Find House Insurance Quotes

The Comprehensive Guide to Finding the Best Home Insurance Quotes

Protecting your home and its contents is an essential aspect of responsible homeownership. Home insurance provides financial security and peace of mind, covering various risks and potential damages. Obtaining the right home insurance policy is crucial, and finding competitive quotes is the first step toward securing adequate coverage. This guide will walk you through the process of comparing house insurance quotes, highlighting the key factors to consider and the steps to take to ensure you make an informed decision.

With numerous insurance providers offering a wide range of policies, finding the most suitable home insurance quote can seem daunting. However, by understanding the factors that influence rates and being aware of the different coverage options available, you can navigate the process efficiently and effectively.

In this comprehensive guide, we will delve into the world of home insurance quotes, exploring the various aspects that impact rates, the coverage options you should consider, and the steps to take to secure the best possible quote for your unique circumstances.

Understanding the Factors That Influence House Insurance Quotes

Numerous factors come into play when it comes to home insurance quotes. These factors are considered by insurance providers to assess the risk associated with insuring your home. Understanding these factors can help you prepare for the quote process and potentially negotiate better rates.

Location and Geographical Risks

The location of your home is a significant factor in determining insurance rates. Different areas have varying levels of risk, such as natural disasters, crime rates, and proximity to fire stations or emergency services. For instance, areas prone to hurricanes or earthquakes may have higher premiums due to the increased risk of property damage.

Home Value and Construction Materials

The value of your home and the materials used in its construction play a vital role in insurance quotes. More expensive homes or those built with premium materials may result in higher premiums. Additionally, the age of your home and its construction quality can influence rates, as older homes may require more maintenance and pose a higher risk of damage.

Coverage Limits and Deductibles

The coverage limits you choose and the associated deductibles impact your insurance quote. Higher coverage limits and lower deductibles generally result in higher premiums. It's essential to strike a balance between adequate coverage and affordable premiums to ensure you're not overpaying for insurance.

Personal Factors

Your personal circumstances and history can also affect your home insurance rates. Factors such as your age, occupation, and credit score may be considered by insurance providers. Additionally, your claims history and the number of years you've been with a particular insurer can impact the quote you receive.

| Factor | Impact on Quote |

|---|---|

| Location | Higher rates in areas with higher risk of natural disasters or crime. |

| Home Value | More expensive homes or those with premium materials may have higher premiums. |

| Coverage Limits | Higher coverage limits generally result in higher premiums. |

| Personal Factors | Your age, occupation, credit score, and claims history can influence rates. |

Exploring Coverage Options and Additional Perks

When comparing house insurance quotes, it's crucial to understand the different coverage options available and the additional perks that certain policies offer. These factors can significantly impact the level of protection and peace of mind you receive from your insurance policy.

Standard Coverage Options

Most home insurance policies offer standard coverage options, including:

- Dwelling Coverage: This covers the structure of your home, including repairs or rebuilding in case of damage.

- Personal Property Coverage: Covers the cost of replacing or repairing your personal belongings, such as furniture and electronics.

- Liability Coverage: Provides protection if someone is injured on your property or if you are held legally responsible for causing property damage or bodily injury to others.

- Additional Living Expenses: Covers the cost of temporary accommodation and other expenses if your home becomes uninhabitable due to a covered event.

Additional Coverage Options

Beyond the standard coverage options, there are additional coverage choices you can consider, depending on your specific needs and the risks associated with your home and location.

- Flood Insurance: If your home is in a flood-prone area, purchasing flood insurance separately may be necessary, as standard home insurance policies typically do not cover flood damage.

- Earthquake Insurance: Similar to flood insurance, earthquake coverage is often not included in standard policies and may be required in areas with high seismic activity.

- Personal Articles Floater: This coverage provides additional protection for high-value items such as jewelry, artwork, or collectibles, ensuring they are adequately insured.

- Umbrella Insurance: Umbrella policies offer additional liability coverage beyond the limits of your standard home insurance policy, providing an extra layer of protection in case of catastrophic events.

Additional Perks and Benefits

Some house insurance policies come with additional perks and benefits that can enhance your coverage and overall experience. These may include:

- Replacement Cost Coverage: This option ensures that your belongings are replaced with new items of similar quality, rather than being compensated based on the depreciated value.

- Discounts and Bundling: Many insurance providers offer discounts for bundling multiple policies (e.g., home insurance and auto insurance) or for taking advantage of safety features in your home, such as smoke detectors or security systems.

- Loss Assessment Coverage: Covers your portion of the cost if your homeowners' association or community experiences damage and requires you to contribute to the repairs.

- Identity Theft Protection: Provides assistance and resources if you become a victim of identity theft, helping you recover and mitigate potential damages.

Comparing Quotes and Negotiating Rates

Now that you have a comprehensive understanding of the factors that influence house insurance quotes and the coverage options available, it's time to compare quotes from different insurance providers. This process ensures you find the most suitable policy at the best possible price.

Gathering Quotes

Begin by obtaining quotes from multiple insurance providers. You can do this online, over the phone, or by visiting insurance agents in person. Ensure that you provide accurate and detailed information about your home, including its value, construction materials, and any additional features or improvements.

Comparing Policies and Rates

When comparing quotes, pay close attention to the coverage limits, deductibles, and any additional perks or benefits included in the policies. Make sure you are comparing apples to apples by ensuring that the quotes you receive cover similar risks and provide comparable levels of protection.

Consider the following aspects when comparing quotes:

- Coverage Limits: Ensure that the policies you're comparing have adequate coverage limits to protect your home and belongings.

- Deductibles: Evaluate the deductibles associated with each policy and assess whether you're comfortable with the out-of-pocket expenses in the event of a claim.

- Additional Coverage Options: Compare the availability and cost of additional coverage options, such as flood or earthquake insurance, to ensure you have the necessary protection for your area's specific risks.

- Discounts and Bundling: Look for opportunities to save money by bundling multiple policies or taking advantage of discounts offered by the insurance providers.

Negotiating Rates

Once you have gathered and compared quotes, you may find that there are discrepancies in rates between different providers. This is an opportunity to negotiate and potentially secure a better deal. Here are some tips for negotiating house insurance rates:

- Understand Your Risk Profile: Review the factors that influence insurance quotes and assess your risk profile. If you believe you pose a lower risk than what is reflected in the quotes, highlight these factors to the insurance provider and request a review of your rates.

- Provide Additional Information: If you have taken measures to reduce risks, such as installing security systems or making home improvements, inform the insurance provider. This can demonstrate your commitment to safety and potentially result in lower rates.

- Shop Around: Don't be afraid to leverage the quotes you've received from other providers. Let the insurance company know that you are considering other options and inquire about any potential discounts or promotions they may offer to retain your business.

- Consider Long-Term Relationships: Some insurance providers offer loyalty discounts or better rates for long-term customers. If you have a good relationship with an existing provider, discuss your options and inquire about any benefits associated with maintaining your business with them.

Securing Your Home Insurance Policy

Once you have compared quotes, negotiated rates, and selected the most suitable home insurance policy for your needs, it's time to secure your coverage. This process ensures that your home and belongings are adequately protected, providing you with the peace of mind that comes with comprehensive insurance.

Reviewing the Policy

Before finalizing your decision, carefully review the policy documents provided by the insurance company. Pay close attention to the coverage limits, deductibles, and any exclusions or limitations outlined in the policy. Ensure that the policy aligns with your expectations and provides the level of protection you require.

Understanding Exclusions and Limitations

All house insurance policies have exclusions and limitations, which are specific situations or risks that are not covered by the policy. It's crucial to understand these exclusions to avoid any surprises in the event of a claim. Some common exclusions include:

- Damage caused by natural disasters such as earthquakes, floods, or hurricanes (unless specifically covered by additional policies)

- Intentional damage or acts of vandalism

- Damage resulting from poor maintenance or neglect

- Certain types of water damage, such as damage caused by leaking pipes or appliances

Understanding Deductibles and Out-of-Pocket Expenses

Deductibles are the amount you must pay out of pocket before your insurance coverage kicks in. It's important to understand the deductibles associated with your policy and assess whether you are comfortable with the financial responsibility in the event of a claim. Higher deductibles can result in lower premiums, so it's a balance between cost and potential out-of-pocket expenses.

Finalizing the Policy and Making Payments

Once you are satisfied with the policy and its terms, it's time to finalize your home insurance purchase. This typically involves providing payment information and setting up a payment schedule with the insurance provider. Ensure that you understand the payment terms and any potential penalties for late payments.

It's worth noting that some insurance providers offer flexible payment options, such as monthly installments or automatic payments from your bank account. Choose the payment method that best suits your financial situation and preferences.

Maintaining Your Policy and Staying Informed

Securing your house insurance policy is just the beginning. It's essential to maintain your coverage and stay informed about any changes or updates to your policy. Here are some key considerations for ongoing policy management:

- Regularly Review Your Policy: Periodically review your home insurance policy to ensure it continues to meet your needs. Life circumstances and the value of your home may change over time, so it's crucial to assess whether your coverage limits and deductibles remain appropriate.

- Keep Your Insurer Informed: If you make significant improvements to your home, such as adding a room or upgrading your security system, inform your insurance provider. These changes may impact your coverage and rates, and it's important to keep your insurer up to date to avoid any gaps in protection.

- Stay Informed About Changes: Insurance providers may update their policies or introduce new coverage options. Stay informed about any changes to your policy or the insurance market as a whole. This ensures you can make informed decisions about your coverage and take advantage of any new benefits or discounts.

FAQs: Common Questions about Finding House Insurance Quotes

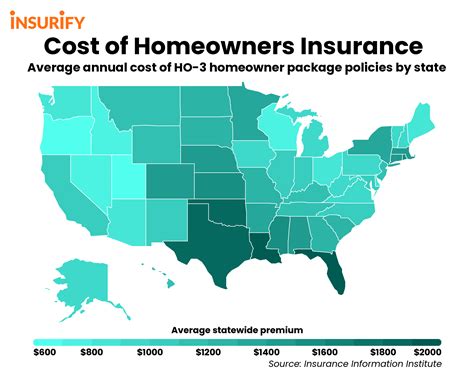

What is the average cost of home insurance in the US?

+The average cost of home insurance in the US varies depending on factors such as location, home value, and coverage limits. According to recent data, the national average premium for house insurance is approximately $1,300 per year. However, it's important to note that rates can vary significantly from state to state and even within different regions of the same state.

How can I save money on my home insurance policy?

+There are several strategies you can employ to save money on your home insurance policy. Some of these include:

- Increasing your deductible: Higher deductibles can result in lower premiums, but ensure you are comfortable with the out-of-pocket expenses.

- Bundling policies: Many insurance providers offer discounts when you bundle multiple policies, such as home insurance and auto insurance.

- Taking advantage of safety features: Installing security systems, smoke detectors, and fire sprinklers can often lead to discounts on your insurance premiums.

- Shopping around: Compare quotes from multiple insurance providers to find the best rates for your specific circumstances.

What factors determine my home insurance rates?

+Several factors influence your house insurance rates. These include your home's location, its value and construction materials, your claims history, and personal factors such as your age, occupation, and credit score. Additionally, the coverage limits and deductibles you choose can impact your premiums.

Do I need additional coverage for natural disasters?

+It depends on your location and the specific risks associated with your area. Standard home insurance policies typically do not cover damage caused by natural disasters such as floods, earthquakes, or hurricanes. If you live in an area prone to these events, purchasing additional coverage, such as flood or earthquake insurance, may be necessary to protect your home and belongings.

What should I do if I'm unhappy with my home insurance rates?

+If you feel that your house insurance rates are too high, there are a few steps you can take. First, review the factors that influence rates and assess whether there are any areas where you can reduce risk, such as installing additional safety features or making home improvements. Then, compare quotes from multiple insurance providers to see if you can find a better deal. Finally, consider negotiating with your current insurer by highlighting your reduced risk profile and inquiring about any potential discounts or promotions.

Finding the best home insurance quote is