needs.

Liability coverage, for instance, is a must-have. It protects you against financial loss if you're found at fault in an accident, covering the cost of injuries and damages caused to others. Collision coverage, on the other hand, covers damage to your own vehicle in an accident, regardless of fault.

Comprehensive coverage is another important option. It provides protection against theft, vandalism, and damage caused by events like fires, floods, or falling objects. If you have a loan on your vehicle, your lender may require you to carry comprehensive coverage.

| Coverage Type | Description |

|---|---|

| Liability | Covers damages to others in an accident. |

| Collision | Covers damage to your vehicle in an accident. |

| Comprehensive | Covers a wide range of non-collision incidents. |

Obtaining Insurance Quotes

Once you’ve identified the insurance companies you’re interested in, the next step is to obtain quotes. This process allows you to compare prices and coverage options to find the best deal.

The Quote Process

Most insurance companies offer online quote tools, making it convenient to get a preliminary estimate. These tools will ask for basic information about you, your vehicle, and your driving history. Based on this data, they’ll provide an estimated premium.

However, it's important to note that these online quotes are just estimates. To get an accurate quote, you'll need to provide more detailed information, often over the phone or through an in-person meeting with an insurance agent.

When obtaining quotes, be sure to ask about any discounts you might be eligible for. Many insurance companies offer discounts for things like safe driving records, multiple policy bundles (e.g., bundling car insurance with home insurance), or certain vehicle safety features.

Comparing Quotes

When you have multiple quotes, it’s time to compare them side by side. Look beyond just the price. Consider the coverage limits, deductibles, and any additional benefits or perks included in the policy.

Remember, the cheapest quote might not always be the best option. It's essential to find a balance between cost and coverage that meets your specific needs. Consider the financial stability of the insurance company and their reputation for customer service as well.

| Quote Comparison Factors | Description |

|---|---|

| Premium Cost | The amount you'll pay for coverage. |

| Coverage Limits | The maximum amount the insurer will pay out in a claim. |

| Deductibles | The amount you'll pay out-of-pocket before the insurer covers the rest. |

Making Your Insurance Decision

With all the information you’ve gathered, it’s time to make a decision. Choose the insurance company and policy that best meets your needs and budget.

Evaluating Your Options

Look at the big picture. Consider not just the premium cost but also the coverage limits, deductibles, and any additional benefits. Remember, you want to ensure you’re adequately protected in the event of an accident or other covered incident.

If you're still unsure, don't hesitate to reach out to the insurance companies for clarification. A good insurance provider should be willing to explain their policies and help you understand the fine print.

The Importance of Regular Reviews

Once you’ve chosen an insurance policy, your work isn’t done. It’s important to review your coverage regularly, especially when significant life changes occur. Getting married, buying a new home, or adding a teen driver to your policy can all impact your insurance needs and rates.

Additionally, insurance rates can change over time. It's a good idea to shop around every few years to ensure you're still getting the best deal. You might find that your current provider has increased their rates, or that another company is now offering a more competitive option.

FAQ

What factors influence car insurance rates the most?

+

Car insurance rates are influenced by several factors, including your age, driving record, the type of car you drive, and the coverage limits you choose. Location and the insurance company’s assessment of risk in your area also play a role.

Can I get car insurance if I have a poor driving record?

+

Yes, but you may face higher premiums. Some insurance companies specialize in covering high-risk drivers, but it’s always beneficial to improve your driving record to potentially reduce future insurance costs.

What is the difference between liability and comprehensive coverage?

+

Liability coverage protects you financially if you’re at fault in an accident, covering damages to others. Comprehensive coverage, on the other hand, protects your vehicle from non-collision incidents like theft, vandalism, and natural disasters.